An investor will buy a protective put when his outlook on the stock is bullish, but he wants to protect the value of the stock in the event of a downturn.

Contents

- Introduction

- Maximum Loss

- Maximum Gain

- Breakeven Price

- The Greeks

- How Volatility Impacts the Trade

- How Theta Impacts the Trade

- Risks

- Protective Put Examples

- Summary

Introduction

When someone concurrently holds a long position in a stock and a long position in a put option on that stock, the put is called a protective put.

The put protects against losses in the value of the underlying asset.

You can think of protective put as a savvy investor’s alternative to entering a stop order.

Stop orders are a great way to limit an investor’s loss as they allow the investor to exit out of a position when the stock hits a particular price.

However, stock orders often get triggered prematurely with fluctuations in the stock price.

On the other hand, a protective put gives you some control as the long put gives you the right, but not the obligation, to exercise your option to sell the stock at a predefined price.

The catch – you have to pay a premium upfront to buy the put.

Let’s look at an example of when someone would buy a protective put.

Suppose an investor is long 100 shares of Uber at $36.50 as of September 11, 2020.

The investor’s research suggests there may be a negative shock to the stock price in the next 3 to 5 weeks.

He doesn’t want to exit out of his stock position because he wants to preserve the upside but at the same time, he wants protection from downside risk.

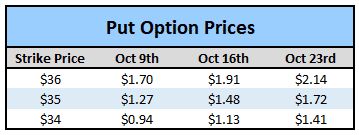

He looks at the options chain and notes the following put prices and put greeks.

Exhibit 1

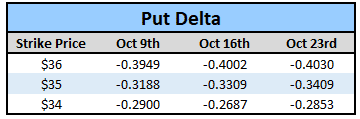

Exhibit 2

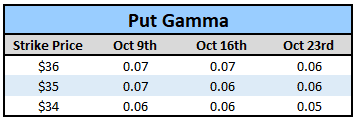

Exhibit 3

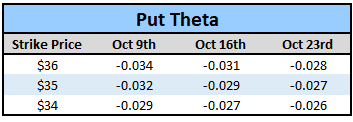

Exhibit 4

Exhibit 5

A put represents the right to sell at a strike/exercise price, so the higher the strike price, the more expensive the put will be.

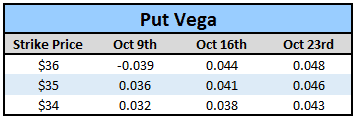

Also, longer maturity puts will be more expensive than their equivalent shorter maturity puts as longer maturity puts provide more time for the investor to exit the position (Exhibit 1).

Which put should the investor buy depends on the investor’s stock outlook as well as the greeks such as delta, theta, gamma, vega.

>

Generally speaking traders should buy long dated options as the option value decays slowly initially and picks up pace as it reaches expiration.

We will look at the Greeks in detail in sections below.

Maximum Loss

The investor paid to enter the protective put so right away he is down the premium.

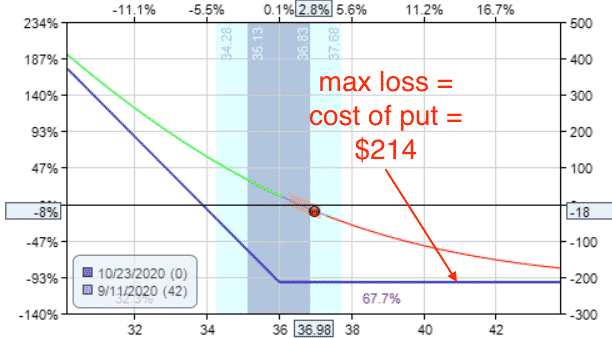

In the Uber example, let’s say the investor bought the $36 exercise Oct 23rd put at $2.14.

The moment he places the order, he must pay $2.14 per 100 shares to buy the downside protection.

If the stock price hits $0, the most he will lose is $2.64. He was long the stock at $36.50 and he exercised his put option to sell the stock at $36.

Hence, he lost $0.50 on the stock and also paid $2.14 to buy downside protection so in total he lost $2.64.

No matter what happens to the stock price, the investor can not lose more than $2.64.

The put only provides downside protection up until expiration.

After that the investor can purchase another put if he still wants to maintain downside protection.

Maximum Gain

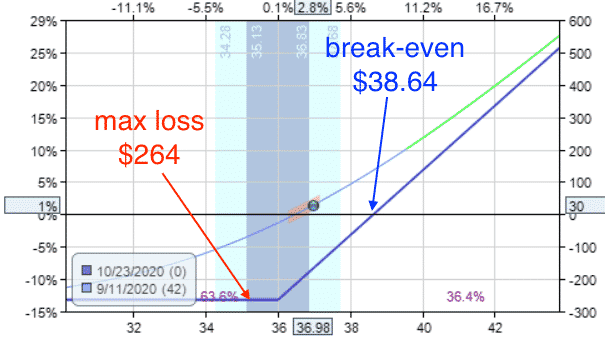

The maximum gain is unlimited as there is no limit to how high the stock can go.

However, the maximum gain of this position will be lower than the maximum gain on a long only position by the amount of the put premium.

For example, if Uber closes at $40 at expiration, the investor’s gain will be $1.36 ($40 – $36.50 – $2.14).

Compare this with the gain if the investor did not pay to buy the put: $3.50 ($40 – $36.50).

In buying the put, the investor gave up $2.14 in profit but remember the investor only bought the put because he was worried about a price decrease in the near term and wanted to buy protection.

Breakeven Price

We know that the investor paid $2.14 to buy the put in the previous example.

The stock will have to rise by at least that much for the investor to break even.

If the stock rises to $38.64 ($36.50 + $2.14), he would break even.

The Greeks

Delta

Delta is the change in price of the position for a $1 change in the underlying.

Delta for a long position in the stock would be 1 because for every $1 move in the underlying (stock), the long stock will change by $1 as well.

On the other hand, the delta of a put ranges from -1 to 0 because as the underlying (stock) increases by $1, the put price will decrease.

How much it decreases depends on where the price of the stock is relative to the exercise price.

A put delta will be -1 for deep in-the-money options, and 0 for deep out-of-the-money options.

In our Uber example, the investor bought the $36 strike Oct 23rd put at $2.14. The delta was -0.4030 because the option is close to at the money.

The investor’s long stock and long put position will have a combined delta of 0.5970 per share. Since he owns 100 shares and 1 put, the combined delta of his position is 59.70.

This means if the stock decreases by $1, the value of his position will only decrease by 0.5970.

Remember this is an approximation and only holds true for small changes in the stock price because delta continues to change as the stock price changes.

This brings us to the next greek – gamma.

Gamma

Gamma is the change in option’s delta for a change in the price of the underlying.

Gamma is always positive for all long options. In our Uber example, the gamma of the long put is 0.0629.

Gamma is highest for at the money options because that is the point where delta changes fastest with changes in the stock price.

As the stock price moves away from the strike price (in either direction), gamma approaches zero and delta becomes less sensitive to changes in the stock price.

How Volatility Impacts the Trade

A long put will rise in value as volatility in the underlying rises.

This is because an investor will pay more for downside protection when there is a lot of volatility in the stock price.

In our Uber example, the investor bought a put on a stock he owns. The long put will benefit from a rise in volatility.

Typically, a rise in volatility is associated with a falling stock price, but that isn’t always the case.

If the stock price remains flat and volatility increases, the overall position will show a small profit.

The October 23rd put at $36 has vega of +0.05. This means that for every 1% increase in volatility, the put will gain $5 with all else being equal.

How Theta Impacts the Trade

Theta measures how sensitive the option price is to the passage of time – i.e. how much value does the long put lose each day as the trade approaches expiration.

This can be the investors biggest friend or foe depending on how he uses it.

Recall, from exhibit 4 that theta is highest (absolute value) for shorter maturity options and lowest for longer maturity options.

This is because the speed at which time value decays increases as the time to expiration decreases.

The best way to trade theta is buying long maturity options and selling short maturity options.

In our Uber example, the investor’s long put would expire on October 23rd and has a Theta of -0.0283.

This means the put will lose $2.83 each day with all else being equal.

Compare this with the October 9th put with the same strike price (Theta of -0.0344) and a December 18th put with the same strike price (Theta of -0.0204).

The longer maturity put loses less value as time passes (at least initially).

Even though the longer maturity put will be more expensive, the investor can always sell the put when he no longer needs downside protection and recoup most of the price.

Risks

Think of the protective put like an insurance premium on your house.

You bought the insurance to provide coverage for damages to your property but no person in their right mind would hope for damages just to claim a payout from the insurance company.

On the other hand, you also feel like a fool paying a hefty premium to the insurance company each month.

In our Uber example, the investor is worried about a price decrease in his position, but he is bullish overall on the position otherwise he would have simply sold the stock.

He can create a zero dollar insurance by selling some of his upside.

For example, since he paid $2.14 to buy downside protection below $36, he can sell a October 23rd call with the strike price of $38 for $2.04.

By doing this he is giving up any upside above $38 but he recouped some of the premium for the put insurance.

The selling of call in this case is known as covered call.

There are some tax considerations that come into play when you enter a protective put and covered call at the same time. We will cover this in a different article.

Protective Put Examples

Here is what the payoff diagram looks like for the following protective put:

Date: September 11, 2020

Buy one Oct 23rd UBER put with strike price of $36 @ $2.14

If you combine that with the fact that the investor already owns 100 shares of Uber purchased at $36.50, then you get the following payoff diagram…

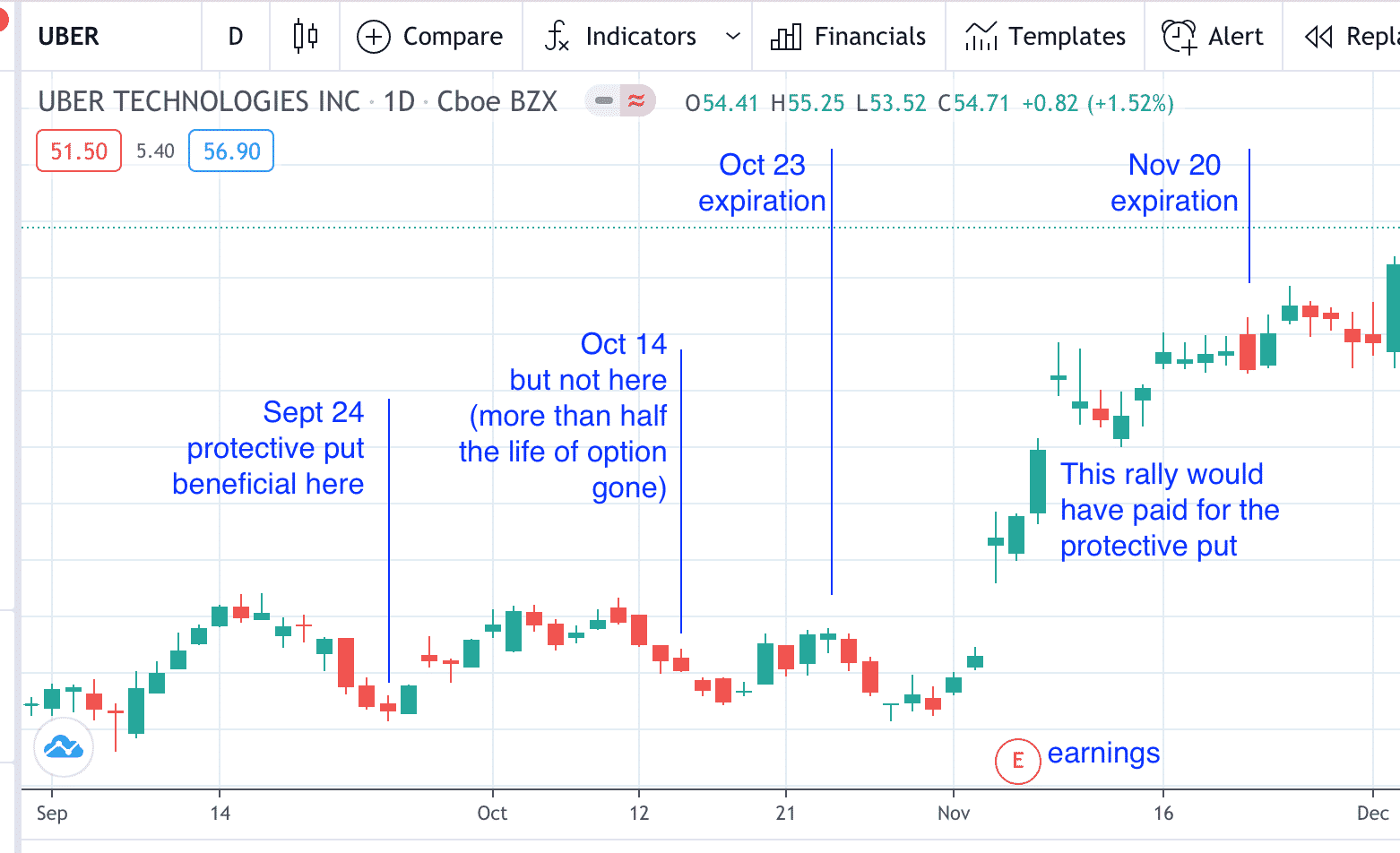

On September 24, UBER price is down at $33.35 which means that the investor lost $315 on the stock position itself.

However, since the investor owns the protective put, the put increased in value by $146 such that the investor is only down $169 on the combined stock and put position.

Then UBER chopped sideways for a while and recovered a bit.

On October 14, its price is at $35.11.

The investor is down $139 on the stock position alone.

On the combined stock and put position, the investor is down $212.

This is because long puts are decaying assets, losing a little bit of value each day.

At this point in time, the put option is worth only $141, when the investor had purchased it for $214.

This loss in value is due to a combination of factors including the price of the underlying, implied volatility, and the passage of time.

On expiration day October 23rd, UBER closed at $36.75, which is $0.25 above the investor’s purchase price.

Hence, with the stock alone, the investor would have had a $25 profit.

But since the investor spent $214 to purchase the protective put, which now has expired worthless out-of-the-money, the investor lost in total $189.

Yes, the protective put will offer protection when needed.

But when not needed, there is a cost for having the protective put.

The underlying stock price needs to appreciate more than the cost of the put to be profitable.

If the put was purchased for the next monthly expiration cycle of November 20, after’s UBER’s earning report, then there would have been enough time to catch UBER’s subsequent rally, which would surely be more than enough to pay for that protective put.

And if UBER had gapped down during earnings instead, then the put would have protected the investor as well.

Summary

Protective puts are a great way to reduce the risk of a position as they reduce the positions delta.

However, this insurance lasts only until expiration and the investor must pay a premium which can reduce overall returns.

The investor should be happy if the risk he envisioned of a drop in stock price does not materialize.

Still, he should not buy insurance he does not need.

Continually purchasing protective puts to protect against a probable decline in stock price will result in lower volatility but he should carefully consider the trade-off between premium cost and risk reduction.

Continuously paying premiums to protect against the downside will wipe out most of your hard-earned gains.

Consider selling calls to pay for protective puts if you intend to protect against the downside on a regular basis.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

I have a question.

If I don’t buy 100 shares but only a quantity to neutralize Delta, how I could manage it? Its a scalping? Also if the underlying go up I can sell the ITM PUT and roll up, I could fix a min profit but continuing to scalp on the underlying variations without danger of loss?

I use roll up on 100/100 positions to reach bulletproof long positions, but I never tried to do it with neutral Delta positions to scalp on both directions.