This article will discuss the positives and negatives of using stop losses and look at the best stop loss strategy.

The use of stop losses can be very effective in portfolio management as a tool to mitigate risk.

I will introduce a basic, but effective, stop loss strategy that anyone can use in their portfolio.

Contents

- What is a Stop Loss?

- Benefits of the Stop Loss Order

- Drawbacks of a Stop Loss Order

- Best Stop Loss Strategy (And It’s Easy To Implement)

- Drawbacks to this Strategy:

- Concluding Remarks

What is a Stop Loss?

A stop loss is an active order placed by an investor holding a position in an equity.

This order while active is only triggered once the securities price falls below the stop loss limit which is set by the investor.

If at any point that price is breached the order is then executed and the investor sells their position at the prevailing market price.

Therefore, stopping further losses on the position.

Benefits of the Stop Loss Order

The single greatest benefit of the stop loss order is for an investor to limit drawdowns on a trade.

The unique versatility of a stop allows an investor to define a risk amount they would like to allocate to a trade.

They can also adjust and change this stop as their view evolves.

Unlike a put option, where the investor must pay a premium for protection, stop losses are free to place, monitor and change.

Drawbacks of a Stop Loss Order

While a stop loss order does provide a way to mitigate risk it only provides protection on intraday movements of a security, not overnight jumps.

For example, imagine Apple is trading at $120.

An investor decides they want to lose no more than 9% so they place a stop loss at $110.

Apple has earnings after hours and it turns out iPhone sales were a dud.

The stock drops dramatically and opens at $100.

In this case the stop will be executed at $100 at the market open and the investor would have lost double what their stop loss price.

Looks like next time they are shopping they might be buying a flip phone instead.

An additional risk to stop losses are liquidity events such as flash crashes.

These can cause rapid declines in the price of a security, often in minutes, for no apparent reason.

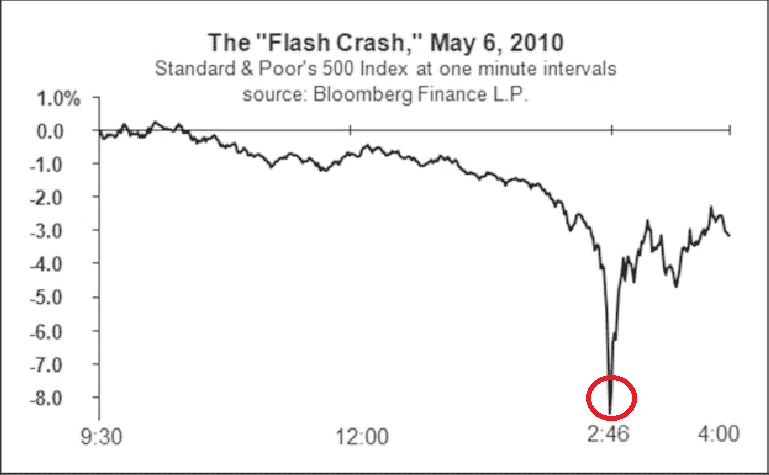

One of the major market wide flash crashes occurred in May of 2010.

While there were some macro events to justify a minor decline in equity prices an 8% decline made absolutely no sense.

An investor may have had no intention to sell due to the particularities of the decline but could have been knocked out right at the bottom (red circle), only to have equities mostly recover minutes later.

Source: Research Gate

Now for both of these disadvantages a put option can easily solve them.

The issue is that the premium paid for a put option can often turn a whole strategy sour.

After all, insurance isn’t free.

So how can we implement a simple stop loss strategy in our portfolio which minimizes these problems?

Best Stop Loss Strategy (And It’s Easy To Implement)

This strategy looks to take advantage of the market anomaly of momentum.

This anomaly states that stocks will trend more often than mean revert.

In addition, by placing stop losses we limit drawdowns therefore increasing our risk to return or sharpe ratio.

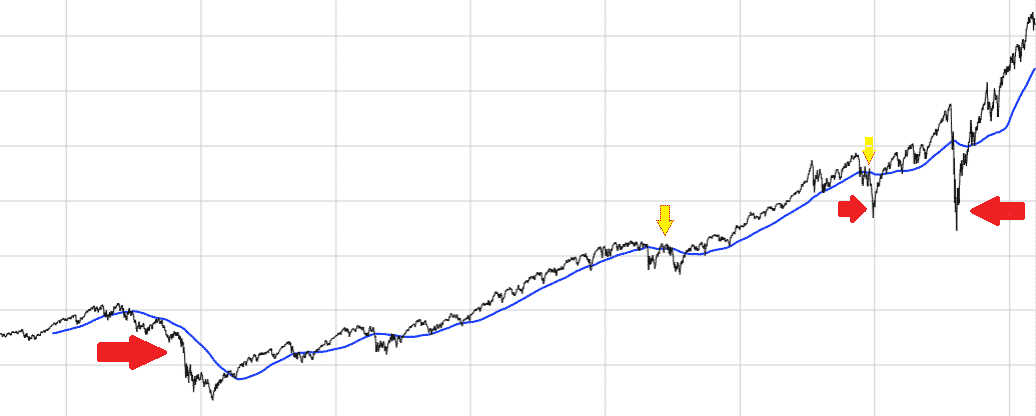

The strategy is simple. Buy SPY and set a stop loss at the 200-day moving average (blue line in chart below) This stop loss could then be adjusted periodically, say once a week as the moving average changes.

Once the index crosses the 200-day moving average the trade is exited.

At this point a new stop buy order is placed at the same blue line to re-enter the trade once the index overtakes the moving average again.

So, what would it look like? Let’s have a look!

Here we have a backtest from 2006. We can see that by implementing this strategy We would have avoided most of the drawdowns in the 2008 financial meltdown, the 2018 correction and the Covid pandemic of 2020.

This performance is even better in risk adjusted returns.

Due to the lower drawdowns an investor could apply leverage and easily beat the index.

Or alternatively have less variance while receiving equity like returns.

This looks too good to be true. So why doesn’t everyone do it?

The answer is many do. In fact, trend following and other volatility targeting strategies are one of the favorite among active managers.

So, while many retail investors focus on buying the dip (which works well until it flames out), the truth is, at least over history, trend following and selling the dip works much better.

Drawbacks to this Strategy:

Despite this, the strategy is not a free lunch.

For example, while the yellow arrows may seem insignificant, they would be periods where you would be whipsawed around.

Re-entering positions only to be stopped out weeks later, then doing it again, all while racking up losses.

If in the long run the market has volatility in both directions, but the index stays range bound this strategy will underperform simple buy and hold investing.

The thesis and potential alpha of this strategy is based on one’s belief in momentum in the markets as opposed to mean reversion.

The Risk of Flash Crashes

Regarding the risks of flash crashes and price jumps.

This is also the reason I choose the S&P 500 for this strategy and not individual equities.

Individual equities have a far greater risk of price spikes and price jumps, even in conservative equities.

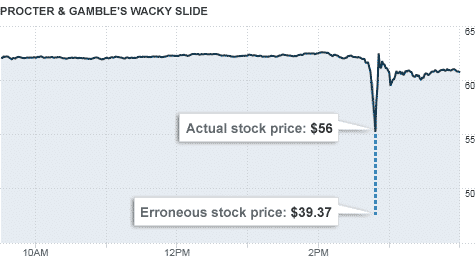

For example, in the same flash crash of 2010, while the index was down 8%, Proctor and Gamble was down over 20%! Even worse was the erroneous stock price, which caused Jim Cramer of Mad Money to almost blow up on live television.

Source: CNN Business

Remember Proctor and Gamble is a very liquid stock. Let’s imagine a small cap Chinese ADR with limited liquidity. It might not be pretty.

This is just one example of a simple strategy using stop losses.

There are many others that can be effective.

For example, if you thought there was a price floor at a certain level you could set a stop loss below it, if that price floor holds and your thesis holds you will stay in the position.

Conversely if you are wrong, you are able to quickly exit the position.

This mechanical ability of stop losses is a hidden benefit as it can allow investors to stick to their strategy and avoid bag holding worthless companies.

Shares of Enron anyone?

Bear Stearns?

Lehman Brothers?

Concluding Remarks

Stop losses offer a unique ability to limit a position’s loss while allowing an investor to not be constantly monitoring positions.

They also offer the versatility to be adapted, changed and modified to an individual’s risk constraints and view.

All this can be done at no cost, unlike put options.

While there are some drawbacks and risks to using stop losses these can be partially mitigated by focusing on very liquid products with less jump and manipulation risks.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.