Contents

Iron Condors should play a large role in any traders methodology. They are a fantastic strategy that will profit if a stock stays flat, moves up a little or moves down a little.

However, there are times when a trader might be leaning slightly bullish or slightly bearish, in which case they may want to skew the iron condor so there is less risk on one side of the trade.

That’s what we’re going to look at today including a couple of different ways to set them up.

What Is An Iron Condor

An Iron Condor is actually a combination of a Bull Put Spread and a Bear Call Spread. If you’re new to iron condors, you will want to check out this post first.

Iron condors are best entered when volatility is high and likely to drop after placing the trade. You also want to look for stocks that you think will stay relatively flat over the course of the trade.

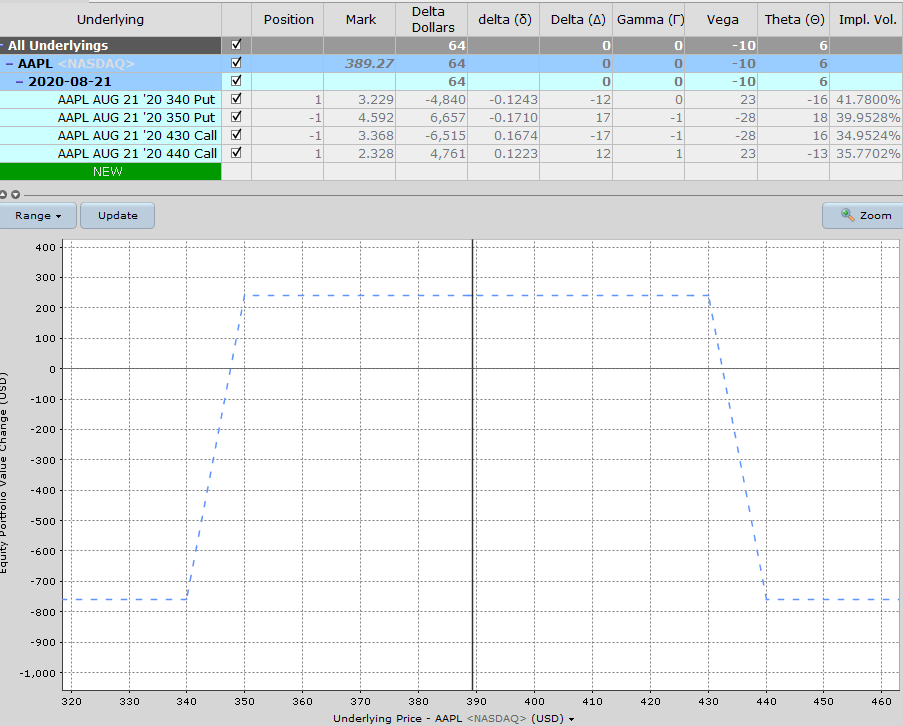

Here’s an example of how a typical iron condor might look:

AAPL REGULAR MONTHLY IRON CONDOR

Date: July 21st, 2020

Current Price: 389.27

Trade Details:

Buy 1 AAPL Aug 21st, 340 put @ $3.23

Sell 1 AAPL Aug 21st, 350 put @ $4.59

Sell 1 AAPL Aug 21st, 430 call @ $3.37

Buy 1 AAPL Aug 21st, 440 call @ $2.33

Premium: $240 net credit

Max Loss: $760

Return Potential: 31.58%

Now let’s take a look at how an unbalanced or skewed iron condor might look.

Unbalanced Iron Condor

Apple has been a very bullish stock for years, so perhaps the trader wants to trade an iron condor but turn it into a trade that can be skewed towards the bullish side.

There are a couple of ways to d this and we’ll look at both:

- Trade more contracts on the put side than the call side.

- Reduce the distance between the strikes on the call side

Of course, the trade could also do the opposite if they wanted to skew the trade on the bearish side.

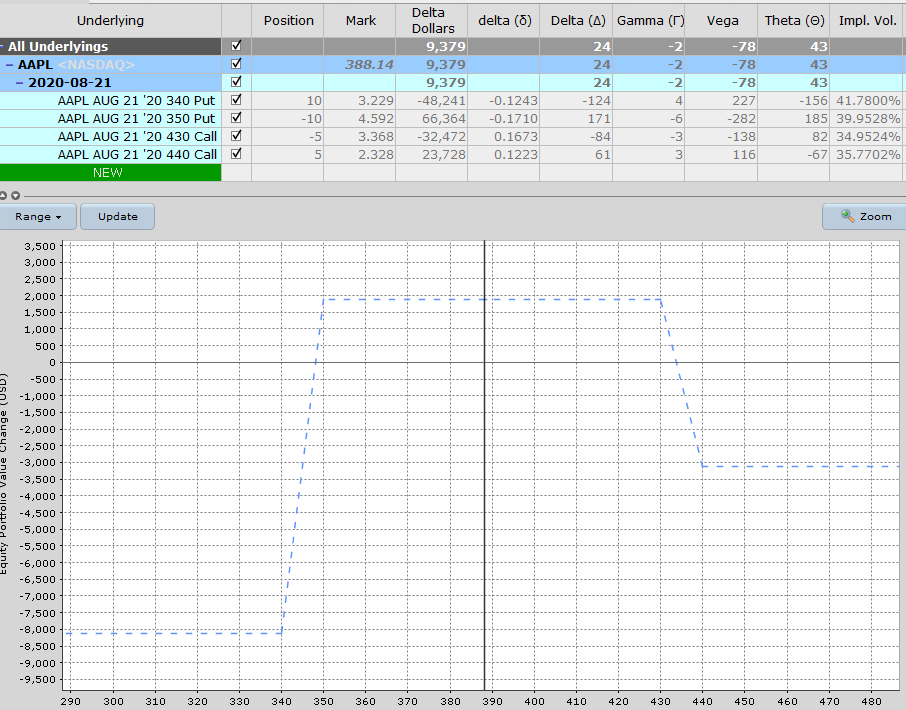

Trading More Contracts On The Put Side

This is a nice easy way to trade an unbalanced iron condor, but it is only relevant for those that are trading larger position sizes.

In our example above, we were only trading one contract, so if that’s the case, the trade would need to use method 2.

Let’s assume the trade wants to trade 10x higher than our example. Here’s how they might set up a skewed iron condor:

AAPL SKEWED MONTHLY IRON CONDOR

Date: July 21st, 2020

Current Price: 389.27

Trade Details:

Buy 10 AAPL Aug 21st, 340 puts @ $3.23

Sell 10 AAPL Aug 21st, 350 puts @ $4.59

Sell 5 AAPL Aug 21st, 430 calls @ $3.37

Buy 5 AAPL Aug 21st, 440 calls @ $2.33

Premium: $1880 net credit

Max Loss: $8120

Return Potential: 23.15%

One major thing to note here other than the obvious change in the shape of the risk graph is that rather than being a neutral trade, this trade is now a bullish trade with delta of 24 and delta dollars of 9,379.

Capital at risk is slightly higher than a regular condor (8120 vs 7600) due to the fact that less premium is being generated on the call side.

The return on capital at risk is also slightly lower at 23.15% compared to 31.58%.

Interestingly enough you can do almost the exact same thing by reducing the width between the call strikes which is what we’ll look at now.

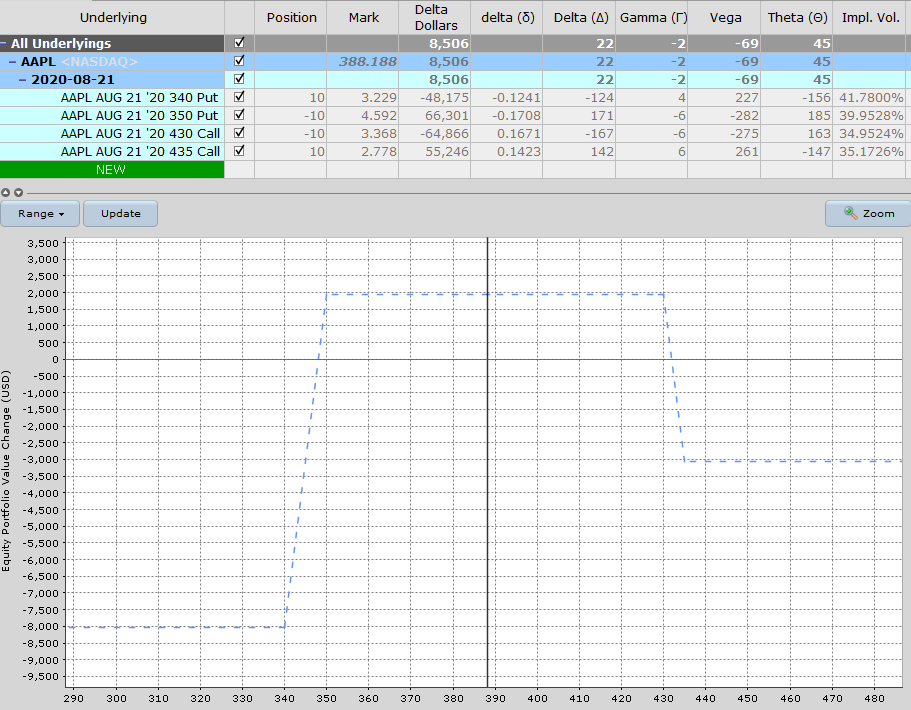

Reducing The Distance Between The Strikes On The Call Side

Here we’ll look at the same trade, but instead of trading less contracts on the call side, we’ll drop the width from 10 points to 5 points.

AAPL SKEWED MONTHLY IRON CONDOR VERSION 2

Date: July 21st, 2020

Current Price: 389.27

Trade Details:

Buy 10 AAPL Aug 21st, 340 puts @ $3.23

Sell 10 AAPL Aug 21st, 350 puts @ $4.59

Sell 10 AAPL Aug 21st, 430 calls @ $3.37

Buy 10 AAPL Aug 21st, 435 calls @ $2.78

Premium: $1940 net credit

Max Loss: $8060

Return Potential: 24.07%

The two versions are very similar in terms of premium received and capital at risk with the second version have a slightly higher return.

Conclusion

Now you know why to trade unbalanced iron condor as well as how to do it including two different methods.

If you want to learn more about iron condors, make sure to check out this post. If you’re interested in other options strategies I have detailed guides on calendar spreads, double calendar spreads, put ratio spreads, bull call spreads and bear call spreads to name a few.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.