Homebuilder stocks are being downgraded in what is a warning sign for the real estate sector.

We’re getting some mixed economic messages, but the general consensus is for a slowing economy over the next 6-12 months. The fact that durable good orders recently fell off a cliff is also not a great sign for housing.

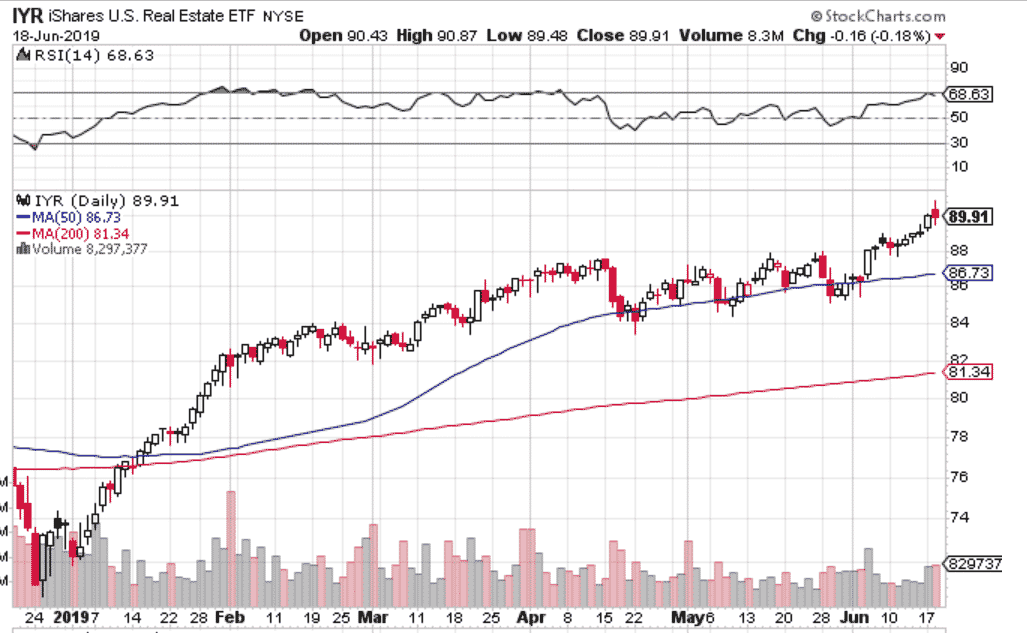

While all this is happening shares of iShares US Real Estate ETF (IYR) have been steadily climbing. So much so, that the ETF is up 21% for the year. That’s a stellar return and we’re only halfway through the year.

My guess is that IYR needs to consolidate here and upside is likely to be limited over the next few months.

The ETF is also the furthest is has been from the 200-day moving average in about a year. To me that says, it’s a little too extended here.

Traders, who believe IYR may stall here can achieve high returns via a bear call spread.

One trading opportunity for those traders with a bearish bias is a bear call spread using the $95 strike as the short call and the $100 strike as the long call.

As of June 18th, this trade offered a 21.36% return on risk over the next 6 months when using the December 20th expiry.

The maximum profit on the trade would be $88 per contract with a maximum risk of $412. The spread would achieve the maximum 21.36% profit if IYR closes below $95 on December 20th in which case the entire spread would expire worthless allowing the premium seller to keep the $88 option premium.

The maximum loss would occur if IYR closes above $100 on December 20th which would see the premium seller lose $412 on the trade.

The breakeven point for the bear call spread is $95.88 which is calculated as $95 plus the $0.88 option premium per contract. Keep in mind that due to the bid-ask spread, you may not be able to get filled at these prices.

For a trade like this, I would set a stop loss of 20% of capital at risk, so around $82.

Trade safe!