Despite not being advocated as a mainstream option strategy, the diagonal call spread is pretty easy to understand.

Let’s take a look at this dynamic strategy.

Contents

- Introduction

- Maximum Loss

- Maximum Gain

- Breakeven Price

- Payoff Diagram

- Risk of Early Assignment

- How Volatility Impacts Diagonal Call Spreads

- How Theta Impacts Diagonal Call Spreads

- Other Greeks

- Risks

- Diagonal Call Spread vs Diagonal Put Spread

- Diagonal Call Spread vs Covered Call

- Trade Management

- Examples

- Summary

Introduction

There are actually two types of diagonal call spreads we’ll cover today, the first is the standard version which is sometimes called a poor man’s covered call which was covered in detail here.

These are easy if you are familiar with covered calls.

It is initiated by buying a long-term in-the-money call and selling a short-term out-of-the-money call.

Some investors use it as a way of generating greater returns than a covered call strategy, as the long stock position is replaced with a deep in-the-money long dated call option.

This long-dated call option will have a high delta and behave similar to a long stock position.

The second type is where the trader sells a near term out-of-the-money call and then buys a longer-term call that is further out-of-the-money.

Here’s an example of how that looks and this is the type we will discuss in detail in this article.

Maximum Loss

If the stock drops, the maximum loss is limited to the debit paid to enter the trade. Sometimes, the near-term options is sold for a higher price than the longer dated option.

In this case, there is no loss on the downside and if the stock is below both call strikes at expiry, they both expire worthless and trade would actually be in profit by the amount of the credit received for opening the trade.

If the stock rallies, the maximum loss on the upside is equal to the difference in the strike prices plus / minus the option premium paid / received.

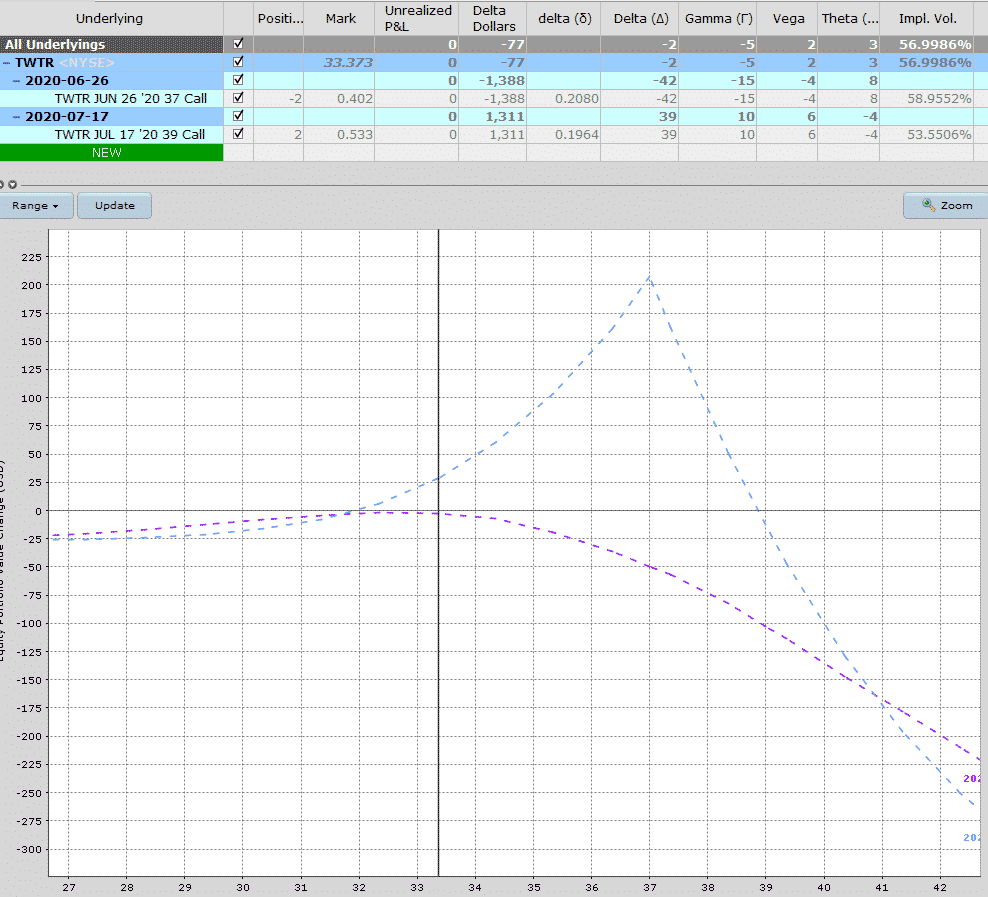

In the TWTR example above, the strikes are $2 apart and there are two contracts, so that makes a $400 potential loss, plus the $26 in premium paid for a total maximum potential loss of $426.

Maximum Gain

The maximum gain on a diagonal spread can’t actually be worked out in advance because it’s impossible to know what the back-month option will be trading for when the front-month option expires.

This is due to changes in implied volatility.

The best we can do is use our broker platform or software such as Option Net Explorer to estimate the maximum gain.

In our TWTR example, the maximum gain is estimated at just over $200.

The ideal scenario for the trade is that the stock ends near the short strike at the expiration of the near-term option.

Ideally this would be associated with an increase in implied volatility in the back-month option.

The increase in implied volatility in the back-month helps to offset any negative effects from time decay.

Some traders like to hold the long call as a stand-alone trade after the short call expires.

The expired short call helps offset the cost of the long call.

Breakeven Price

Like the maximum gain, the exact breakeven price can’t actually be calculated but we can estimate it.

Looking at the TWTR example, we can see that the breakeven points are estimated around $32 and $38.80.

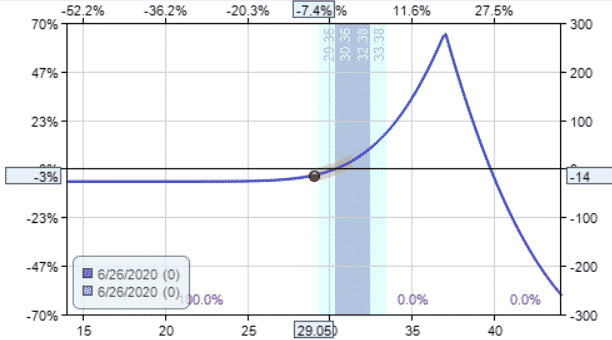

If the trade is entered for a net credit, there will be no breakeven price on the downside. See example below:

Payoff Diagram

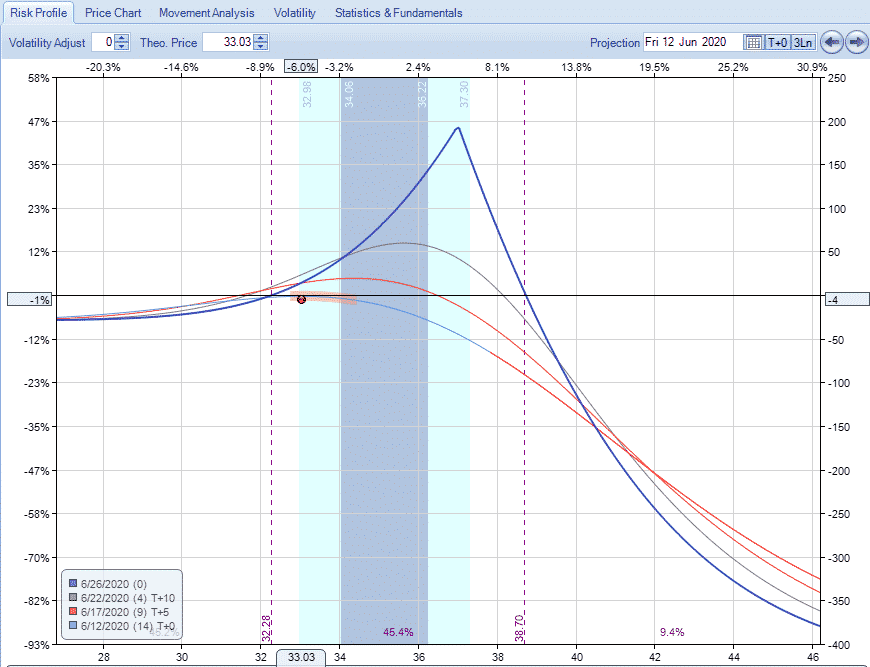

Diagonal call spreads have low risk on the downside and a tent shaped profit zone on the upside, with all the risk in the trade being above the profit tent.

For this reason, a big rally in the stock early in the trade is the worst case scenario.

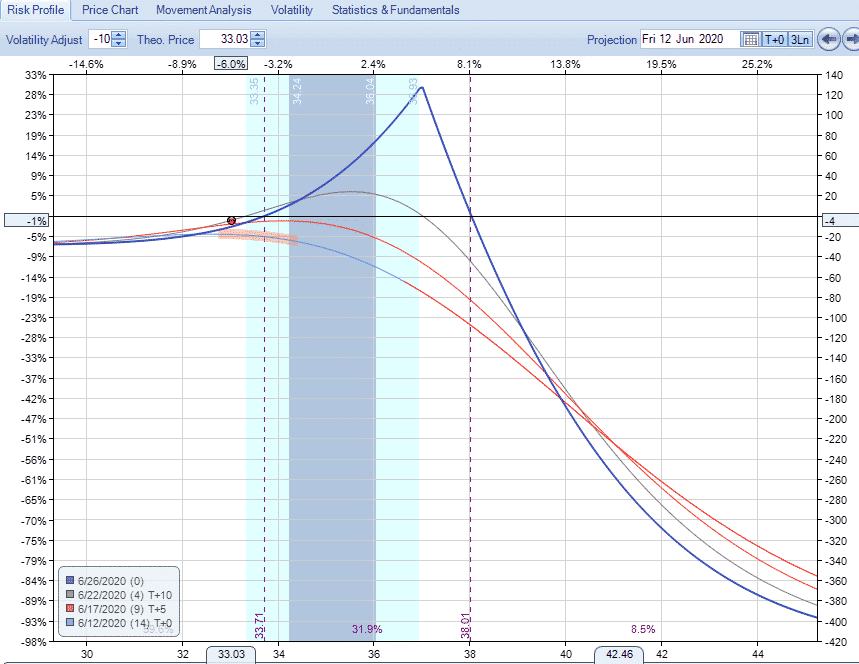

Using our TWTR example, we can see how the trade performs over different time periods by looking at the T+0, T+5 and T+10 lines.

Notice that an initial rally up to $36 will see the trade in a loss situation, but if that level is reached on day 5-10, the trade is actually in profit.

Losses start to accelerate if the stock breaks through the short strike, so for this reason, it is best to close the trade before the stock breaks above that level.

Risk of Early Assignment

There is always a risk of early assignment when having a short option position in an individual stock or ETF. You can mitigate this risk by trading Index options, but they are more expensive.

Usually early assignment only occurs on call options when there is an upcoming dividend payment. Traders will exercise the call in order to take ownership of the share before the ex-date and receive the dividend.

For this reason, it’s important to watch out for ex-dividend dates. Otherwise, make sure to close the trade before the short call goes in-the-money and this will help avoid early assignment.

How Volatility Impacts Diagonal Call Spreads

Diagonal spreads are long vega trades, so generally speaking they benefit from rising volatility after the trade has been placed.

Vega is the greek that measures a position’s exposure to changes in implied volatility. If a position has negative vega overall, it will benefit from falling volatility.

If the position has positive vega, it will benefit from rising volatility. You can read more about implied volatility and vega in detail here.

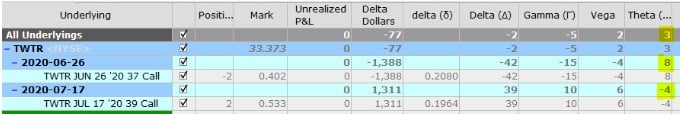

Our TWTR example starts with a vega of 2. This means that for every 1% rise in implied volatility, the trade should gain $2.

The opposite is true if implied volatility drops 1% – the position would lose $2.

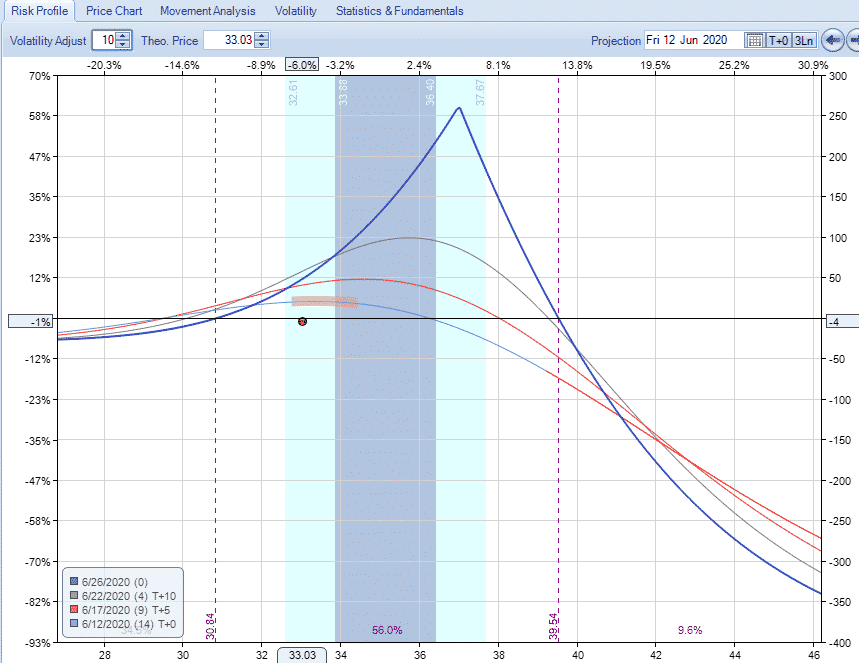

Here’s how the TWTR trade looks assuming a 10% rise in implied volatility.

Notice that the expiration line maximum profit has rises from around $200 to over $250 and all three of the interim lines have also been lifted up.

The opposite is true if we estimate a 10% drop in volatility, the whole payoff graph has now moved downwards with a maximum potential profit of only $125.

It’s important to note that the maximum potential loss has not changed.

How Theta Impacts Diagonal Call Spreads

Diagonal spreads are positive theta trades in that they make money as time passes, with all else being equal.

This is due to the fact that the short call suffers faster time decay than the bought call.

This is especially true if the bought call is much further out in time (I.e. more than just one month).

In our TWTR example, the trade has positive Theta of 13.

This means that, all else being equal, the trade will gain $13 per day due to time decay.

Notice that the positive time decay on the short-term sold call is higher than the time decay being suffered on the longer-dated long call.

Other Greeks

DELTA

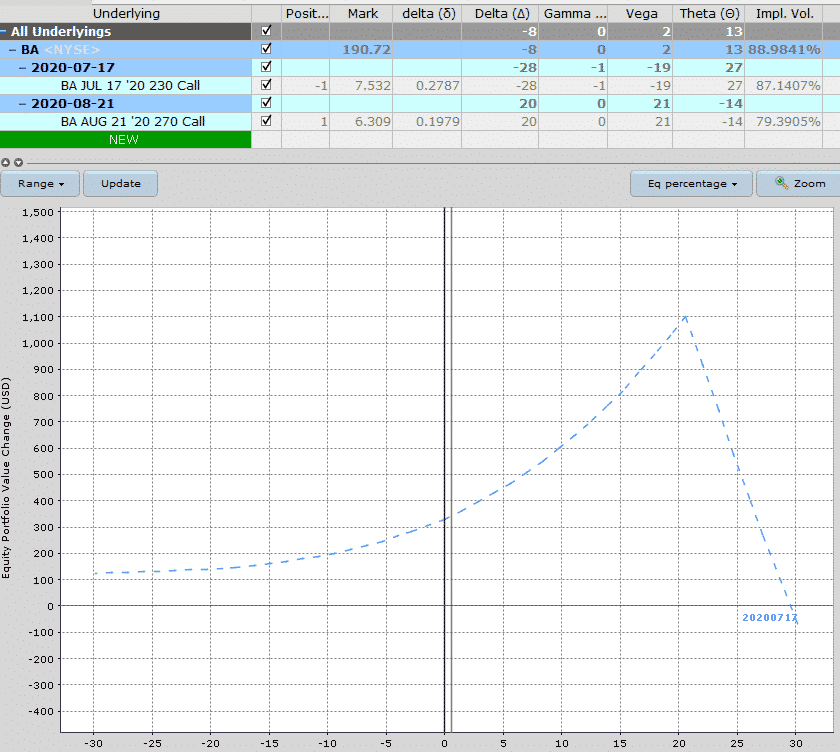

Delta on a diagonal spread is generally going to be negative to start with and we can see that in our TWTR (-2) and BA (-8) examples.

As the trade progresses, the delta will change.

For example, if TWTR drops below $33, the trade actually flips to be slightly positive delta, because the trader wants the stock to head back up towards the profit zone as the trade gets closer to expiry.

GAMMA

Diagonal spreads are negative gamma. Generally any trade that has a profit tent above the zero line will be negative gamma because they will benefit from stable prices.

Gamma is one of the lesser known greeks and usually, not as important as the others.

I say usually, because you’ll see further down in this post why it can be really important to understand gamma risk.

Diagonal spreads maintain a bit of a natural hedge because they are negative gamma, but positive vega. The ideal scenario is that implied volatility rises (good for positive Vega) but realized volatility remains low (good for negative gamma).

In other words you want the stock to stay relatively flat, but show a rise in implied volatility (the expectation of future big price moves).

In our TWTR example the initial diagonal had -5 gamma while the BA trade has almost 0 gamma.

Risks

The main risk with the trade is a sharp rally in the underlying stock early in the trade.

A rally late in the trade can be ok, provided the stock doesn’t break through the short call.

ASSIGNMENT RISK

We talked about this already so won’t go into to much detail here and while this doesn’t happen often it can theoretically happen at any point during the trade.

The risk is most acute when a stock trades ex-dividend.

If the stock is trading well below the sold call, the risk of assignment is very low.

E.g. a trader would generally not exercise his right to buy TWTR at $37 when TWTR is trading at $33. For a stock like

TWTR that doesn’t pay a dividend, the risk of early assignment is quite low but that would be different when using this strategy on a stock that does pay a dividend.

Assignment risk is highest if the stock is trading ex-dividend and the short call is in the money.

One way to avoid assignment risk is to trade stocks that don’t pay dividends, or trade indexes that are European style and cannot be exercised early.

The risk is also very low if the short calls are out-of-the-money.

To reduce assignment risk consider closing your trade if short call is close to being in-the-money, particularly if it is close to expiry.

EXPIRATION RISK

Leading into expiration, if the stock is trading just above or just below the short call, the trader has expiration risk.

The risk here is that the trader might get assigned and then the stock makes an adverse movement before he has had a chance to cover the assignment.

In this case, the best way to avoid this risk is to simply close out the spread before expiry.

While it might be tempting to hold the spread and hope that the stock drops and stays below the short call, the risks are high that things end badly.

Sure, the trader might get lucky, but do you really want to expose your account to those risks?

VOLATILITY RISK

As mentioned on the section on the greeks, this is a positive vega strategy meaning the position benefits from a rise in implied volatility.

If volatility falls after trade initiation, the position will likely suffer losses.

The other risk with volatility relates to the volatility curve.

Generally speaking, when volatility rises or fall it has a similar impact across all expiration periods.

However, you could potentially run into a scenario where volatility in the front month rises (bad for the short call) and volatility in the back month drops (bad for the long call).

That would result in a double whammy for the trade.

That scenario may not be that common but it could happen and it’s important that trades understand volatility term structure when placing trades that span different expiration periods.

Diagonal Call Spread vs Diagonal Put Spread

The opposite of a diagonal call spread is a diagonal put spread. With a put spread, the risk and also the profit tent are on the downside.

Here’s what a diagonal put spread would look like:

Diagonal put spreads have a lot of similarities with put ratio spreads.

Diagonal Call Spread vs Covered Call

As mentioned at the start of this article, there are two different types of diagonal call spreads and in this article we have focused on the second type rather than the poor man’s covered call.

The poor man’s covered call is very similar to a regular covered call but uses an in-the-money long call in place of the stock.

This allows the trader to enter the trade with much less capital at risk and still potentially achieve a similar dollar return.

The diagonal call spread that we have looked at in this article is very different to a covered call.

Trade Management

As with all trading strategies, it’s important to plan out in advance exactly how you are going to manage the trade in any scenario.

What will you do if the stock rallies? What about if it drops? Where will you take profits? Where and how will you adjust? When will you get stopped out?

Lot’s to consider here but let’s look at some of the basics of how to manage diagonal spreads.

PROFIT TARGET

First and foremost, it’s important to have a profit target.

That might be 10% of capital at risk or you may plan on holding to expiration provided the stock stays within the profit tent. Ten to fifteen percent is a good target for a trade like this.

STOP LOSS

Having a stop loss is also important, perhaps more so than the profit target.

With diagonal spreads, you can set a stop loss based on percentage of the capital at risk. In this case it might be closing the trade if the loss reaches 15-20%.

Examples

Let’s see what actually happened in our Twitter (TWTR) diagonal call spread.

Date: Jun 12, 2020

Price: $33.37

Sell two Jun 26 TWTR $37 call @ $0.402

Buy two Jul 17 TWTR $39 call @ $0.533

Total Debit: $26

Max Risk: $426

Investor plans to take profit at 15% of max risk, or $64.

Investor plans to exit if loss 20% of max risk, or $85.

Neither of these levels was reached. On Jun 26 expiration, TWTR closed at $29.05 when the short call expired worthless out-of-the-money.

The investor sells the remaining two long call for $13.

The net loss to the investor about $13, more or less depending on fills and commissions.

Summary

Diagonal call spreads are a neutral trade that can handle a move higher in the stock provided the move isn’t too big or too early in the trade.

For this reason they should only be placed on stocks the trader thinks might move slightly higher but not too much higher.

A good time to enter this type of trade is at the end of a strong bull move where further upside is likely to be limited.

Given that the position contains options across multiple expiration dates, it’s important to have a solid grasp of implied volatility including how volatility changes impact options with different expiration periods.

One nice feature of the trade is that there is very little risk on the downside and in some instances, even the ability to generate a small amount of premium if both calls expire worthless.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

I can’t seem to find any information about shorting a call diagonal, or selling 60 day calls and buying 30 day. The spread is a cheap net debit, and risk profile looks like a magic trick (at least before expiration), therefore I’m reluctant to believe it’s a good strategy. Would I be able to close the position if I wanted to take profit before the sold call expires, or would closing the position result in a loss? Any thoughts?

Hi Brandon, sorry for the delayed response.

Doing that type of trade, gives you a payoff diagram that is basically a mirror image of a diagonal call spread.

The main problem I see with it is the short 60 day option is very short vol, so a vol spike could hurt you. But as you are selling a call, perhaps a vol spike indicates a large downward move in which case you would be fine.

Very interesting concept, not something I have ever tried or really heard about to be honest. Would be good to test it out for a few months to see how it goes.

Hi Gavin,

Thank you for this – your site is very comprehensive in explaining everything related to options compared to other sites.

I do have some question regarding Diagonal Bull Credit Put Spreads (i’m not sure if this is the terminology), but essentially the Long Leg is OTM as oppose to ITM like in a PMCP.

This is more pertaining to the idea you could setup a long OTM back-month option leg (put) and sell a near-month short ATM/Slightly OTM option put as a means to run a one-wing Iron Condor but using a LEAP put-option as a peg Insurance / Peg to define the max risk.

What are the implications of setting something up like this and then managing the Short Leg for adjustments (Rolling Out, and down if necessary), Are there any

If this is a viable strategy what sort of rule of thumbs would be applicable for the long leg (How far away from current price – 2 SDs, / Support Levels / 0.10 Delta?) Would the PMCC/PMCP rule of thumb of say

a) Strike Difference between the Long Leg vs the Short Leg vs the Initial Net Debit (almost always), such that the Net Debit is not more than 75% of the Strike Difference.

I’ved posted a write up on reddit https://www.reddit.com/r/options/comments/hsioqa/diagonal_bull_put_debitcredit_spread_pmcp/ and copied here.

Hello,

I’m looking for some feedback and insights for consideration for the variations in Diagonal Spreads:

a) Diagonal Bull Put Debit Spread (“Poor Man Covered Put “) where the

Long LEAP Put is ATM/ITM and the Short Near-Term Put is OTM.

The Directional Bias is Bearish for the underlying.

b) Diagonal Bull Put Credit Spread – (Not sure if this is the correct terminology) but essentially you have a LEAP Wing of an Iron Condor where the

Long LEAP Put is OTM and the Short Near-Term Put is Closer to the Underlying Price.

The Directional Bias is Bullish for the underlying.

Example

Let’s say for example stock XYZ is $50.

Setup a Diagonal Bull Put Credit Spread, selling near-term $45, and establish a LEAP Put of $40 giving you a $5 spread and collecting credit.

If the underlying trades against you and touches $45 by 7-20 DTE, you have some room to roll-out in time for more credit and in the secondary case roll down.

QQ1: If the underlying continues to drop to your $40 LEAP Put Strike, what are the implications of continue to roll out in time (horizontally), or down in strike (vertically) the short near-term Leg to say $40 (converting it to a Calendar Spread), and/or possibly below $40 (changing it to a Diagonal Bull Put Debit Spread (PMCP))?

QQ2: What are the risk management, stop loss, profit close, and adjustment protocols?

Based on my understanding:

a) Ideally only adjust the Short Put, based on Time, Outlook of Underlying, and for a continually Net Credit

b) If it turns into a Put Calendar Spread or Diagonal Bull Put Debit Spread, wouldn’t it be advantageous to keep going up until a certain point and take profit since the Long Put would be ITM and would benefit from large Vega (IV increases if the underlying drops in price)

c) Can possibly Sell Call Credit Spreads to make it into sort of an Iron Condor as an adjustment strategy to net a credit to play the fact that the Underlying is Dropping in Price. Not sure if you would create a Diagonal Bearish Credit Spread or something more short-term if you’re long the underlying.

QQ3: What would be a good profit target based on the initial capital risk debited 50%-100%?

What would be good stop-loss should the underlying rise up in price and your LEAP put continues to lose value due to negative Delta as the underlying rises giving that you’re still able to sell Near-Term Puts ATM/slightly OTM to reduce cost basis?

Thanks in advance.

F L

Hey F L, thanks for the feedback, much appreciated. You sure have got a lot of questions there. I would say the best thing is to test things out and gain the experience. Once you know how the trade performs in a variety of different markets, the management of the trade will become second nature and you won’t have to think about it so much.

Option Net Explorer is a nice tool for backtesting – https://optionstradingiq.com/optionnet-explorer-review/

Hope it helps you.