Let’s take a look at some of the key differences between SPX options vs SPY options. Dividend and tax implications are two big differences.

Contents

- American vs European Style Options

- Contract Sizes and Prices

- Dividends

- Liquidity

- Options Expiration

- Tax Differences

- Conclusion

A very common question that option traders ask themselves is whether to trade SPX or SPY options, which are often two of the most popular trading vehicles available.

While neither is inherently better than the other, it’s important to understand the key differences so you can select the right one for your chosen strategy, trading style and personal situation.

At their core, SPX and SPY options are used by options traders looking to trade the S&P 500 (the top 500 public traded companies in the United States).

However the way in which they represent the S&P 500 is different, with the SPX being a capitilsation-weighted index, while the SPY is an Exchange Traded Fund (ETF) that tracks the performance of the S&P 500.

This means that SPY options have the SPY ETF fund as their underlying, while SPX options are based on the stocks that compose the S&P 500.

This leads to a number of different characteristics that should be considered before choosing one to trade with, which this article will explore.

1. American vs European Style Options

SPX is a European style option while SPY is an American style option. The main difference in these two styles is with regards to expiration dates.

For European style options like the SPX, cash is settled at the expiration date. This prevents you from exercising the option prior to expiration.

This is an important risk to be aware of and build into your risk management strategy.

Meanwhile, American style options like the SPY do not have cash settlement at the expiration date so traders have the freedom to exercise options prior to expiration.

Most traders will already be familiar with American style options as most equity options are of this style.

2. Contract Sizes and Prices

SPX contracts are very large, much larger than SPY.

In fact they are approximately 10x larger, which can provide some advantages to experienced traders.

Smaller traders can start out trading SPY and have a much smaller exposure than if they were to trade SPX.

This can allow for scaling in to positions and more flexibility.

Larger traders may prefer SPX because they can trade less contract meaning less commission and fees (less important in this new zero commission world.

3. Dividends

SPX options never pay a dividend which can be a good or bad thing depending on your goals..

SPY options pay a dividend that will correspond with the day of expiration.

4. Liquidity

The SPY typically has a tighter market, with better spread between bids and offers.

This often makes the SPY very attractive for active traders as it is seen as more liquid and price efficient than SPX options (although both have high trading volumes making entering and exiting trades easy).

As better liquidity leads to better price fills, traders can avoid losses in the SPX spread between the bid and offer, offsetting any gains they would have made in trading the SPX and saving money on commissions.

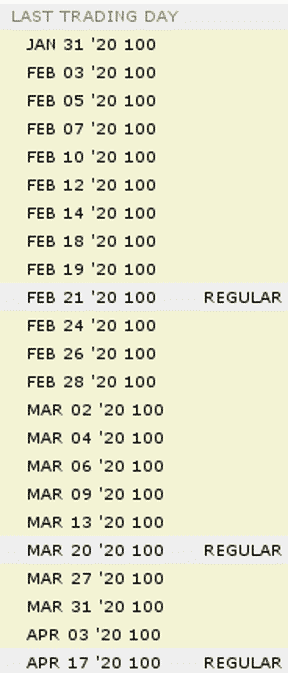

5. Options Expiration

Option expiry for SPY is a straightforward affair, with options stopping trading at the close of business on expiration Friday for the regular monthly options.

With the explosion in popularity of options in recent years, SPY now has options expiring every second day out to about 6 weeks. See below.

For SPX however, it is a lot more complicated as they are European style options which stop on the third Thursday of each month, while the settlement price is determined at the next day’s opening price.

This is for the regular monthly options only. All other SPX options are settled after the market close on expiration day.

These days, SPX also has options expiring every second day:

Due to the time difference between when trading stops and when the settlement price is determined, there can be large differences in the price of an option if the underlying index has a large move between Thursday at closing and Friday at opening.

This mechanic will introduce heightened risks of adverse consequences into your trading strategy if you don’t consider mitigating this risk by exiting your position before the Thursday close.

A final point worth noting is that some brokerages may automatically exit SPY weekly options.

This generally happens when it is in-the-money on expiration day before the close.

Before trading the SPY it’s worth consulting with your broker to understand if there are any situations where they may automatically exit your SPY trades.

6. Tax Differences of SPX Options vs SPY Options

As SPX and SPY options are sometimes treated differently for taxation purposes it’s worth speaking with your local tax professional to understand how this may impact you.

For example, in the United States, the Internal Revenue Service gives the SPX special section 1256 treatment.

This treatment allows investors to have most of their trading profits, 60%, subject to a long term tax rate which could offer them an advantage.

Conclusion

Understanding the characteristics of SPX options vs SPY options is important in ensuring you pick the right vehicle for your trading strategy.

Both have advantages and disadvantages and will suit different situations.

SPY options are a good candidate for traders looking for cheaper prices, smaller spreads and for trading with smaller accounts.

Meanwhile, SPX options are a good candidate for traders seeking lower commissions, potential tax benefits and for those with large amounts of capital.

As with all trading, always consider your strategy and risk management when choosing between SPY and SPX.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.