Contents

When it comes to trading volatility, long straddles and long strangles give you the biggest bang for you buck.

These trades have a huge vega exposure and will benefit from rising volatility after the trade is placed.

But which one is better?

Long Strangles are cheaper because you are buying out-of-the-money options, but the need the stock to move further to make a profit (at expiration, not necessarily at the start).

So, let’s compare a long straddle vs a long strangle using AAPL options.

Here are the parameters for this example:

- 6-month trade duration

- At-the-money vs 20 points out-of-the-money

- No adjustments

- 20% profit target, 20% stop loss

- Time stop – close after 3 months

- Only using end of day prices

AAPL Example

In order to avoid cherry picking an entry point, I used a random number generator to determine the trade entry date which was April 17th, 2019.

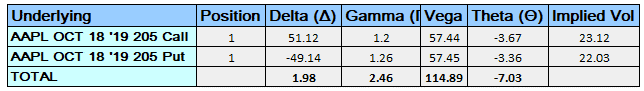

LONG STRADDLE

Date: April 17, 2019

Current Price: $203.13

Trade Set Up:

Buy 1 AAPL Oct 18th, 205 call @ $12.58

Buy 1 AAPL Oct 18th, 205 put @ $13.50

Premium: $2,608 Net Debit

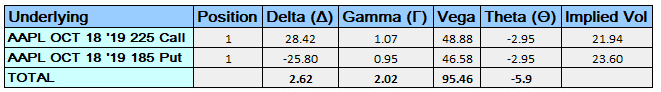

LONG STRANGLE

Date: April 17, 2019

Current Price: $203.13

Trade Set Up:

Buy 1 AAPL Oct 18th, 225 call @ $5.18

Buy 1 AAPL Oct 18th, 185 put @ $5.78

Premium: $1,096 Net Debit

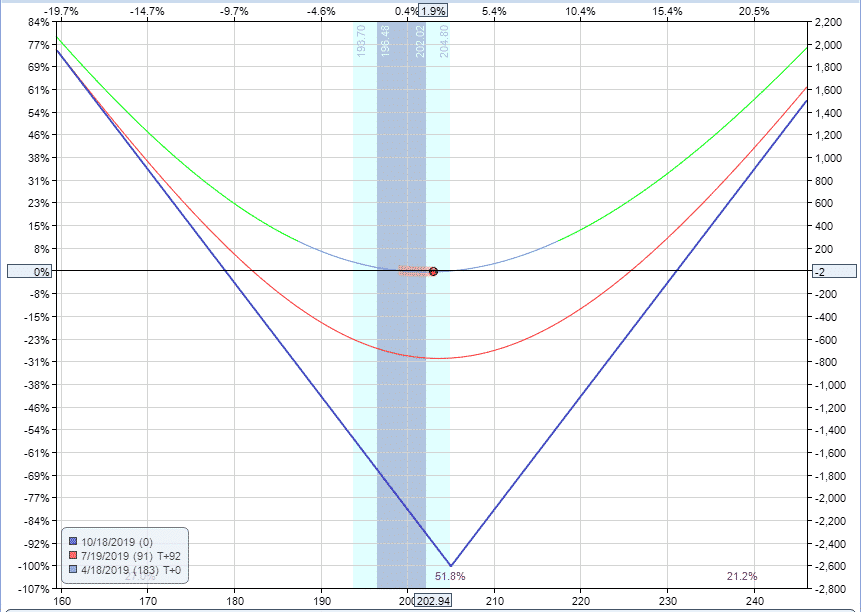

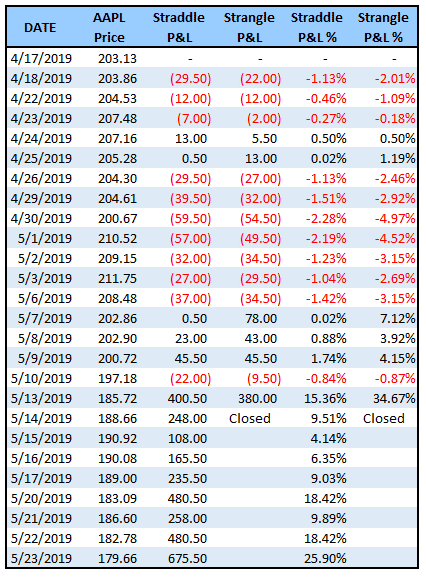

Now that we have our two sample trades, let’s see how they progress.

In terms of dollar values, the trades performed very similarly. However, as the long strangle required less capital, the profit target was reached earlier than the long straddle.

Here is how the trades looked on their respective closing dates.

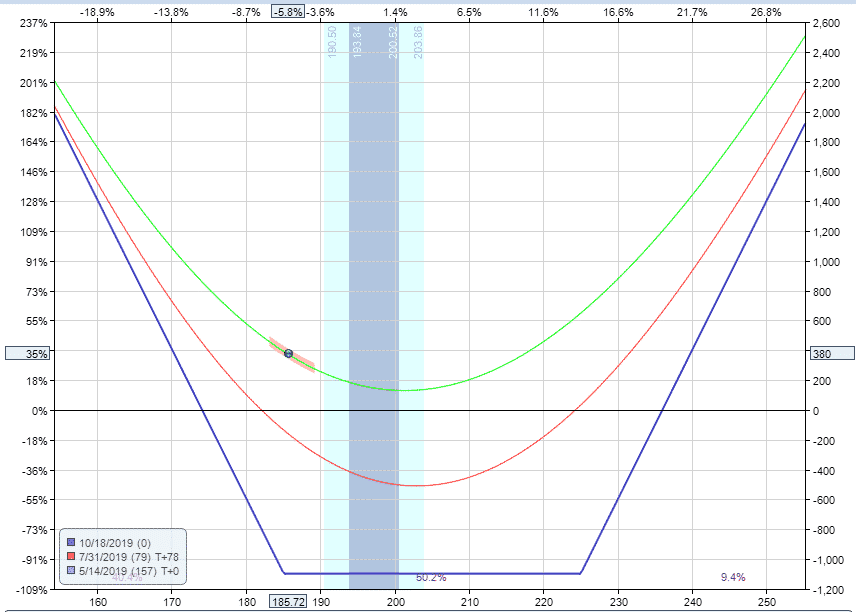

LONG STRANGLE

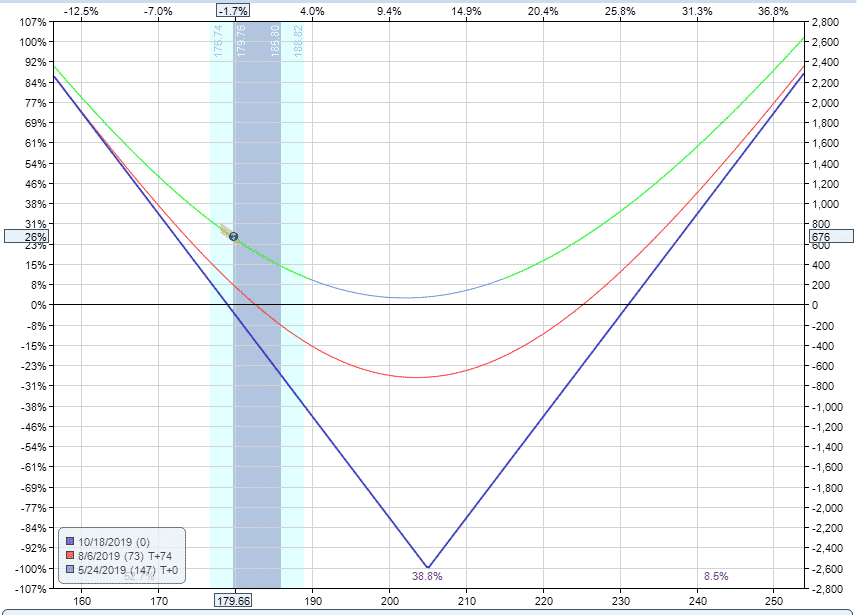

LONG STRADDLE

Let’s look at another example using SPY and again using a random number generator to obtain a random trade entry date.

SPY Example

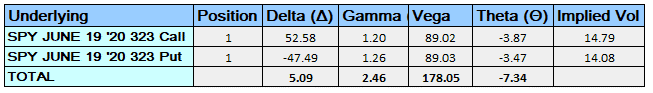

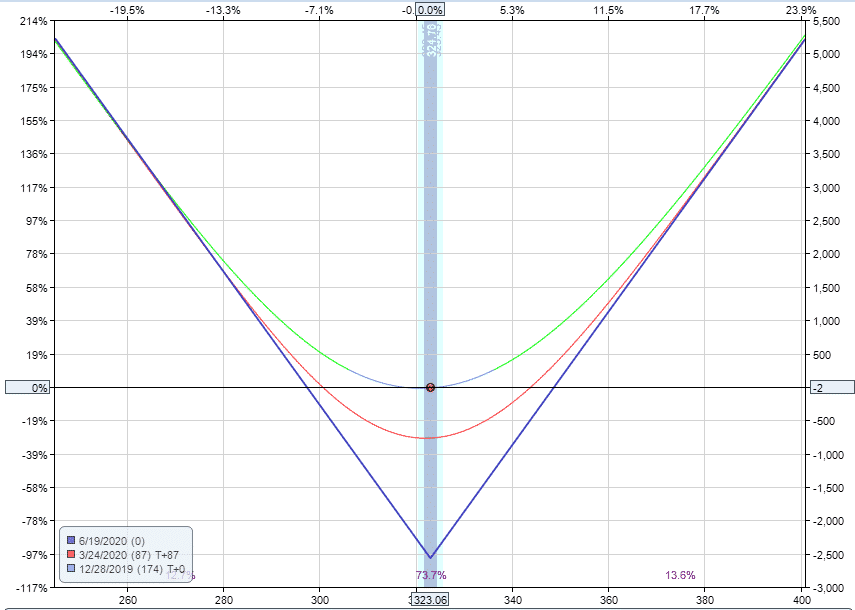

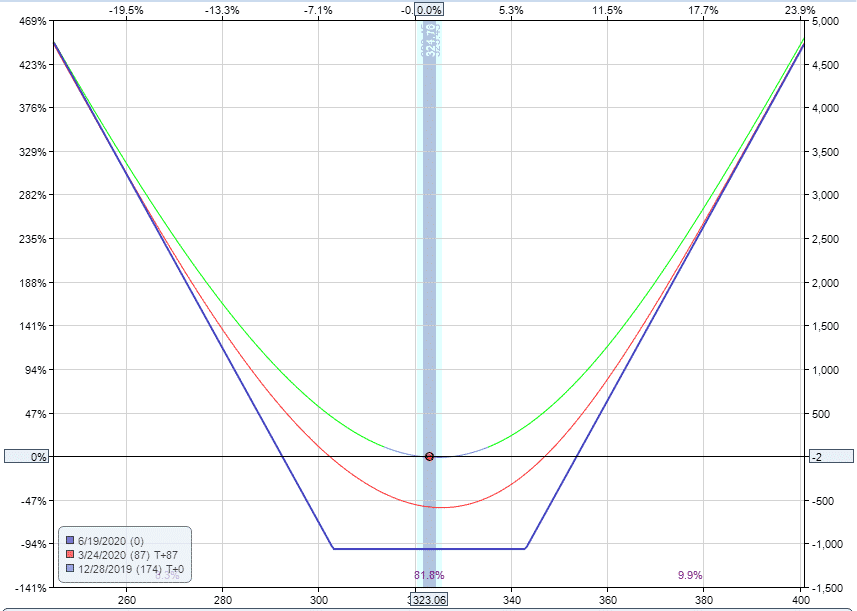

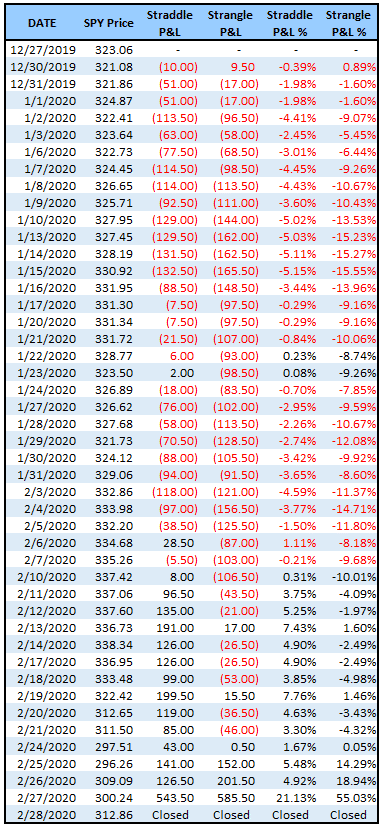

LONG STRADDLE

Date: December 27, 2019

Current Price: $323.06

Trade Set Up:

Buy 1 SPY June 19th, 323 call @ $13.40

Buy 1 SPY June 19th, 323 put @ $12.32

Premium: $2,572 Net Debit

LONG STRANGLE

Date: December 27, 2019

Current Price: $323.06

Trade Set Up:

Buy 1 SPY June 19th, 343 call @ $3.60

Buy 1 SPY June 19th, 303 put @ $7.04

Premium: $1,064 Net Debit

Looking at the results for this example, we see again that the dollar gains and losses are fairly similar but the percentage return is much higher for the long strangle vs the long straddle (due to the lower capital requirement).

The strangle was pretty close to being stopped out in mid-January with losses of around 15% whereas the long straddle was only down around 5% at that time.

Summary

Looking at these examples we can see some obvious differences between long straddles and long strangles.

- Vega exposure is much higher for long straddles

- Theta decay is much higher for long straddles

- Dollar returns are similar, but percentage returns are much higher for long strangles

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Great article!

Thanks, Gavin!