Contents

- What Is A Short Put Option?

- When To Trade A Short Put Option

- Which Stocks To Trade

- Which Expiration To Choose

- Taking Things To The Next Level

- Conclusion

A short put option is a popular strategy with option income traders which allows them to potentially purchase shares of a company at a discount.

Short puts are a bullish strategy but less bullish than buying stock outright.

Selling puts allows the trader to collect a premium while waiting to potentially buy the stock at a lower price.

If you are looking to get into trading the short put option strategy, you’ve come to the right place.

This article will walk you through everything you need to know.

What Is A Short Put Option?

A short put option is a strategy that involves the trader selling or “writing” a put option in exchange for receiving the option premium.

For receiving the premium, the put seller has an obligation to purchase the shares at the strike price if called upon to do so.

The maximum profit on the trade is limited to the premium received which is why the strategy is less bullish than outright stock ownership (stock buyers have unlimited upside).

Losses on the downside are limited, but are similar to stock ownership.

If the stock price goes to $0, then the put seller will lose the strike price x 100 less the premium received.

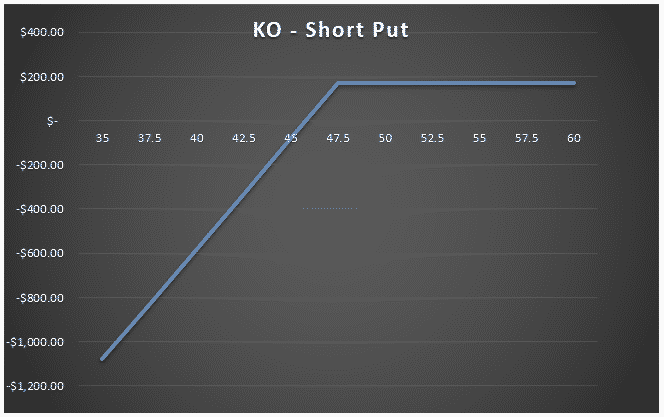

Let’s work through a quick example using Coca Cola (KO) stock:

Trade Date: February 5th, 2021

Underlying Price: 49.75

Trade Details:

Sell 1 KO May 21st 47.50 put @1.70

Net Credit: $170

Capital at Risk: $4,580

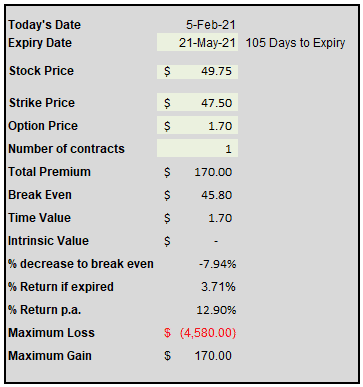

Here we can see that the maximum profit is equal to the premium received of $170.

The breakeven price is equal to the strike price (47.50) less the premium received (1.70) which equals 45.80.

If we multiply the 45.80 by 100 we have the capital at risk ($4,580) which is also the maximum possible loss.

In terms of the return profile, we take the premium ($170) divided by the capital at risk (4,580) which gives us a potential return of 3.71% in just over 3 months.

We can convert that to an annualized return by taking the days in a year (365) divided by the days in the trade (106) and multiply that by the return (3.71%).

This gives us a potential annualized return of 12.90%.

I have a little excel based calculator that I use to quickly and easily do these calculations. You can download it here.

When To Trade A Short Put Option

Being a bullish strategy, this trade should only be placed on stocks the investor is willing to buy.

There are a few other points to consider as well.

Implied volatility is a big factor in the value of options.

Higher implied volatility equals higher option premiums which equals higher returns.

But as we know, higher returns also come with higher risks.

Our example above used KO, which is a low volatility stock.

If we were to look at a similar setup on Nio (NIO), then the annualized return would be more like 61%. But it’s a much riskier stock.

The best time to place short put trades is after the stock has had a big decline.

This means implied volatility will be elevated and stocks are trading at a discount.

Which Stocks To Trade

Occasionally I will do a short put trade on high volatility stocks, but my preference is on stable, blue chip stocks.

Any stock in the Dow Jones Industrial Average is appropriate, but some are much higher value than others.

A short put trade on United Health (UNH) would require around $32,000 of capital if the put was assigned. KO would only requires $4,580.

ETF’s are also great for this strategy because there is no stock specific risk. No quarterly earnings reports to worry about.

Which Expiration To Choose

Every stock has multiple option expiration periods available from weekly options to more long-term LEAP options.

So which expiration should traders look to sell?

Short-term options will generate the highest annualized return but give the smallest margin for error.

Longer-term trades produce a lot of premium (and therefore a bigger decline to the breakeven price), but because the time decay is slower, the annualized return is lower.

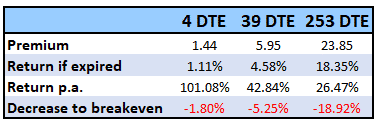

Below is a comparison of a 4 day, 39 day and 253 day short put trade using Apple stock (AAPL).

You can see above that the very short-term puts produce a huge annualized return of 101.08% but only provide a 1.80% decrease to the breakeven price.

The longest term trade still provides a quite healthy annualized return of 26.47% but also provides an 18.92% decline to the breakeven price.

The important thing is to find a style that suits you.

If you’re an active trader then the short-term trades might be your style, but if you prefer a more passive approach, then the longer term style might be more appropriate.

Taking Things To The Next Level

For advanced traders, there is another step that can be taken after being assigned on a short put trade.

Once the put is assigned, the trader then owns 100 shares of the stock.

They can continue to hold that and collect the dividends, but what about using options to generate some more income?

That is certainly possible and a lot of traders will do this by selling covered calls which effectively doubles the amount of premium the trader receives.

They received one lot of premium for selling the initial put, and then a second option premium when selling a covered call.

If the trader has a very bullish outlook, they should sell the call far out-of-the-money.

If they have a more neutral outlook, the call should be sold close to at-the-money.

Conclusion

Short put options are an option strategy that is great for generating income on stocks the trader is willing to own.

It is a neutral to slightly bullish strategy.

The ideal scenario is the stock stays flat or rallies slightly, allowing the trader to keep the option premium without having to purchase the stock.

If the stock declines below the short put strike, the trader may be assigned on the trade and be forced to take ownership of 100 shares of the stock.

After taking ownership of the stock, the trader can then sell covered calls to generate further option premium.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Excellent thank you for the content !

Erick

You’re welcome. Reach out any time with questions.

Can you exit a short put position at any time or do you have to hold until expiry if not assigned?

You can exit it and any time. Just buy to close the same contract that you sold to open.