Sometimes I see an opportunity for a trade arise that is outside the box of my usual core trading strategy.

Recently there was one such example on TGT.

Date: March 9th, 2017

Current Price: $55.20

Trade Details: TGT Put Ratio Spread

Buy 4 TGT April 21st, $55 Puts @ $1.42

Sell 10 TGT April 21st, $52.50 Puts @$0.58

Premium: $12

Margin: $5,600

Profit Target: 5%

Stop Loss: 5%

Trade Thesis: TGT had experienced a severe gap down followed by further selling. With the stock being crushed recently, I figured it would either consolidate, or drift 2-5% lower over the course of the next month. I wanted to protect the upside just in case the stock experienced a dead cat bounce.

The trade cost me nothing in terms of premium. In fact, I actually received $12 to open the trade. This meant I had no risk on the upside. The worst that could happen on the upside is that both strikes would expire worthless and I would keep the $12 which was enough to cover commissions.

Normally for a Ratio Spread, you would use a ratio of 2:1, however in this case, I had to go slightly above that in order to eliminate the risk on the upside.

The major risk to the trade was to the downside. If TGT continued lower early in the trade, losses would accumulate quickly.

The ideal scenario would be for the trade to slowly drift lower over the next 3-4 weeks.

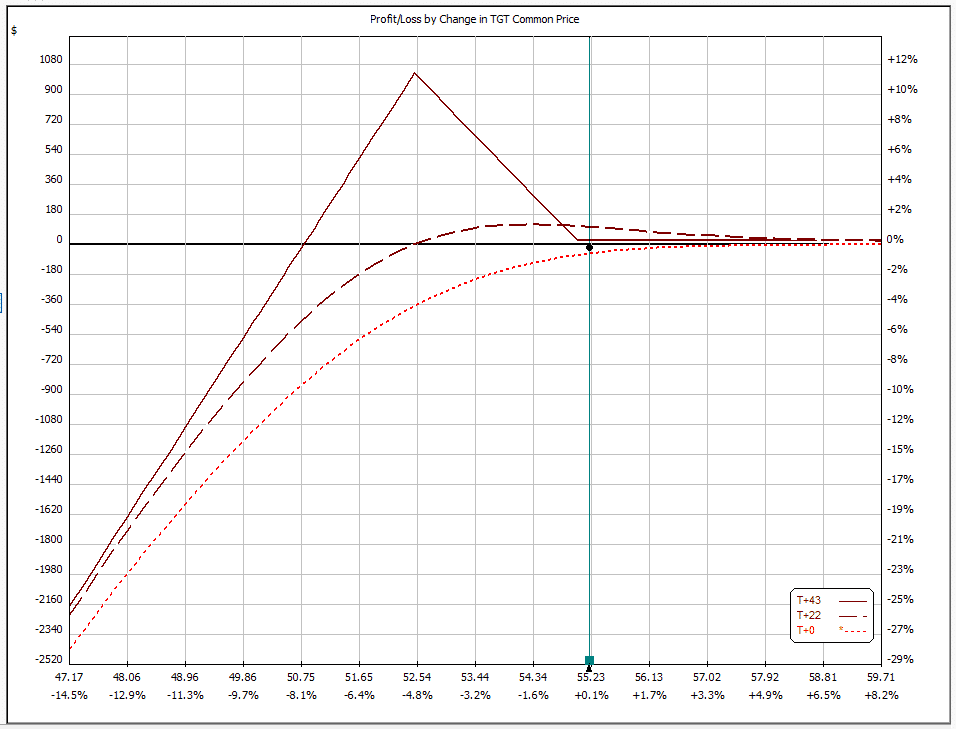

You can see below that a decline early in the trade would hurt, but a 2-3% decline over the next 22 days would actually be good for the trade. Also notice that there is no risk on the upside.

How Did The Trade Work Out?

Over the next 12 days TGT bounced around a bit, including a big up day that was promptly sold a few days later. On April 7th, 30 days after the trade was started, TGT was trading at $53.24 and the trade was +$284 or +5.07%. Time for me to close it out.

I could have potentially stayed in the trade longer, but I was happy with the 5% return on capital at risk.

I hope you enjoyed this trade review. Let me know what you think in the comment section below. Remember that ratio spreads are risky because they involve naked options, so don’t try this at home folks.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Hi Gav,

Were you prepared to buy the stock if the price ran down or would you have closed it for a loss?

Hi Tom, honored to have you commenting here. 🙂

Yes, that was part of the plan, if TGT continued lower, I was happy to take ownership on half of the sold puts. From there I would sell OTM covered calls.

Hi Gavin. You’ve hung around long enough for most of the premium to be lost from the OTM puts. I see the 21 APR, 50 strike puts are now going for about $0.03. Would you consider buying 10 contracts for $30, thereby removing the downside risk, and staying in play until Friday, hoping for another movement lower?

Hi, I actually exited the trade already. I was out on April 7th.

Gavin,

Can you help me understand the mechanics of this trade? It appears that both the buy and sell are worth around $560 so I’m not following what you listed as margin and how you made $$ on 5%.

Hi Ryan,

The trade was put on for more or less neutral. I received a small credit to open the position, but as there were naked options, there was a margin requirement which is set by the broker. That is the amount of capital I needed for the trade. Margin was $5,600 and profit was $285 hence +5.07% return. Hope that helps.

Ready to take the ownership in case the stock further tanked down was hard to digest for me. Nonetheless selling covered calls later once owned, was a good relief to hear.