Hedging with options is an important skill for all traders to learn.

Every once in a while, the market sells off with prices of equities all dropping.

We need to make sure that when (not if) such an event occurs, it does not do too much damage to our portfolio.

The goal in this article to provide analyze different methods of hedging with options.

Contents

- Sell Covered Calls

- Sell Bear Call Spreads

- Poor Man’s Covered Put Strategy

- Buy Bear Put Spreads

- Buy Protective Puts

- Synthetic Shorts

- Option Structures That Can Be Used For Hedging

- Bearish Calendars

- Target Butterflies

- Broken Wing Butterfly

- Broken Heart Butterfly

- Back Ratio Spread

- Conclusion

Sell Covered Calls

Investors who think the market is due for a correction will decrease their portfolio delta so that they do not have as much positive delta.

Some will decrease their portfolio delta to zero, or delta neutral.

Selling covered calls is a way to decrease deltas and pick up a bit of premium to save for your purchase of the larger hedges that you might need soon.

But do not sell covered calls on the same shares that you have stop loss on.

In fact, some accounts will not allow this to happen.

Because if the stop loss sells the shares, then the call will no longer be covered.

Selling calls far out of the money will reduce your positive portfolio delta by just a little.

Selling them closer to the money will reduce portfolio delta more.

Selling at-the-money calls with reduce delta even more.

Some traders will even sell in-the-money calls.

Sell Bear Call Spreads

If you don’t have equity positions to sell covered calls on, sell bear call spreads.

They too will have negative delta. Ideally sell them when implied volatility (IV) is high with rich premiums.

Poor Man’s Covered Put Strategy

To execute a poor man’s covered put, we buy long-dated puts that expires six, nine, or a year out in time.

Then sell shorter term puts against it.

These are great because they have negative delta, positive vega, and positive theta.

All three greeks are working in your favor when the market sells off.

When the prices go down, volatility naturally goes up.

Both these factors work synergistically to increase the price of your long puts.

Ideally, you accumulate these long puts while IV is low, so that they are available during a market sell-off.

These are longer term trades and can be held for a longer time since they do not have theta decay (if they are set up correctly, that is).

Buy Bear Put Spreads

In addition, you can buy smaller bearish put spreads.

Ideally, buy them when volatility and premiums are low.

Because the long put strike price is higher than the short put strike price, the combined spread will have negative delta.

For example, the long put may have -0.70 delta while the short put may have 0.30 delta. Combining the two, you get -0.40 delta for the bear put spread.

Buy Protective Puts

Buying protective puts is the go-to method when the market is crashing, because they benefit when the underlying price drops and when IV goes up.

No doubt about it, hedges will cost a little bit of money.

But it will pay for itself and then some in the event of a crash.

If the market doesn’t sell off, then like insurance, that’s the price we pay for the protection.

What strike and expiry to buy depends on how long and how much the individual investor wants protection versus the cost.

But hopefully the premiums collected beforehand from the other methods above will offset some of this cost.

Because of this expense, some investors will buy protective puts only at tactical times and for short duration.

Other investor may buy long-dated out-of-the money puts if they have continuous bullish option positions in play.

OptionAlpha did some research showing that buying puts 60 days out at the 20 delta was what they found to be ideal.

The next best is buying puts 90 days out at the 10 delta.

While their backtests held the puts to expiration, you may rather apply you own rules as to when to roll the short put.

You can add additional put legs to existing options structures.

Adding a put to a stock position will make it into a married put position.

Adding a put to a covered call position will make it into a collar.

You can even add puts with an iron condor and call it a hedged iron condor.

We’ve described this in Method One of earlier article.

Synthetic Shorts

Synthetic shorts are created by buying a put and selling a call.

Like shorting stock, this is an undefined risk position and is not recommended for beginner investors.

A better more defined-risk method is to add a put or a put debit spread to a bear call spread.

This form of bearish risk reversal simulates shorting stock, but makes it defined-risk.

These synthetics provide negative delta without affecting theta and vega too much.

Option Structures That Can Be Used For Hedging

Now we will look at some more complex option structures that can be used for hedging.

We start with an idea, then backtest it to see what’s wrong with it.

And then improve upon it.

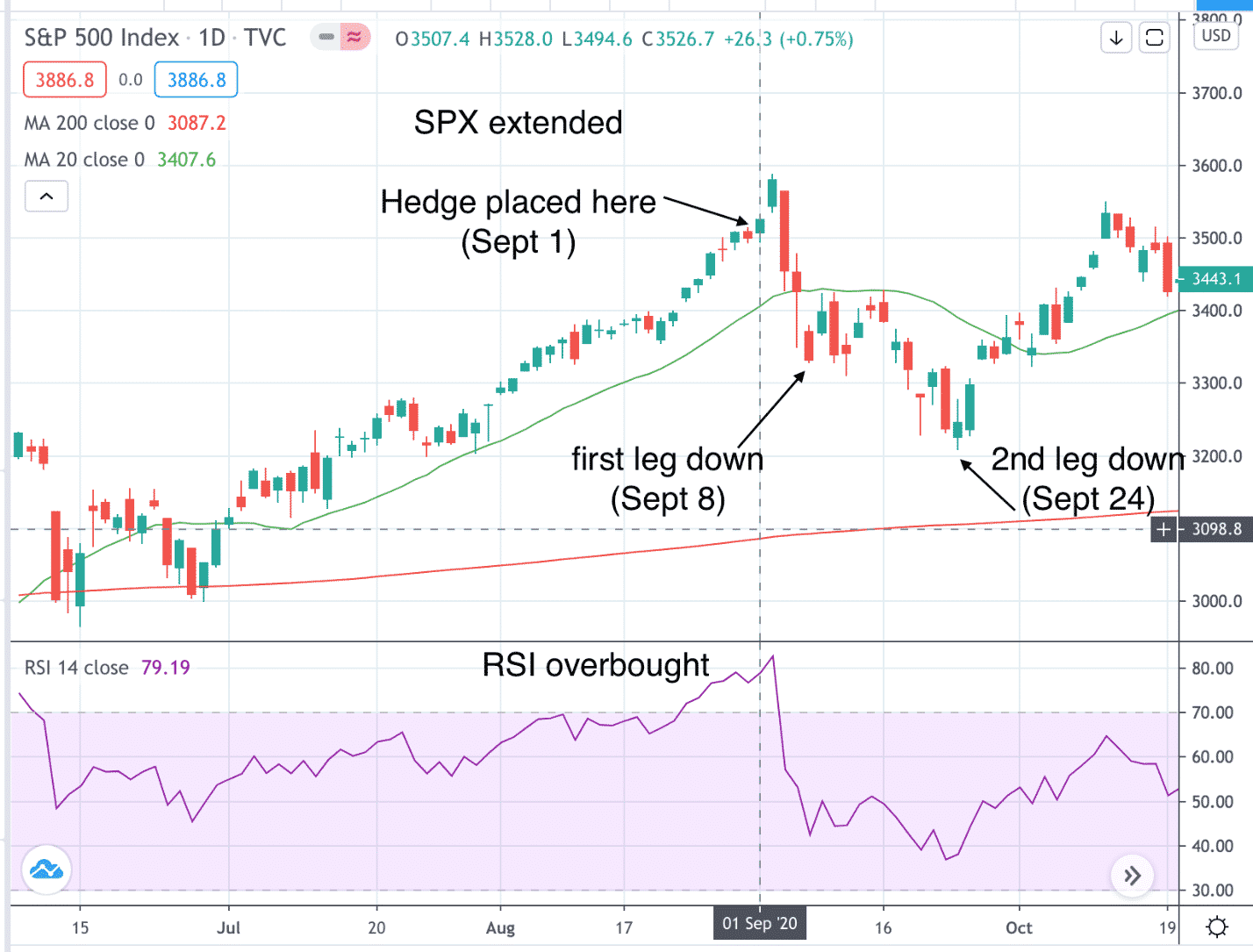

Consider the SPX on September 1, 2020 when its price of $3527 is a bit extended and RSI is showing overbought.

If an investor expects a minor pull back to $3400, then bearish calendars and target butterflies can be used.

Bearish Calendars

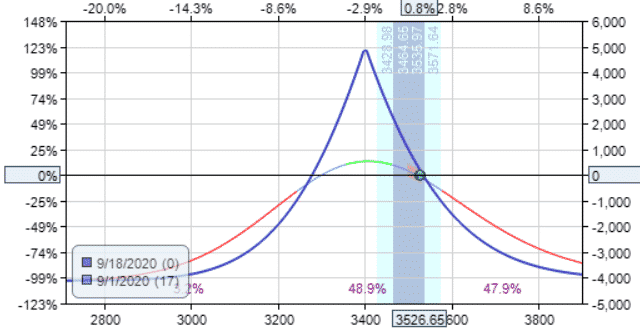

Here an investor buys a bearish calendar centered at $3400.

Sell 1 Sep 18 SPX put with strike $3400 @ $23.30

Buy 1 Oct 16 SPX put with strike $3400 @ $63.80

Max Loss = Total Debit Paid = $4050

This costs $4050 which will be lost the market continues it merry way up without a pullback.

One week later on September 8, SPX pulled back to $3332 and the calendar has a profit of $145, or 3.58%.

The investor can close the trade now thinking that the pullback already overshot the target and the market can still continue to drop, at which case the calendar lose its gains.

Or the investor can hold.

In which case, the market rallied the next day to $3399, whereby the calendar made $670 or 16.54%.

Target Butterflies

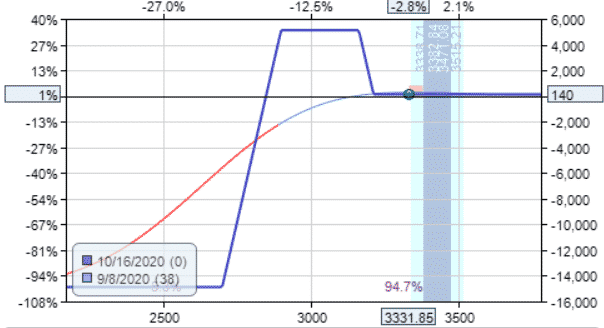

Instead of calendar, suppose an investor centers a butterfly at the $3400 level:

Buy 1 SPX Oct 16 put with strike $3250 @ $40.30

Sell 2 SPX Oct 16 puts with strike $3400 @ $63.80

Buy 1 SPX Oct 16 put with strike $3550 @ $110.75

This costs $2345 with a payoff diagram like this:

On September 8, the butterfly paid for itself plus some.

The investor sells the butterfly back for $4120, receiving a profit of $1775 (or 76%).

Wider butterflies cost more, but will give you greater profits if you are right.

You will also lose more if you are wrong.

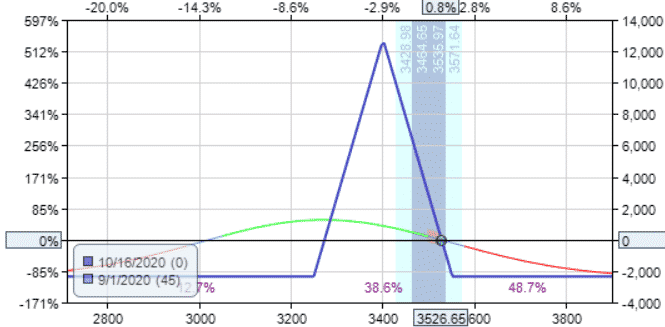

Broken Wing Butterfly

The problem with both the bearish calendar and the target butterfly is that if the market continues upward without a market sell-off, the investor can lose the entire debit.

Let’s try a broken wing butterfly so that there is no risk on the upside.

We move it further out-of-the-money to 15 delta to allow SPX room to move without affecting our butterfly.

The 16 delta is one standard deviation away from current price.

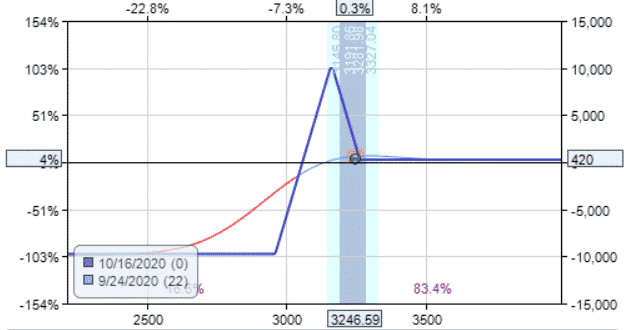

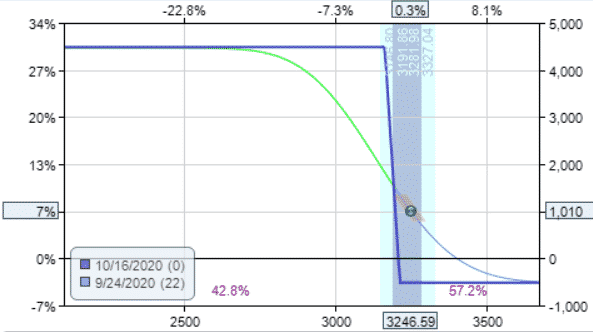

Buy 1 SPX Oct 16 put with strike $2960 @ $18.35

Sell 2 SPX Oct 16 puts with strike $3160 @ $31.20

Buy 1 SPX Oct 16 put with strike $3260 @ $41.50

Total Credit: $225

On September 8, the broken wing butterfly is showing a small loss of $180.

This is the payoff diagram on September 8.

On September 24 when the SPX makes a second leg down, our broken wing butterfly started working by picking up $420 of profits.

It had now paid for itself.

Broken Heart Butterfly

Can this be improved? Yes.

Let’s split apart the butterfly to give a wider range of profit.

This becomes a broken heart butterfly.

It also can be thought of as an asymmetric condor.

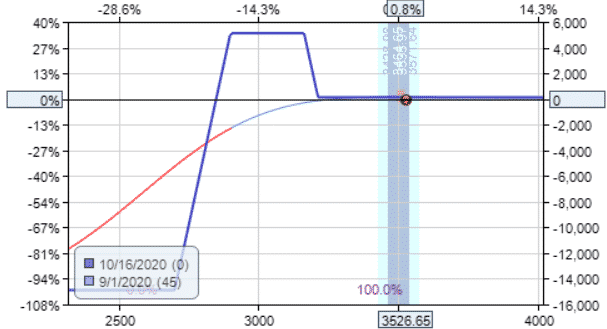

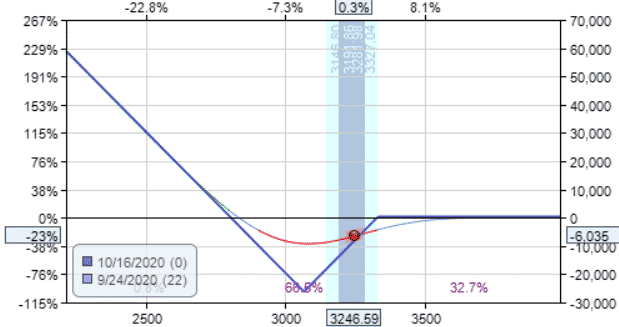

Buy 1 SPX Oct 16 put with strike $2700 @ $9.90

Sell 1 SPX Oct 16 put with strike $2900 @ $15.80

Sell 1 SPX Oct 16 put with strike $3160 @ $31.20

Buy 1 SPX Oct 16 put with strike $3210 @ $35.90

Total Credit: $120

Max Possible Loss: –$14880

The payoff graph has a smooth and flat T+0 line initially.

On September 8, it is showing a slight profit of $140.

With more passage of time, the profit curve starts turning up and on September 24, it shows a profit of $1010, or 6.79%.

At this point when the price is starting to enter our hedging structure, we need to take the trade off, because if the price continues downward past our structure, it would be a big downside loss of nearly $15,000 — our hedge would become our liability.

Or at least buy back the lower put credit spread for $635 and your payoff diagram becomes:

With the remaining debit spread in place, we can still make money if market goes down further. Or we can give back all of our profits if the market reverses back up.

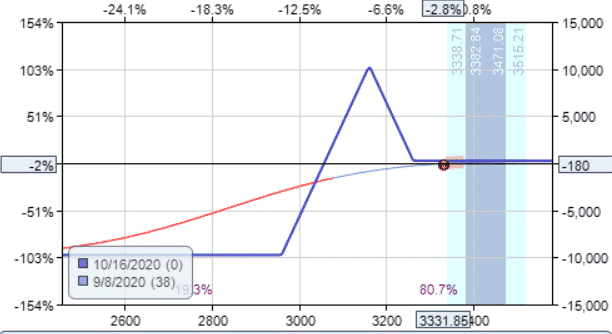

Back Ratio Spread

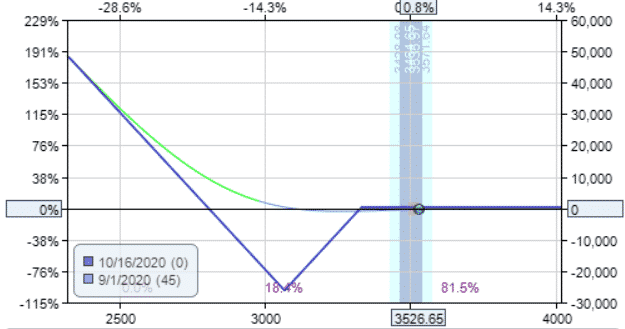

And finally, there is the back ratio spread.

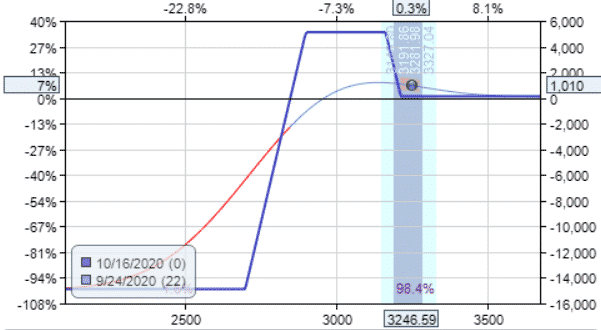

Date: Sept 1, 2020

Price: $3526.65

Sell 1 SPX Oct 16 put with strike 3330 @ $51.15

Buy 2 SPX Oct 16 puts with strike 3065 @ $24.05

Total Credit: $305

Max Loss: –$26195

On September 8, the trade is at a loss of $1980, or down 7.56%.

And on September 24, the ratio spread lost –$6035.00, or down 23%.

The problem is when price does not make a big enough move, it ends up falling into the “valley of death”.

Take the trade off if the price starts to hover around the long strikes or when the T+0 line starts to dip too much into the valley.

Conclusion

There you have it.

A whole range of options hedging strategies for a market sell-off.

There is no perfect hedge (other than moving to cash).

Each has its own pros and cons.

Backtest some of these for yourself.

We’ve used OptionNet Explorer.

And find the one that suits your trading style and risk tolerance.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Awesome explanation & suggestion. Thanks

Glad you enjoyed it. Thanks!