The profits and losses for an iron condor are very easy to calculate in excel using the handy iron condor calculator available in this article.

First, let’s start with how to set up an Iron Condor.

Contents

Iron Condors are a neutral options strategy that attempts to generate a return on stocks that the trader thinks will remain flat over the course of the trade.

An iron condor is constructed by selling a bull put spread and a bear call spread.

Before trading iron condors, it’s important to have a solid understanding of how options work, so if you’re a complete beginner, you may want to check out this post first.

Today, I’m going to teach you how to trade an iron condor and then how to calculate the profits.

I’ll also share with you my iron condor calculator, which you can download below if that’s all you are looking for:

How To Set Up An Iron Condor

An iron condor is a four-legged option strategy and is comprised of a bull put spread and a bear call spread.

A trader could enter all four legs individually, but I find that pretty cumbersome and prefer to enter the trade as two spread orders.

Some brokers like Interactive Brokers will allow you trade an iron condor via a single order entry.

Here’s how we might set up an iron condor on AAPL stock.

AAPL REGULAR MONTHLY IRON CONDOR

Date: July 21st, 2020

Current Price: 389.27

Trade Details:

BULL PUT SPREAD

Buy 1 AAPL Aug 21st, 340 put @ $3.23

Sell 1 AAPL Aug 21st, 350 put @ $4.59

BEAR CALL SPREAD

Sell 1 AAPL Aug 21st, 430 call @ $3.37

Buy 1 AAPL Aug 21st, 440 call @ $2.33

Premium: $240 net credit

Max Loss: $760

Return Potential: 31.58%

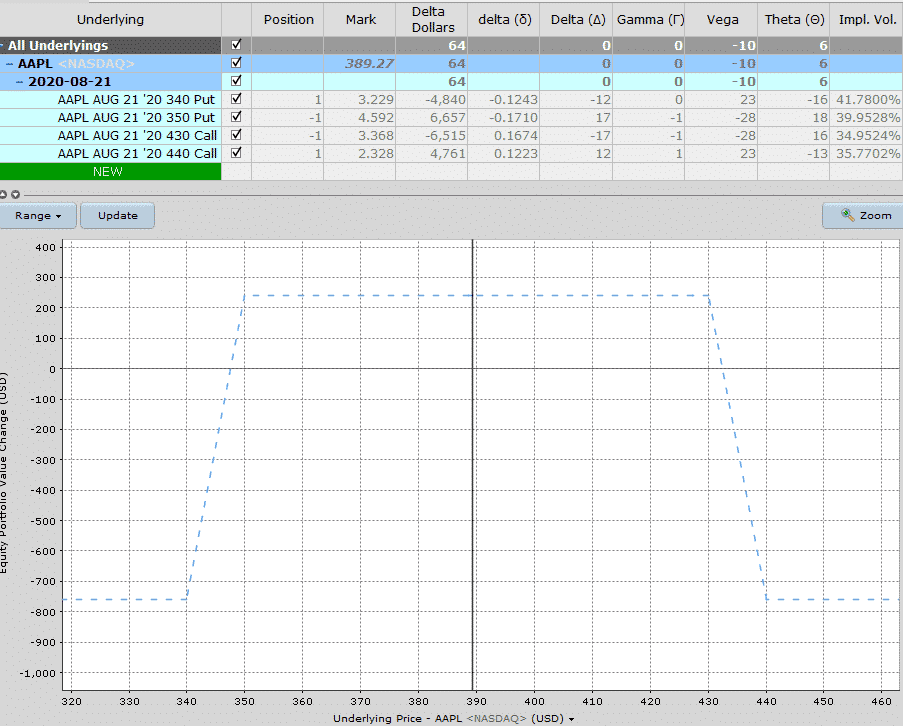

This is what the order entries would look like:

![]()

Once the put side is filled, we want to make sure the call side gets filled quickly.

![]()

And this is how our greeks and profit graph look:

Calculating Iron Condor Profits

Once, we’re in the trade, we need to know what our profit or loss is going to be at various points.

Most brokers will give you this information as you can see above which is from Interactive Brokers Risk Navigator.

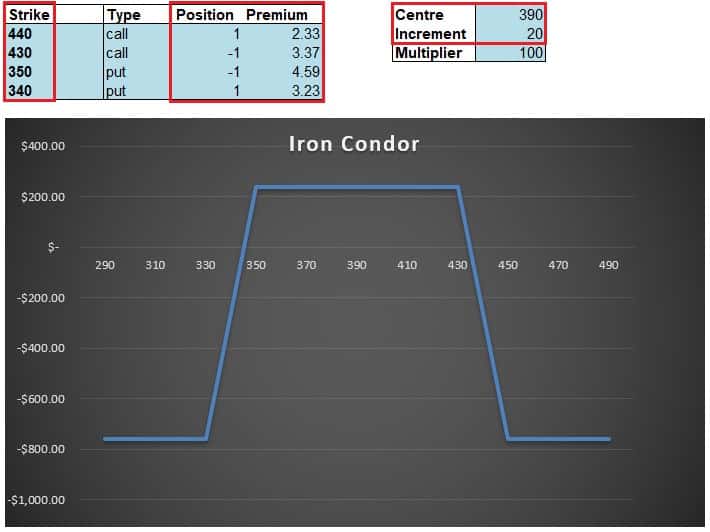

However, if you want to set this up quickly and easily for yourself you can use my handy excel calculator below.

The bonus is you can also use the calculator for most of the major option strategies.

Step one is to download the file using the button below.

Simply navigate to the iron condor tab towards the right of the spreadsheet then enter the strikes, number of contracts (position) and the premium for each option.

Depending on the stock price, you will likely have to adjust the values in Centre and Increment.

Don’t worry about anything else, the calculator will do the rest.

Calculating Interim Profits

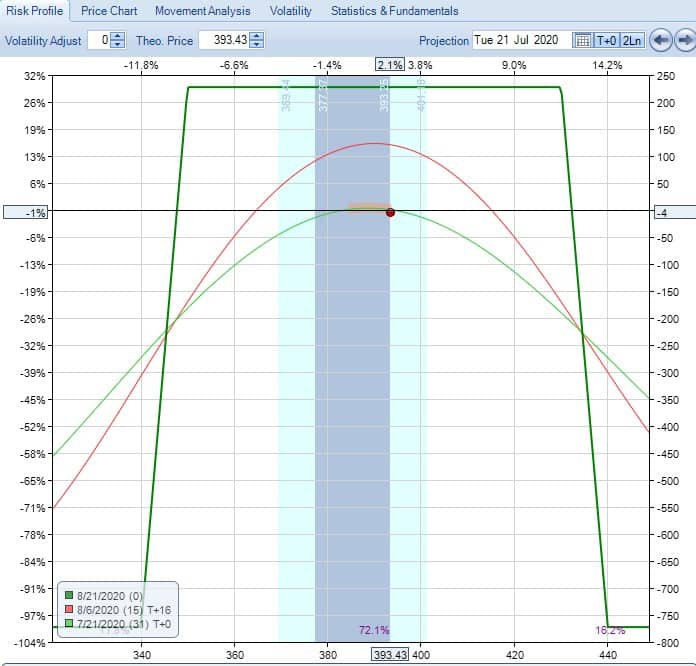

As mentioned, this excel sheet will help you visualize the profit at expiry, but if you want to estimate the interim profits it’s best to use some more advanced software.

The below screenshot is from Option Net Explorer and gives you an estimate of the profit at interim dates which you can specify.

Summary

Iron condors are a staple strategy for many serious option traders. They are a neutral trade that benefits declining implied volatility and stable stock prices.

The profits and losses for an iron condor are very easy to calculate in excel using the handy tool available in this article.

Profits and losses at expiration can be easily calculate using the handy excel tool available for download above.

Calculating the interim profits is more complicated and requires advanced software such as Option Net Explorer.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.