Today we’ll look at a detailed delta hedging example. Delta hedging is an important concept for traders to understand.

I’ve written about delta hedging previously, but today we’ll look at an example.

Let’s look at an iron condor trade and look at a couple of ways we could delta hedge.

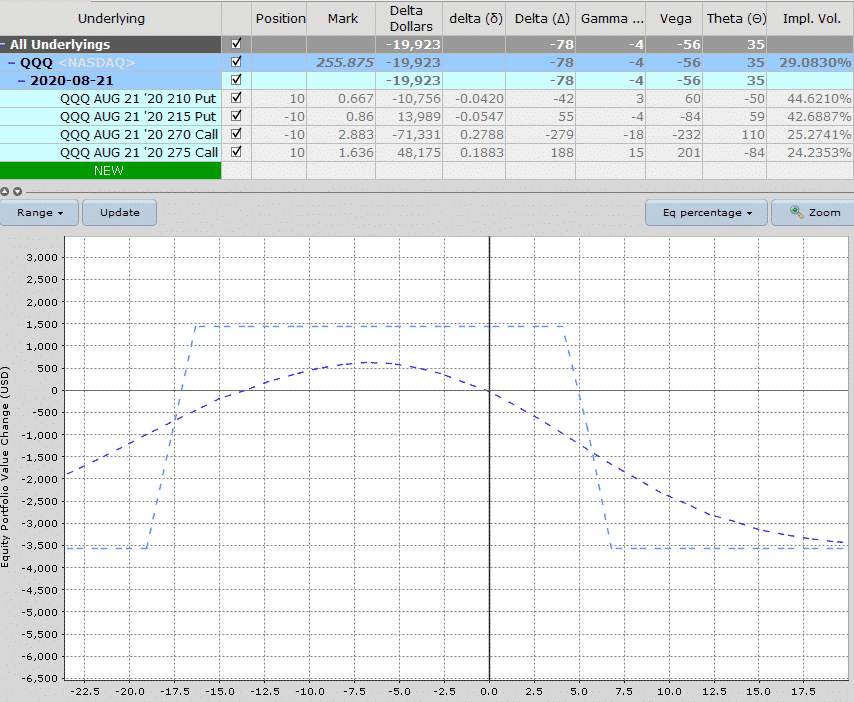

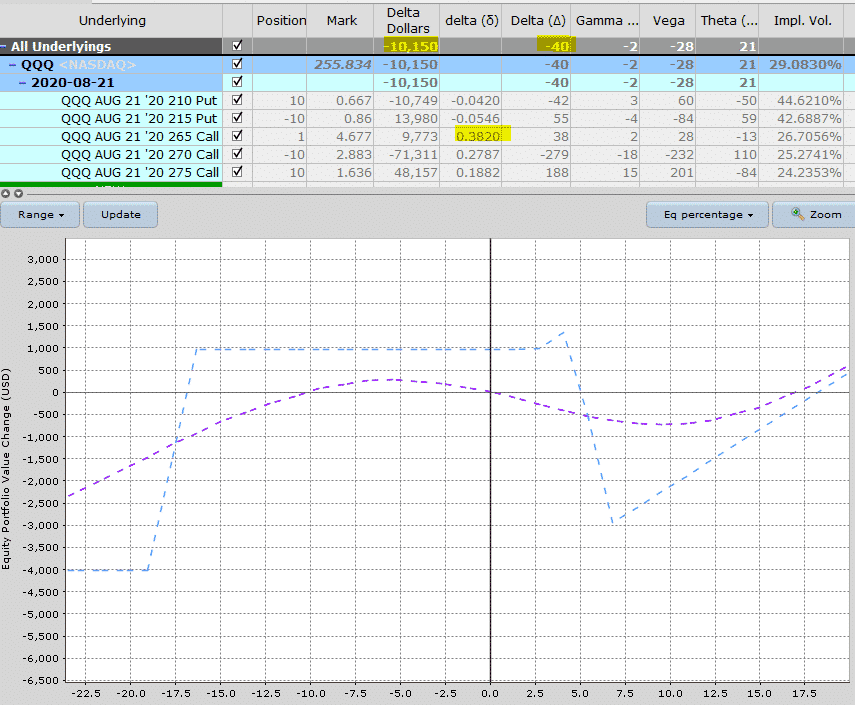

Here we have a QQQ iron condor. After placing the trade, the index has rallied up and is putting the call side under pressure.

We can see in the payoff graph that the position is skewed and we can also see that net delta is -78 and delta dollars is -19,923.

Adjusting the trade might make sense here, but let’s assume the trader is very confident that QQQ won’t break above the short calls at 270.

Instead of adjusting the iron condor, they want to hedge some of the delta or price risk that would come from any further rally in the Nasdaq.

Let’s look at a couple of different ways they could do that.

Buying Shares to Hedge the Delta

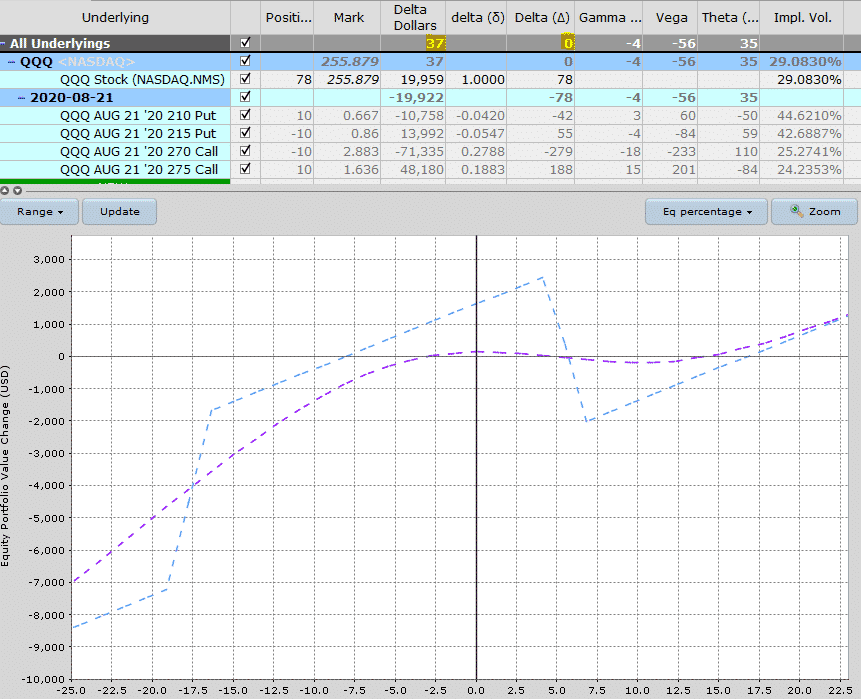

With the net delta of the iron condor at -78, the trader could buy 78 shares of QQQ which would neutralize the delta and eliminate the price risk in the short-term.

Through buying 78 shares, the trader has created a position with 0 net delta and delta dollars of just 37.

Notice also that the T+0 line is much flatter at the current price.

Of course, the position won’t stay delta neutral for long and as the underlying stock starts to move again, the position will start to pick up either positive or negative delta.

The capital at risk on the upside has also been significantly reduced.

The expiration graph also looks a little weird but don’t let that scare you off.

With a hedging strategy like this, if QQQ starts to drop again, the hedge is no longer needed and you can slowly sell the shares back at a small loss, returning the iron condor closer to its original form.

Where Should You Remove the Hedge?

Where the trader decides to remove the delta hedge is a personal preference, but on a trade like this if QQQ dropped 3-4% I would look at removing some or all of the hedge.

In this case, we would lose some money on the hedge, but we don’t mind too much because we’ve been able to keep the iron condor open and hopefully still make a good profit, albeit slightly less than we might have originally hoped for.

There is also nothing stopping the trader from hedging only some of the delta. They don’t necessarily need to hedge all of it.

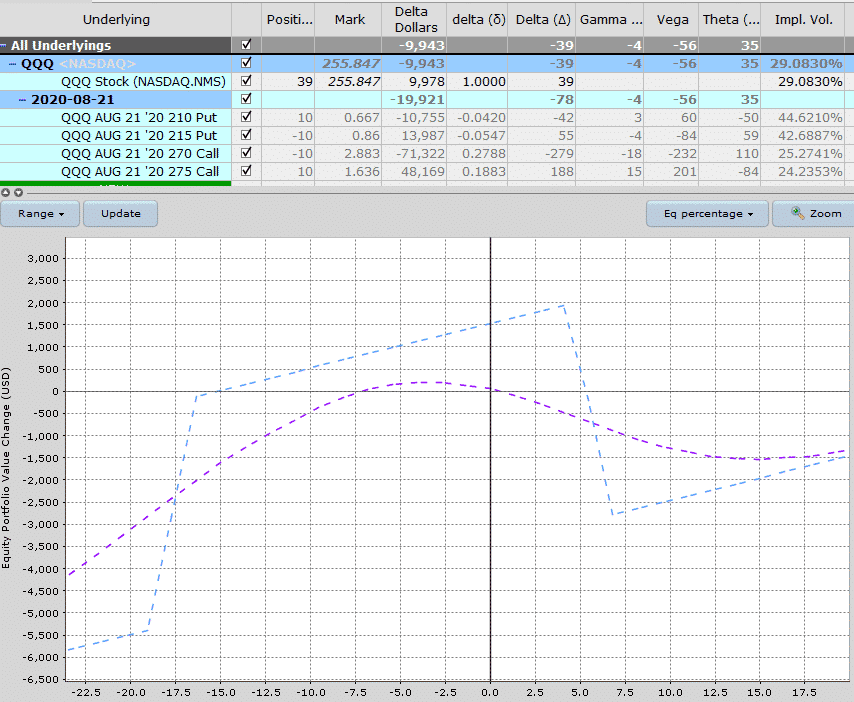

Here is the same trade with a 50% delta hedge rather than 100%.

Through buying 39 shares, the trader has hedged half of his delta risk which is also a valid idea.

The trader could hedge 25% or 75%, any amount really and it’s up to the trader how much protection they want and how much they are willing to pay.

Delta Hedging Example Using Options

Hedging with shares is nice and easy because there are no other greeks to worry about.

39 shares = 39 delta and 78 shares = 78 delta that’s it, and those figures are constant.

There’s no need to worry about vega, gamma, or theta when hedging with shares.

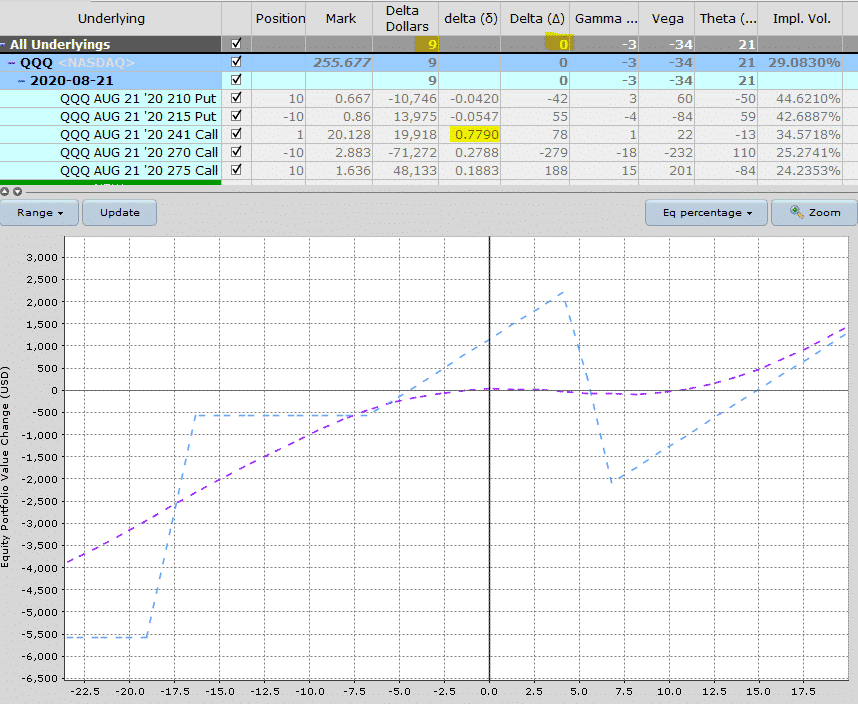

Still, the trader could also choose to delta hedge using call options in much the same manner.

Buying a 78 delta call also neutralizes the delta and flattens out the T+0 line.

In this case, however, there has also been an impact on the other option greeks.

Vega has been reduced from -56 to -34 and theta has also dropped from 35 to 21.

I’m not saying one version is better than the other, but I wanted to highlight the differences.

Just like the previous example, the trader could decide to hedge just half of the delta by purchasing a 39 delta call (there was no 39 delta available, only 38 or 40).

There you have an example of how to delta hedge on the call side.

The same thing can be done on the put side via selling shares or buying puts. Note your broker may have some restrictions around short selling shares.

We’ll look at an example of delta hedging with puts in a future post.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

At Tastyworks they teach always ‘never touch the side of risk but roll the oppsite site if possible with a credit’. The here show method looks far more logical butwhat is the idea behind their method?

Not sure of their logic, maybe they list it somewhere on their site, otherwise you might have to ask them.

Always great info. Thank you!

If the price moves up a little again, assuming you still don’t adjust the spread, would you replace the hedge option (sell and buy another one with a higher delta) or would you add a second hedge option? Does it matter?

Also, considering zero options contract fee for some brokerages now, would frequent delta hedging make sense since transaction costs are no longer a (big) factor? Thanks.

I would move it, or use shares to increase the hedge. Yes delta hedging is easier now transaction costs are lower, but you don’t need to overdo it. Just set your levels at which you will hedge and then also a level to remove the hedge.