Today, we’re doing a quick option greeks tutorial – option gamma explained. It’s in an often overlooked greek, so here are the key things you need to know.

Delta is probably the most common Greek that option traders focus on, and with good reason. It’s certainly an important parameter to monitor closely.

There is another Greek that is quite commonly overlooked, but it can also be very important, and that is Gamma.

Option Gamma is referred to as a second order Greek, because it is a derivative of a derivative.

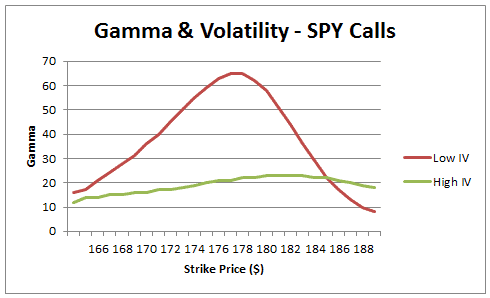

Specifically, it is the rate of change of an option’s delta relative to a change in the underlying security.

So a high Gamma value on a position means the Delta will fluctuate a lot, whereas a low Gamma value will mean the Delta will not change much as the underlying stock moves.

Gamma can be a bit confusing for beginners, so let’s just focus on the most important concepts.

I also put together this detailed guide which you might want to check out – Gamma Risk Explained.

KEY FACTS ABOUT GAMMA

1. When you buy options, whether you buy a single call or put, or you buy spreads, you will have positive Gamma.

a. This means your deltas always change in your favor. You get longer deltas as the market rises; and you get short deltas as the market falls. You’re essentially trading with the trend and will make money at an increasing rate as the stock rises and loses money at a decreasing rate as the stock falls. Positive option Gamma is can be a good thing and is generally considered less risky than being short Gamma.

2. When you sell options you get negative option Gamma. That means your exposure gets bigger and bigger as a position moves against you. This is why it’s important for strategies like Iron Condors, to not let positions get out of control.

3. Gamma is highest for shorter dated options. This is why P&L and delta levels will fluctuate wildly in the last week of an options life. This last week is often referred to as “Gamma Week” for this reason.

Gamma is an often overlooked Greek, but it shouldn’t be and it shouldn’t be too confusing if you keep these three main facts in mind.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.