Gamma is an important concept for option traders, especially for income traders.

Iron Condors, butterflies and short straddles and strangles all have negative gamma.

If you need a detailed refresher on gamma you can check out this comprehensive post.

In any case, I wanted to walk you through a quick trade example from August 2019.

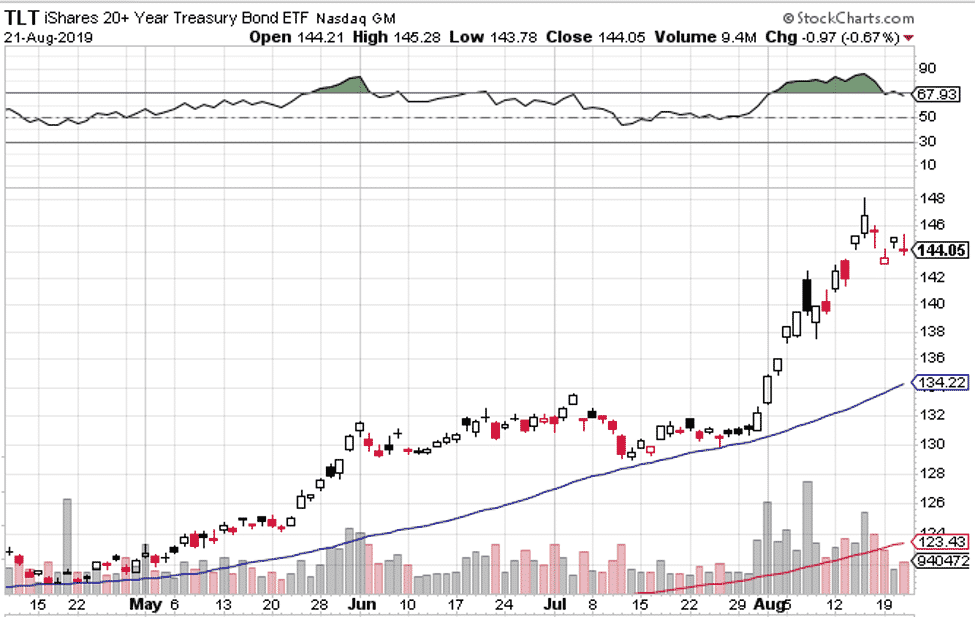

At the time, TLT had experienced a huge run up, going from $122 to $148 in the space of a few months. The ETF was quite overbought, but a lot of time, the momentum is enough to prevent it from correcting too far and what happens is a correction through time.

The stock trades sideways while the moving averages catch up.

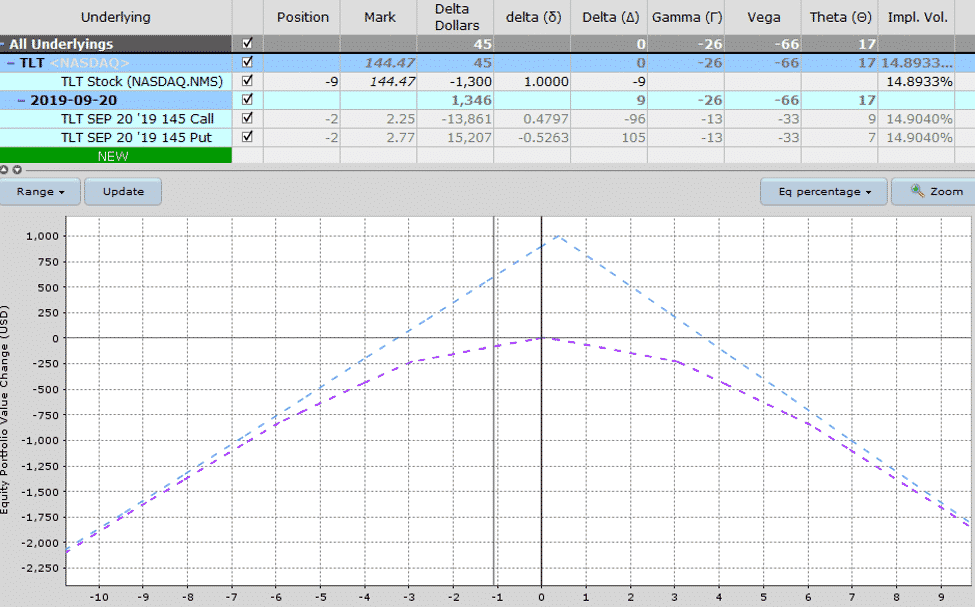

I sold a $145 September Straddle which generated $1,004 in premium. The short straddle had total delta of +9, so to neutralize the delta I sold 9 shares.

Date: August 21st, 2019

Current Price: $144.05

Trade Set Up:

Sell 2 TLT September 20th, 145 calls @ $2.25

Sell 2 TLT September 20th, 145 puts @ $2.77

Premium: $1,004 Net Credit.

Here’s what the initial set up looked like.

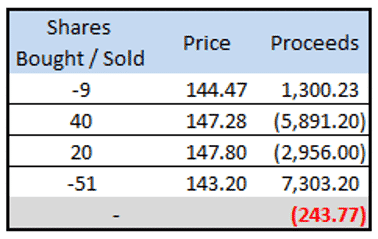

On August 28th, TLT had rallied up to $147.28 and the trade had negative delta of -80.

Normally in that situation, I would neutralize the delta and buy 80 shares, but I felt strongly that TLT would come back into the profit zone, so I bought only 40 shares instead.

Lesson: You don’t always have to fully neutralize delta. Sometimes hedging half the delta is a good idea.

By September 3rd, TLT had risen a bit more to $147.80 and I bought another 20 shares as a delta hedge.

On September 9th, TLT came back into the zone and was sitting at $143.20 and I closed the trade for a gain of $85.

An $85 gain isn’t anything to write home about and was certainly less than the 20-30% I was aiming for but I don’t like to take these trades too close to expiry.

One interesting thing about this trade, and I’ve seen it quite a few times with these gamma scalps is that the delta hedging ended up being detrimental to the trade.

Let’s look at the details:

You can see above that the delta hedging cost me $244 and, and that’s without including commissions. If I had just left the trade as a short straddle, the total profit would have been $329.

It’s an interesting case study. It’s easy to say, just don’t delta hedge the short straddles anymore, but what if TLT had continued shooting higher?

Those 60 shares that I bought would have come in handy as the ETF moved out of the straddle profit zone to the upside.

I still like delta hedging these trades, not every time, but sometimes and it depends what my original plan was for the trade.

In this case I always planned on delta hedging and I stuck to that so I view it as a good trade even though the profit wasn’t as high as it could have been.

What do you think?

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.