Today we’re looking at the bull call spread, a bullish trade with a good risk to reward ratio. This trade is a nice way to take a long exposure on a stock without risking too much capital.

Contents

What Is A Bull Call Spread?

A bull call spread is an options strategy that a trader uses when they believe the price of an underlying stock will go up by a moderate amount in the near term.

To execute the strategy, a trader would buy an at-the-money call option whilst simultaneously selling an out-of-the-money call option with the following conditions:

- Both call options must use the same underlying stock

- Both call options must have the same expiration

- Both call options must have the same number of options

- The sold call must have a higher strike than the bought call option

Since the strike price of the sold call is higher than the strike price of the bought call, the initial position will be a net debit.

The bull call spread profits as the price of the underlying stock increases, similar to a regular long call.

The difference between a bull call spread and a regular long call is that the upside potential is capped by the short call.

The purpose of the short call is to mitigate some of the overall costs of the strategy at the expense of putting a ceiling on the profits.

Losses are also capped, in this case by the debit taken when you execute the trade.

This means the strategy has limited risk as well as limited profit potential and is generally used when the market is in an upward trend.

Maximum Loss

Maximum loss occurs when the underlying stock price falls below the bought call strike at expiry.

When this occurs, both options are out-of-the-money, and will both expire worthless leaving the trader with a loss equal to the premium paid.

To calculate the maximum loss, use the following formulas:

Maximum Loss = Net Premium Paid + Commissions Paid

Which occurs when:

Price of Underlying <= Strike Price of the Long Call at expiry

As an example, imagine you come across a stock (ABC company) that you believe is going to increase in price soon, so you decide to use a bull call spread strategy.

ABC is currently trading at $54 so you buy a call at 50 for $300 and write a call at 56 for $100.

For executing the trade, you pay a net debit of $200 in premium.

Unfortunately, your prediction proved to be wrong and the price subsequently drops to $48.

Since the price is below the strike price of both options they expire worthless and you suffer a loss.

In this case, you suffer the maximum loss which is the $200 net debit you paid when you first executed the position.

Maximum Gain

The maximum gain occurs when the underlying stock price increases and closes above the strike price of the sold call on the expiration date.

When this occurs, both options expire in-the-money and you make a profit equal to the spread less the initial debit when you entered the position.

The greater the spread between the higher strike price and the lower strike price, the greater the gains you can make.

To calculate the maximum gain, use the following formulas:

Maximum Gain = (Strike Price of the Short Call – Strike Price of the Long Call) – Net Premium Paid – Commissions Paid

Which can only be achieved when:

Price of Underlying >= Strike Price of the Short Call

Using our earlier example of ABC stock trading at $54, say we were right about the price increasing and the stock rallies to close at $58 on the expiration date.

As a result, both options expire in-the-money with the 50 call having an intrinsic value of $800 while the 56 call has an intrinsic value of $200.

The ending value of the spread is therefore $600. Since $200 was paid to enter the trade, the final gain is $400.

Breakeven Price

The breakeven is found by applying the following formula:

Breakeven Price = Strike Price of the Long Call + Net Premium Paid

Using our ABC example again that would make the breakeven price $52 (50 long call strike + 2 premium paid).

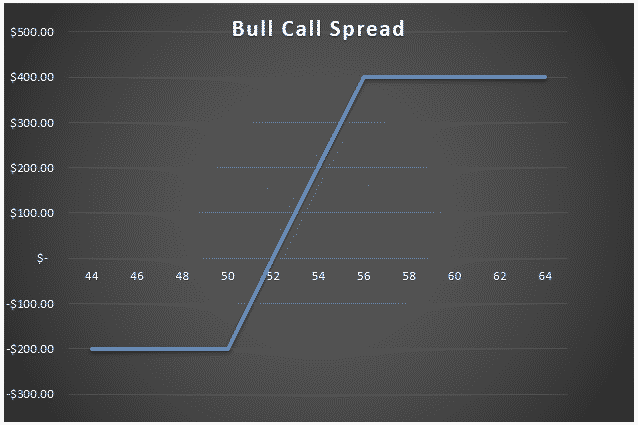

Payoff Diagram

Looking at the payoff diagram, we can see that above the higher strike price, both options are in-the-money and profit is both constant and positive due to the short call offsetting the long call.

Between the higher strike price and the lower strike price, profits grow as the long call increases while the short call is still out-of-the-money.

Finally, when the price moves below the lower strike price, both options are out-of-the-money and the payoff is constant, equivalent to the initial cost of the position.

How Volatility Impacts The Trade

Bull call spreads are generally long vega trades, but that can change depending on where the underlying stock is trading in relation to the spread.

Vega is the greek that measures a position’s exposure to changes in implied volatility. If a position has negative vega overall, it will benefit from falling volatility.

If the position has positive vega, it will benefit from rising volatility. You can read more about implied volatility and vega in detail here.

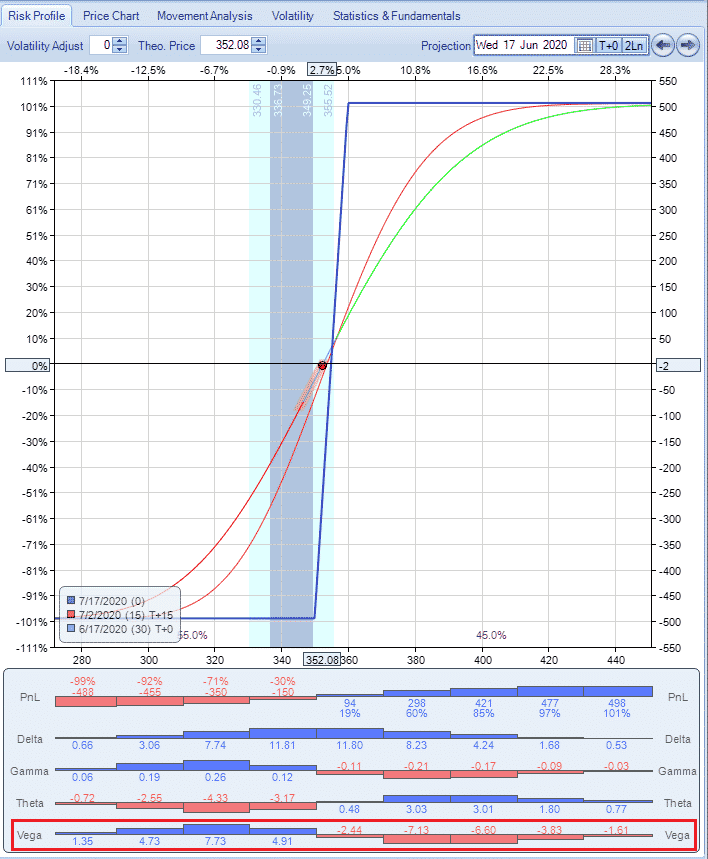

Let’s look at an example:

Trade Date: June 16, 2020

Stock Price: $352.08

Trade Details: AAPL Bull Call Spread

Buy 1 AAPL July 17th 350 Call @ $14.20

Sell 1 AAPL July 17th 360 Call @ $9.28

Premium: $492 Net debit.

Max Loss: $492

Max Gain: $508

Breakeven Price: $354.92

Notice in the image above that the trade is positive vega when the stock is below the lower strike and negative vega when it is above that strike.

At the price of $352, vega is more or less neutral.

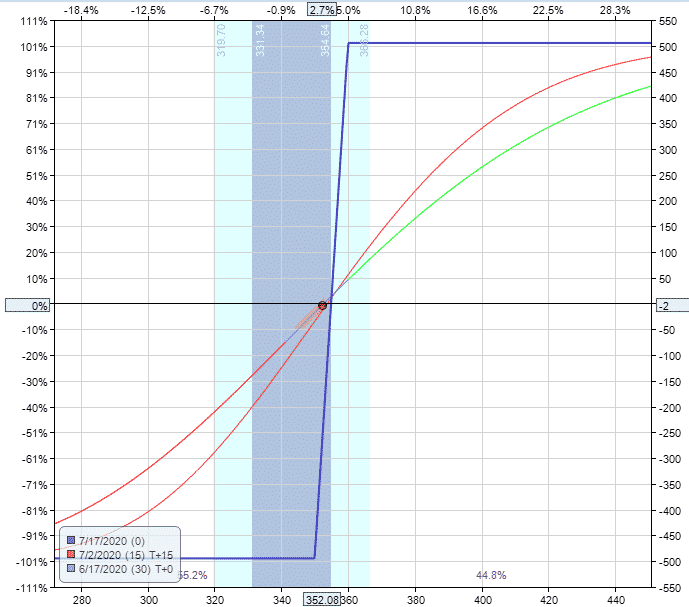

If there is a change in volatility, the expiration graph will not change but the interim dates will. Here’s how the trade looks assuming a 30% rise in implied volatility.

We can see that a rise in implied volatility hurts the trade above the short call, but helps to minimize losses below the long call.

The opposite is true if implied volatility drops.

How Theta Impacts The Trade

Like vega, theta also changes depending on where the stock price is trading.

When the stock is below the lower call, theta hurts the trade as the more time passes the closer the trade gets to the maximum loss.

When the stock is above the short call, theta benefits the trade as the position moves closer to the maximum gain each day.

Other Greeks

DELTA

Bull call spreads are a bullish trade and as such have positive delta. The AAPL trade starts with a positive delta of 11.80 which is an equivalent exposure to owning 11.80 shares of AAPL stock.

The delta exposure is highest when the stock is at the lower call and slightly below.

GAMMA

Option gamma is fairly low with bull call spreads, but it will increase slightly as expiration approaches at will be at its highest when the stock in at-the-money.

Gamma is one of the lesser known greeks and usually, not as important as the others. I say usually, because you’ll see further down in this post why it can be really important to understand gamma risk.

Risks

Price risk is the primary risk with the trade as a sharp drop in the underlying stock will hurt the trade.

ASSIGNMENT RISK

Any option strategy that contains short options is at risk of early assignment. The risk is most acute when a short option is in-the-money and has very little time value left.

This is particularly true will call options when traders will exercise their call option in order to receive an upcoming dividend.

One way to avoid assignment risk is to trade stocks that don’t pay dividends, or trade indexes that are European style and cannot be exercised early.

To reduce assignment risk consider closing your trade if short call is close to being in-the-money, particularly if it is close to expiry and an ex-dividend date is upcoming.

EXPIRATION RISK

Leading into expiration, if the stock is trading just above or just below the short call, the trader has expiration risk.

The risk here is that the trader might get assigned and then the stock makes an adverse movement before he has had a chance to cover the assignment.

In this case, the best way to avoid this risk is to simply close out the spread before expiry.

With a bull call spread the trade can exercise his long call to cover the assignment on the short call.

Bull Call Spread vs Bull Put Spread

Both trades are bullish even though one uses puts and the other uses calls.

The other major difference between the two is that the bull call spread is a debit spread (we pay option premium) whereas the bull put spread is a credit spread (we receive option premium).

Traders buy a bull call spread and option premium is paid by the trader.

For a bull put spread, traders sell the spread and therefore receive money into their account.

Bull Call Spread Example

Let’s see how the AAPL trade would have worked out if the investor decides to take profit at 75% return on the initial debit paid, or in this case when the profits reach $369.

The investor would exit the trade if half of the initial investment is lost, or in this case when the loss reaches $246.

Because AAPL was on a bull run during that time, the trade achieved its profit target on July 6 when AAPL closed at $373.85, up 6% from when we started the trade on June 16.

The net profit for the option investor was $385, or about 78% of the initial debit paid.

Summary

Bull call spread are bullish trades where trades are trying to profit from an increase in the stock price.

By using a spread, traders can offset the cost of the long call, but it comes at the expensive of giving up some upside potential.

For this reason, traders would use it on stocks where they have a slightly bullish view.

Risks are limited on the downside to the amount of premium paid.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.