“Big Boy Iron Condors”, as the people at TastyTrade call them, are iron condors that have wider width between the strikes in both the call spread and the put spread.

They are wide iron condors, if you prefer a more generic term.

Why make the spreads wider?

Are there any benefits?

What are possible disadvantages?

We will get to those questions.

Contents

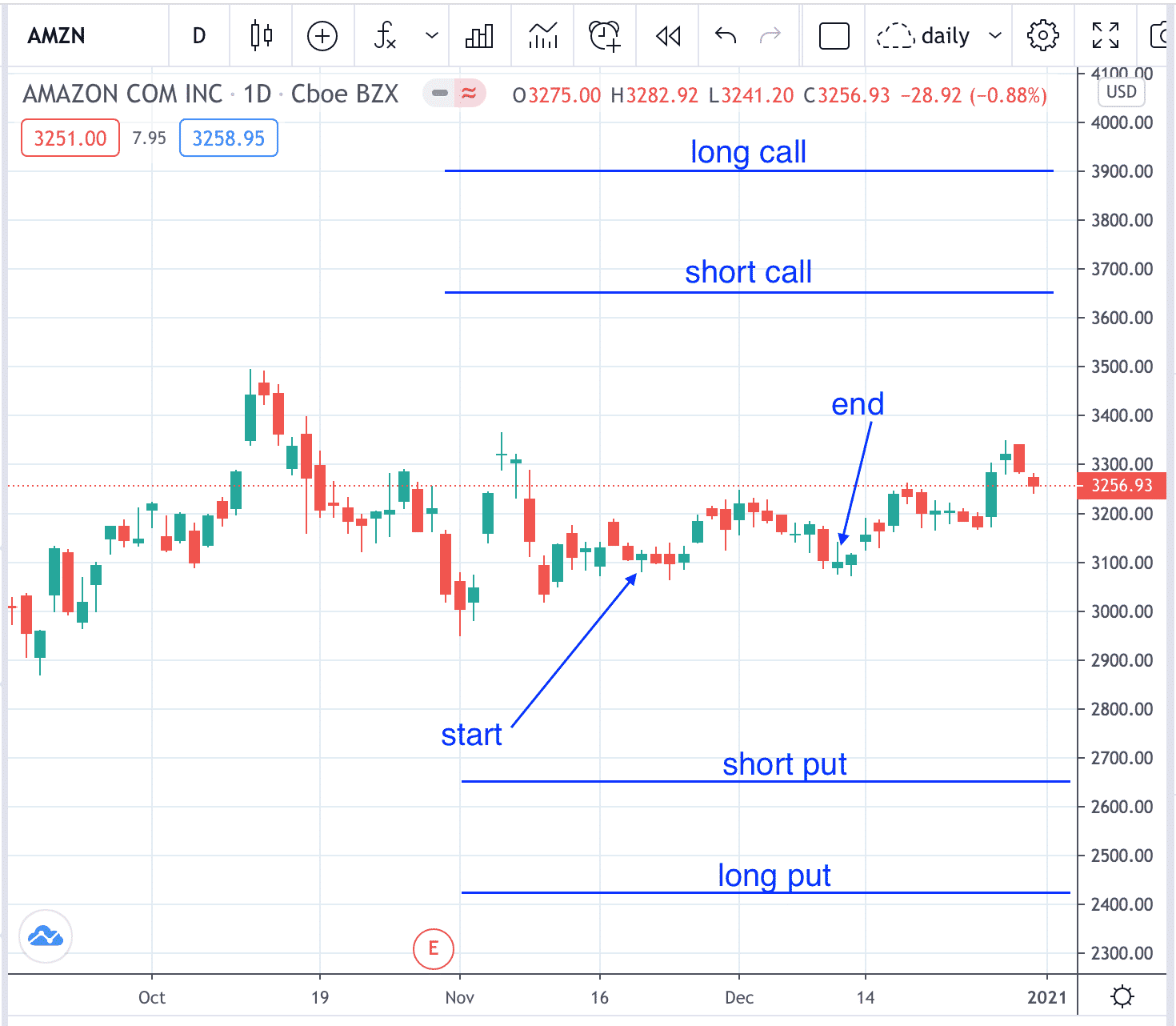

Trade Setup

First, here is a setup for Big Boy Iron Condor.

Date: Nov 19, 2020

Price: AMZN @ $3117.02

Buy one AMZN Jan 15, 2021 – $2420 put @ $8.98 (at delta=-4)

Sell one AMZN Jan 15, 2021 – $2670 put @ $27.55 (at delta=-13)

Sell one AMZN Jan 15, 2021 – $3650 call @ $25.08 (at delta=13)

Buy one AMZN Jan 15, 2021 – $3900 call @ $9.79 (at delta=5)

(57 days till expiration)

Net Credit: $3388

Max Risk: $25,000

(width of spreads = $250)

Risk to Reward ratio: 7.4

Delta: 0.61

Delta Dollars: $1901

Theta: 80

Vega: -270

Theta/Vega ratio: 0.30

Selection criteria for iron condors is to look for highly liquid large-cap stocks.

Don’t do them during earnings, backwardation, or low IV rank.

Following our rules for iron condors, we exit this example trade with a profit target of $1558 if received before Dec 18.

Trade Management

We adjust when either of the short strikes gets to 25-delta.

Our stop loss is two times premium, or $6776.

If neither of these things happen, we close the trade 7 days before expiration.

In this cherry-picked example, things happened to have worked out.

The AMZN trade exited with profits of $1635 on Dec 10 without any adjustments.

The total trade duration is 21 days.

However, if this profit did not come before Dec 18, we might have to hold this trade until Jan 8, 2021 — 7 days prior to expiration with a total trade duration of 50 days.

Not all investors will be comfortable holding a $25,000 risk in their portfolio for almost two months.

The stop loss is at $6776, which means that the investor can see a P&L loss of –$6500 in their brokerage account for one trade.

However, this is normal for a trade of this size.

Risk tolerance is a muscle that needs to be built up over the years.

An investor not used to seeing numbers of this size may break the iron condor rules and exit the trade early and not letting the favorable long term statistics play out.

So that’s why they named it the “Big Boy Iron Condor”.

It is only suitable for larger investors.

Comparison with Regular Iron Condor

The previous example was already at the smallest contract size of one. The risk of iron condors can be reduced by two other ways.

- Move the strikes further out of the money.

- Narrowing the width of the strikes between each spread.

For this comparison, let’s keep the short strike where they are.

We’ll narrow the width to be a more typical iron condor.

Buy one AMZN Jan 15, 2021 – $2620 put @ $21.95 (at delta=-11)

Sell one AMZN Jan 15, 2021 – $2670 put @ $27.55 (at delta=-13)

Sell one AMZN Jan 15, 2021 – $3650 call @ $25.08 (at delta=13)

Buy one AMZN Jan 15, 2021 – $3700 call @ $19.25 (at delta=11)

Net Credit: $1,143

Max Risk: $5,000 (width of spreads = $50)

Risk to Reward ratio: 4.4

Delta: 0.27

Delta Dollars: $842

Theta: 18

Vega: -63

Theta/Vega ratio: 0.29

Profit target: $572 if before Dec 18.

Stop loss: $2286

This trade exited with profits of $600 on Dec 8.

Comparison with Short Strangle

When we widen the width of the wings on an iron condor, we get an Big Boy Iron Condor.

If we widen it even further, it acts and behaves more and more like a short strangle. Until you throw away the wings, then it is a strangle.

A short strangle is like an iron condor without the long options for protection.

It is an undefined risk strategy.

Hence it is not allowed in certain accounts.

When it is allowed, the margin and buying power needed is large.

Therefore, people use the Big Big Iron Condor as an alternative to the strangle.

Let’s see how the strangle behaves at the same short strikes.

Sell one AMZN Jan 15, 2021 – $2670 put @ $27.55 (at delta=-13)

Sell one AMZN Jan 15, 2021 – $3650 call @ $25.08 (at delta=13)

Net Credit: $5263

Max Risk: unlimited

Risk to Reward ratio: unlimited

Delta: -0.29

Delta Dollars: –$904

Theta: 155

Vega: -510

Theta/Vega ratio: 0.30

Profit target: $2632

Stop loss: $10526

This trade exited with profits of $2768 on Dec 15.

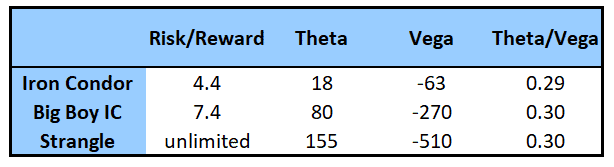

Comparison Summary

In our example, the iron condor, Big Boy, and strangle all achieved the profit target around the same time — just slightly before half the trade duration.

They are all delta-neutral strategies.

So delta will be similar.

The difference is the risk level, and the theta and vega exposure.

At first glance, it would seem that the iron condor looks better because of its better risk-reward ratio.

No doubt that the Big Boy and the strangle are higher risk and can incur bigger losses in an individual trade.

However, we cannot tell from this ratio what is the long-term profitability of a strategy over many occurrences.

There are too many other factors that have to be taken into account, such as the probability of profit, and the size of average wins to size of average loss.

The Big Boy and Strangle pick up profits faster from the higher theta time decay (which is a good thing).

They also have greater exposure to vega risk (which can be a bad thing).

The strangle has such large vega that it is almost a pure volatility play.

It is a bet that volatility will go down.

All three have negative vega, meaning it makes money if volatility goes down.

If volatility spikes up during the trade (such as in a market crash), the strangle will be hurt the most, followed by the Big Boy.

The iron condor will lose the least of the three.

Volatility can be unpredictable and can spike up quickly and go down slowly.

Therefore, iron condor investors want theta to be high and vega to be low — meaning they want theta/vega ratio to be high.

This occurs when:

1) IV is high,

2) when selling further out of the money, and

3) as the iron condor trade gets closer to expiration.

The width of the spreads on the ratio is a smaller effect.

But the Big Boy and the Strangle have slightly better theta/vega ratio because of the larger spread widths.

Whether this is enough to warrant the higher risk is dependent on the investor’s trading style and risk tolerance.

All three strategies are viable.

The strangle is for the more aggressive trader, and the iron condor for the more conservative trader.

And the Big Boy is in between.

As always, if you have any questions, please don’t hesitate to reach out.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Seems Sellers delta sign has to be interchanged.

i.e put writer will have +delta and call writter will have -ve delta.

Yes, I’ve just listed the actual deltas of the option strikes. You would need to multiply them by the position to get the position delta. e.g. -1 put x -13 delta = +13 delta.

Hi Gavin,

Thanks for this great post! What are your thoughts on having automatic stop losses set for iron condors instead of closing the position after a close below your stop? Not having an automatic stop set up freaks me out a little.

Thank you!

Hi Neil,

I’m not a huge fan of automated stop losses for options because if the bid-ask spread is wide, you can end up getting filled at a bad price. For stocks it’s fine and for options with tight spreads like SPY it’s ok, but otherwise I prefer to set price alerts and close manually.