If you’ve ever traded iron condors before, you probably know that the big risk is if the market tanks straight after you put on a trade.

I’ve previously talked about how to protect iron condors from a flash crash, and if you want to trade iron condors for a living, you need to know what happens if you open a trade, then the very next day the market tanks.

Today I’m going to show you exactly what can happen with iron condors in that situation. I’ll walk you through 4 different examples – two monthly condors, a weekly condor and a longer term condor.

Date: March 20th, 2017

Underlying: RUT – trading at 1384

MONTHLY IRON CONDOR: 10 DELTA, 10 POINTS WIDE

Trade Details:

Buy 10 RUT April 21st 1300 Puts @ $4.05

Sell 10 RUT April 21st 1310 Puts @ $4.90

Sell 10 RUT April 21st 1440 Calls @ $3.45

Buy 10 RUT April 21st 1450 Calls @ $2.37

Premium: $1,930

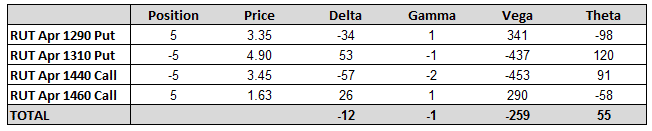

MONTHLY IRON CONDOR: 10 DELTA, 20 POINTS WIDE

Trade Details:

Buy 5 RUT April 21st 1290 Puts @ $3.35

Sell 5 RUT April 21st 1310 Puts @ $4.90

Sell 5 RUT April 21st 1440 Calls @ $3.45

Buy 5 RUT April 21st 1460 Calls @ $1.63

Premium: $1,685

WEEKLY IRON CONDOR: 10 DELTA, 10 POINTS WIDE

Trade Details:

Buy 10 RUT March 31st 1330 Puts @ $1.91

Sell 10 RUT March 31st 1340 Puts @ $2.65

Sell 10 RUT March 31st 1420 Calls @ $1.90

Buy 10 RUT March 31st 1430 Calls @ $1.08

Premium: $1,560

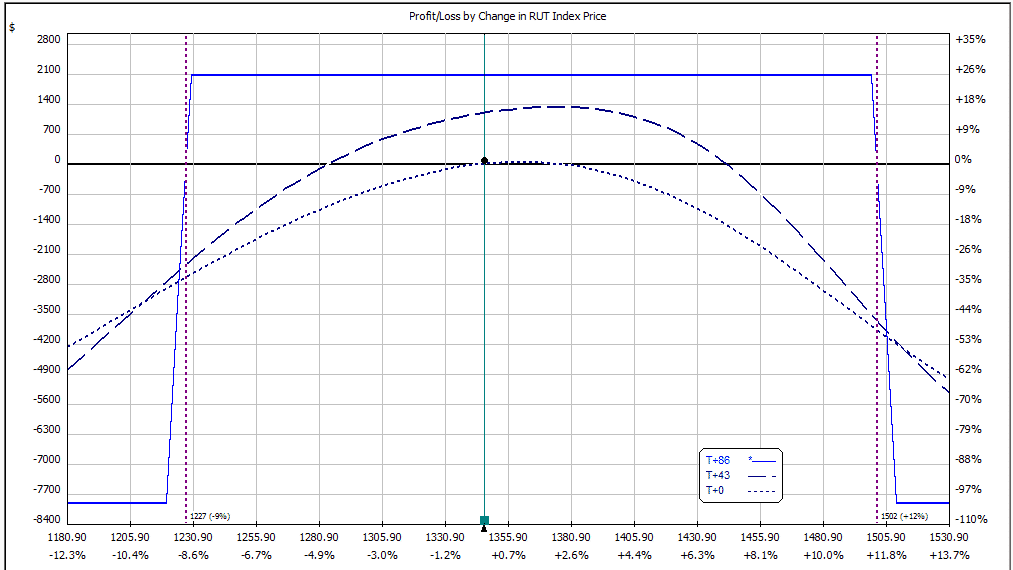

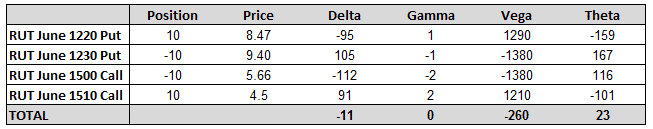

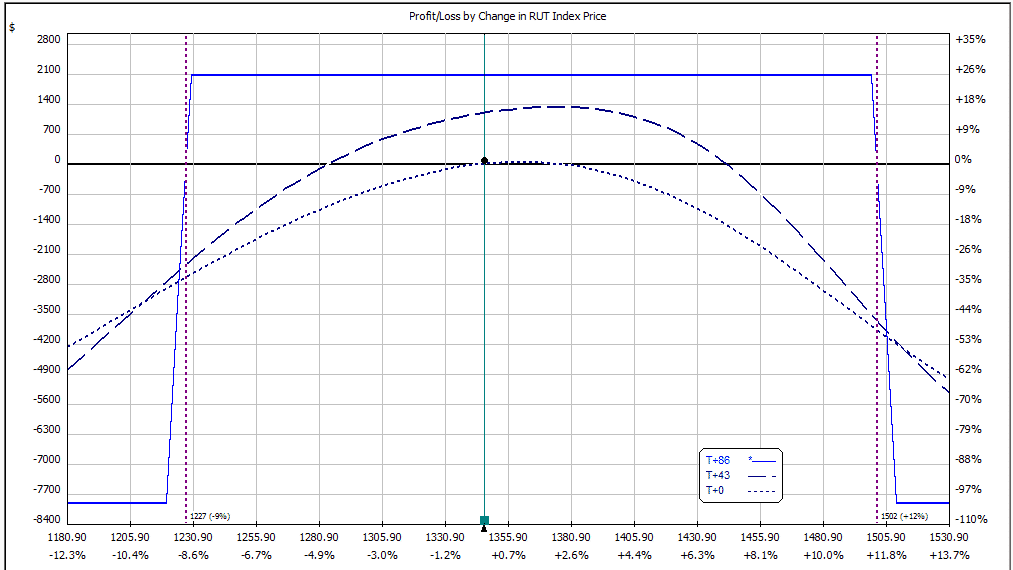

3 MONTH IRON CONDOR: 10 DELTA, 10 POINTS WIDE

Trade Details:

Buy 10 RUT June 16th 1220 Puts @ $8.47

Sell 10 RUT June 16th 1230 Puts @ $9.40

Sell 10 RUT June 16th 1500 Calls @ $5.66

Buy 10 RUT June 16th 1510 Calls @ $4.50

Premium: $2,090

It’s important to note that all these iron condors started out with negative delta and that delta figure was fairly similar across the board. Sometimes I like to start my iron condors with negative delta, just in case we get a big selloff early in the trade.

The negative delta helps to offset the losses from the negative Vega.

Vega is also pretty similar across the four trades.

Notice that the gamma on the weekly iron condor is very high. Weekly condors have very high gamma risk.

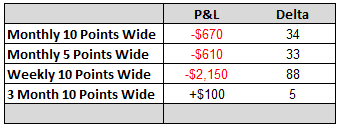

Now let’s fast forward to the next day when RUT dropped 37.50 points or 2.71%.

March 21st, 2017 – RUT Down 2.71%

The very next day RUT closed 2.71% lower, so let’s check in with our four iron condors and see how they did.

You can see that the weekly condor was by far the worst performer being down $2,150. IT also now has a HUGE delta exposure.

The longer term, 3-month condor was actually positive to the tune of $100 following the move. Delta has not had much of a swing either. Here’s how the longer term trade looks after the selloff. This trade doesn’t even need adjusting.

I’ve been saying for a long time that weekly iron condors are very risky and this example shows you why. If you are like me and prefer a lower risk style of trading, try looking at longer term condors instead of weekly or monthly trades.

The added advantage is that because they are slower moving, you have more time to think about how best to adjust if the underlying instrument starts to trend.

Trade safe.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.