CAT is one stock that has taken a beating lately and rightly so given that it will suffer from the severe drop in commodity prices.

After a 5% drop on Monday, traders might start to get interested in this stock as it approaches some appealing price levels.

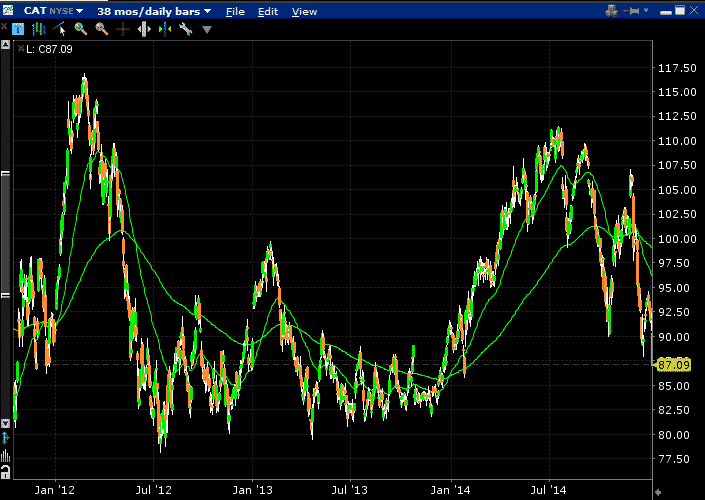

While the current chart looks pretty ugly, there is plenty of support around $80, a level the stock has rarely dropped below since late 2011.

It’s hard to imagine this Dow stock falling below that level in the next few months. CAT is a member of the Dogs of the Dow for 2015 due to its high dividend yield of 3.22%

Rather than purchase the stock outright, Traders looking to gain exposure to CAT could look to sell a March $85 cash secured out for $3.40. This gives the trader a potential return of 4.00% if the stock stays above $85. That’s a 21% annualized return.

If CAT is below $85 at expiry, the trader will be assigned 100 shares at $85. With the premium received from the option sale, this gives a net cost of $81.60 and an effective dividend yield of 3.43%.

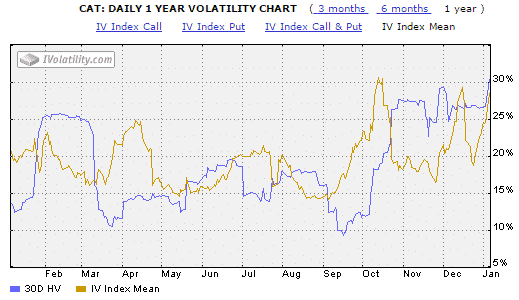

CAT is down 21.92% from its 52 week high and traders who think the sell off has been overdone can receive healthy premiums for cash secured puts due to the higher than normal levels of implied volatility.

If a trader thinks CAT has further to run to the downside, rather than entering a trade now, they could set an alert and start looking at cash secured puts if CAT reaches $82.50.

Get Your Free Covered Call Calculator

I sold the Jan 2016 65’s on Cat a few weeks ago and got $2.85 out it and sold more yesterday for $2.35. This is an excellent time to do so as the stock rarely gets to the current level.

Hi Tom,

Yes, it’s been hit hard, there could be some further downside in the short-term, but long-term it’s a solid company for your portfolio. March $80 puts now yielding 2.75% or 13.75% annualized.