We’ve seen Quantitative Easing occurring all around the world ever since the 2008 Financial Crisis. The US, UK, Eurozone, and Japan are just some of the countries that have implemented the unconventional monetary policy as a way of helping their economies recover from the great recession.

But what exactly is Quantitative Easing?

In short, it involves printing money, which is thought to encourage business activity. But in today’s digital world, it’s not physically money being printed, it all happens electronically.

The central bank will use the newly created money that it produces to purchase assets from the market, and while this isn’t different from what the institution typically does, it’s the scale and the type of assets involved that makes Quantitative Easing so unconventional and quite frankly, controversial.

ROLE OF THE CENTRAL BANKS

A countries central bank such as the Federal Reserve in the United States or the Reserve Bank in Australia is intended to be an institutional completely separate from the government that acts as a steward of the country’s currency.

Their other main roles include managing the money supply and keeping inflation in check while helping to maximize economic output.

If a country’s economy is showing signs of slowing, the central bank will step in via expansionary monetary policy (lowering interest rates) in an effort to boost spending and stimulate lending and in turn improve economic growth.

Lowering their policy interest rate will lead to downward pressure on other interest rates within the economy, from interest rates paid on government bonds and corporate debts, to car loans and mortgages that you or I might take out.

Lower borrowing costs encourages spending and therefore stimulates growth.

INTEREST RATES ARE ALREADY LOW

With interest rates already at historic lows, and in some country’s, rates are even negative which is crazy. We’ve never seen anything like this before, so policy makers are running out of ammunition.

And so with little to no leverage left in that department, many central banks have implemented or considered expanding Quantitative Easing programs, first started a decade ago as a way to continue stimulating their economies.

Quantitative Easing or QE as it’s commonly referred, is the process by which the central bank injects money into the economy.

Instead of printing physical bills, the central bank credits themselves electronic funds, and the money enters the economy through open market operations. Using this new money, the central bank purchases assets, typically government bonds from banks and other institutions and thus increases the size of its balance sheet.

WHY DO CENTRAL BANKS ENGAGE IN QUANTITATIVE EASING?

One of the main reasons for QE is to lower the cost of borrowing to stimulate growth. This is done during periods where financial markets are tight or when banks are more reluctant to lend, like after the Financial Crisis, when the credibility of many businesses and organizations became less certain.

When overnight rates are near 0% from the central bank’s point of view, banks already borrow at a cheap cost, but the rates they turn around and charge on other longer-term loans may still be high.

So by increasing money held by the banks, which is sitting around not earning a very high return, the hope is that the banks will be more willing to lend out to businesses and consumers, and since there are more banks with more money to lend, they will ideally compete and lower interest rates, making it easier for market participants to borrow and spend, therefore (hopefully) increasing economic activity.

This is why higher money supply is thought to lead to lower interest rates. Money becomes easier to come across, so it costs less to borrow. QE can also decrease interest rates by lowering the yields on financial assets.

By buying financial assets like Treasury bills, the central bank increases its price by bidding it up, thereby lowering its yield with interest rates remaining constant. Some people surmise that we are currently in a great bond bubble with interest rates falling for around 30 years.

The other advantage of lower interest rates is that the government can reduce its borrowing costs allowing them to finance their deficit more effectively (or are they just kicking the can down the road??).

Lower borrowing costs for governments allow them to stimulate the economy through fiscal policy and infrastructure projects.

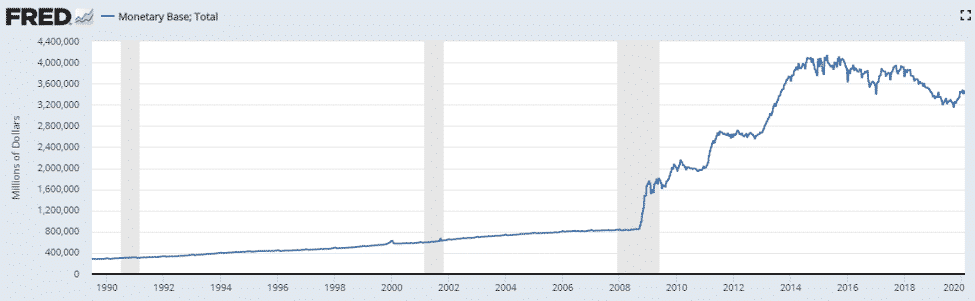

That explains a bit about QE and why central banks engage in this practice. It actually pretty standard stuff. But what has chance since 2009 is the scale of the operations as you may have notice in the above chart.

IT’S ALL ABOUT THE SCALE

What makes QE different is its scale and the fact that it can spend other financial assets outside of government debt.

In the US, for example, the Federal Reserve found itself adding over $3 trillion to the US economy after 2008, and from 2009 to 2010, the central bank bought just over $1 trillion worth of mortgage-backed securities, an investment that became unpopular and risky due to its exposure to the housing market.

This not only helped boost money supply but it unloaded unwanted assets from the banks with the hope that it would improve confidence in the housing market and allow banks to continue providing mortgages to homebuyers.

WHAT COULD GO WRONG?

It sounds like a pretty solid win-win, right? An institution that can print money buys assets investors don’t want to boost the economy. What could go wrong? Well, as with most things in economics, the action is not without its own risks and downsides.

For one, QE can lead to runaway inflation. Inflation is when the value of a currency falls. With more money in circulation, each dollar becomes less valuable, leading to rising prices.

QE will most of the time cause inflation and while most developed countries target a low single digit inflation rate, they may accidentally push inflation much higher, potentially causing a crisis when QE is implemented.

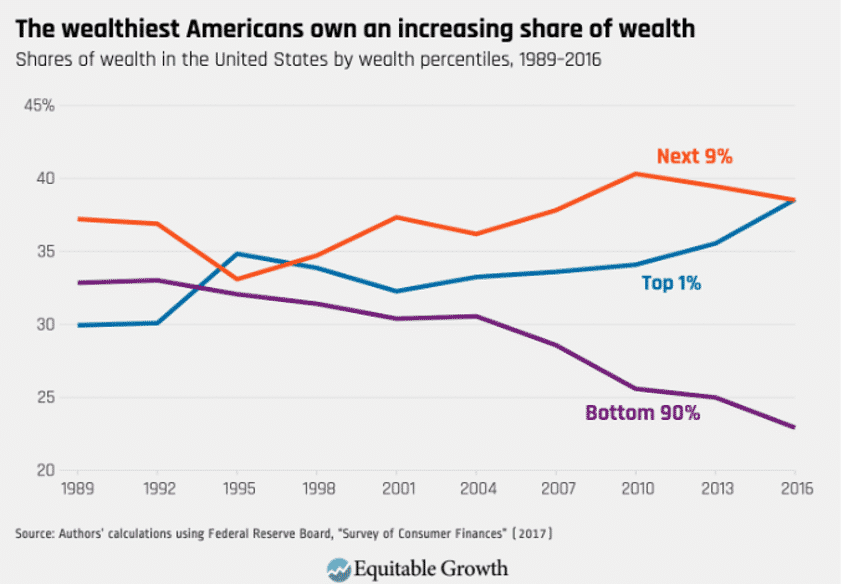

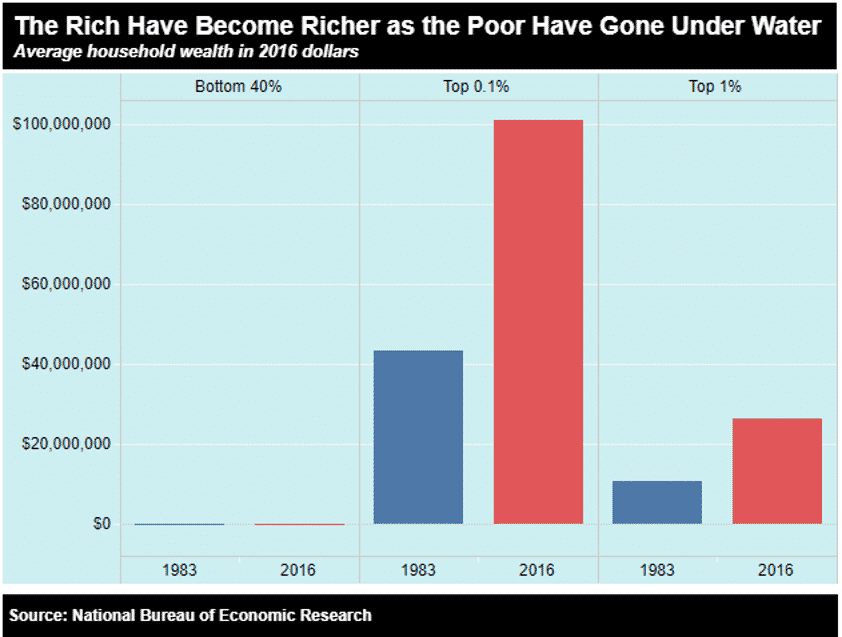

While there hasn’t yet been runaway inflation in US consumer prices, you could argue that we are seeing significant inflation in asset prices.

We currently have a situation where the wealth gap is getting bigger and bigger. The below chart is from 2016 and I would think the gap between the top 1% and the bottom 90% is even larger now. An increase in wealth inequality can potentially lead to social unrest.

Secondly, injecting money into the economy may not necessarily lead to higher business activity. After all, the central bank can’t force banks and businesses to use their newfound liquidity, and if institutions don’t have confidence in the stability of the economy, they may simply hoard their newfound cash.

This is part of the reason why Japan has continued to experience deflation, even after implementing QE programs and boosting money supply. And even US banks were found to have held quite a bit of the money they received from the post 2008 program rather than lending it out.

Finally, QE programs are not intended to be permanent. Once the economy has recovered, gotten back on its feet and inflation starts to rise, the central bank will often reverse its QE program, selling assets back into the market and shrinking its balance sheet.

WHAT’S NEXT?

Deciding when to end QE is just as important as the decision of implementing QE. Have businesses and banks come to rely on QE? How would they handle life after QE?

Quantitative Easing is thought to have helped quite a bit with the post 2008 recovery of countries around the world, a possibly even avoided another Great Depression. But we have yet to see countries fully reverse the programs they put in place.

What do you think comes next? Is QE here to stay? Does it wind down slowly? Or does hyper-inflation rear its ugly head?

Let me know what you think in the comment section below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.