Contents

Every day legions of new investors and traders are drawn to the possibility of striking it rich in financial markets.

After all, who would’t want to make a lot of money working when and where they want, with no boss and little overheads?

As is the case with any industry where it appears easy to get rich, it is filled with its fair share of scammers, shady practices, and downright unsafe methods.

So before jumping onto any new platform or method, or before following any gurus online, always do your research to confirm that they have proven results to back up their claims and that there is no risk of you being scammed.

In 2014, a mobile-only online brokerage app called Robinhood was released by two Stanford physics graduates, Vladimir Tenev and Baiju Bhatt.

They sought to inspire an entirely new generation of investors to begin trading by making it more accessible.

The primary hook for the app was that they would offer commission-free trades with no account minimums.

At launch, the app had a waitlist of 500,000 people and it has since exploded in popularity, boasting millions of users.

Robinhood has not been without its fair share of controversy, being featured regularly online and in the news over concerns of legitimacy and safety.

So before you decide to download Robinhood and begin trading on your mobile, read on to understand what are the risks involved in using the app and whether it is right for you.

What Is Robinhood?

Robinhood is a mobile-based app for both iOS and Android that allows users to trade in a variety of financial assets such as stocks, cryptocurrencies, and options (subject to approval).

The primary draw of Robinhood is that it allows users to trade free of commissions, without a minimum account required.

In addition, it is designed to be easy to use for complete beginners, with information, interfaces, and functions presented in an easily accessible manner.

The app also features the ability to upgrade to Robinhood Gold – a premium account that will allow a user to access margin for trading.

The combination of no minimum account amount, commission-free trades, and easy-to-use functionality has seen its popularity soar, particularly amongst young demographics that have traditionally not participated in the markets.

People like Dave Portnoy with huge online followings are increasing the popularity of Robinhood, particularly among younger investors.

Is Robinhood Safe?

In order to answer this question, we need to examine it from two perspectives – the first is from a legal, regulatory, and consumer protection standpoint, while the other is from an accessibility standpoint.

For example, while gambling and alcohol use is regulated and could be seen as “safe” when used by minors and vulnerable people, it can cause significant harm and be seen as “unsafe”.

Legal, Regulatory and Consumer Protection

Since Robinhood functions as a securities brokerage, it is required to comply with the regulation set and enforced by the Securities and Exchange Commission (SEC).

As a compliant broker, Robinhood’s customers are protected by the Securities Investor Protection Corporation (SIPC), which means that customer’s money is protected up to certain limits.

For any securities held, customers are protected up to $500,000, while for any cash they have, they are protected up to $250,000.

The app itself is protected by a number of security measures and privacy policies, ensuring personal data, information, and account security is protected.

Despite these protections in place, Robinhood created controversy and put regulators on edge when it announced plans to launch a checking and savings account, offering an attractive 3% interest rate.

The problem with their plans is that although Robinhood is SIPC insured, it is not insured by the Federal Deposit Insurance Corporation (FDIC).

Insurance by the FDIC is required for any organization offering a checking and savings account and is designed to protect consumer’s money in the event of the organization being unable to meet claims on deposits.

Controversy surrounding the launch of the product caused the company to issue a public apology on its website and withdraw the product and related marketing material.

For many critics, the whole episode left a sour taste in their mouths as they became concerned over Robinhood’s willingness to release regulated products and marketing material without actual regulatory support.

So while the company is currently meeting legal, regulatory, and consumer protection, consumers should monitor any future product launches closely to ensure they are compliant.

Accessibility

Robinhood aimed to make investing easier and accessible for the masses and to appeal to an entirely new generation of would-be traders.

The company and its application have been designed with a millennial audience in mind.

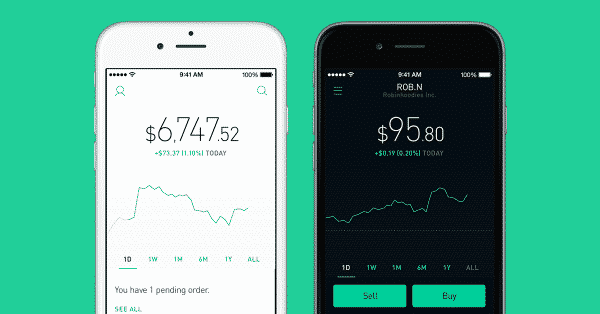

Their beautifully designed apps make it easy to buy and sell financial assets, with enticing graphs and menus that serve to almost gamify the experience for end-users.

Robinhood also provides zero-commission trades with no minimum account balance, meaning anyone can get started with even the smallest amount of money.

These factors mean many young and inexperienced investors are downloading the app and engaging in day-trading.

So much so, that money.com calls Robinhood “day trading for the mobile era” as the app places a heavy emphasis on trading high-flying stocks and highly volatile assets like cryptocurrencies, rather than encouraging a long-term investor mindset with investments into low-risk funds and ETFs.

Image credit: drivenxdesign.com

Image credit: drivenxdesign.com

The app even goes so far as to allow the early morning trading of some IPOs which is a highly speculative activity and enticing for new investors who don’t understand basic risk and reward dynamics, as well as trade and portfolio management.

Coupled with the ability to use margin, push notifications about stock changes, and visual encouragements such as confetti appearing on-screen every time a stock is purchased, it has a number of critics worried about how it might be influencing novice investors.

Unfortunately, the app doesn’t provide much education for new users, instead it promotes a “learn by doing” approach.

The approach is fine across many contexts, but dangerous in a situation where naive and novice users are using real money coupled with leverage to make speculative trades in a gamified and zero-sum environment.

The internet is littered with people who have lost their life savings while trading on Robinhood after getting sucked into the experience and not obtaining appropriate education upfront.

So How Does Robinhood Make Money?

Robinhood makes money in a variety of ways.

The first is via their premium account service which charges a monthly fee to allow users to trade on margin (i.e. with more cash than they have in their account).

Robinhood also collects interest from their margin lending operations as well as from customer cash and stocks, while also collecting rebates from market makers and trading venues.

These rebates from market makers and trading venues throw into doubt whether Robinhood is really putting its customers first or that has a conflict of interest, incentivizing it to design and run the service in a way that contributes to market maker activity.

SEC Investigation

In September 2020, Forbes reported that Robinhood was under investigation by the Securities and Exchange Commission for failing to disclose that it was selling clients’ orders to high-speed trading firms.

According to Forbes, the civil fraud investigation could result in a fine of around $10million if Robinhood decides to settle with the SEC.

Earlier in 2020, Robinhood came under further criticism for it’s methods of marketing to inexperienced retail traders.

There are concerns on Wall Street that younger traders may not full understand the risks of certain trading strategies, particularly with options trading.

According to Forbes:

Conclusion

The question of whether Robinhood is safe and legitimate comes down to two main factors – the first is from a legal, regulatory, and consumer protection standpoint, while the other is from an accessibility standpoint.

From a legal, regulatory, and consumer protection standpoint the company operates as a regulated securities broker, complying with all required regulations and consumer protection laws.

While it has on rare occasions breached regulations, it has moved swiftly to correct any issues and maintain compliance.

Coupled with a robust and problem-free app with extensive data and privacy protection, consumers can rest assured the service is safe from that perspective.

The real concern with Robinhood lies in the accessibility and gamification of the experience as well as the potential conflict of interest it has with market makers.

Coupled with little education and exposure to margin and high-risk financial assets such as cryptocurrencies, novice investors might find themselves in a position where they could become addicted to the rush of day trading and lose their life savings.

Like any endeavor, receiving a proper education before risking any real money is vital.

For experienced traders, Robinhood can provide an easy to use and attractive way to trade from your mobile and is safe to use.

For new traders they might find that the app proves to be very unsafe for them, leading them down a path of financial misery.

So for any new investor considering using Robinhood, before you spend a single dollar, ensure you take the time to educate yourself on how to trade correctly.

This means understanding both fundamental and technical analysis, the types of orders and assets available (e.g. options vs stocks), how to manage risk, and how to construct and manage a portfolio.

Only once having a firm grounding in each should novice investors consider using Robinhood.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

No, it’s not safe.

They will lock your account and keep you from getting to your money and there is nothing you will be able to do about it.

Fortunately, I lost less than $50 this way. But keep in mind, if you open an account with Robinhood, you may never be able to close it if they lock your account with a balance in it. That’s what happened to me. 3 months of emails and trying to find a phone number did absolutely no good.

They’re thieves, in my opinion.

Thanks for sharing your experience.

I have a question. I had heard that (part of) the reason Alex Kearns killed himself (at least the part related to Robinhood… as suicide is often multifactorial) was related to a failed bull put credit spread: something about the short put being assigned after hours (after 4:00 but prior to 8:00pm EST) at a time when he was not able to respond to it, on a Friday. And the long puts that he brought to protect his downside expired over the weekend, so on Monday when he opened his account the short puts had been assigned to him and the long puts were gone. I have read that this is something unique to Robinhood, (that they will let the protective arm of these spreads expire without resolving the spread), and most other platforms will not allow this to happen(?) Do you know if this is true and if Robinhood is made any changes in regards to this yet?

Not sure and don’t want to comment on it out of respect to the family.