Today, we will look at how to adjust a losing credit spread.

When a credit spread goes against us, there are three primary actions we can take: hedge it, roll it, or close it.

Yes, you can do a combination of the actions, or reduce the size of the position, or apply other advanced techniques.

But we will focus on these primary methods to understand the concepts first.

Contents

- Example Of How To Adjust A Losing Credit Spread

- 1: Decide On The Time Frame

- 2: Decide On The Short Leg

- 3: Decide On The Long Leg

- 4: Decide On The Take-Profit Level

- 5: Decide When To Hedge

- 6: Decide When To Roll

- 7: Decide When To Exit The Trade

- Using Stop Losses For Losing Credit Spreads

- Adjusting Examples

- Trade Summary

- Losing Bull Puts Coming Out Positive

- Bear Call Credit Spread Example

- Adjusting A Losing Credit Spread By Hedging With Stock

- FAQ

- Conclusions

Example Of How To Adjust A Losing Credit Spread

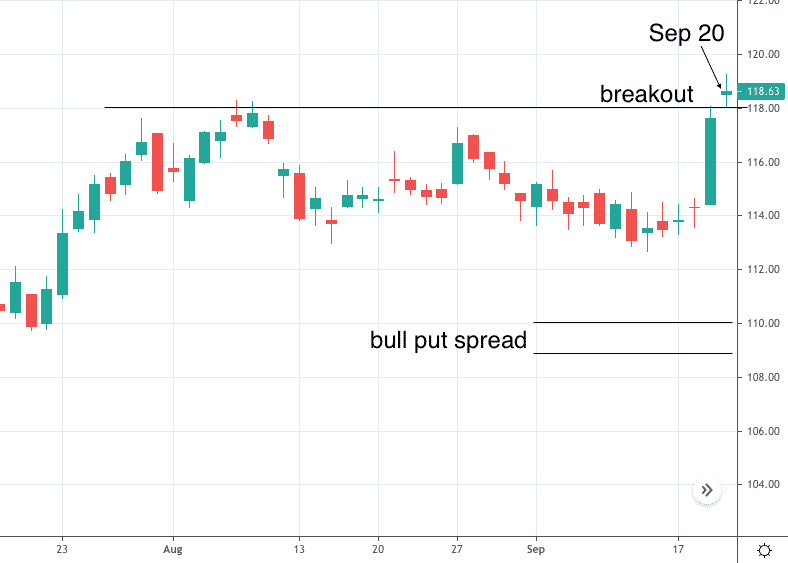

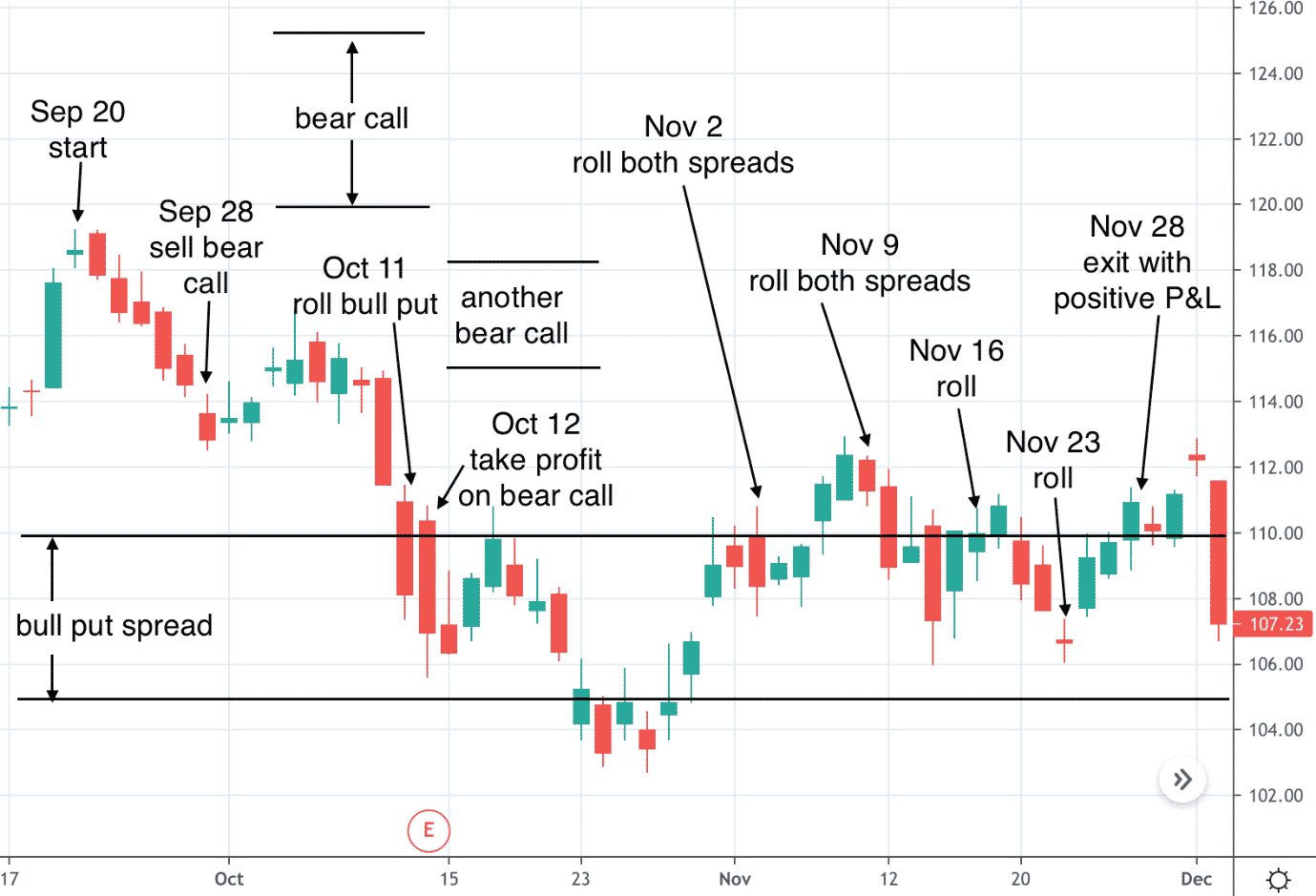

For our example, suppose we saw a breakout on JP Morgan Chase (JPM) on September 20, 2018, and would like to sell a bull put spread…

Let’s do this step-by-step.

Step 1: Decide On The Time Frame

A shorter-term trader may do 21 days to expiration (DTE) for the spread.

A longer-term trader may do 75 days to expiration.

While a 45 DTE might be ideal; in this case, there was not a monthly expiration at that timeframe.

So, we will go with the longer-term DTE expiring on Nov 16.

The reason we prefer monthly expiration cycles is that they are more liquid and have tighter bid/ask spreads.

Step 2: Decide On The Short Leg

The question is how far out of the money should we put the short strike.

There is no one right answer for this one. Anywhere from 10 Delta to 30 Delta would be acceptable.

Going closer to the money at the 30 Delta means we collect a greater premium but have a greater risk of the price testing our spread.

Going further out-of-the-money at the 15 Delta means that we would have a greater probability of profit.

But on the times when we do not profit, we can lose a lot more than we win. The risk to reward ratio is greater.

In this case, we choose the $110 strike at the 17 Delta.

Step 3: Decide On The Long Leg

The long leg of the credit spread is our protective leg.

Putting it closer to our short strike will give us greater protection.

The max loss will be less. However, the total premium received will be lower.

Putting it further away from the short leg and widening the spread will make it behave closer to that of an undefined strategy (such as a naked short put or cash-secured put).

This means a greater risk to reward ratio.

However, because the trade collects a larger credit, it moves the break-even point further away from the current price, which will mean a greater probability of profit.

We must be careful not to make the spread too tight.

It reduces our ability to roll the spread for a credit.

In this case, we choose the $105 long strike at the 9 Delta.

5 points wide is common for credit spreads.

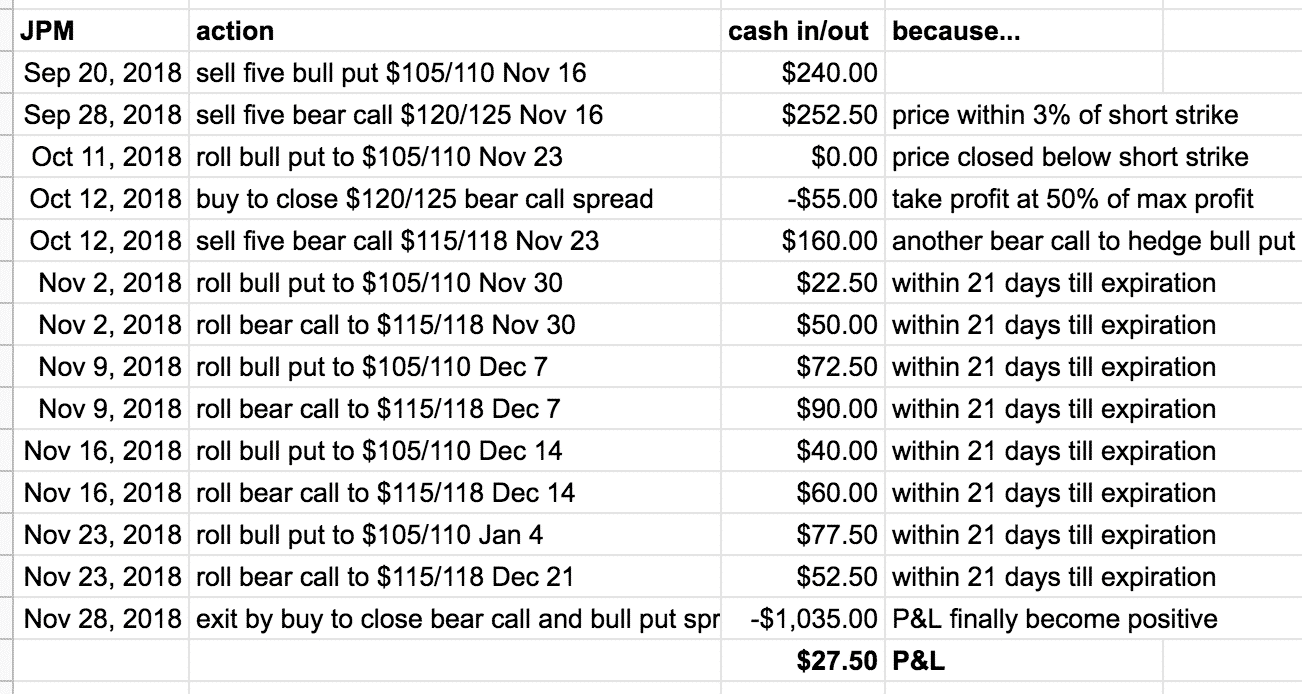

Date: Sep 20, 2018

Price: JPM @ 118.63

Sell five Nov 16 JPM $110 put @ $0.90.

Buy five Nov 16 JPM $105 put @ $0.42.

Credit: $240

Max Risk: $2500 – 240 = $2260

Risk to Reward: 9.4

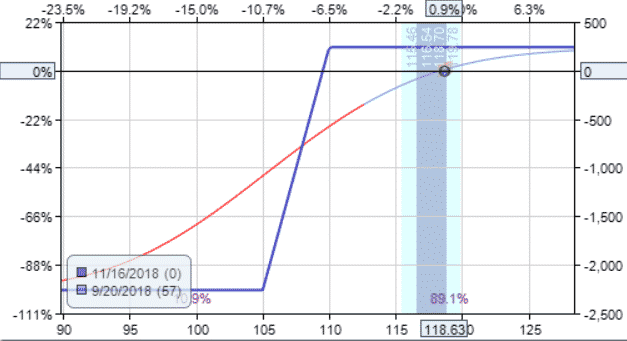

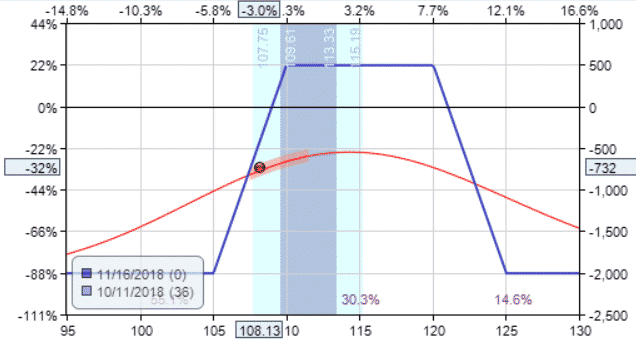

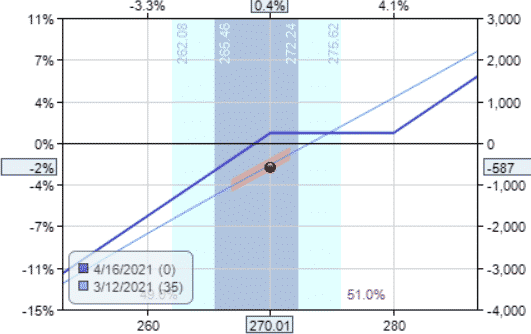

The payoff diagram looks like this…

Step 4: Decide On The Take-Profit Level

A take profit level of 50% of max profit is common and that is what we will use.

Since the initial premium that we received is $240, we will exit the trade and take our profits if we see that our P&L (profit-and-loss) exceeds $120.

Step 5: Decide When To Hedge

If our bull put credit spread is under pressure, meaning the price is coming down close to our short strike, we want to take offensive action and put on a bear call spread to hedge.

When?

As the price comes close to the bull put spread, the short strike Delta will increase from its initial value of 17 Delta to 30 or something like that.

Some investors like to watch this Delta to decide when to hedge.

Others like to see how close the price is to the short strike in terms of percentage points.

Both ways are correct.

For our back test, we will hedge when the price comes within 3% of our short strike.

Since we sold the short put at strike of $110, we will hedge by selling a bear call spread if the price drops to $113.30.

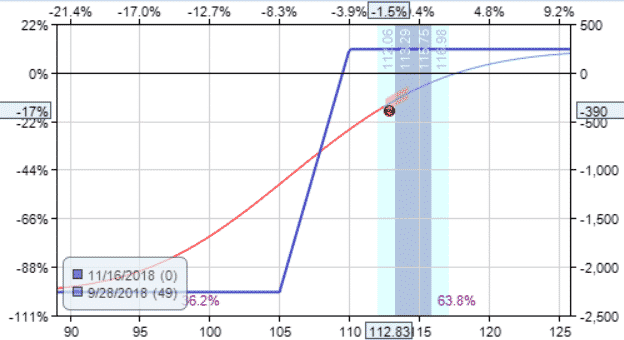

Looking only at the closing prices, the price of JPM on September 28 is within 3% of our short strike.

What Delta and how far out should we sell the bear call?

Sell it at around the same Delta as what you had chosen initially for the bull put spread.

Sell it at the same expiration as the bull put spread if it is 30 or more days away till expiration.

Otherwise, sell it at least 30 days away from expiration.

For this hedging spread, we do not have to limit ourselves to the monthly expiration cycle.

We can go with the weekly expiration cycles.

In this case, we sold at 19 Delta and bought at 6 Delta:

Date: Sep 28, 2018

Price: $112.84

Sell five Nov 16 JPM $120 call @ $0.725.

Buy five Nov 16 JPM $125 call @ $0.22.

Credit: $252.50

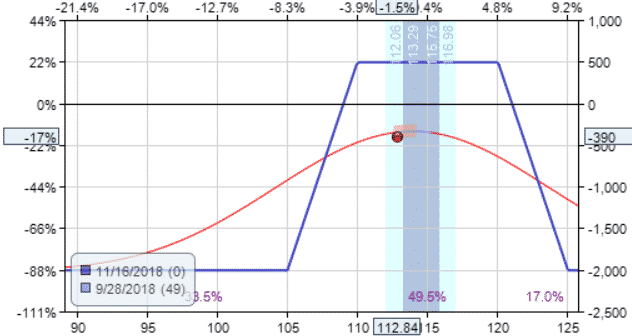

This adjustment reduced our Delta from 84 to 19.

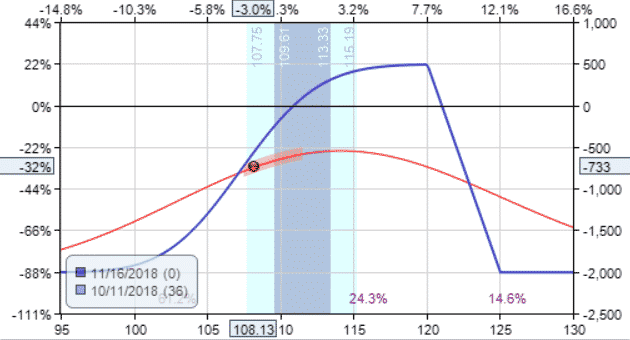

Before adjustment:

After adjustment:

Step 6: Decide When To Roll

If the price closes lower than our short strike of $110, then we will see if we can roll the spread out in time for a credit.

On October 11, the price breached our short strike…

We roll the spread one week out in time for even money.

Date: Oct 11, 2018

Price: $108.13

Buy five Nov 16 JPM $110 put @ $4.575.

Sell five Nov 23 JPM $110 put @ $4.725.

Sell five Nov 16 JPM $105 put @ $2.41.

Buy five Nov 23 JPM $105 put @ $2.56.

If we were not able to roll it out one week for even money or for a credit.

We would try to roll it further out in time until we can get a credit.

If you must go out further than a month to collect a credit, that means the trade has gone against us quite a bit. In that case, close the spread instead of rolling.

Rolling the spread out one week reduced our Delta slightly from 69 to 64.

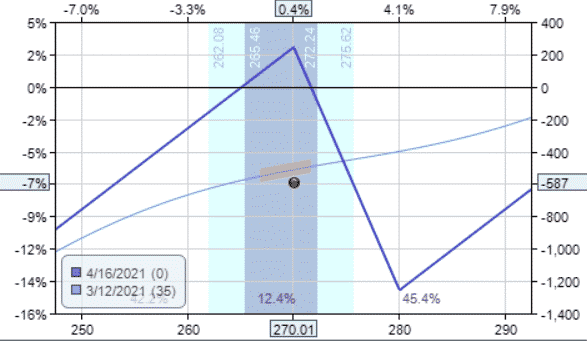

The payoff diagram now looks like a shark fin.

We do not want to pay a debit to perform the roll because that would be adding additional money to a losing trade.

Whenever you add money to a trade, you add the additional risk that you might lose that money.

Step 7: Decide When To Exit The Trade

If a roll must be made, that means the trade has gone against us.

At this point, we just want to come out positive.

Forget about reaching the profit target.

We now plan to exit the trade as soon as our profit and loss (P&L) of the entire trade shows a positive number again.

On Oct 12, our bull put spread is still at a loss. But our bear call spread exceeded 50% profit.

So, we buy all five contracts back for $55.

Date: Oct 12

Buy five Nov 16 JPM $120 call @ $0.15.

Sell five Nov 18 JPM $125 call @ $0.04.

We can immediately sell another bear call spread at 42 days to expiration at the 17 and 9 Delta.

Sell five Nov 23 JPM $115 call @ $0.64.

Buy five Nov 23 JPM $118 call @ $0.32.

Credit: $160

For our bull put spread, the profit-taking level was never reached. We need to have an exit plan for those cases.

Some investors like to have a stop loss. If the amount of the loss exceeds twice the premium received, then close the trade — that’s a really simple rule to follow.

Some will do three times the premium received, and others will do one times the premium received.

As a note of reference, our example trade on October 11 is currently at a loss equal to three times the initial premium amount.

Using Stop Losses For Losing Credit Spreads

Be careful not to make your stop loss too tight.

You need to give the stock room and time to move so that it can come back to profitability.

Allowing the trade to continue for a longer duration keeps theta decay working in our favor.

For undefined risk strategies, having a stop-loss plan in place is a definite must. You do not want unlimited loss.

But for a defined risk strategy (such as our case), we can opt to use a timed exit point instead of a stop-loss point.

A defined risk strategy already has a pre-defined max loss.

This max loss typically occurs close to expiration.

By exiting earlier than the expiration date, we will generally not see the max loss — the key word being “generally”.

Our plan is to exit the trade when the trade has only 21 days till expiration left and it cannot be rolled for a credit.

On November 2, our bull put spread has only 21 days till expiration and it is still under pressure. Can we roll it out in time for a credit?

Yes, we can.

We can roll it out one more week for a credit.

Now it will no longer be at 21 days to expiration, which means we do not have to exit the trade for at least another week.

Adjusting Examples

Date: Nov 2

Buy five Nov 23 JPM $110 put @ $3.18.

Sell five Nov 30 JPM $110 put @ $3.53.

Sell five Nov 23 JPM $105 put @ $1.24.

Buy five Nov 30 JPM $105 put @ $1.54.

Credit: $25.0

Can the bear call spread be rolled out for a credit? Yes, it can.

Date: Nov 2

Buy five Nov 23 JPM $115 call @ $0.33.

Sell five Nov 30 JPM $115 call @ $0.53.

Sell five Nov 23 JPM $118 call @ $0.11.

Buy five Nov 30 JPM $118 call @ $0.21.

Credit: $50

On November 9, both the bear call and bull put again are at 21 days to expiration. P&L has not yet gone above zero.

Roll the bull put spread one week out for a credit of $72.5.

Date: Nov 9

Buy five Nov 30 JPM $110 put @ $1.50.

Sell five Dec 7 JPM $110 put @ $1.86.

Sell five Nov 30 JPM $105 put @ $0.50.

Buy five Dec 7 JPM $105 put @ $0.71.

And roll the bear call spread one week out for a credit of $90.

Buy five Nov 30 JPM $115 call @ $0.63.

Sell five Dec 7 JPM $115 call @ $0.97.

Sell five Nov 30 JPM $118 call @ $0.19.

Buy five Dec 7 JPM $118 call @ $0.34.

On Nov 16, we roll both the bull put and bear call for $40 and $60 credit respectively.

Date: Nov 16

Buy five Dec 7 JPM $110 put @ $2.19.

Sell five Dec 14 JPM $110 put @ $2.52.

Sell five Dec 7 JPM $105 put @ $0.79.

Buy five Dec 14 JPM $105 put @ $1.05.

Buy five Dec 7 JPM $115 call @ $0.52.

Sell five Dec 14 JPM $115 call @ $0.79.

Sell five Dec 7 JPM $118 call @ $0.15.

Buy five Dec 14 JPM $118 call @ $0.30.

On Nov 23, we must roll the bull put spread out three weeks to get a credit of $77.50.

Buy five Dec 14 JPM $110 put @ $4.48.

Sell five Jan 4 JPM $110 put @ $5.60.

Sell five Dec 14 JPM $105 put @ $1.94.

Buy five Jan 4 JPM $105 put @ $2.91.

On Nov 23, we roll the bear call spread out one week for a credit of $52.50:

Buy five Dec 14 JPM $115 call @ $0.25.

Sell five Dec 21 JPM $115 call @ $0.43.

Sell five Dec 14 JPM $118 call @ $0.09.

Buy five Dec 21 JPM $118 call @ $0.17.

Finally, on November 28, the P&L of our entire trade is showing a positive $27.50.

Exit the trade by …

Buy five Jan 4 JPM $110 put @ $2.72.

Sell five Jan 4 JPM $105 put @ $1.21.

Buy five Dec 21 JPM $115 call @ $0.87.

Sell five Dec 21 JPM $118 call @ $0.31.

Debit: –$1035

Trade Summary

The trade ran two months from September 20 to November 28 with the price going from $118.63 down to $110.94.

Although the price went in the wrong direction, the use of options and proper trade management, it was still possible to end up with positive P&L — which does not happen when using only stocks.

This is one of the reasons we like to use options.

Options are more complex than buying and selling stocks.

There are a lot of moving parts.

You must keep track of where price is in relation to the short strikes.

You must keep track of how many days to expiration, the P&L of each spread, and calculate the overall trade P&L in a spreadsheet.

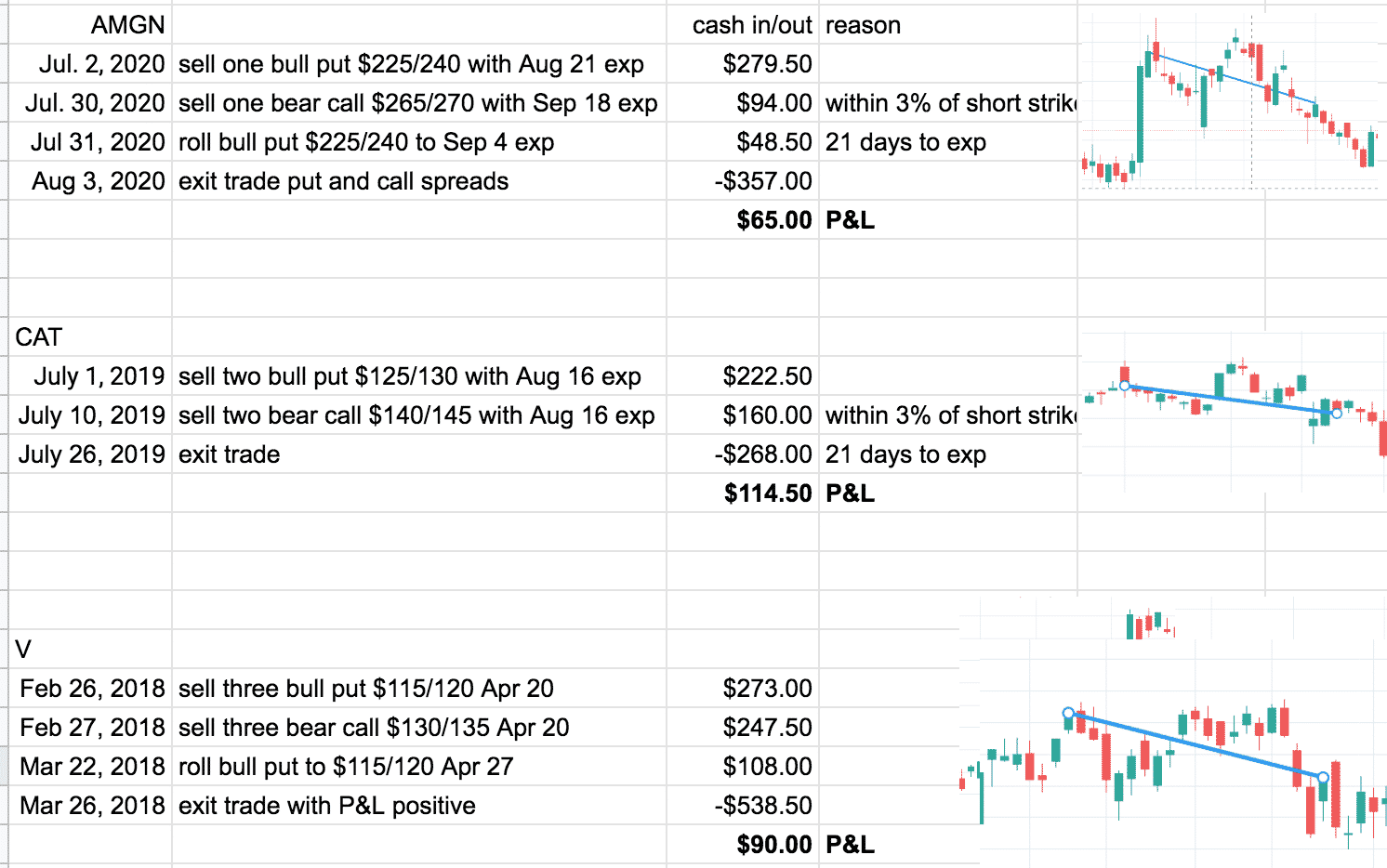

Losing Bull Puts Coming Out Positive

It is not uncommon for trades to go against us and still come out positive. Here are some examples.

Getting back to break-even in a losing credit spread is possible only if price goes against the trade slightly.

In the next example, we will see a losing credit spread where the price went relentlessly against us such that we are not able to break even.

Bear Call Credit Spread Example

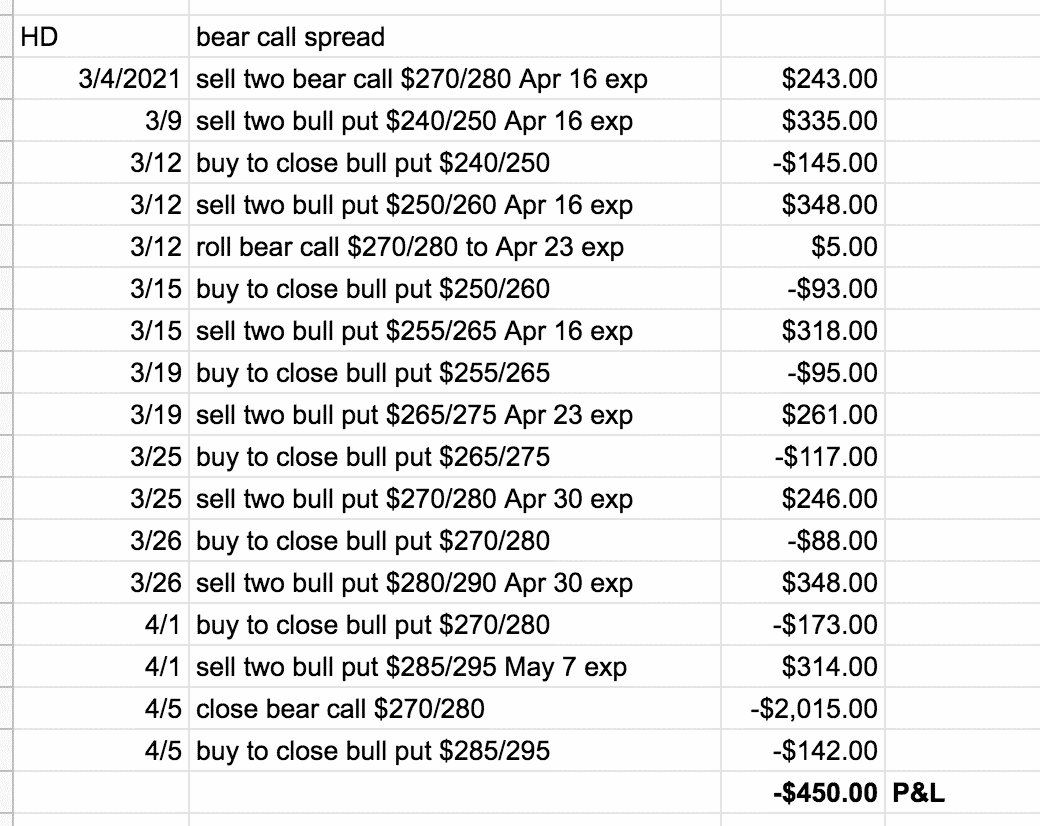

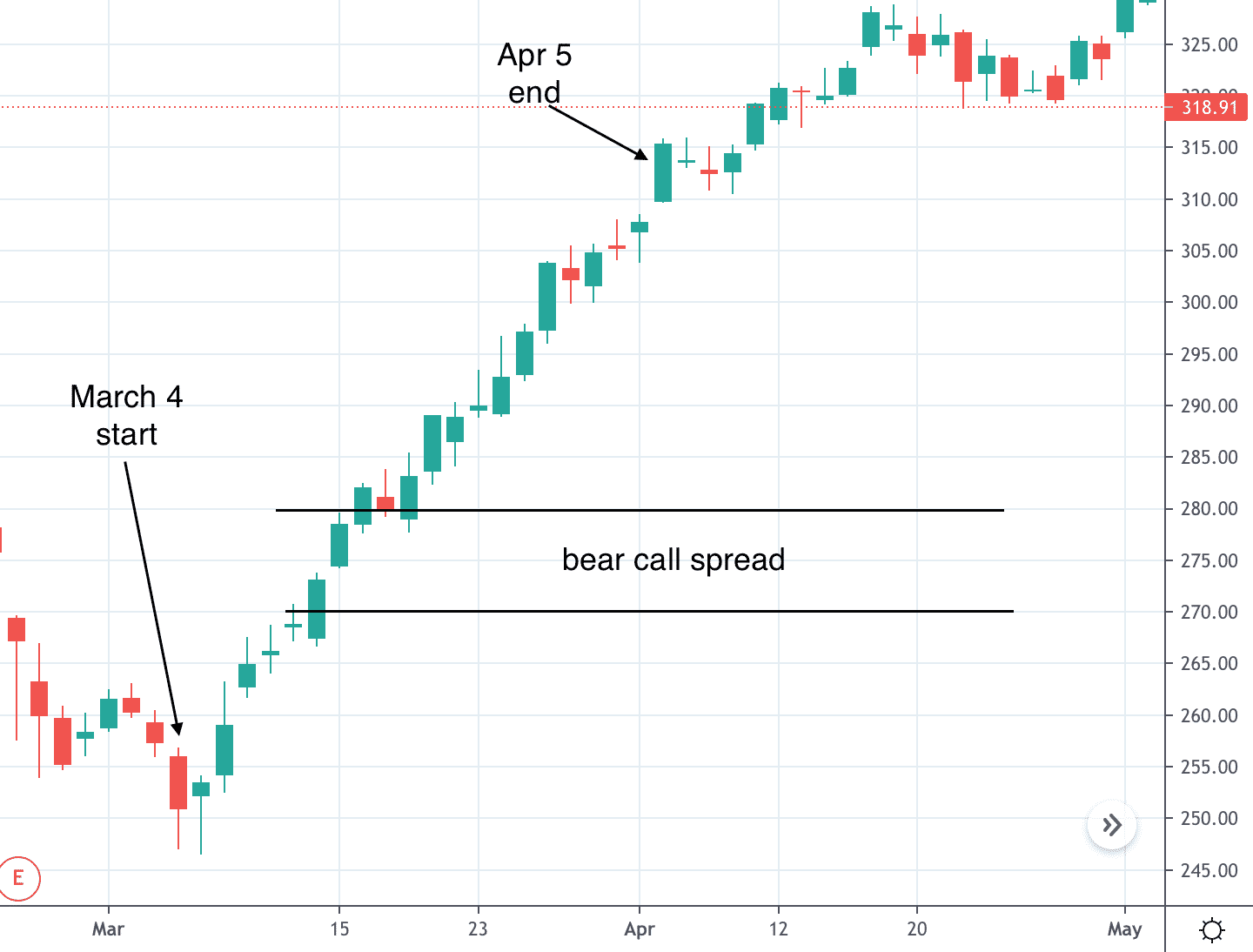

In this example, we will do a bear call spread on Home Depot (HD) on March 4, 2021.

Price: $250.93

Sell two Apr 16 HD $270 call @ $2.31.

Buy two Apr 16 HD $280 call @ $1.10.

Credit: $243

Max Risk: $1757

On March 9, price came up to within 3% of the short strike.

So, we sold bull put spreads to hedge.

We keep taking profit on the bull put spreads whenever 50% of max profit is received.

We then immediately sell another spread.

Here are the back test transactions.

On March 12, the price closed above the short call, so we rolled it one week out for a credit.

On April 5, the bear call spread has less than 21 days to expiration.

We try to roll for a credit, but it was not possible to do without going out further than one month in time.

Therefore, we close the bear call spread — costing us over $2000 to close.

On that same day, the bull put credit spread reached 50% of max profit, so we closed that trade as well.

The final net P&L on the entire trade is –$450.

Our max possible loss going into the trade was $1757.

All the credits we collected from the bull put spreads plus the fact that we do not go closer to 21 days to expiration helped us avoid taking the max loss.

If we had put on the exact same starting bear call spread and did nothing at all, we would have been at max loss on April 5th.

If you see what price did from March 4 to April 5, you will see why this trade went so wrong.

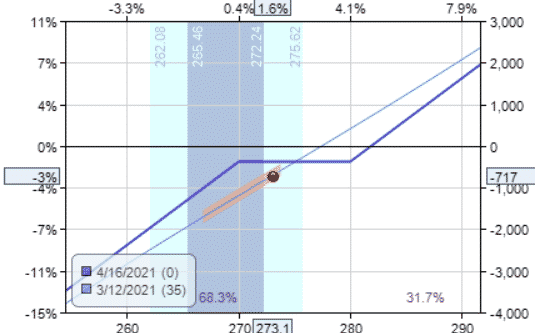

Adjusting A Losing Credit Spread By Hedging With Stock

For bear call spreads, there is another hedging technique that we would like to mention.

That is to buy shares of stock to cover the short call whenever the price goes above the short call.

In this example, we would buy 200 shares at $273.10 on March 12.

The payoff graph will then look like this…

Or you can set a buy limit order to buy as soon as price breaks above $270.

In that case, the payoff graph will look like this…

Because the 200 shares were purchased at the price point of the short call strike.

The shares completely hedge the risk of the short call. We gain on the initial credit received.

Note that we have turned our initially bearish credit spread into a very bullish trade.

This is not something you want if the price reverses and goes back down.

At least have a plan or a stock stop lost in place if the price does drops.

If the price closes back below $270, we would sell the 200 shares.

To avoid price whipsaws, many investors will choose to partially hedge instead of hedging 100%.

For example, if we had purchased 50 shares instead of 200, we get a much flatter T+0 line:

FAQ

What Is A Credit Spread?

A credit spread is an options trading strategy that involves simultaneously buying and selling options contracts with different strike prices.

The goal is to receive a net credit for the transaction, which is the difference between the premium received from selling the options and the premium paid for buying the options.

What Happens If A Credit Spread Is Losing Money?

If a credit spread is losing money, it means that the price of the underlying asset has moved against the trader’s position.

The trader may need to adjust the position in order to limit further losses or potentially turn the trade into a profitable one.

What Are Some Ways To Adjust A Losing Credit Spread?

There are several ways to adjust a losing credit spread, including rolling the spread to a different strike price or expiration date, adding a protective put option to limit downside risk, or closing the losing leg of the spread and leaving the winning leg open.

When Should I Consider Adjusting A Losing Credit Spread?

You should consider adjusting a losing credit spread when the price of the underlying asset has moved against your position and the potential losses are greater than the maximum profit of the trade.

It’s important to have a plan in place before entering the trade and to monitor the position regularly.

Conclusions

These credit spread adjustments can become quite involved.

The reader is encouraged to develop their own rules and write them down.

Then paper trade and back test the rules to get the mechanics correct and see possible outcomes before trading live with real money.

We hope you enjoyed this article on how to adjust a losing credit spread. If you have any questions, please send us an email or post a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Hi Gavin,

Thanks for the great article and content, as always.

A follow up question for you please.

Let’s assume that you’ve sold a bull credit spread at 15 delta that went against you, and the short leg is now at 30 delta. According to the logic in the article, we would want to hedge and sell a bear credit spread.

What happens if that trade reverses and now the bull spread is favourable, and the call spread is now in trouble?

As an example:

IWM bull spread sold on 23/04/2021 at 205/200 strikes.

205 strike on 12/05/2021 is at 32 delta, bear spread sold at 227/232.

The next day, the trade reverses and the market goes upwards and breaches the short call on 01/06/2021.

What would you do in these scenarios?

Thanks in advance!

Ofer

Hi Ofer,

Unfortunately, this sometimes happens. Whipsaw in prices are one of the most difficult to trade. Since you have two spreads on now, I would watch the P&L of the entire position. As soon as the entire position gets back to even or positive, take both spreads off. You might want to put in a standing order for that so you don’t have to be constantly at the screen. Continue to monitor each spread for three things. 1. As soon as either spread has 50% of its max profit, take the profit on that spread. 2. If price has breached either spread and that spread can be rolled further out in time for a credit, perform the roll. 3. If either spread has less than 21 days till expiration, close the spread. Hope that helps.

very smart

Hi Gavin,

Thanks for the article, very interesting.

What do you think of being very aggressive with the opposite side and place the short strikes at the same price? Then one could roll over and over again until the max loss is earned. I did do that in Crude Oil once the price went down so dramatically.. still was able to roll for a credit at that time, even the price went through both, short and long strike of the BPS..

BR, Markus

Hi Gavin.

Thanks for the brilliant article.

It is amazing to profit from a losing position!

I just wanted to clarify something

In your article you said at one point “As the price comes close to the bull put spread, the short strike Delta will increase from its initial value of 25 Delta to 30 or something like that.”

I was wondering what you meant by initial value of 25 when earlier you said when opening the trade “In this case, we choose the $110 strike at the 17 Delta.” or is that just a typo ?

Shouldn’t the 17 Delta be the initial value ?

Yes, it was a typo and should have been delta 17. Thanks for letting me know, it’s fixed now.

Hi Gavin, what you think of trading weekly credit spreads? The weekly looks to be more risky in term of the short time duration? Thanks

Yes much riskier. Too risky for me and you also have to watch them very closely which is not the style I want to trade, particularly with the time difference. If you have lots of time to watch them then the rewards are high. But high reward always = high risk.

Adjusting Examples

Date: Nov 2

Buy five Nov 23 JPM $110 put @ $3.18.

Sell five Nov 30 JPM $110 put @ $3.53.

Sell five Nov 23 JPM $105 put @ $1.24.

Buy five Nov 30 JPM $105 put @ $1.54.

Credit: $22.5, is there typo error in the number ? it should be $25 instead. thanks

You’re right. Thanks for letting me know, I’ve fixed it now.

in step-5 :bull put credit spread:

since we sold the short put@ $110, we will hedge by selling bear-call-spread , if the price drops to 113.30.. please advise if it is a typo and instead of drop , it should read if price rises to $113.30… many thanks

Hi bashu. No, it’s correct. The stock starts at 118.63 and it’s a bullish trade, so if the stock drops to 113.30, we need to start hedging. Hope that helps.

Thanks for these great examples, Gavin.

While I like the idea of collecting credits from the untested side to make up for the loss from the tested side, I have two concerns.

In the HD example, the call spread is so in the money. I wonder realistically how likely it will get assigned. (RUT or SPX should be fine.)

The call and put spreads have different exp. dates so the capital requirement will be doubled (not Iron Condor anymore). If I have already invested 50%+ of my account, this method will be harder to use if too much of my portfolio is being tested, especially when the market tanks. However, if I invest too little, I won’t get a good return on my whole account. Hard decision…

And a collar? (wait to be assigned).It can be do even with weekly spread that have high return on investment.

Or make the pendulum (trasform the bull put in a bear put, selling the long under the short and buy a long over the short (it he case a a bull PUT).

If bear call, do the opposite.

Stop loss are touched 80% of times.

Looks like your dates are off by a week, is that true? Tried following along on a tradingview chart and it wasn’t matching up. Thanks for the info though. Cheers

Looks ok to me.