“Option credit spreads destroyed my life”.

Unfortunately, I have heard this before, which is why we will discuss what to do when credit spreads move against you.

Contents

- Bull Put Credit Spread Example

- Rule 1: Hedge at 3% of the Short Strike

- Rule #2: Take Profits at 50% of Max Profit

- Rule #3: Roll Spread For A Credit If Breached

- Rule #4: Repeat As Necessary

- Rule #5: Take Profits At Breakeven On Trades Gone Bad

- Bear Call Credit Spread Example

- Apply Rule 1: Hedge At 3% Of The Short Strike

- Apply Rule #3: Roll Spread For Credit If Breached

- Apply Rule 2: Take Profits At 50% Of Max Profit

- Apply Rule #4: Repeat Hedge

- Rule #6: Don’t Let The Spread Get Closer Than 3 Weeks To Expiration

- FAQ

- Conclusion

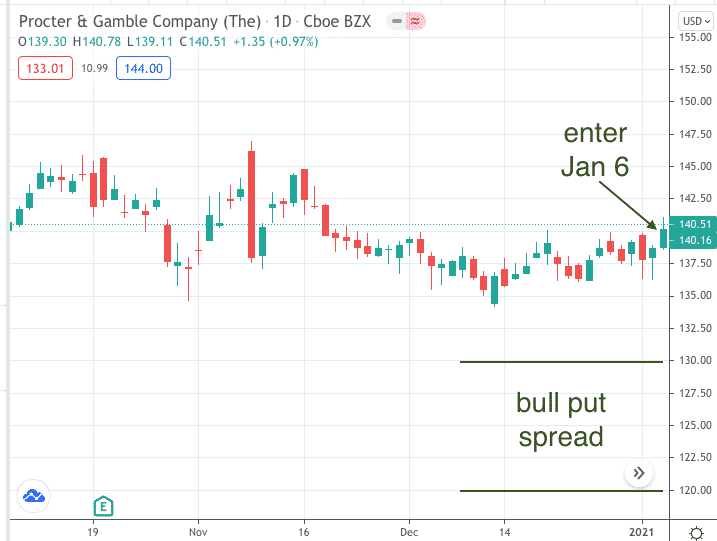

Suppose we had placed a bull put spread on Procter & Gamble (PG) when it made a new high in an uptrend.

And then it proceeded to breach the spread to expire with the price below the short strike price with no trading day ending positive.

These things happen.

Let’s learn an adjustment strategy for credit spreads so that they don’t destroy your life.

Bull Put Credit Spread Example

For this strategy to have a decent chance of working, the original credit spread must have been sold with at least 45 days till expiration.

And the risk to reward ratio must not be greater than 10.

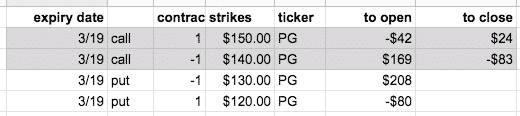

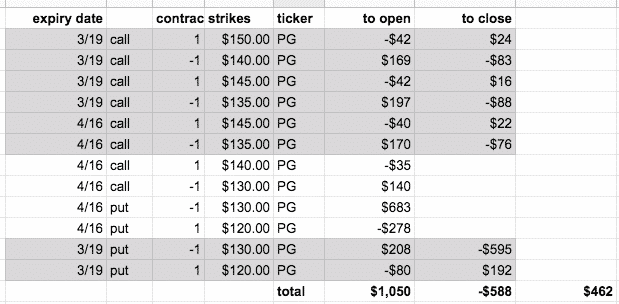

Here is the bull put spread example that we were looking at.

We’ll use one contract to keep the math simple.

Date: Jan 6, 2021

Buy one $120 PG Mar 19 put @ $0.80

Sell one $130 PG Mar 19 put @ $2.08

Credit: $128

Max Risk: $872

Risk to Reward Ratio: 6.8

The planned take profit level is 50% of max profit, or $64.

This did not occur.

Or at least not occurred based on the closing prices of each trading day.

Rule 1: Hedge at 3% of the Short Strike

That means we need to hedge if the price drops below $133.90, which it did on January 19th.

Some investors may prefer to hedge earlier, and that’s fine.

But 3% is the latest that one should let the price go before hedging.

We hedge with an opposing bear call spread with at least 45 days till expiration.

Keep the width the same as the other spread.

That way, the max risk on either side is the same.

Date: Jan 19

Sell one $140 PG Mar 19 call @ $1.685

Buy one $150 PG Mar 19 call @ $0.415

Credit: $127

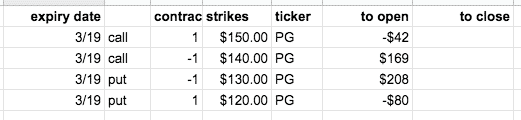

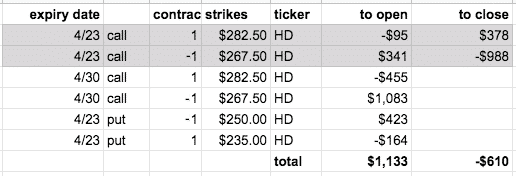

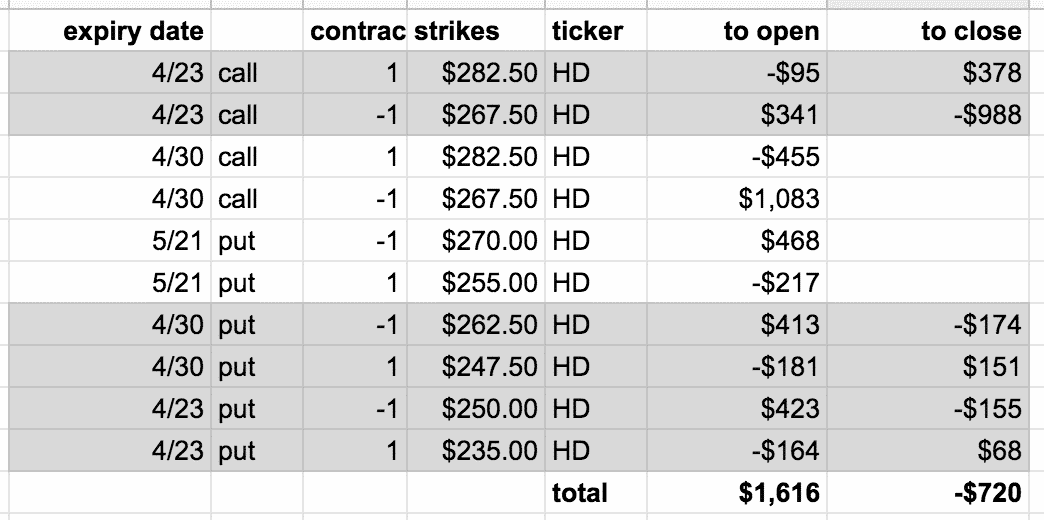

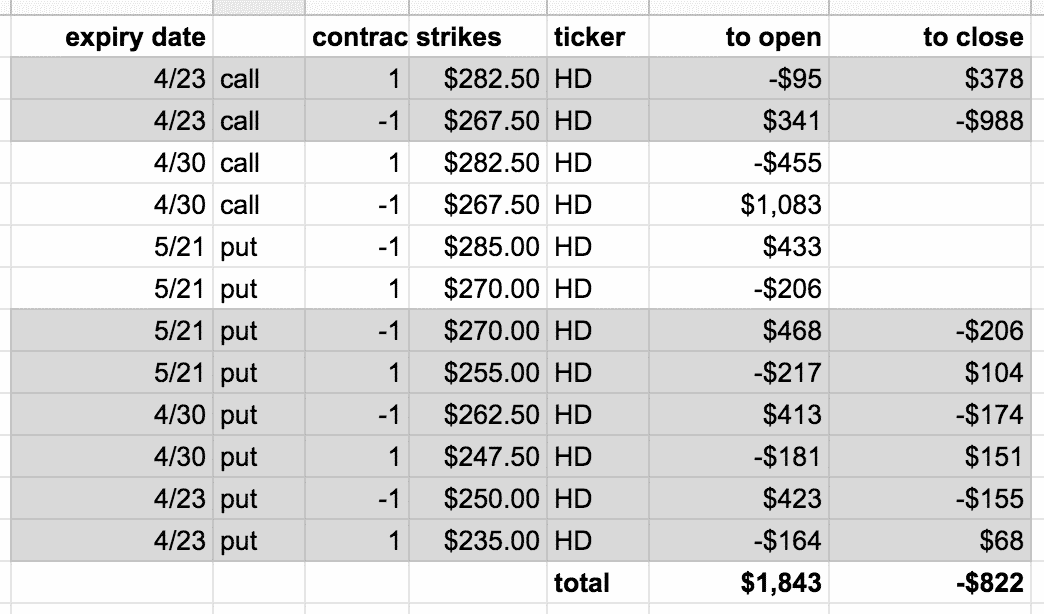

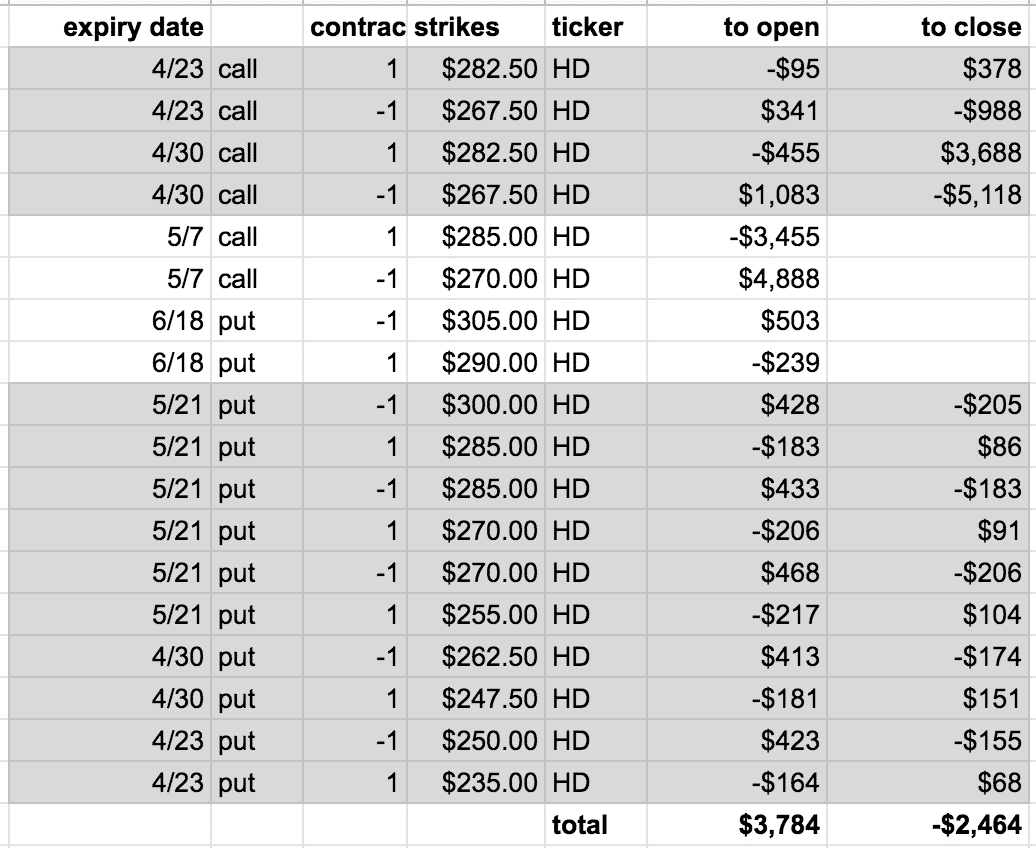

We need to keep detailed track of the credits and debits of each option leg, as well as their expiration date, in a spreadsheet.

A negative one contract means that we sold that option contract.

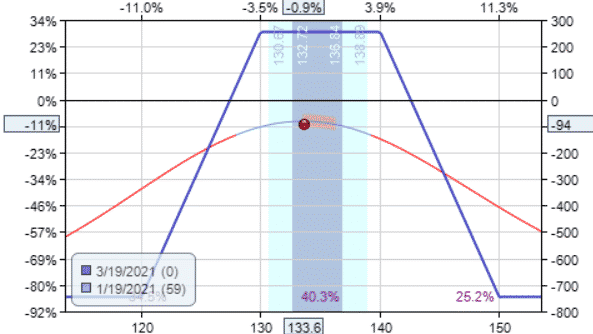

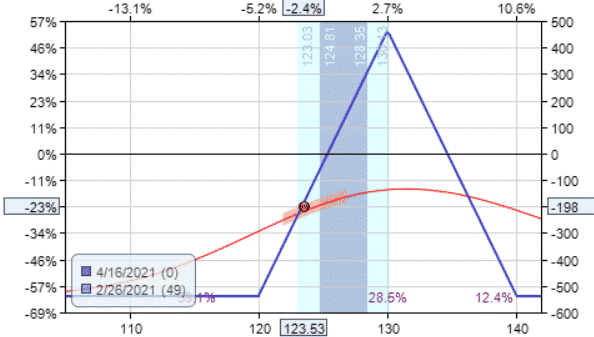

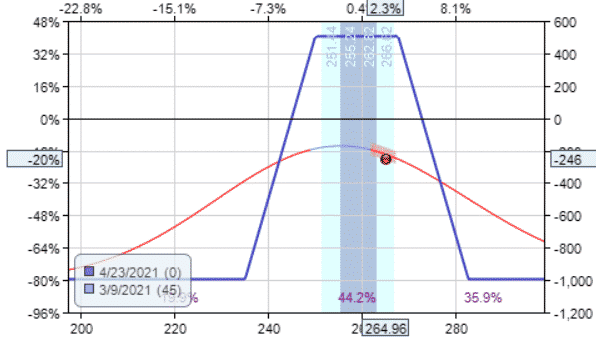

We end up with an iron condor payoff diagram:

The delta at which we sell the bear call spread will depend on this diagram and can vary based on the situation.

In this case, we were a bit more aggressive with the hedge by selling the bear call with the short strike at a relatively high delta of 30 to collect a better credit.

As can be seen, by the curvature of the T+0 line, this is just enough to neutralize the delta down to close to zero.

Some investors do not like to do a complete hedge, and it is unnecessary to do so.

Over-hedging can cause problems if prices reverse.

Rule #2: Take Profits at 50% of Max Profit

On a daily basis, check if either spread has reached 50% of max potential profit.

This will be the case if we can buy to close the spread for less than 50% of what we paid for the spread.

On January 22nd, the bear call spread can be repurchased for $59, which is less than half of the credit received.

So we close that spread to take profits.

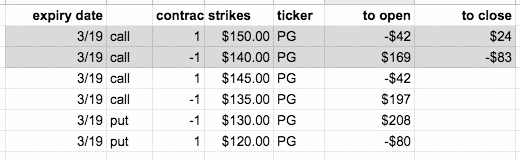

Date: January 22nd

Buy to close one $140 PG March 19th call @ $0.83

Sell to close one $150 PG March 19th call @ $0.24

Debit: $59

We update the spreadsheet by coloring the rows grey to indicate that those options have been closed out.

We immediately sell another bear call (at least 45 days away) to maintain our hedge against the bull put spread that is still in trouble.

Date: Jan 22

Sell one $135 PG Mar 19 call @ $1.97

Buy one $145 PG Mar 19 call @ $0.42

Credit: $155

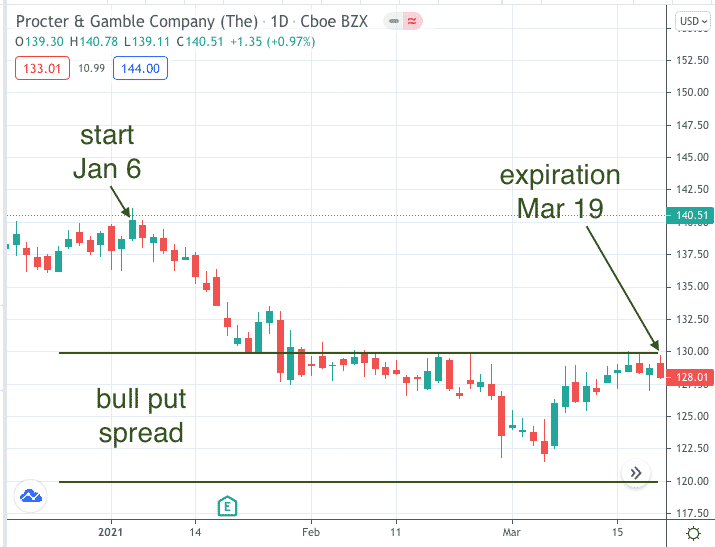

Rule #3: Roll Spread For A Credit If Breached

On January 27th, the bull put spread was breached with price closing below the short strike. The short option is now in the money.

When this happens, we roll to a future expiration keeping the strike prices the same.

But only if we can perform the roll for a credit.

Adding money to the roll would be increasing our risk because we would risk losing the max lost on the spread plus the additional money that we would have added.

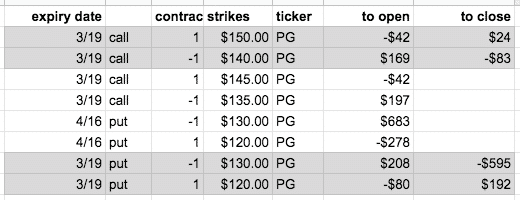

Date: Jan 27

Sell to close $120 PG Mar 19 put @ $1.92

Buy to close $130 PG Mar 19 put @ $5.95

Buy one $120 PG Apr 16 put @ $2.78

Sell one $130 PG Apr 16 put @ $6.83

Credit: $2

Rule #4: Repeat As Necessary

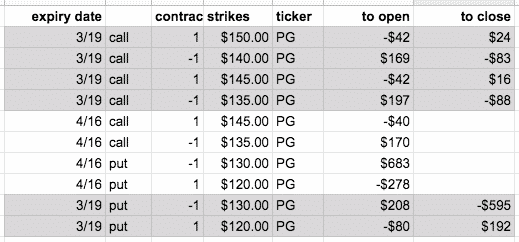

On February 10th, we take profit on the bear call spread and put on another one.

Date: Feb 10

Buy to close $135 PG Mar 19 call @ $0.88

Sell to close $145 PG Mar 19 call @ $0.16

Sell one $135 PG Apr 16 call @ $1.70

Buy one $145 PG Apr 16 call @ $40

Credit: $57

Again on February 26th, we close the bear call:

Date: Feb 26

Buy to close one $135 PG Apr 16 call @ $0.76

Sell to open one $145 PG Apr 16 call @ $0.22

Debit: $53.5

Sell one $130 PG Apr 16 call @ $1.40

Buy one $140 PG Apr 16 call @ $0.35

Credit: $105

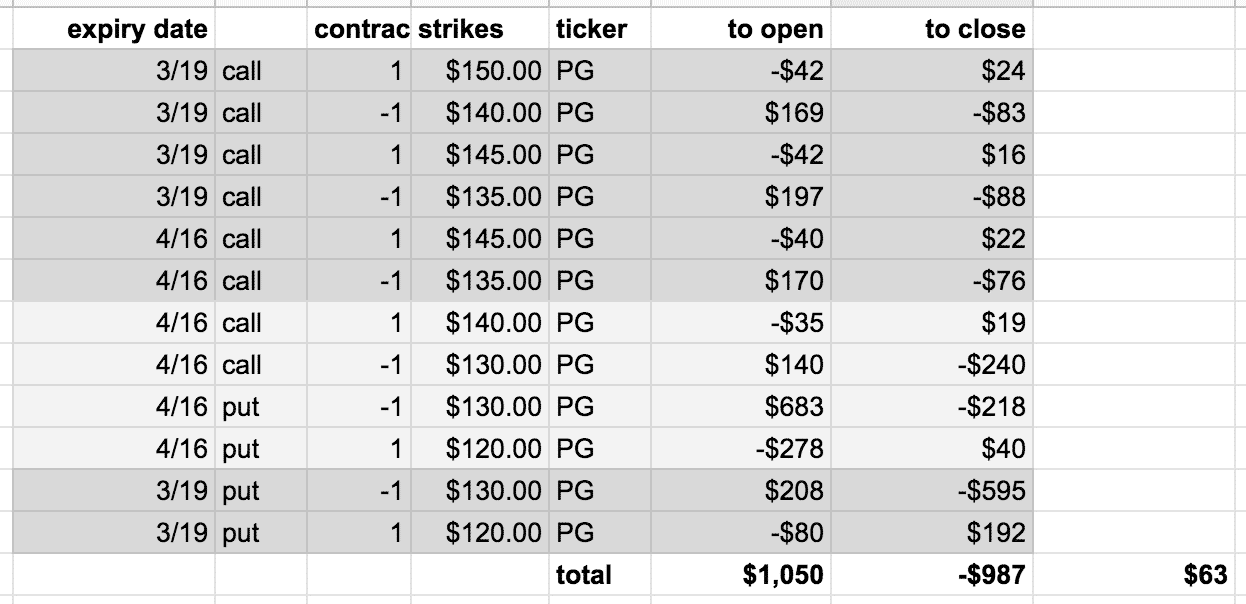

Our spreadsheet now looks like:

The bear call spread has moved so close to our original bull put spread that the short strikes touch, creating a butterfly.

By continuing to pick up credits, we reduced our max risk to $538, which is less than our original max risk of $872.

How did we compute $538? Suppose if PG price goes to zero, then the existing calls would expire worthless, and we would lose $1000 from the existing put spread.

Take $1000 and subtract the $462 (see spreadsheet) of credit that we got from the closed options, and we get $538, which matches what the butterfly payoff diagram shows.

Rule #5: Take Profits At Breakeven On Trades Gone Bad

Once our initial bull put spread has been tested (price within 3% of short strike) and/or breached (price below short strike), that means that price had gone against us.

We would look to exit the entire position at breakeven or positive P&L (profit and loss).

No longer are we seeking the 50% of max profits.

On March 22nd, the P&L closed positive for the first time in the entire trade. So we paid $398 to close out the position.

Date: March 22

Buy to close one $130 PG Apr 16 call @ $2.40

Sell to close one $140 PG Apr 16 call @ $0.19

Buy to close one $130 PG Apr 16 put @ $2.18

Sell to close one $120 PG Apr 16 put @ $0.40

Debit: $398

The net result was a small profit of $63.

Ironically, we came into profit one trading day after the original bull put spread would have expired.

The rolling of our spreads had given us additional time for the cyclicality of price movements to move just enough for us to come out positive.

In the following hypothetical example, we have one more rule to get us out of a trade if the price never accommodated us.

Bear Call Credit Spread Example

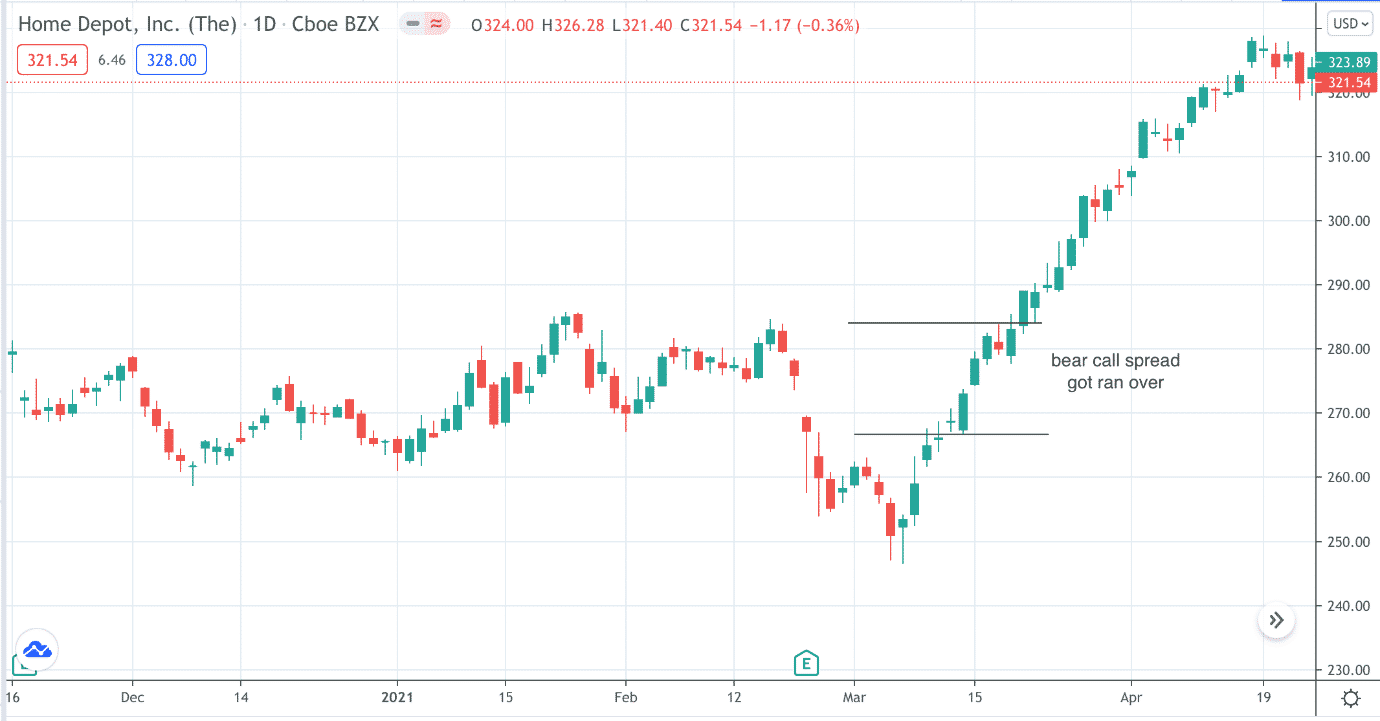

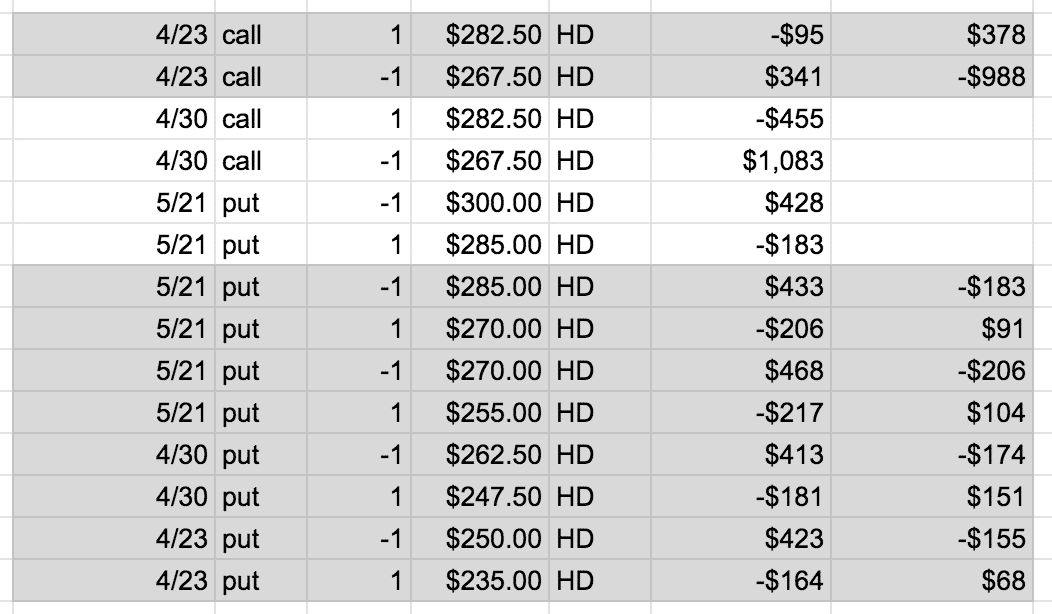

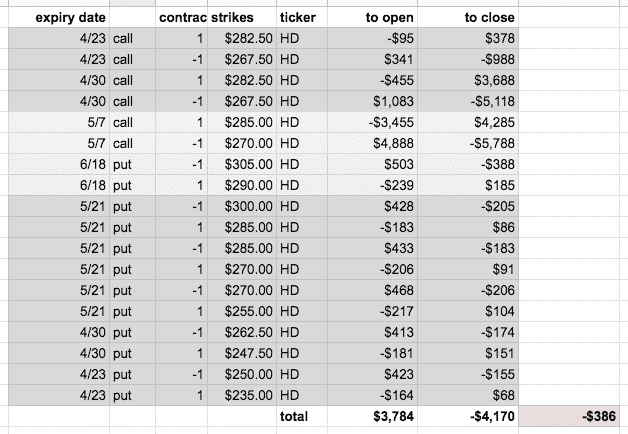

Imagine if we had placed a bear call spread when Home Depot (HD) stock price made a lower low.

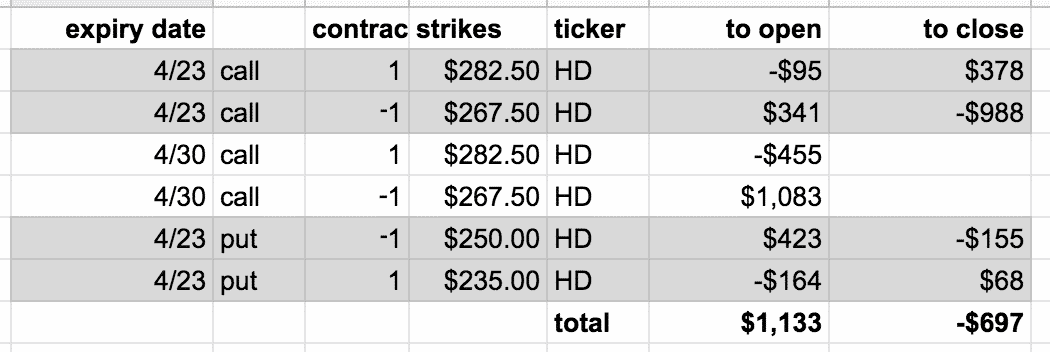

Date: March 4, 2021

Price: HD @ $250.93

Sell one $267.5 HD Apr 23 call @ $3.41

Buy one $282.5 HD Apr 23 call @ $0.95

Credit: $246

Max Risk: $1254

Risk to Reward ratio: 5.1

And then it makes a crazy move like this against us:

Yes, you can purchase shares of HD to hedge when the price breached the short strike.

That can work and is a perfectly valid strategy.

But let’s apply the five steps of our adjustment strategy to see what happens.

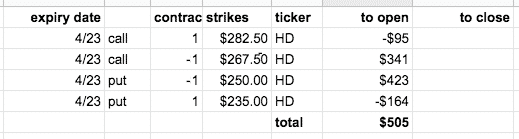

Apply Rule 1: Hedge At 3% Of The Short Strike

On March 9th, the price of HD closed within 3% of the short strike of $267.5.

We hedge by adding a bull put credit spread with at least 45 days till expiration.

Date: March 9

Price: $264.96

Buy one $235 HD Apr 23 put @ $1.64

Sell one $250 HD Apr 23 put @ $4.23

Credit: $259

In this case, the bull put spread expiration happens to be the same as the bear call spread. So we end up with a payoff diagram of an iron condor.

Apply Rule #3: Roll Spread For Credit If Breached

On March 11th, the price of HD closed at $268.85, which is above the short call strike price of $267.50.

The bear call spread has been breached.

We roll.

Date: March 11

Price: $268.85

Buy to close one $267.5 HD Apr 23 call @ $9.88

Sell to close one $282.5 HD Apr 23 call @ $3.78

Sell one $267.5 HD Apr 30 call @ $10.83

Buy one $282.5 HD Apr 30 call @ $4.55

Credit: $18

Apply Rule 2: Take Profits At 50% Of Max Profit

On March 15th, we can close the bull put spread for a debit of $87.

Date: March 15

Sell one $235 HD Apr 23 put @ $0.68

But one $250 HD Apr 23 put @ $1.55

Debit: $87

Apply Rule #4: Repeat Hedge

Our bear call spread is still in trouble. We continue to add a new bull put hedge.

We are putting that short strike at around 25 delta.

But this can be adjusted at the investor’s discretion.

Remember to sell the spread with at least 45 days till expiration.

Date: March 15

Buy one $247.5 HD Apr 30 put @ $1.81

Sell one $262.5 HD Apr 30 put @ $4.13

Credit: $232

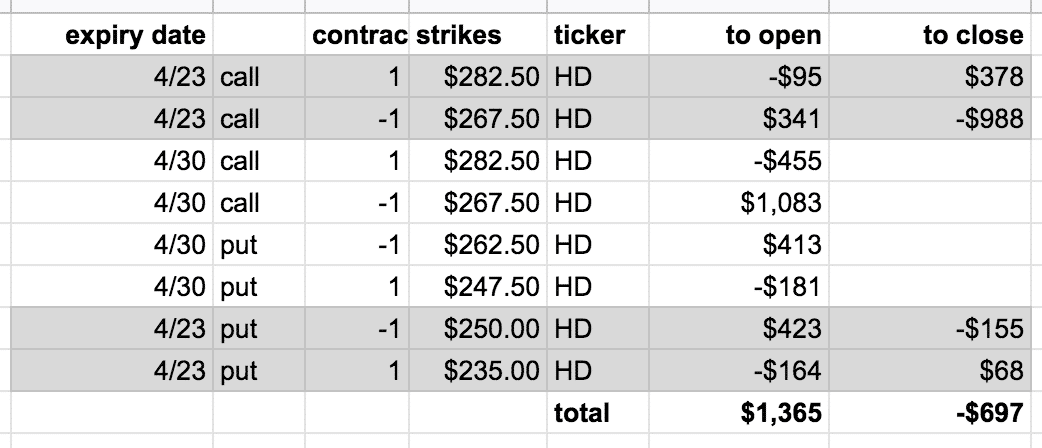

On March 19th, our bull put spread has more than 50% of max profit.

We close it and open another one all in one transaction.

Date: March 19

Sell to close one $247.5 HD Apr 30 put @ $1.51

Buy to close one $262.5 HD Apr 30 put @ $1.74

Buy one $255 HD May 21 put @ $2.17

Sell one $270 HD May 21 put @ $4.68

Credit: $228

Note that the expiration dates on the two spreads need not be the same.

Home Depot stock keeps going up, which means that we keep taking profits on the bull put spread.

Date: March 26

Sell to close $255 HD May 21 put @ $1.04

Buy to close $270 HD May 21 put @ $2.06

Buy one $270 HD May 21 put @ $2.06

Sell one $285 HD May 21 put @ $4.33

Credit: $125

We rolled up the bull put spread while keeping the same expiration dates since it is still further than 45 days away.

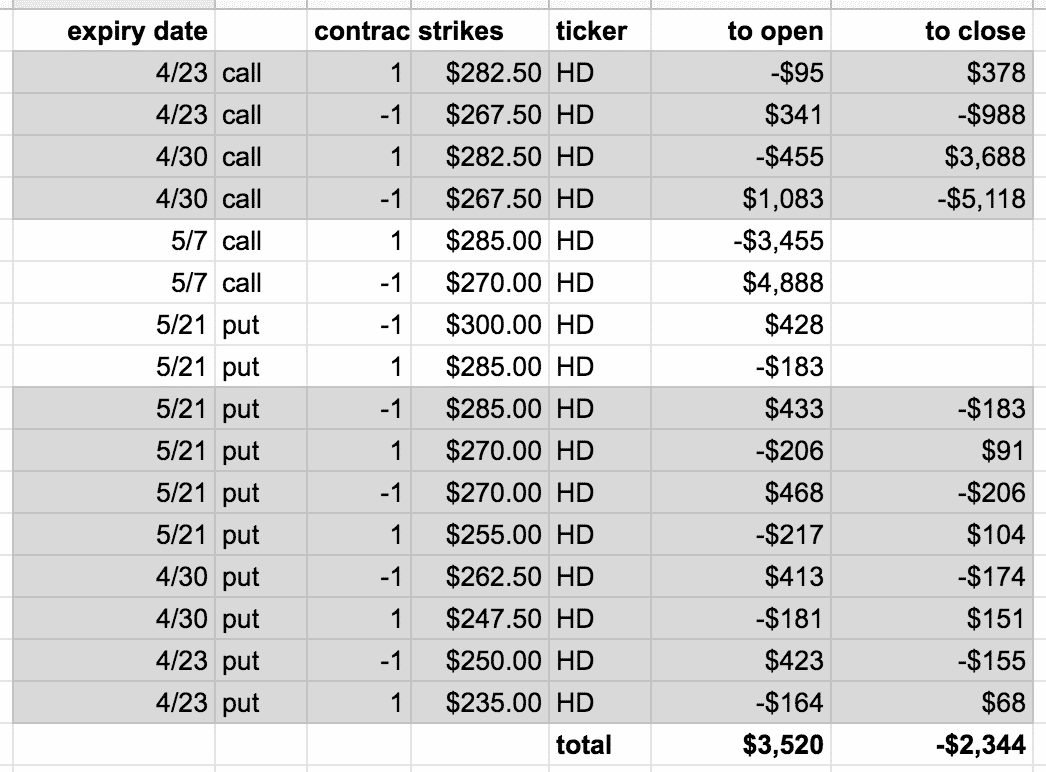

And again:

Date: Apr 5

Sell to close $270 HD May 21 put @ $0.91

Buy to close $285 HD May 21 put @ $1.83

Buy one $285 HD May 21 put @ $1.83

Sell one $300 HD May 21 put @ $4.28

Credit: $153

Rule #6: Don’t Let The Spread Get Closer Than 3 Weeks To Expiration

When a spread has 21 days or less till expiration, see if the spread can be rolled further out in time for a credit.

On April 9th, the bear call spread has only 21 days till expiration.

We can roll the spread further out in time for a credit. So we do so.

Date: April 9

Buy to close $267.5 HD Apr 30 call @ $51.18

Sell to close $282.5 HD Apr 30 call @ $36.88

Sell one $270 HD May 7 call @ $48.88

Buy one $285 HD May 7 call @ $34.55

Credit: $2.50

We usually would roll to the same strikes, but there was no $276.50 strike for the May 7th expiration.

So we had to use the $270 strike.

Hence we rolled to the $270/$285 bull put spread to maintain the 15 point width.

On April 15th, the bull put spread is ready for profit-taking, and then sell another bull put.

Date: April 15

Sell to close $285 HD May 21 put @ $0.86

Buy to close $300 HD May 21 put @ $2.05

Buy one $290 HD June 18 put @ $2.39

Sell one $305 HD June 18 put @ $5.03

Credit: $144.50

On April 16th, the bear call spread is at 21 days to expiration again.

We looked to roll to the May 14th, May 21st, May 28th, and June 18th expiration while keeping the same strikes.

But none of the rolls gave us a credit.

We don’t want to roll more than a month out because it would drag the trade on for too long, tying up capital.

Time to close this bear call spread since we don’t want to carry it closer to 21 days till expiration.

The final weeks of the spread are when gamma risk is high and is statistically where the most money is lost.

Date: April 16

Buy to close $270 HD May 7 call @ $57.88

Sell to close $285 HD May 7 call @ $42.85

Debit: $1502.50

Since the original bear call spread closed, we will close our hedging bull put spread as well, exiting the entire position.

Date: April 16

Sell to close $290 HD Jun 18 put @ $1.85

Buy to close $305 HD Jun 18 put @ $3.88

Debit: $203

The total P&L of the entire trade was a loss of –$386.

This is about 1.5 times the original credit — also known as a 1.5X loss.

This is not too bad, considering that we are not anywhere near the max loss of $1254.

Some investors may argue to continue with the bull put spread since it still has more than three weeks left.

That is a valid point, and one can continue that as a new trade if desired.

FAQ

What Is An Option Credit Spread?

An option credit spread is a trading strategy that involves selling an option with a higher strike price and buying an option with a lower strike price.

The goal is to collect a credit from the difference in premiums between the two options, while limiting the potential loss to the difference in strike prices.

What Went Wrong With The Author’s Option Credit Spreads?

The author’s option credit spreads went wrong because the underlying stock price moved against the position, causing losses to mount and eventually triggering a margin call.

The author also made the mistake of not closing losing trades early, which exacerbated the losses.

Is Option Trading Risky?

Yes, option trading can be risky, especially if you don’t understand the potential risks and strategies involved.

Options can be complex and volatile, and losses can mount quickly if the underlying stock price moves against your position.

It’s important to do your research, have a trading plan, and use risk management strategies like stop-loss orders and position sizing to manage your risk.

Can Option Credit Spreads Be Profitable?

Yes, option credit spreads can be profitable if executed properly and with a sound trading plan.

The strategy can generate consistent income by collecting credits from the difference in premiums between the options.

However, it’s important to manage risk by setting stop-loss orders, closing losing trades early, and avoiding over-leveraging or taking on positions that are too large for your account.

Conclusion

Now you have some strategies and ideas to prevent credit spreads for destroying your life.

The main take-away is to roll spreads out for more time when it can be done for a credit.

Pickup credits by selling opposing hedges to reduce delta as well as max risk.

Hopefully, the cyclicality of stock prices will move the P&L back to breakeven from trades gone bad.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Hi there,

I love the strategy you have laid out here, it’s pretty neat! 🙂 Our of curiosity, how did you arrive at the conclusion that 3% is the latest point for one to start hedging?

Thanks.

Glad you liked it. Just from experience, that once it gets closer than that, the losses start to snowball pretty quickly and it gets harder to adjust.

Hi! Great blog.

I also trade credit spreads on weeklies in Indian indices but I prefer to close my trade when the trend direction changes and my trade goes in a loss and then I take the opposite side credit spread trade by matching the premium. So in your bull put spread example, I would have reversed my position most probably on Jan 14 or 15 by taking a loss and then selling a bear call spread as clearly the trend of the stock was downwards.

I believe credit spreads should be traded strictly with the direction of the stock or index and never be held till expiration. I would never ever let my sold options leg to become ITM ever. I know people have made fortunes trading credit spreads with discipline which means to reverse the position the moment direction of the trend changes by taking the loss as that loss most probably would be covered with the reversed trade.

The biggest challenge for this approach is to get comfortable with finding the trend direction. It can be with Moving Averages, Supertrend or what ever indicator you chose but just stick to it.

Would love your thoughts on my approach. Thank you.

Yes I agree with your approach, it’s a good one. Definitely never let a credit spread go in-the-money.

You said in reply to a comment above: “Definitely never let a credit spread go in-the-money.” And yet your bear call credit spread went deeply in the money. Just checking what you mean by that

These were just for example purposes. I try to not let my credit spreads go in the money, ever. But, sometimes there can be a big gap up or down and you find yourself in that situation. Hopefully the article presented some ideas of how to handle that situation, but it’s best to try and avoid it in the first place.

When rolling an ITM spread, can you just roll the sold option and keep the long where it is (assuming you still have 2-3 weeks until expiration)?

No reason why not, but I would want to analyze each situation, check the greeks and the risk graph to make sure I was happy with the adjusted trade.