Ok so, you guys officially suck at reader challenges even when there is a $50 Amazon voucher up for grabs. This is the second time I’ve done one of these and the response has been pretty poor both times so this might be the last one.

I love all my readers, but it seems like the reader challenges are not appreciated. Sad face. 🙁

In any case, congrats to Chandran and Brooks who will split the $50 voucher as the only 2 people who responded.

As part of the challenge I said I would trade a put ratio spread and report the findings here on the blog. It was certainly an interesting month for trading in general and the ratio spread was no different.

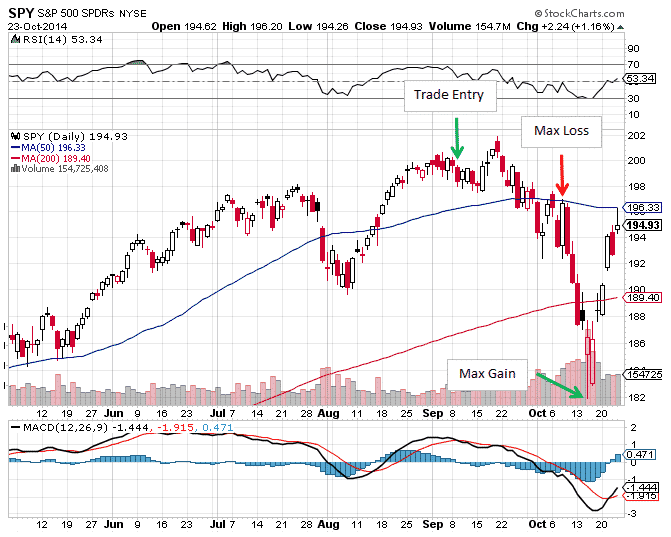

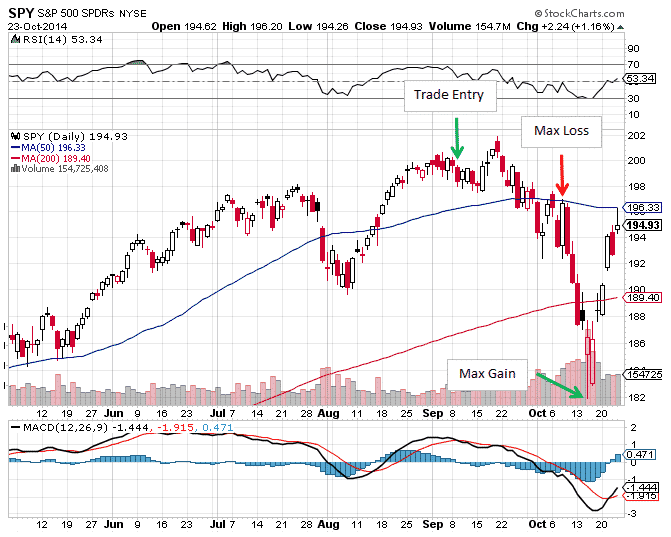

Starting the trade on September 9th, I was of the opinion that SPY would either continue to grind higher, or completely tank. How prescient that proved to be!!

Given my opinion, a Put Ratio spread was the ideal trade.

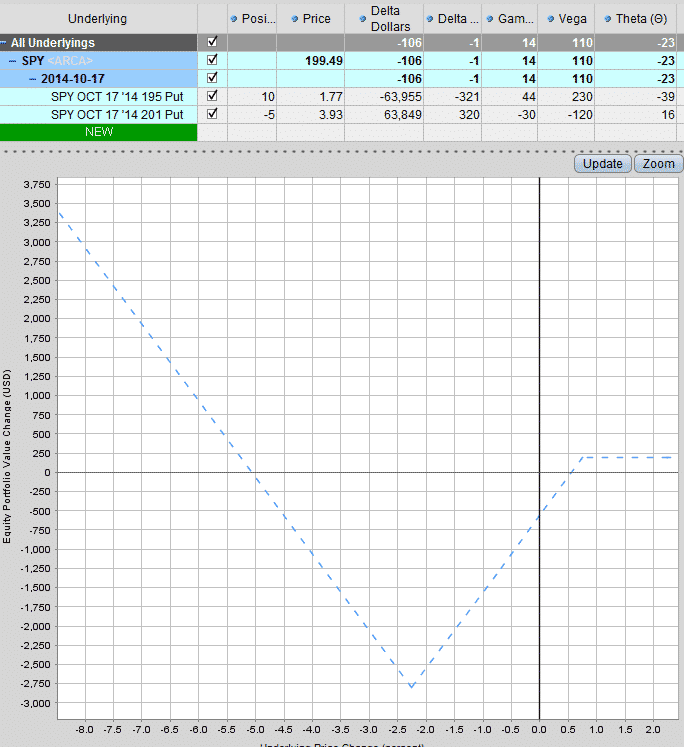

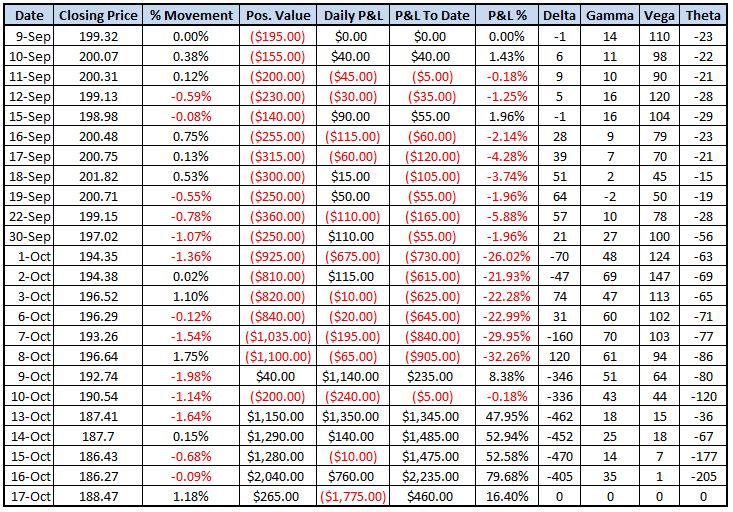

Date: September 9, 2014

Trade Details: SPY Put Ratio Spread

Current Price: $199.49

Buy 10 SPY October 17th 195 puts @ 1.77

Sell 5 SPY October 17th 201 puts @ 3.93

Premium: $195 Net Debit

You can see on the above risk graph that if we drifted higher, there was a $200 income potential in the trade. This represented a 7% return on capital at risk.

You will also notice that the huge risk in the trade lies in the “sea of death” which would affect us if SPY fell around 4.5% or less. If SPY did drop, the losses would be offset somewhat by the rise in volatility given the trade is long Vega. However I would not want to get stuck around $195 as we approached expiry.

The other key fact about this trade is that it is long gamma. This means if SPY drops the trade will pick up negative delta. In other words, it will tend to ride the trend downward if SPY drops.

When I initiated the trade, I set a mental stop loss of 20%. So with capital at risk of $2,750, I would close the trade if it got down $550.

The table below shows the performance of the trade as days past. Unfortunately I was travelling and missed grabbing the data on some days, but most of the key details are there.

For the first 21 days, the trade just drifted sideways as SPY fluctuated in a relatively small range between 197 and 202.

On October 1st, the trade took a turn for the worse and I would have been stopped out as SPY closed right near the center of the sea of death at $195. Unfortunately this meant I would have missed the wild ride and the sizeable gains that followed.

By October 8th with SPY closing at $196.64, the trade would have been down $905 or around 32%.

Over the next few days however, the trade came roaring back as SPY tanked in the wake of the Ebola outbreak.

The point of the highest P&L occurred on October 16th when SPY closed at $186.27. However the maximum P&L would have been during the “crash” on October 15th when SPY hit $181.92 on an intra-day basis.

I didn’t record the P&L at that point, but based on the SPY price, we can assume the trade was in profit to the tune of nearly $3,700 or around 134%.

After following along with this trade I came to the following conclusions:

- Put Ratio spreads are an excellent way to protect your portfolio from a major market meltdown.

- As the market drops, the Put Ratio spread picks up negative delta.

- The rise in negative delta means profits accelerate as the market falls rapidly

- The sea of death is not a good place to be

While one trade and one month is a very small sample size, this was definitely an interesting experiment. I like the portfolio protection provided by the Put Ratio spread and perhaps some relaxing of the stop loss level could be in order.

However, I would not want to get stuck in the sea of death with the position eroding by $120 per day.

Would I feel differently about this trade if SPY had traded sideways from October 8th to October 16th?

What are your thoughts on this SPY Put Ratio spread? Let me know in the comments section below.

Gavin, It’s hard to follow your trade examples because your risk curves only show @ expiration.

Can you add a couple other dates onto your risk graph?

Also, the percentage on the x-axis really makes it harder to see.

Can you put the Price on the x-axis?

sincerely,

iris

I wonder how you determined the stop loss. Also, I understand that you were looking at an increase in volatility. If that is correct, I would have expected a different play such as a short iron condor, for instance.

Ratios are obviously extremely powerful when a major market move takes off. Same reason being short a ratio spread requires so much margin! As the market heads in the right direction and begins to pick up deltas, have you considered buying stock to hedge/lock in profits? Since the markets these days tend to be more like a pinball arcade than anything else, I’ve seen most large moves (short of a real crash, which is a fool’s game to actually just sit around bleeding out waiting for the “big one” IMHO) tend to retrace fairly rapidly… Thus dynamic hedging may help lock in the profits on the big moves.

I don’t know a whole lot about ratios per se, but it seems like dynamic hedging could help offset the theta bleed as the market moves around.

Hi Iris, I will try to remember that for next time.

Hi Martin, interesting ideas although I don’t trade many short iron condors. Remember also that I was looking for either a slow grind higher OR a big crash. Short iron condor would not have done well with a slow grind higher.

Hi Nate,

Good comment. Had not considered that but now that you mention it, it makes a lot of sense.

Very interesting. The main problem here as you mention is that sea of death. It can really hurt you. To me buying a long put way OTM can be a bit more conservative or maybe buy a debit spread. I want to make sure that I know how much I am risking. It will not make money if the market continues to go up like in this case of the put ratio but I chose exactly in the first day how much my insurance can cost me. Cheers.

Gavin, wasn’t your trade, technically, a PUT BACKSPREAD. the PUT RATIO spread is a very dangerous play as it has UNLIMITED risk as the underlying goes down while the Backspread has limited upside risk (or even a credit in your case) and UNLIMITED profit potential as the market tanks.

I know there’s a lot of confusion here as I’ve read many writers referring to BOTH of the positions, COLLECTIVELY, as Ratios or Ratio Spreads, which is true, again technically, but when referring to one OR the other positions, by type they seem to be specific as to WHICH type (put or call) position we are referring to, which in the instant case is a PUT BACKSPREAD. (Buy 10 P @ 195 and Sell 5 P @ 201.)

BTW: To make things even more confusing, to me at least, I’ve read where some writers would call your position a PUT RATIO BACKSPREAD, as well.

Leonard

Gavin,

I hate the term gamma scalping, etc as it is such a marketing term and marketed to people who have no business using it and/or they are taught to do it improperly. Transaction costs can be prohibitive if not done properly, and it is a heuristic process…not necessarily formulaic as it tends to be marketed as (in my opinion).

However, trading gamma properly and managing deltas by using stocks when big moves takes place can help avoid the frustration of seeing your trade go in the right direction only to return back into the sea of death (love your term there). Hope it helps mate

As far as participating in the challenge itself, I do not have any of the listed positions on. I do tend to look for flies (I like the bearish fly strategy, as well as using flies along with aggressive delta management fwiw).

Right now I am actually working on a coal position I took. I am long a coal stock from appx $4 that is now trading below $2. It crashed hard as part of this whole crude/ptero “oversupply” issue everyone is talking about.

I have averaged in with some extra shares, and by selling puts and calls around the position I have been able to lower my cost basis down to below $3 and have almost tripled my position. That means my risk reward is through the roof. Even if the stock gets back to $5 I will be killing it. Much less if it takes off back to $10 or even the $30 it was trading at a couple years ago.

I am NOT trading for that kind of homerun!! (I am merely mentioning that to highlight risk reward possibilities)

Even if the stock continues to hover below my average price or even continues down, I am continuously lowering my cost basis, creating virtual dividends etc. to where eventually I will own the stock at (maybe) zero lol.

This is a long term position and I am getting to actively manage it, so it satisfies my desire to trade while forcing me to be a good investor. Hope this makes sense.

Hi Gavin,

It seems to me that the sea of death is pretty wide and deep…I don’t know if I could hold-on through a fear of the market going sideways. To me, a (high magnitude) market drop scenerio would have to be pretty convincing.

That said, you’ve proved it would have worked this time.

I think minimizing that sea of death size would be the more important variable over maximizimg premium received when opening the position.

Yes interesting point. Maybe you would accept a small loss on the upside in return for a smaller sea of death. Good comment.