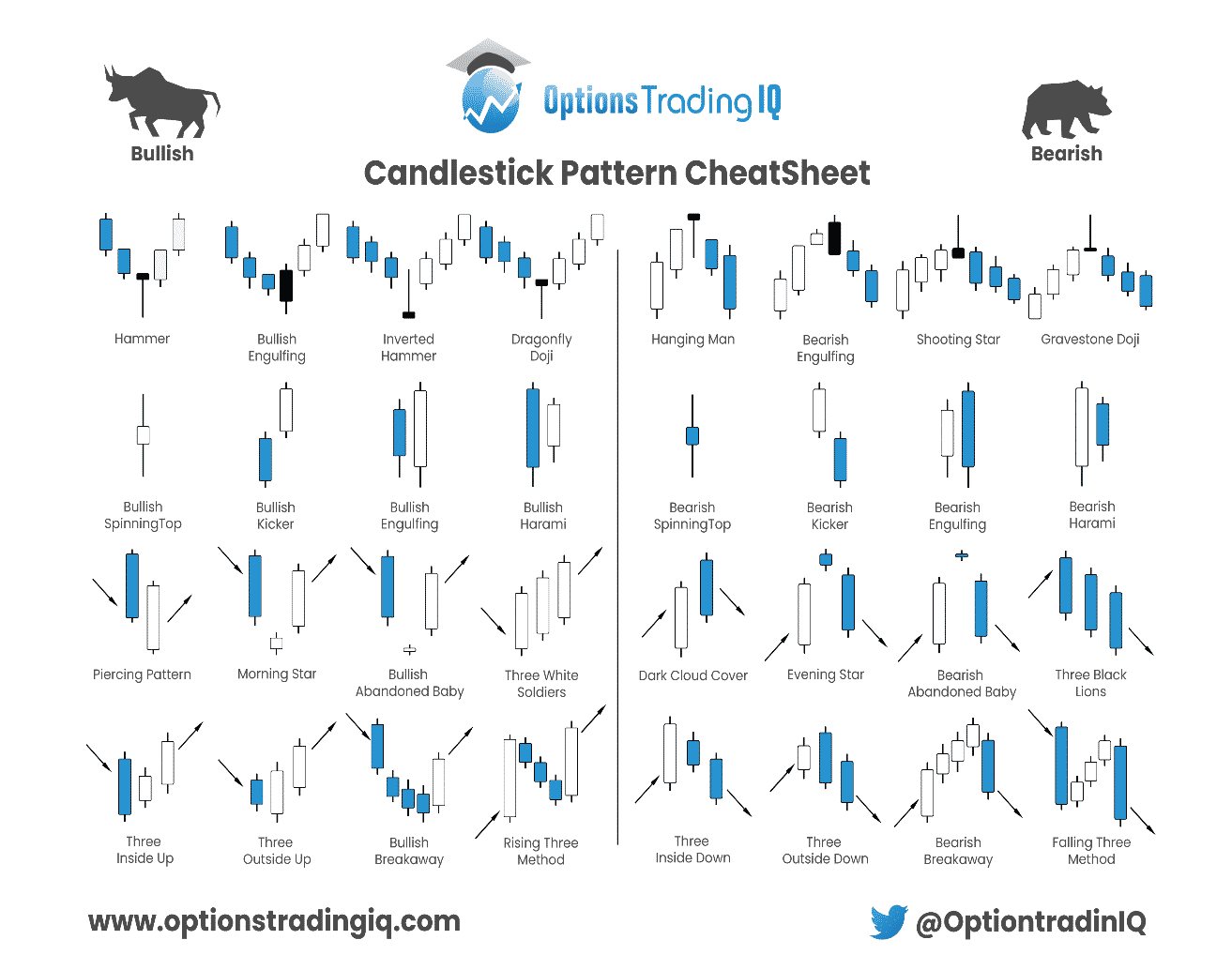

Today, we have a special treat for you, a Candlestick Pattern Cheat Sheet.

The image is below, and you can right-click to save it as a pdf.

Contents

Introduction

Technical charts are a two-dimensional representation of price over time.

There are various types of charts, from line charts, bar charts, and candlestick charts.

While line charts help give us an overall movement of the stock, bar charts are more detailed and are suitable for demonstrating or spotting the classical price patterns.

In the next section, we will discuss the different types of candlesticks.

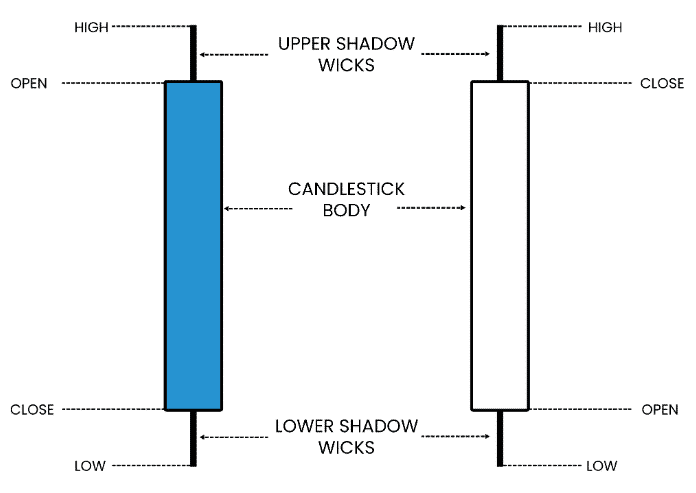

What are Candlesticks?

Candlesticks charts originated in Japan and are referred to as Japanese candlestick charts. These are the most popular type of chart patterns and are very versatile.

The candle represents price movement.

Each candle has a body and two wicks.

The body of a candle represents the distance between open to close, and the upper and lower wicks represent the highs and lows of a candle.

If the close price is below the open price, then the candle is red (we have used blue above to match our branding).

If the closing price is higher than the open price, then the candle is green or white.

Candlesticks charts help in adding visual clarity.

Moreover, two or more candlesticks create patterns that enable a trader to make decisions on the market’s direction.

Several continuation and reversal patterns give a strong signal and assist in making successful trades.

Candlestick Charts

Candlestick chart patterns are the distinguishing formations created by the movement in stock prices and are the groundwork of technical analysis.

Technical Analysts and Chartists globally seek to identify chart patterns to predict the future direction of a particular stock.

Patterns can be simple as trendlines and can get even complex, like double head and shoulder formations.

Reversal Patterns

They are chart patterns that signal a trader about a change in an existing trend.

They signify periods where the bulls and bears could not drive the market in a particular direction.

Continuation Patterns

They are chart patterns that display a temporary interruption in an ongoing trend, and after a short period, the trend continues in the original direction.

Right-click the image below to download the candlestick patterns cheat sheet pdf.

Candlestick Patterns

Candlestick patterns are separated into bullish and bearish patterns.

Bullish patterns indicate that prices are likely to rise whereas, bearish patterns suggest that prices are going to fall.

From the diagram above, we will study some candlestick patterns to aid you in gaining a clearer idea of how studying these patterns are helpful in the early identification of trends.

Bullish Reversal Patterns

The hammer candlestick pattern occurs in a prolonged downtrend.

The candle formed in this process should have a small body and a prominent lower shadow.

The color of this candle can be either green or red.

If it is green, the hammer is bullish. If the stock moves higher after the hammer, the ideal strategy would be to go long with a stop loss below the candle’s low.

The bullish engulfing pattern can usually be found in a downtrend.

We should see a red candle, followed by a green candle.

The body of the green candle needs to engulf or be slightly bigger than the red candle.

If the price starts moving up after the next few candles, that is a clear indication that this pattern is confirmed.

The strategy would be to go long and place a stop loss below the low of both the candles.

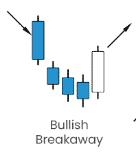

The bullish breakaway pattern is usually formed at the end of a bearish move.

This pattern is a trend reversal and translates into a bullish trend.

However, there is a chance that the trend might not reverse quickly, and ideally, the trader should wait till a larger green candle appears to confirm this pattern.

We follow the same strategy as before, go long once the pattern is confirmed with a stop loss from the point where the price increases.

Other Bullish Candlestick Patterns

Other bullish candlestick patterns include:

- Bullish Hammer

- Bullish Engulfing

- Inverted Hammer

- Dragonfly Doji

- Bullish Spinning Top

- Bullish Kicker

- Bullish Engulfing

- Bullish Harami

- Piercing Pattern

- Tweezer Bottom

- Morning Star

- Bullish Abandoned Baby

- Three White Soldiers

- Three Inside Up

- Three Outside Up

- Bullish Breakaway

- Rising Three Method

Bearish Reversal Patterns

The hanging man pattern is a bearish reversal pattern and looks like a hammer candle we looked at earlier.

The only difference between the two is that the hanging man appears at the end of an ongoing uptrend.

If the color of the hanging man candlestick is red, it is a strong indication that a bearish trend is likely to start.

Once a trader confirms this pattern, they should take a short position and set a stop loss above the high of the candle.

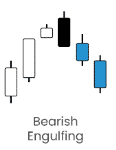

The bearish engulfing pattern is found in an uptrend. We should see a green candle which is followed by a red candle.

The body of the red candle needs to engulf or be slightly bigger than the green candle.

If the price starts moving down after the next few candles, that is a clear indication that this pattern is confirmed.

The strategy, in this case, would be to short the security once a trader has confirmed the pattern and place a stop loss above the two candlesticks.

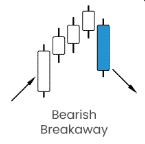

The bearish reversal pattern is like a mirror image of the bullish reversal pattern.

The bearish breakaway pattern is typically formed at the end of a strong bull rally.

This pattern is a trend reversal and migrates into a bearish trend.

Just like we saw in the bullish breakaway, there is a chance that even in this pattern, the trend might not reverse rapidly.

Preferably the trader should use other indicators to confirm the trend reversal.

Other Bearish Candlestick Patterns

Other bearish candlestick patterns include:

- Hanging Man

- Bearish Engulfing

- Shooting Star

- Gravestone Doji

- Bearish Spinning Top

- Bearish Kicker

- Evening Star

- Bearish Harami

- Dark Cloud Cover

- Tweezer Top

- Bearish Abandoned Baby

- Three Black Lions

- Evening Star Doji

- Three Inside Down

- Three Outside Down

- Bearish Breakaway

- Falling Three Method

FAQ

What Is A Candlestick Pattern?

A candlestick pattern is a visual representation of price movements in a financial market, commonly used in technical analysis.

Candlestick charts display price action for a given time period using individual candlesticks that represent the opening, closing, high, and low prices.

What Are Some Common Candlestick Patterns?

There are many candlestick patterns, but some of the most common include doji, hammer, shooting star, engulfing, and harami. Financial Tech Wiz has some good information on doji candle types if you want to check it out.

Each pattern has its own unique characteristics and can indicate bullish or bearish market sentiment.

How Can Candlestick Patterns Be Used In Trading?

Candlestick patterns can be used in trading to identify potential trends and reversals in the market.

Traders can use candlestick patterns to make informed decisions about buying or selling assets based on the price action indicated by the patterns.

Where Can I find A Cheat Sheet of Common Candlestick Patterns?

Right here! Download the cheat sheet here.

Are Candlestick Patterns a Reliable Indicator of Future Price Movements?

Candlestick patterns can provide useful information about market sentiment and potential price movements, but they should not be relied on exclusively.

It is important to use other forms of analysis, such as fundamental analysis and technical indicators, in conjunction with candlestick patterns to make informed trading decisions.

Which Candlestick Pattern Is Most Reliable?

The Shooting Star candlestick pattern is a popular and reliable pattern that many day traders and investors use because it is accurate and predictable.

No candlestick pattern is 100% reliable, but some candlestick patterns are more accurate at predicting market movements than others.

Since investors are looking for consistency and accuracy, it’s certainly not a terrible idea to base some investment decisions on a reliable candlestick pattern like the Shooting Star candlestick pattern

How Many Candlestick Patterns Are There? (Note: We have 32 listed in our cheat sheet)

Depending on who you ask, there are between 30 and 35 stock market candlestick patterns that can predict market movements and use general technical analysis on a particular market.

Most candlestick patterns are categorized into a few different groups. Some patterns are designed to send reversal signals to investors, while other patterns may simply be a reaffirmation of the current market momentum.

This can also be called a continuation candlestick pattern.

Since there are more than 30 candlestick patterns that can be used for technical analysis and charting purposes, it can take some time to learn how to use each one to your advantage.

Do Candlestick Patterns Work?

One of the most common questions new investors ask is whether or not candlestick patterns can be effective?

While a candlestick pattern can’t be correct 100% of the time, some patterns have an excellent track record for predicting how a market might react in the future.

The best way to read into candlestick patterns and use them is based on the percentages.

As a general rule, candlestick patterns work between 55% and 65% of the time, which is generally pretty good.

Don’t forget that there’s still about a 40% chance of the candlestick pattern not working out.

These general analytics show us that strong candlestick patterns work more often than they don’t.

How Do You Read A Candlestick Pattern?

Day and swing traders must understand how to read various candlestick patterns to help them make split-second decisions in the stock market.

A candlestick on a trading chart consists of two wicks and two ends of the candlestick itself.

The top of the higher wick is the higher price within the market’s selected timeframe, while the bottom of the lower wick is the lowest price within the same timeframe.

Each end of the candlestick is also indicative of either the opening or closing price.

After multiple candlesticks start filling out a chart, a candlestick pattern can develop, which could give you an understanding of future market movements and the most likely outcome.

As electronic market trading continues to evolve and change, some of the most reliable candlestick patterns could become less advantageous, especially in changing market conditions.

Conclusion

Technical analysis is a widely used tool to attempt to predict stock price movement. It aids in taking advantage of the price discrepancies with the support of various indicators and patterns.

Some candlesticks that we studied above help give a trader an edge by early identification of an uptrend or downtrend.

There are many similarities, and at times some patterns can get confusing.

Therefore, it is advised that before directly making use of the candlestick patterns, traders should go through all the patterns and try to understand them virtually.

Doing so will drastically increase confidence and enable any trader to make accurate financial decisions when applying these concepts.

Perhaps even print out the candlestick pattern cheat sheet and have it on your trading desk.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Thank you, Gav!

More about Chart Patterns:

http://thepatternsite.com/visualcpindex.html

Thank you Gav, your articles are always short, concise, and useful.