Today, we are looking at selling puts for income.

We will discuss how to do it, the expected returns and the risks.

Enjoy!

Contents

- Introduction

- Basics of the Put Option

- Why Should I Make Money?

- What About The Left Tail, Is Put Selling Risky?

- Expected Returns

- Basic Put Selling Strategy Guide – Tips, Tricks And Enhancements

- Start Your Own Insurance Company

- Managing Tail Risk

- Delta Hedging

- Concluding Remarks

Introduction

In a world where global yields are zero, or even negative the search for income is increasingly prevalent.

For investors who are nearing retirement and looking for steady income sources this can be challenging.

In the fixed income space, it can lead to portfolios chasing whatever yield they can get, depressing yields further for riskier assets.

The result is not pretty for an investor seeking income.

Despite this there are many income generating strategies using options.

This article will explore the strategy of selling puts as an income-based strategy.

Basics of the Put Option

A put option gives an investor the right to sell a security below a certain price before a predetermined date.

As a seller we are selling this right to someone. In return we collect a premium.

If the security remains above the strike price the put seller will pocket the whole premium.

Despite this if the security falls below the strike price the investor will suffer losses as shown below.

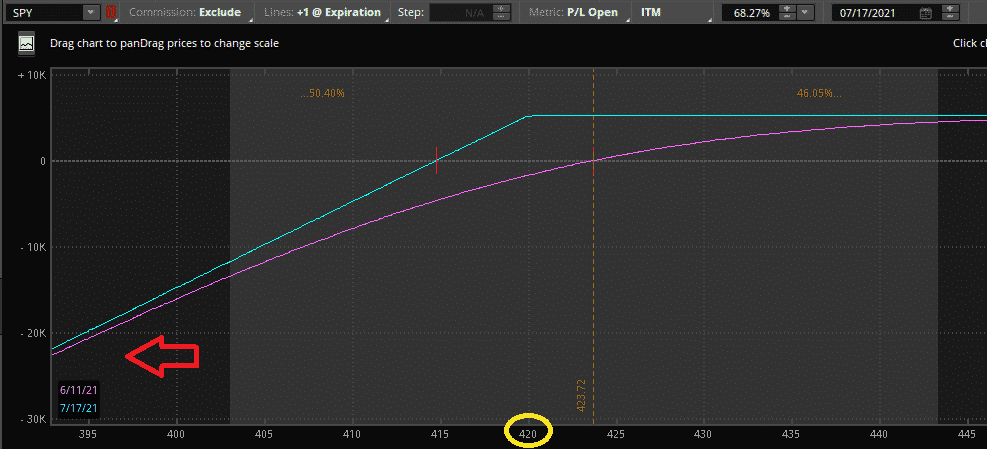

In this example with SPY trading at $423.72 we have sold the monthly $420 put option and received a $5 credit for doing so.

In this case we make money in 3 ways:

- If the stock moves up, we keep the entire credit of $5.

- If the stock stays flat or moves down slightly (still above our 420 strike) we also collect $5

- Stock moves down but stays above $415, we collect a part of the $5 premium.

Notice how we make money in most scenarios.

Selling puts will result in a consistent, stress free income 90% of the time.

It is the other 10% where the red arrow is that we need to be worried about.

More on tail risk and risk management to come.

In terms of our exposure to Greeks selling puts is long delta, long theta, short gamma, and short vega.

Why Should I Make Money?

Whenever we place a trade, it is important to know why the trade should make money.

In the case of selling puts the trade has a positive expectancy as it provides protection to the person holding the security and caps their losses.

The best way to think of a put seller is like an insurance provider. Most of the time insurance providers simply collect the premium from their clients.

Despite this, when disaster hits, they are on the hook for often hefty claims.

Insurance selling has to be a profitable business in the long run.

After all, if it was not, nobody would provide insurance.

The same goes for put selling. If it wasn’t we would just buy puts on everything and leverage up using futures.

Specifically, selling out of the money puts benefit from three market phenomena that have been heavily studied.

The equity risk premia (stocks tend to go up over time) the variance risk premia (stocks volatility tends to be overpriced) and the skew risk premia (that tail risk tends to be overpriced).

This trifecta makes selling put options a great passive income strategy with a positive expected value.

What About The Left Tail, Is Put Selling Risky?

A lot of investors say they would never consider selling “risky” put options.

Despite this, ironically these investors are some of the same people selling covered calls as an income strategy.

News flash! A covered call is simply an ITM Put.

Needless to say it is amusing watching investors trash selling puts when they are closet ITM Put sellers themselves.

Conversely a lot of “gurus” suggest selling puts is an easy risk-free income.

This is not the case. Selling puts has an unlimited loss potential until the stock is delisted.

This is a fact.

Often the gurus try to sell an easy income strategy yet leave subscribers left in the wind when their position moves against them.

You can sell puts all the way down and it’s not pretty.

Despite this in order to generate a substantial income above a few percent a year, you need to take on risk. Selling put options has that risk.

Yet the amazing thing about options is that the risk can really be customized to individuals’ goals, tolerances, and constraints.

Expected Returns

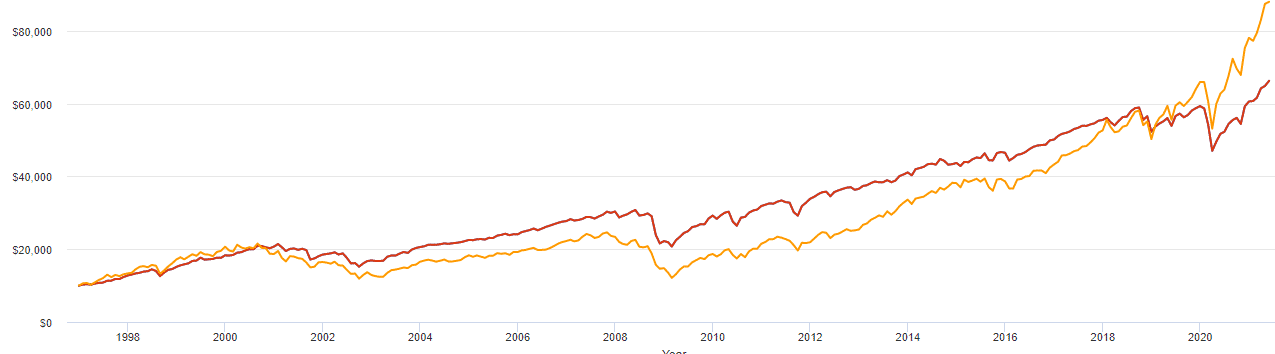

The CBOE has a Put Write index which sells a 1 month at the money put, rebalancing the following month.

Performance since 1997 is slightly shy of 9% (red line).

While it has underperformed the S&P 500 on an absolute basis it has had a slightly higher risk adjusted Sharpe ratio (.58 vs .53) respectively.

While this may not seem dramatic, I noticed the Sharpe ratio can be increased substantially by moving slightly OTM while rolling and hedging positions allowing for more consistent delta exposure.

Simply said, the PUT index can be improved sizably to suit an investor’s desired returns and risk constraints. Let’s see how we can do it!

Basic Put Selling Strategy Guide – Tips, Tricks and Enhancements

For a casual investor looking for income there are a few tips on the best assets, expiries and strikes to sell put options on.

The first is to focus on selling index options.

Numerous studies have proven that the variance risk premia is higher for indexes than single stocks.

This makes sense.

Most people want protection against market risk, not the risk of one specific stock.

Index and major ETF options like SPY are also the most liquid options in the world.

This adds a further benefit of reducing transaction costs. When choosing strikes, focusing on the slightly OTM strikes (around delta 30) allow you to strike a balance where you take advantage of some skew risk premia while still having exposure to delta.

While selling further OTM options may seem tempting as the odds of profit are higher, it also comes with increased tail risk due to the amount of options you have to sell.

In terms of days till expiration choosing options with shorter expiries increases theta.

Though it is at the cost of an increased gamma and potentially more hedging. Selling puts with 1-3 month expiration strikes a good balance.

Some investors avoid selling puts in low volatility environments as the premiums are lower.

Despite this, lower premiums are offset with lower realized volatility.

There is some research suggesting selling puts on index options in lower volatility environments is actually more profitable.

So, as an income strategy trying not to time the market will pay off in the long run. Unless of course you have a crystal ball!

Start Your Own Insurance Company

While selling index options isn’t sexy it maximizes all the risk premiums and provides the insurance investors are most willing to pay for.

Being selective selling puts on single stock options can be more profitable, though this requires advanced knowledge and selective timing which most investors and their gurus for that matter do not have.

Another issue is that the best long-term holdings also have the lowest premiums.

Sure, Proctor and Gamble is a good stable company for retirement but who is buying puts on it?

This sometimes causes investors to dumpster dive and sell puts on stocks that while may have over inflated premiums are horrible companies.

This again leads to underperformance in the long term.

Managing Tail Risk

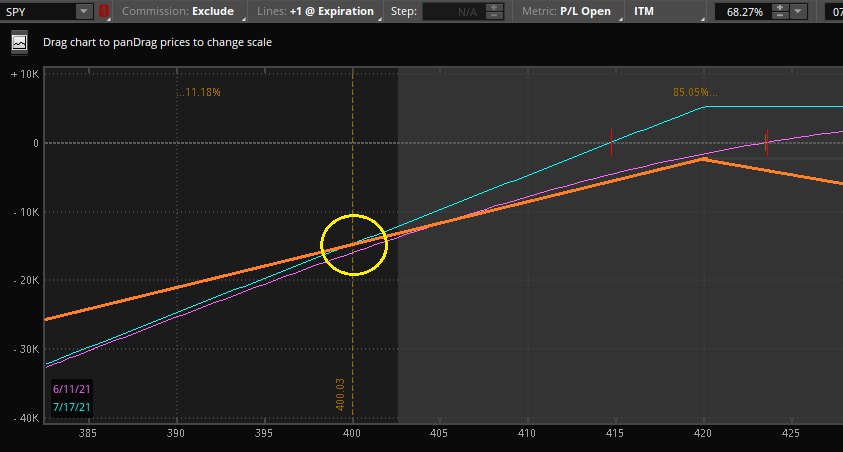

Remember when I promptly ignored the red arrow?

It is back. Let’s address it now.

A put does not have an equal risk as the trade evolves.

This is shown by the purple line. At inception the put we sold had 30 delta.

That makes 1 put equivalent to 30 shares of SPY.

What about at the red circle?

Well at this point our put is 70 delta and we are long the equivalent of 70 shares of SPY.

We now have higher risk than we did at inception.

Conversely at the green circle the opposite is the case.

Our put has only 10 deltas.

At this point it is probably better to roll the position as there is very little credit and exposure to anything remaining.

This is also illustrated by the purple line showing the instantaneous profit and loss.

We notice that on the far end the purple line almost becomes linear like stock while on the other end it flattens out to become nothing.

So how can we hedge this increased risk at the red circle?

Delta Hedging

Here we have the same trade but SPY is now trading at $400, we are in trouble!

One of the easiest methods to hedge risk is to simply short shares.

Our delta is now 70, in this example we bought a partial hedge of 40 shares of SPY.

Our new payoff is the orange line. We can see that we have now flattened the line and we will lose less if the stock continues to fall.

Despite this, in this case we have locked in a loss.

While it may seem unappealing, bag holding and hoping for a rebound can be like playing with fire.

Hedging with shares is just one way to hedge the delta of a position.

We can also close the position and establish a new position at our preferred delta.

This option works very well when the option is close to expiry as it will need to be rolled soon regardless.

Again, this will lock in a loss, but it helps dampen tail risk.

Concluding Remarks

Selling put options for income can be a very smart strategy as it takes advantage of various premiums and can provide solid stable returns.

These can be larger than returns available through more conventional methods such as fixed income.

Other structured products offer income but many simply sell the same puts that you can sell yourself, and include a Manhattan office fee along with it.

Despite this attraction, selling puts is not a free lunch.

There is significant tail risk experienced in market corrections.

By having a plan in place and hedging during downturns investors can reduce variance and tail risks in exchange for locking in some smaller losses.

Allowing them to both sleep easy and make put selling a very attractive passive income strategy.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.