Volatility has started dropping but is still elevated compared to a “normal” market. In high volatility environments, option premiums increase.

Higher volatility means a 15 delta put is now further away from the stock price than it was last week.

Selling options further away from the stock price gives us a greater margin for error when trading option strategies such as an iron condor.

Today, we are using Option Omega to look at a backtest on SPX iron condors.

An iron condor aims to profit from a drop in implied volatility, with the stock staying within an expected range.

When implied volatility is high, the wider the expected range becomes.

The maximum profit for an iron condor is limited to the premium received, while the maximum potential loss is also capped.

To calculate the maximum loss, take the difference in the strike prices of the long and short options, and subtract the premium received.

Traders should have a neutral outlook on the stock and ideally look to enter when the stock has a high implied volatility percentile.

Let’s work through the backtest parameters.

SPX IRON CONDOR BACKTEST 2018 – 2022

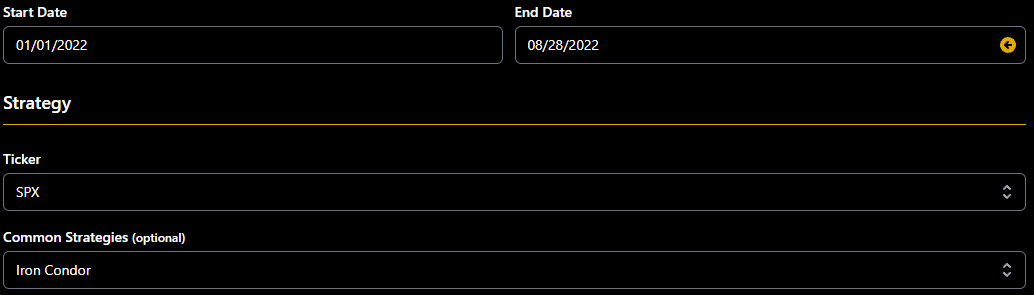

The first step is to pick our start dates.

For this backtest, we will use January 1st, 2022, to August 28th, 2022.

Then we select our ticker (SPX) and strategy (Iron Condor):

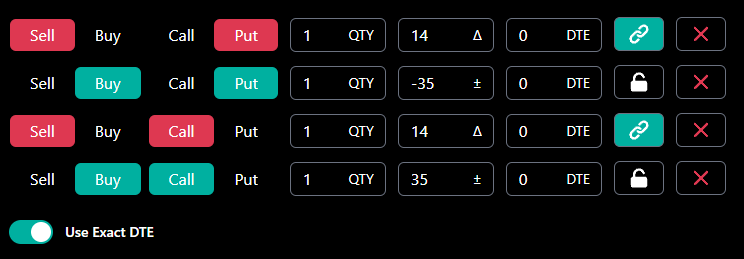

Step 2 is to select our delta.

For this test, we will sell the 14 delta put and call and place the long leg 35 points away.

We’re also going to be looking at a 0 DTE Condor, which has exploded in popularity in recent years.

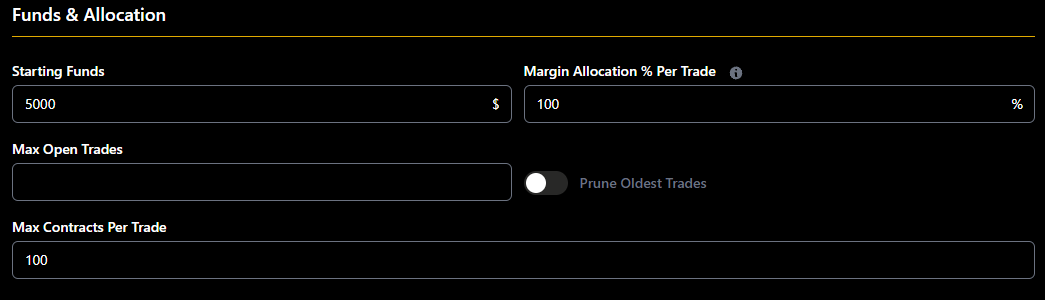

We will start with a low balance of $5,000 but allow 100% allocation to any trade.

It’s not typically a good idea to allocate all of your capital to one trade, but it’s fine for this backtest.

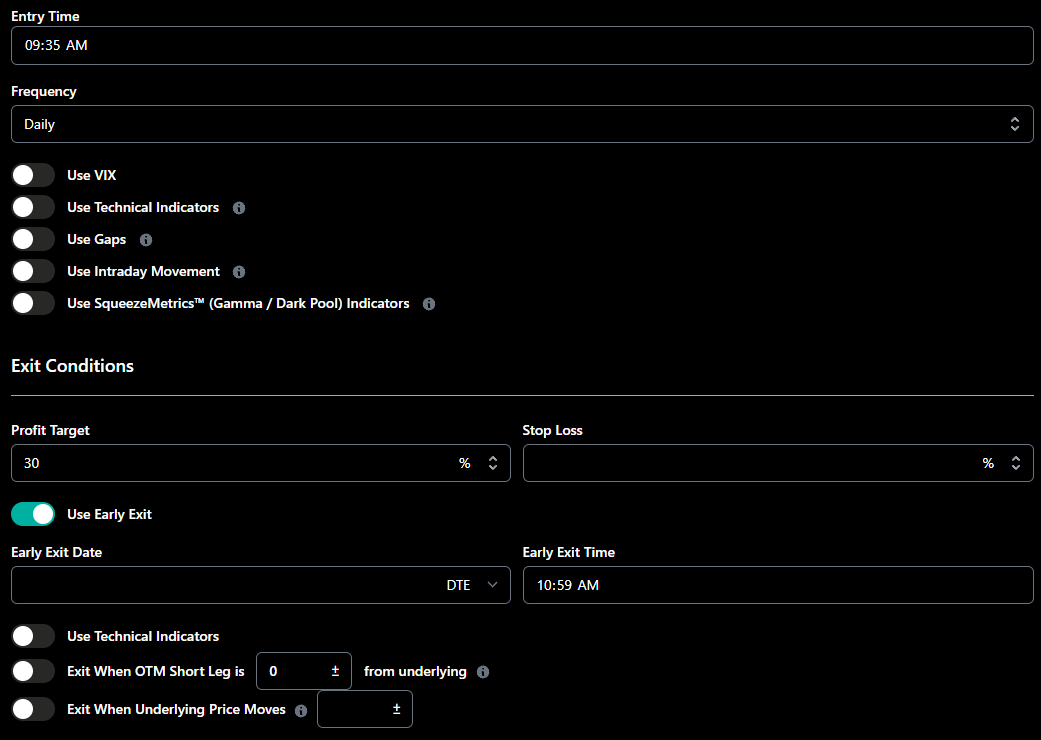

For this backtest, we open the trade at 9:35am, have a 30% profit target, and a timed exit of 10:59am.

* Advertising disclosure: All opinions expressed are our own. We may receive compensation from some of our partner brands in this article. However, we only promote brands we trust and have personally used.

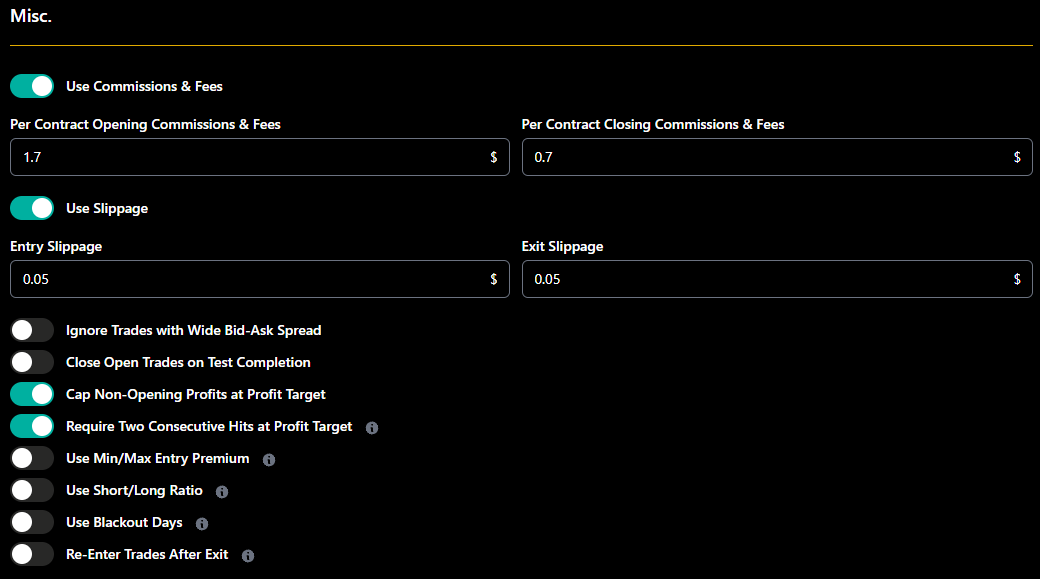

An important aspect of any backtest is making it as realistic as possible, so using the software, we can add in commissions and slippage.

We estimate $1.70 per contract for trade opening and $0.70 for closing.

Most trades will not get filled at the exact mid-point of a spread, so we will assume a $0.05 slippage on entry and exit.

Now that we have all our parameters in place let’s evaluate the results.

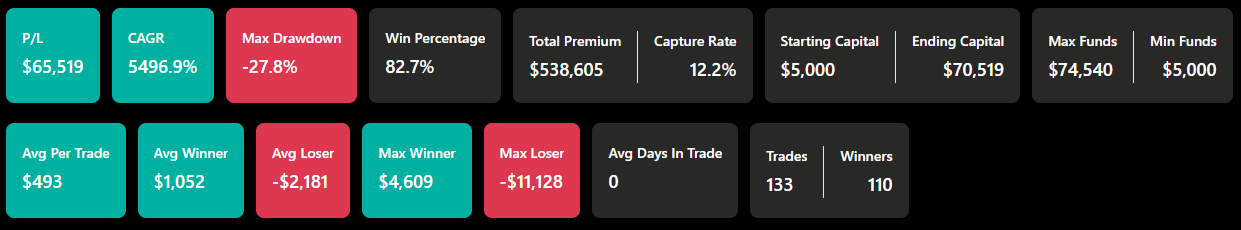

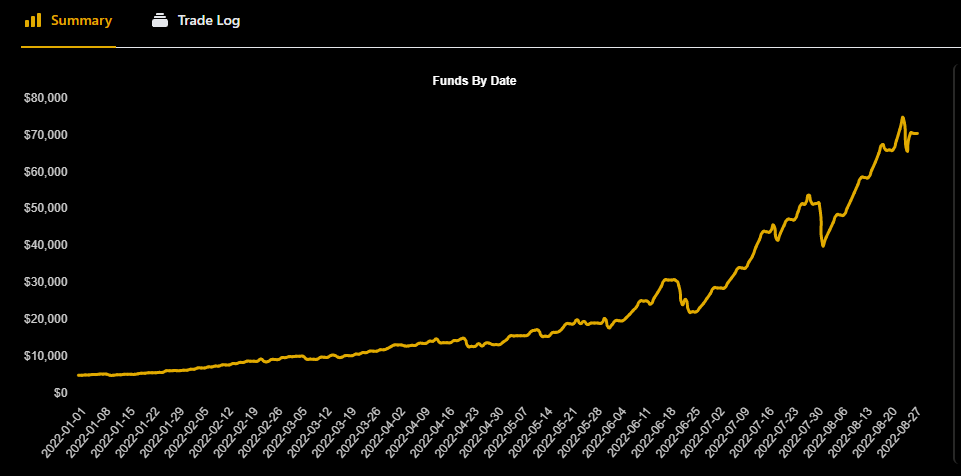

The test took around 15 seconds to run and showed overall positive results.

Out of 133 trades, there were 100 winners for a win rate of 82.7%.

Pretty impressive so far!

The average winning trade was $1,052, and the average losing trade was -$2,181, with a max drawdown of -27.8%.

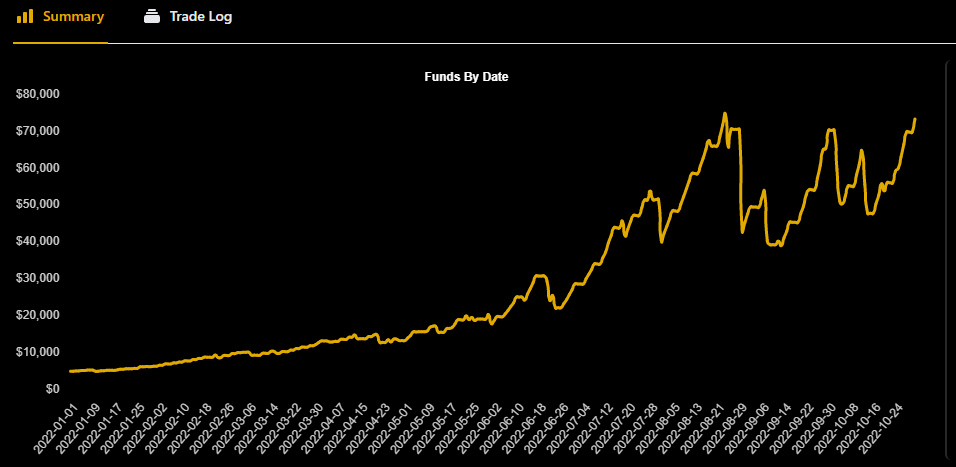

The overall CAGR is an impressive 5496.9%, so this trade seems to work very well.

This is also during a period that regularly saw VIX spikes up to the 32-28 range.

With this strategy, profits are re-invested, resulting in a larger trade size towards the end of the test period.

This can be both a good and a bad thing.

The overall equity curve is fantastic, but the losses in dollar terms become much larger as the trade progresses, with the biggest losing trade being -$11,128.

That loss came at the start of August.

That being said, the gains get bigger as well, with the biggest winning trade being the very last trade on August 26th.

Perhaps when trading this type of strategy, it might be worth taking some profit out of the account and putting it into dividend stocks, paying down the mortgage, or even taking a nice holiday!

The full trade log can be viewed within the platform and can even be exported to Excel if you want to drill into the data in more detail.

Here is a copy of the Excel trade log for ease of use.

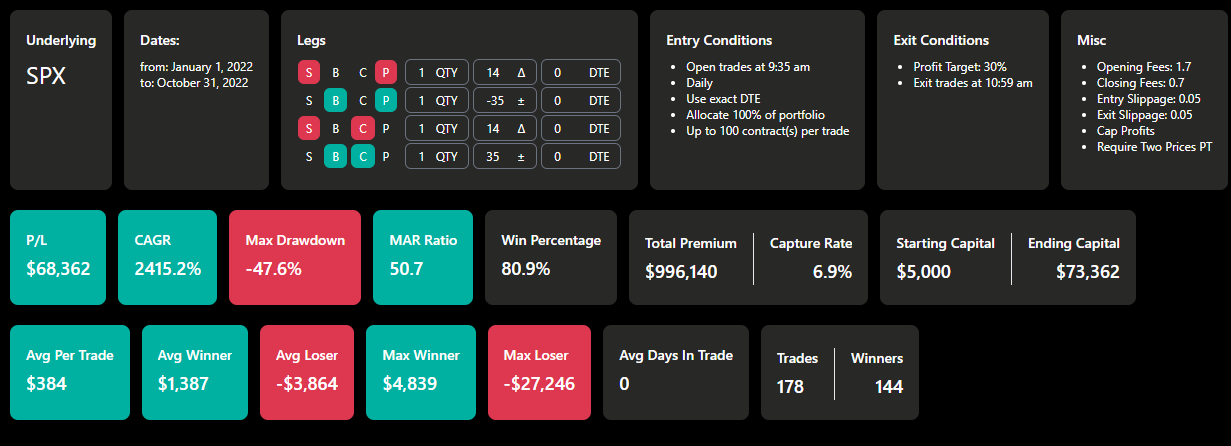

Backtest Update for Aug – Oct 2022

Here are the updated details on the backtest including the August to October period.

The strategy did not perform as well during this period. Max drawdown is larger, but the strategy has recovered to around its high water mark by the end of October.

Mitigating Risk

With any option trade, it’s important to have a plan in place on how you will manage the trade if it moves against you.

This trading strategy would require a lot of active management, with trades being opened and closed almost every day.

If you have questions about this strategy, please let us know.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

* Advertising disclosure: All opinions expressed are our own. We may receive compensation from some of our partner brands in this article. However, we only promote brands we trust and have personally used.

That looks interesting but i wonder why you decided to backtest up to August only as the article seems to just have been posted and we are already November.

That’s when I wrote the article. Only getting around to posting it now. 🙂

I just updated the results to the end of October.

Good Morning. I can’t see the Excel trade log . The link appears empty.

Fixed now.

How are you making money on this when your average losing trades are twice as much as your winners?

“The average winning trade was $1,052, and the average losing trade was -$2,181, with a max drawdown of -27.8%.”

Because the “win” rate was 82.7% (read above).

They don’t lose as much as they win. With an 80%+win rate a couple of higher ticket losses are manageable.

More winning trades than losing trades, a lot more …

Jeff, if you read “Out of 133 trades, there were 100 winners for a win rate of 82.7%” , that might help understanding. Regards.

win rate of 82.7%; 100 winners at $1,052 and 33 losers at $2,181. thats a pretty large drawdown though. id like to see a longer backtest.

I believe the answer is in the 82% win rate.

Yes that’s right.

Gavin, I don’t think the link is active i.e. “Here is a copy of the Excel trade log for ease of use.”

I like this strategy as it minimises overnight exposure but I would prefer to leg into the Condor i.e. as 2 vertical credit spreads and only put them on when the 5 min or 15 min is oversold RSI(2) 95-90 for bear call, then enter on the first reversal bar usually when price moves above/below the previous close for put/call

I hope that makes sense?

Hi Bruce, the link is active now. Legging in is good if you have the time to sit and watch all the ticks.

Thanks Gavin!

how were the entry and exit times selected? Were these the optimal times from testing results or were these arbitrarily selected?

Tried a few different times to see what worked well.

No stop loss on these trades? Won’t that leave you a very large exposure if your short leg goes in the money very quickly?

No, there is a timed exit which is generally going to get you out before any big losses, but obviously there’s no guarantee.

I am having trouble downloading the copy of the excel trade log. Can you point me the the file?

Send an email to info@optionstradingiq and I will send you a copy.

Would you mind doing a backtest using 1 DTE and a delta if 7?

Results are not good. -$2,684 P&L CAG -60.30%. Would need some tweaking to find something that works.

PDT issues with only $5k account trading every day?

Yes, possibly.

Hi Gav,

Thanks for the interesting information.

I wanted to clarify the following questions.

Why was such a short period of trading time from 9.35 to 10.59 during testing?

I would like to see the full test report, but unfortunately the link to the Excel file does not work.

I think that with a significant drawdown could help capital management, reducing the volume of traded contracts when entering an unfavorable series of trades.

It would also be interesting to compare the test results with for example symmetric butterfly or other gamma negative strategy.

Did I understand correctly that during testing the capital was not reinvested in subsequent trades, and the same number of contracts was traded each time?

Translated with http://www.DeepL.com/Translator (free version)

Capital was re-invested. If you send me an email I will get you a copy of the excel file. That time frame seemed to be optimal. If held any longer, the losing trades started to get bigger. So a times exit was crucial.

I am sending the email address, as it was not possible to download the file from the site [email protected]

Hi Gavin,

Thanks for sharing. A few additional statistics for the period until August without(!) reinvesting, based on my analysis of your Excel file.

1) Max. consec winners: 18, 2nd largest strike 15.

2) Largest consec loosers: 2

3) Max days to recover: 9, 2nd largest draw down period 7 days (2x).

I’d love to know how sensitive the backtest results are, if you shift start and end time, each +/- 5 mins.

Hello Gavin!

Could you also share the excel sheet for the period August – October?

I have a statistical method that I’m testing and trying to parallel yours.

My strategy:

– SPX open (GAP) less than +-0.8% , then I open an Iron Condor with +-2% legs.

– If opening VIX is less than +-8%, I open an Iron Condor with +-2% legs.

– If SPX opening is greater than +-0.8%, I open only one leg of the IC.

– If VIX open is greater than +-8%, I open only one leg of the IC.

Stoploss 400 bucks, no take profit because I let it close.

I’ve looked at 855 days and less than 30 days with losses. Those days can be avoided with a good chance if you pay attention to the economic calendar.

Could you also share the excel spreadsheet for the period August – October?

Thank you! RZ.

The August to October results have been added above. I will email you the spreadsheet.

Hello. This message is for Revesz. Gavin would appreciate it if you can forward to him via email and share my email with him [email protected]

I was wondering if he implemented his strategy above or did he make further changes and what are the results for his real trades.

Thank You.

Devan

Apologies for the additional work this may take.

I’ve sent him your email.

Thank you Gavin. Contact made with Zoltan.

Best to you and Happy Happy Holidays for the end of 2022.

Revesz – I’ve been doing 1DTE SPX ICs for a few months starting in October 22. Mostly 7-8 deltas, open the trades right as the market opened, stops at 3X total credit received, no profit takes (just let it expire). October and November were good, December not great and January break even so far. Looking for a better way to do this and would love to compare notes. Could you email me at [email protected] please? Thanks!

Gavin, started trading this 0DTE SPX strategy for 2023. So far so good. All winners. Early days, but promising.

I’ve been trading this since your post 2 years ago. In that time I’ve been doing well. I trade vertical56 spreads/ entered after the first 15 min of opening/ taken at 75% profit/ stop loss at 200%.

Nice. Well done William.

Hi Gavin,

Really interesting results. – would it be possible to email me the August to October Excel file. Intending to try this strategy, with a 30% profit target but perhaps a stop loss of 2 x Credit received, (to avoid any major losses prior to 11 am close )

Gavin, I f I monitored the trade for the 1.5 hours what would you consider an appropriate criteria for rolling the spread under threat.

For example if the short leg goes from a 14 delta to 20 or 25 delta, roll that spread to get it back to 14 delta on the short leg.

What are your thoughts – 20 or 25 delta to trigger the adjustment? Would you agree with my adjustment or do you have a different recommendation.

Thank You. Much Appreciated.

Devan

Hi Devan, yes I usually roll credit spreads at between 20 and 25 delta depending on the situation. Definitely no later than 25.

Thank you Gavin. Appreciate it as always

Hey just starting something similar, I am waiting until 2 hours to open position after the initial morning volatility. Seems like thats a sweet spot to when the volatility starts to die. And set it to hold no longer than 1PM. So 10:30AM-1:00PM CST with 15% profit taking and 25% stop. Can you get results for this? Any suggestions? Thanks Man Awesome Of You To Share This

Hey Kyle, those parameters produced a new loss of 25%. Sorry. 🙁

Hi Gavin –

Late to the party on this 0 DTE Iron Condor backtest. Can you help me understand the spreadsheet a little? If the test was to assume an entry for a $1.70 credit, I’m not understanding how you received $320 in premium on the first trade for 1 contract? I notice that “Premium Received” stays fairly consistent even as # of contracts employed steadily increases, so I understand that the “Premium Received” is on a per contract basis. So, I guess my basic question is how you’re counting “contracts” for the basis of this backtest?

Lastly – – and I get it, this is not “real world”, it’s a backtest – – but, given your parameters, it’s not possible to meet a 30% profit target on $3500 of capital risked at the inception of your $5000 account. The backtest’s first trade generated a 3% profit, not 30% assuming a 1 contract iron condor on SPX.

Again, I get it. The backtest simply assumed it was possible – with a $5000 account – to put on an SPX iron condor with only $350 of risk, i.e. it assumed that SPX contract size was $10 instead of $100 in order to make the 30% profit target “work” within the test.

(Interesting aside: recently, the CBOE did announce their intention to trade “mini” index options, which would have indeed created SPX options with a multiplier of 10 instead of 100. Sadly, the project has been shelved. For now, anyway.)

Sorry for the long-windedness, but again, not tracking with how “Premium Received” correlates with “# of Contracts” given a $1.70 assumed entry?

Thanks Gavin!

so this is the holy grail then, infinite profits, something about this seems to good to be true, not to be a hater but realistically what could go wrong real time that this backtest didnt show?

secondly, are you personally using this strategy with your own money and how has it gone so far? based on this you should be very rich already, i hope its true.

It has certainly worked well the last few years, but nothing lasts forever. I have traders in my group doing multiple thousand in profit each day. I’m not trading the strategy as it is too time intensive for me and doesn’t fit my risk profile.