Option screening tools are becoming more common and one such tool that we’ll be reviewing today is Born To Sell.

Let’s get started.

Introduction

Whether you’re new to trading or looking to expand your horizons, it can be daunting to learn new strategies.

Even after learning them, you may hesitate at the execution.

That’s where it can be helpful to have software tools.

They can aid in the setup and execution of new strategies and simplify the process of finding the trades you’re interested in.

Contents

- Introduction

- Born To Sell

- Why Covered Calls

- Key Features

- Ease of Use

- Pricing

- Pros & Cons

- Value

- Conclusion

Born To Sell

Born To Sell is a browser-based tool that is specially crafted to focus on covered calls.

For those new to covered calls, it also offers an educational section that covers many different aspects of covered calls, what they are, why you might want to trade them, etc..

Born To Sell offers tools for more advanced traders as well, allowing them to search for specific criteria that meet their trading goals.

Why Covered Calls

Covered calls are a conservative trading strategy that allows you to generate income on stocks you already own (or may want to own).

For every 100 shares of a stock you own, you can sell a call option against those shares.

If the price of the stock goes above the call option’s strike price at expiration, your shares will be called away at the call option strike price.

If the price of the stock is at or below the strike price of the call option, then you get to keep your shares and the call option expires worthless.

Some may look at that as limiting your upside potential, and they wouldn’t be entirely wrong.

However, there are some additional benefits to covered calls that may be harder to see.

First, selling a call option against your shares lowers your overall cost basis for the stock.

Second, it helps generate income you can use now without having to sell your stock shares to do so.

(You may end up selling them later, but that’s the next benefit.)

Third, it “forces” you to take profits on your stock – and pays you to do so.

You can structure the covered call in a way that the stock price has to go up by 5% or more before it will be above the strike price.

Downside Protection

Finally, it can even offer downside protection you may otherwise not have.

Let’s say you have 100 shares of XYZ and you bought them for $100 each.

You can sell the $105 call that expires the third week of next month, and let’s say you can do that for $2/share.

At expiration, XYZ is trading at $105.01, so you have to sell your shares at $105.

You made $5 per share just on the stock, but also an additional $2 per share for the call you sold.

Yes, you “lost out” on the $0.01 per share if you could have held on to the shares, but you made $7 per share (7% ROI) in a little under a month’s time.

You could buy the shares back (at the higher price) and play the game again with a call option at, say, $112.50 . 7% a month for 12 months is 84% a year.

But let’s say that the price of XYZ stays at or below $100 all year.

Just holding the stock, you would have (at best) a 0% ROI. Not if you sold covered calls, though.

You’d be earning 2% a month, or 24% annualized – on a stock that’s literally doing nothing.

(That assumes you’d be able to sell the covered call each month for $2/share.

Prices can and do fluctuate, so some months may be more or less than others.)

Or worst case, the stock price falls.

By selling the first month’s call for $2, you’ve lowered your cost basis to $98.

That means you’ve got protection to the downside of 2% for that month.

Versus just holding the stock and you have no protection.

Key Features

Born To Sell offers tools to help new and experienced traders find covered calls that meet their criteria.

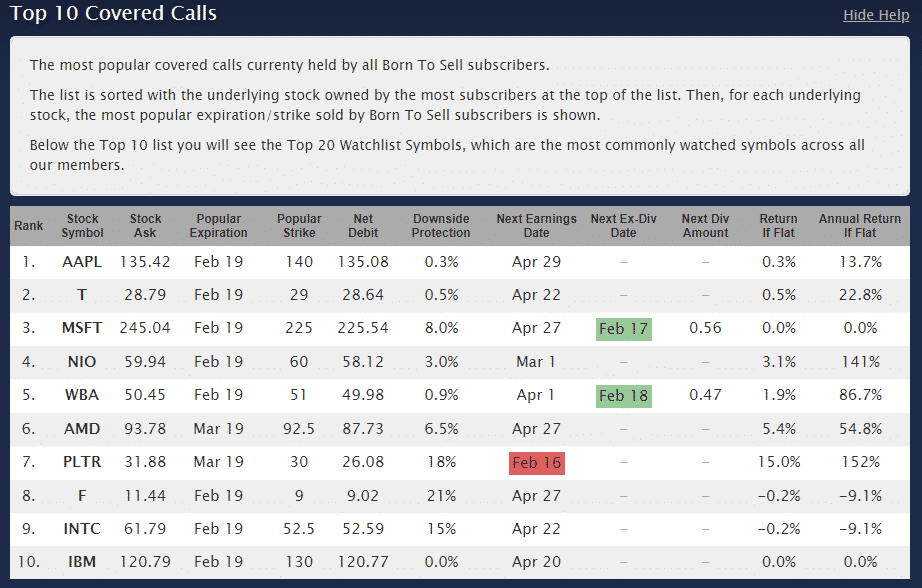

There’s a Top 10 list, for those unsure where to start, or for those interested in seeing what some of the more popular covered calls are.

There’s a search option that looks to find all options available based on whatever criteria is entered.

By default, it’s looking at the nearest expirations, at or near the actual stock price, for stocks above $10/share.

These options can be modified to further limit the results.

There are specialized search modes for more advanced traders that look to capture dividends without earnings risk, deep in the money calls (which offer different benefits with different risks), and other advanced searching.

Columns can be sorted however you want, and prices are updated during market hours.

There’s also an Income Goal finder.

You enter your capital, monthly goal, whether you use margin, and the number of positions you want to manage and it will generate a list of possible matches meeting that criteria (obviously, there are no guarantees; individual stock performance and overall market direction can and will impact results).

There’s also a Chain view that allows you to focus on a particular stock and highlights ex-dividend or earnings dates prior to expiration; this can help you choose options to gravitate towards or avoid, based on your preferences.

All of these options offer additional data such as downside protection, percentage return (if flat), and annualized return.

For those traders/investors who already have 100 or more shares of stock in a single company, there’s also a Portfolio Manager.

Portfolio Manager Tool

You can enter the stocks where you own 100 or more shares, and it will offer possible options for covered calls against those.

If/when you sell a call against shares you own, you can also enter that and it will track how much time value is left, any upside potential and intrinsic value.

There’s a nice Dashboard section that lets you see the details of your entered positions more graphically as well as in table format.

And never be surprised by any earnings or ex-dividend dates for the stocks you own by using the Calendar (on the Portfolio Summary page).

Also among the Portfolio Manager are sections called Cover Me, Roll Me, and Diversify Me. These are fairly straightforward:

Cover Me looks at potential what if scenarios for stocks you own but have not yet sold calls against;

Roll Me looks at existing positions where you’ve sold calls and offers options for rolling out to a new expiration and/or strike; and Diversify Me shows how the stocks you own by industry sector, showing you where you may be over/under-weighted as compared to the S&P 500.

You can use that to search for stocks in a particular industry sector if you wanted to match the overall market – or if you wanted to focus on a particular industry sector.

Rounding out the Portfolio Manager is the History section.

Once you’ve sold your stock (or had it called away), this will give you details about any income you generated off that stock as well as P/L per share and total.

If you have your eyes set on a stock (or multiple stocks), there’s a Watchlist feature that allows you to enter symbols you want to get email updates on for potential Buy-Writes (buying the stock and simultaneously selling a covered call).

Ease of Use

Born To Sell is relatively simplistic in terms of looks. However, there is a lot of heavy-lifting going on with each of those features which can save amplitudes of time.

While there are a lot of features and details on existing and potential positions, it can be a little tricky finding exactly where that one piece of data you’re looking for is located.

Some of that will likely get easier the longer you use the tool, but it can be a little overwhelming for those new to trading.

Pricing

Born To Sell offers 3 pricing options:

- $60/month

- $150/quarter ($50/month average)

- $500/year (~42/month average)

They also offer a free 2 week trial for any option you choose.

It is fully functional, no limits, within the 2 weeks.

Cancel before the 2 weeks are up and there is no charge.

You can change options or cancel at any time.

Pros & Cons

Pros:

- Tons of features to find/manage covered call positions

- Easy interface to filter results

- Can enter their own stock portfolio for potential covered calls as well as tracking positions

- Saves a bunch of time trying to find covered calls and calculate potential returns

- An extensive learning library, including videos and links to additional material (free without subscription)

Cons:

- Lots of tables/numbers and very little graphics

- Watchlist findings are only emailed at end of day; not available within tool

- Can be hard to find specific data without going from feature to feature (each feature shows a different subset of data)

Value

A tool is only valuable insofar as it can save (or make) you more than it costs.

Born To Sell absolutely saves time trying to find potential covered call positions and calculating the potential returns, etc..

In and of itself, however, this may not justify the $42-$60 per month.

While it is possible to find covered calls that will generate more than the cost based on even a $5,000 account, doing so would put too much risk in a single position.

Of course, you have to determine your own risk tolerance to determine if it is right for you or not.

Conclusion

Covered calls are one of the more conservative trading strategies, however, they are a strategy that is more capital intensive than others.

For that reason, if you have a small account (<$25K), you may not be able to use Born To Sell to its full potential – or rather, you may find that your options for diversification are limited, which may impact your ability to make more than the cost of the tool.

Expert traders who are more aggressive may be fine with the cost of the tool, but for new and/or casual traders/investors, it would be better to use Born To Sell only if your account was 6 figures or more.

That would allow you to diversify your trades so not everything was dependent on any single stock or two.

Every trader/investor needs to determine if a particular strategy or tool is right for them.

For those with capital looking for a more conservative way to generate income on stocks they already own, or may like to own, the Born To Sell offers a nice collection of tools specifically geared towards covered calls.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.