Yesterday, we looked at the concept of IV crush and some specific examples from this year. Today, we’re going to drill down further into a specific IV crush example using NVDA.

Contents

- Introduction

- IV Crush Example – NVDA

- IV Crush Example – NVDA Short Straddle

- NVDA IV Crush Earnings History

- NVDA Short Straddle Result

- FAQ

- Conclusion

Introduction

IV crush is a phenomenon that tends to catch many beginners off guard.

It is a situation where the extrinsic value of an option contract declines sharply because of a significant event occurring.

For example, the reporting of corporate earnings or a regulatory announcement.

IV Crush Example – NVDA

Two days before earnings, NVDA was trading at 302.32.

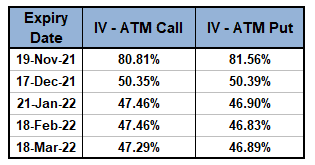

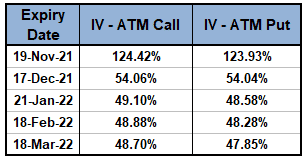

Here is how the implied volatility looked for the at-the-money options over various expiration dates:

We can see that the shortest-term options have the highest level of implied volatility.

These options will be impacted the most by volatility changes.

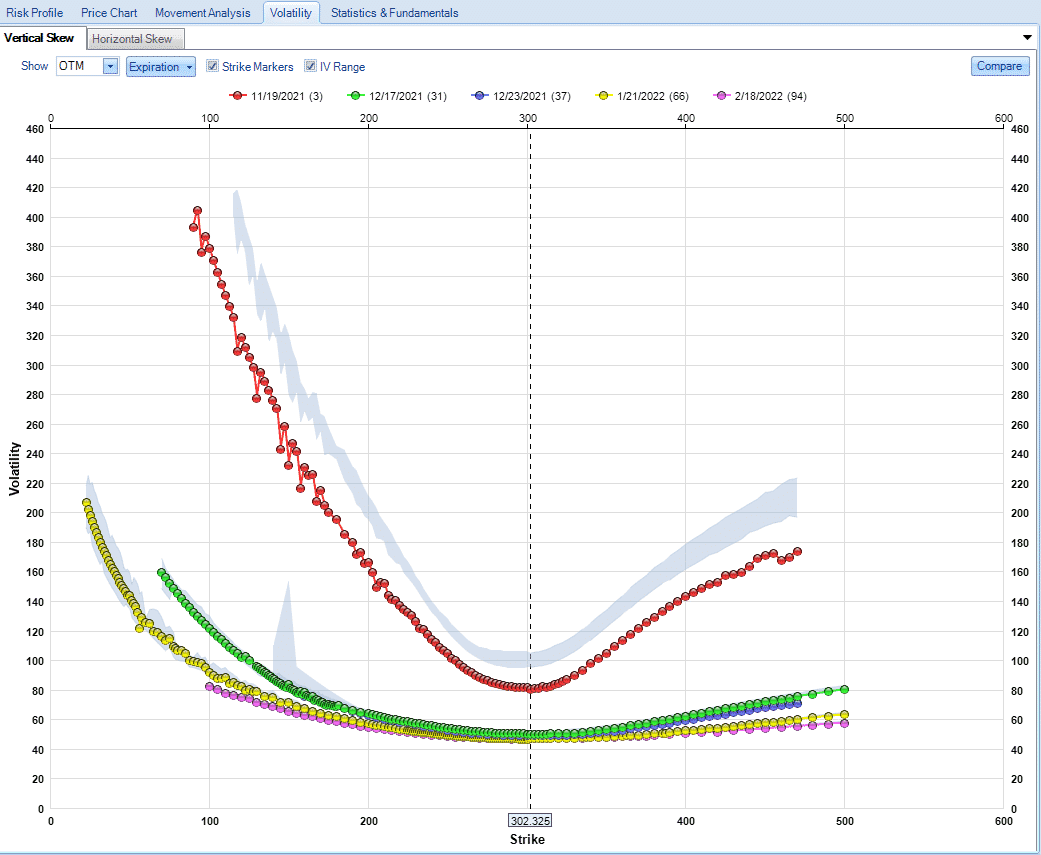

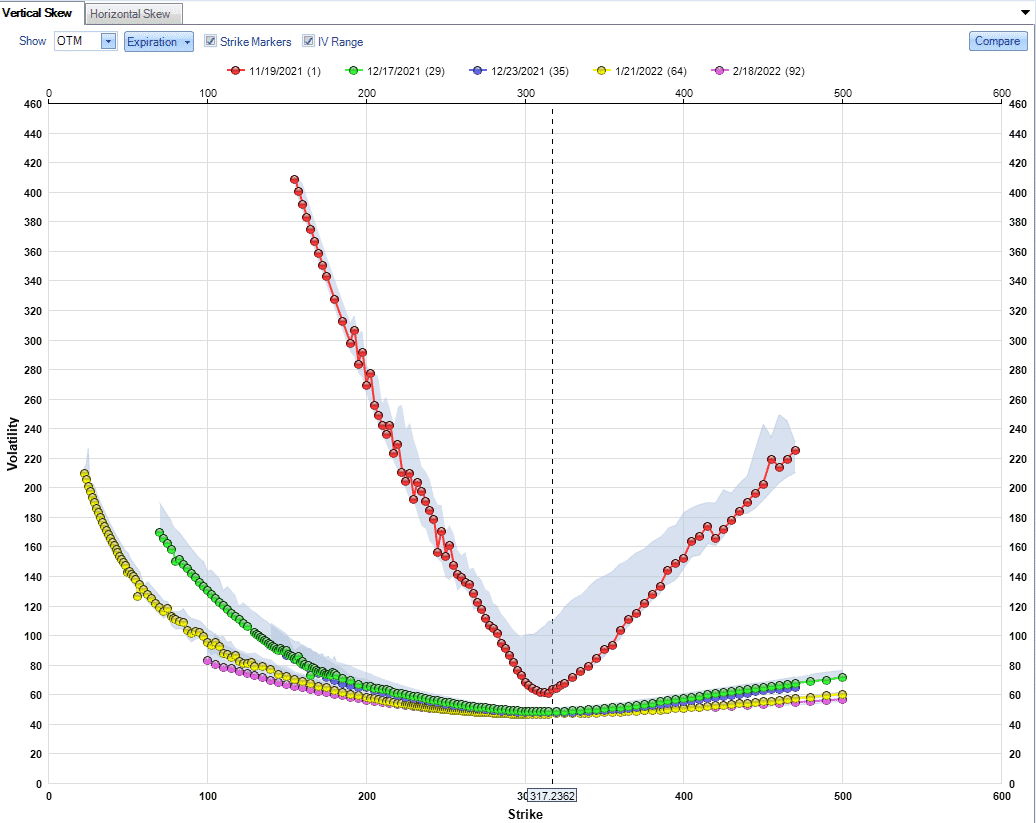

The following image is from OptionNet Explorer and shows a great visual of the volatility skew.

We can see the level of implied volatility for all strikes across various time periods.

Source: OptionNet Explorer

We can see that skew is the highest in the short-term options with out-of-the-money puts showing a volatility reading of nearly 400%!

However, in reality, no one would be trading 100 strike options when NVDA is trading above 300.

The November put option with a strike price of 250 was trading for around $0.22 and showed an IV reading of 104.74%.

IV Crush Example – NVDA Short Straddle

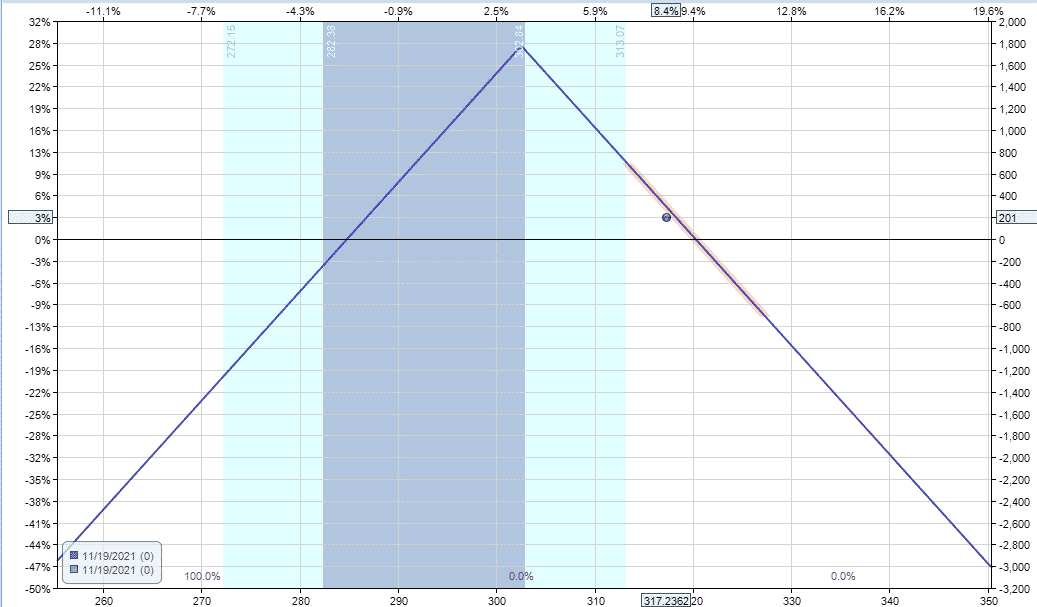

Let’s look at an example of how a short straddle performed over NVDA’s 3rd quarter earnings report.

Date: November 16, 2021 (10 minutes before the close)

Stock Price: 302.32

Trade Details:

Sell 1 NVDA November 19, 302.50 put @ 9.00

Sell 1 NVDA November 19, 302.50 call @ 8.75

Net Credit: $1,775

Max Loss: Unlimited

Max Profit: $1,775

Breakeven Prices: 284.75 and 320.25

As a reminder, a short straddle involves selling the at-the-money call, and at-the-money put.

Traders entering this trade are hoping the stock has a small move over the life of the options.

When held over earnings, traders are selling the expensive implied volatility and looking to profit from the IV crush.

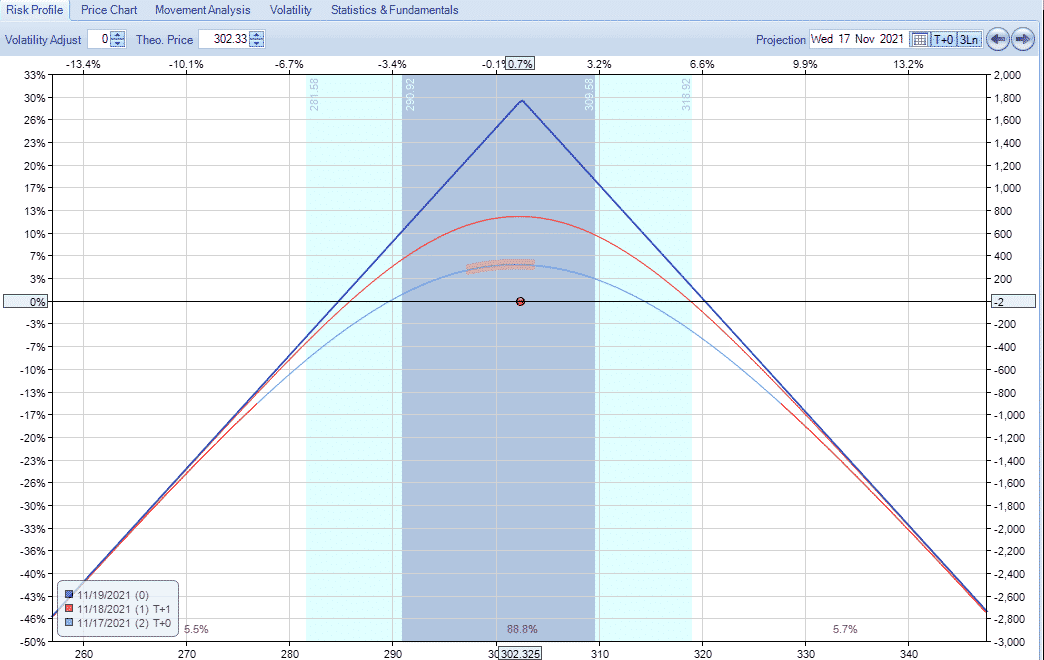

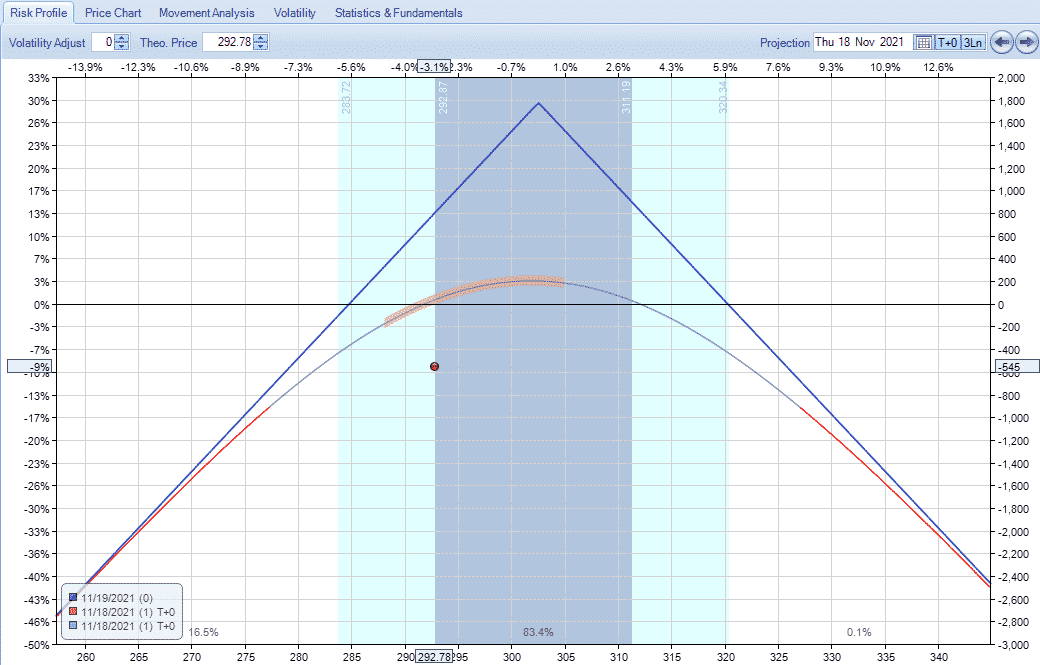

Here’s how the trade looks.

Delta: -2.33

Gamma: -3.59

Vega: -21.85

Theta: 295.88

As you can see from the greeks, Theta is the biggest driver of the trade.

But, we need to stock to stay within the expected range.

NVDA IV Crush Earnings History

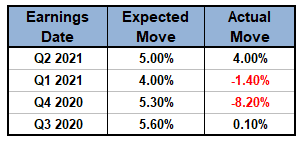

Before seeing how this trade played out, let’s look back at the past four earnings announcements and compare the expected move with the actual move.

When a stock stays within the expected move, straddle sellers win.

When the stock moves outside the expected range, straddle sellers lose.

Here we can see that NVDA has stayed within the expected range on three out of the last four occasions.

So, what happened with the most recent example?

Let’s find out.

NVDA Short Straddle Result

The trade was started two days before earnings.

After one day, NVDA dropped 3.06%, and the trade was down $545.

Implied volatility in the front-month options also rose significantly from 81% to 124%.

Let’s go forward one more day, so we can see the IV crush come into effect.

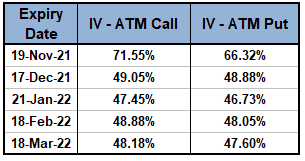

After earnings, NVDA bounced back up to 317.23, a gain of 8.42% on the day.

Implied volatility in the November at-the-money options dropped from 124% to 71% and 66%.

That’s what we’re talking about when we say IV crush!

Notice that the drop in IV was most pronounced in the front-month options, but the December options also saw a small reduction in IV.

They dropped from around 54% to 49%. Here is the new volatility curve:

And here is how the trade ended:

FAQ

What is IV Crush?

IV Crush is a phenomenon in options trading where the implied volatility (IV) of an option decreases rapidly, resulting in a decrease in the option’s value, even if the underlying asset price remains the same.

What Causes IV Crush?

IV Crush is caused by a decrease in the expected volatility of the underlying asset. This can happen after an earnings announcement or other news event that was expected to cause a large move in the stock price but didn’t.

How Can I Protect Myself From IV Crush?

There are several ways to protect yourself from IV Crush, including avoiding trading options during high IV periods, using option spreads to limit your risk, and adjusting your trading strategy to take advantage of IV Crush when it occurs.

Is IV Crush Always A Bad Thing?

Not necessarily. If you are a seller of options, IV Crush can be beneficial as it can decrease the value of the options you have sold. However, if you are a buyer of options, IV Crush can result in significant losses.

How Can I Learn More About IV Crush?

You can learn more about IV Crush by reading articles and books on options trading, following experienced traders on social media, and practicing trading options on a demo account before risking real money.

Consider using a backtesting tool such as OptionNet Explorer to understand how IV Crush affects option prices.

Conclusion

IV crush occurs for all stocks after an earnings announcement.

The degree of the drop in IV will differ from stock to stock.

In this example, we saw IV drop from 124% to 71% in the front-month options and from 54% to 49% in the second-month options.

We hope you enjoyed this specific example.

If you want to see more content like this, let us know!

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.