What is profit factor in trading? Have you ever heard this term and wondered what it means?

Read on to find out.

Contents

- Introduction

- What Is The Profit Factor?

- What Is An Acceptable Profit Factor Level?

- Benefits Of Using The Profit Factor

- Problems Related To The Profit Factor

- Bottom Line

Introduction

Trading is never simple. In the stock market the margins between success and failure are razor thin.

To succeed some of the top minds formulate strategies and streamline those to achieve the best possible results.

This involves the creation of an idea and thesis.

Then research is needed to back test the strategy to see if it has any practical value.

Finally, the strategy needs to be tested in a live market environment.

Formulation of any kind of strategy is just the beginning and the same is followed with back testing to improve it.

Without this evaluation investors have no idea whether they are the casino or the gambler at the blackjack table.

One such barometer of performance is the Profit Factor.

Which helps to identify the profitability of a strategy.

What is Profit Factor?

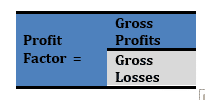

A profit factor is the parameter to evaluate the efficacy of any trading strategy and can be mathematically calculated using the formula as:

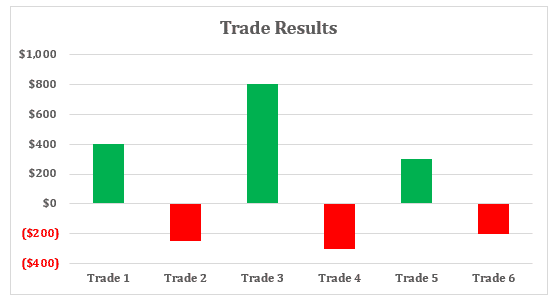

Let us take an example and calculate the profit factor of a strategy which results in three winning trades ($400, $800 & $300) and three losing trades (-$250, -$300 & -$200) for two weeks.

Shown in the chart below.

The profit factor of the strategy is = ($400 + $800 + $300)/ ($250 + $300+ $200) which comes to be 2.

A profit factor of 2 states that the winning trades are twice as large as losing trades.

In other words, it can also be said that for every $1 in risk, the return expected is $2.

What Is The Accepted Profit Factor Level?

Normally, the higher the profit factor, the better is the performance of the strategy. Despite this there is no universal profit factor that is recognized as successful.

Normally, a profit factor greater than 1 indicates a winning system and less than 1 a losing system. Despite this, the profit factor is based on gross profits.

As this is the case transaction fees such as broker commissions, slippage and taxes are not considered.

This can mean that a profit factor slightly over 1 may not be profitable.

These should be factored in when evaluating a strategies performance.

Moreover, any sort of strategy will result in a drawdown phase and go through degradation in the future as the nature of the markets does not remain the same.

Hence, considering room for strategy degradation should be accounted for.

Just because something worked in the past does not guarantee it will work in the future.

More likely than not a strategy that preforms very well over a certain period (for example momentum trading) will mean revert in the long run.

Benefits Of Profit Factor

- It monitors and evaluates the performance of a trading strategy.

- It helps in adjusting the trading parameters of a strategy. Tightening of parameters helps to take only the good trades which in turn can increase gross profits and the profit factor considerably.

- It guides in eliminating strategies that have a poor profit factor.

- It helps in assessing the win rate and drawdown of a strategy.

Problems related to Profit Factor

The profit factor is the most important metric to assess the performance of a strategy but its usage alone to judge a strategy is short sighted.

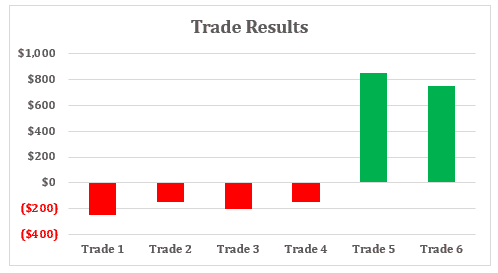

Let us take an example to analyze the problem related to the usage of profit factor.

Suppose the initial results for a new strategy result in 4 losing trades (- $250, -$150, -$200, -$150) and two winning trades ($850 & $750) in two weeks as seen in the chart below.

The profit factor in such scenario would be = ($850 + $750)/ ($250 + $150+ $200+ $150) which comes to 2.13.

It is worthwhile to notice that the new strategy results in a profit factor of 2.13 which is significant but there are a few points to be addressed.

- The data set only has six trades, so the profit factor cannot be reliable without a larger sample size.

- The drawdown seems to be high as there is a series of four consecutive losing trades.

The high drawdown and the low win rate may burn a trader mentally even if their strategy was profitable.

Additionally, in a situation with a few large winners and frequent losers it will take a considerable number of occurrences to find the true profit factor of a strategy.

For example, if we simply removed trade 5 from this example the profit factor is now negative.

Bottom Line

Profit factor is a useful measurement to evaluate the profitability of a trading system.

Despite this it has its drawbacks as it does not consider the length of drawdowns and can oversimplify small samples.

It is best used in combination with other performance metrics to rightly judge and assess the viability of any trading strategy.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.