Today we are doing a Trade Ideas review. We will look at the suite of products and services provided and determine if it is worth the cost.

Let’s get started.

Contents

About Trade Ideas

Trade-Ideas has been providing top-notch intelligence to active investors since 2003.

The award-winning platform is popular with hedge funds, day traders, and educators such as TradeCrushers, Bulls on Wall St, and TodayTrader.

It’s built for traders by traders — almost everyone on the Trade-Ideas team has experience trading and comes from a financial background.

This becomes very evident as one grows more comfortable with the software.

It offers exactly what you need to make smart trading decisions and none of what you don’t.

Pricing

Trade-Ideas has a very transparent and easy to understand pricing structure.

There are only two options–Standard and Premium.

Both of these options are available monthly and yearly.

The Standard plan offers the following features:

- Streaming Trade-Ideas

- Simulated Trading

- 10 Simultaneous Charts

- Chart Based Visual Trade Assistant

- Up to 500 Price Alerts

- Curated Workspaces

- Manage portfolio in Brokerage Plus

- One click trading w/ Participating Brokers

- Includes Trade Strategy (stop, target, etc)

- Includes Positions Tab

- Live Trading Room—Hosted by Barrie Einarson.

The Premium plan offers all of the Standard features plus:

- Simulated Trading

- 20 Simultaneous Charts

- A.I. Virtual Trading Analyst

- Entry and Exit Signals

- Risk Assessment

- Chart Based A.I.

- Trade Assistance

- Build and Backtest any Trade Idea

- Autotrade on Interactive Brokers w/ Brokerage plus

The Standard plan costs $2.90/day if you pay yearly or $3.90/day if you pay monthly.

The Premium plan costs $6.20/day if you pay yearly or $7.50/day if you pay monthly.

Trade Ideas Review

Trading Room

One of the highlights of Trade-Ideas is being able to participate in their live trading room and watch the magic of Barrie.

It’s a great opportunity to learn the platform, connect with other traders, and get pro-tips from an expert user.

While he’s not able to make specific trade recommendations or suggestions, he can provide commentary and thoughts on what he might do if he was trading the account.

The room is live-streamed on YouTube, but members will enjoy access to the private room where you will be able to interact with Barrie and other traders like yourself.

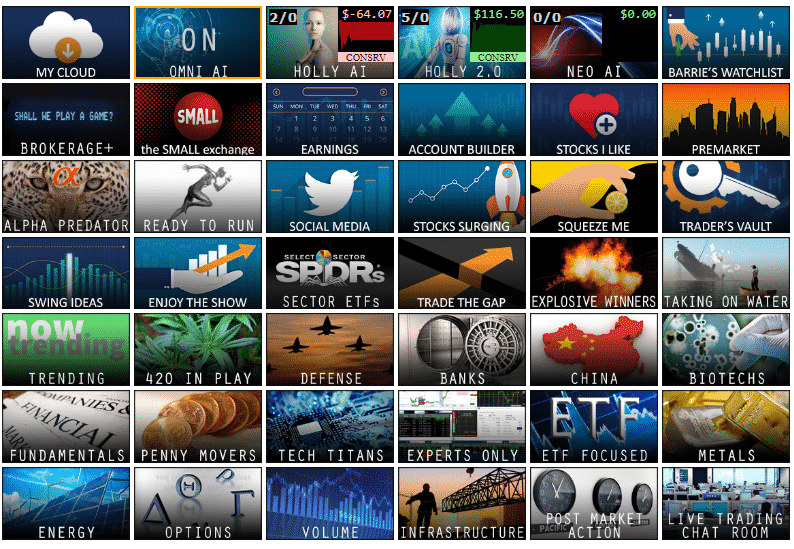

Channel Bar

The Channel Bar is where you’ll find all of the curated workspaces that Trade-Ideas has built for you.

There are many options and I’ll highlight a few here and go into more detail on the Options channel in the next section.

One of the highlights of the channel bar and a great way to get the day started is the Pre-Market Mover channel.

Pre-market trading on the NYSE begins at 6:30 EST so you will have 3 hours before the opening bell to start planning moves and getting a feel for what the trading day will be like.

This channel will identify stocks that are moving with very high volume in the pre-market session.

Trading volume in the pre-market session is typically very low so you’ll very often run into the problem of a wide spread on the bid-ask.

With this scanner, you’ll be able to identify stocks that are making a big move in a particular direction and have enough volume to make sure that your order is filled at the right price.

Even if you decide to not pull the trigger on a trade before the opening bell, you still want to know about unusual pre-market price action.

It will give you clues about what’s to come later in the day, set up opportunities for you to ride the momentum at the open, or identify reversals.

As usual, the filters are completely adjustable and customizable.

Social Media Channel

Some of the other more interesting channels are the Social Media channel and the Earnings channel.

The Social Media channel monitors activity on StockTwits and measures the social sentiment surrounding a particular stock.

The exact parameters are of course customizable but, in any case, you will be alerted to stocks that have an unusually positive or negative sentiment.

This channel is very useful lately as so many more retail traders pile into the market.

Now, more than ever social sentiment can significantly move the price of a stock perhaps more than fundamentals, macro sentiment, or other traditional catalysts.

The earnings channel is similar to what you might find on other platforms however it has alerts built-in so that you can easily filter out earnings reports that are not notable.

There is a window that shows you all of the companies reporting on a particular day–but there are also windows that only show you companies that have had a large beat or miss.

These are the stocks that we can expect that have more significant price action and potentially be an opportunity to trade.

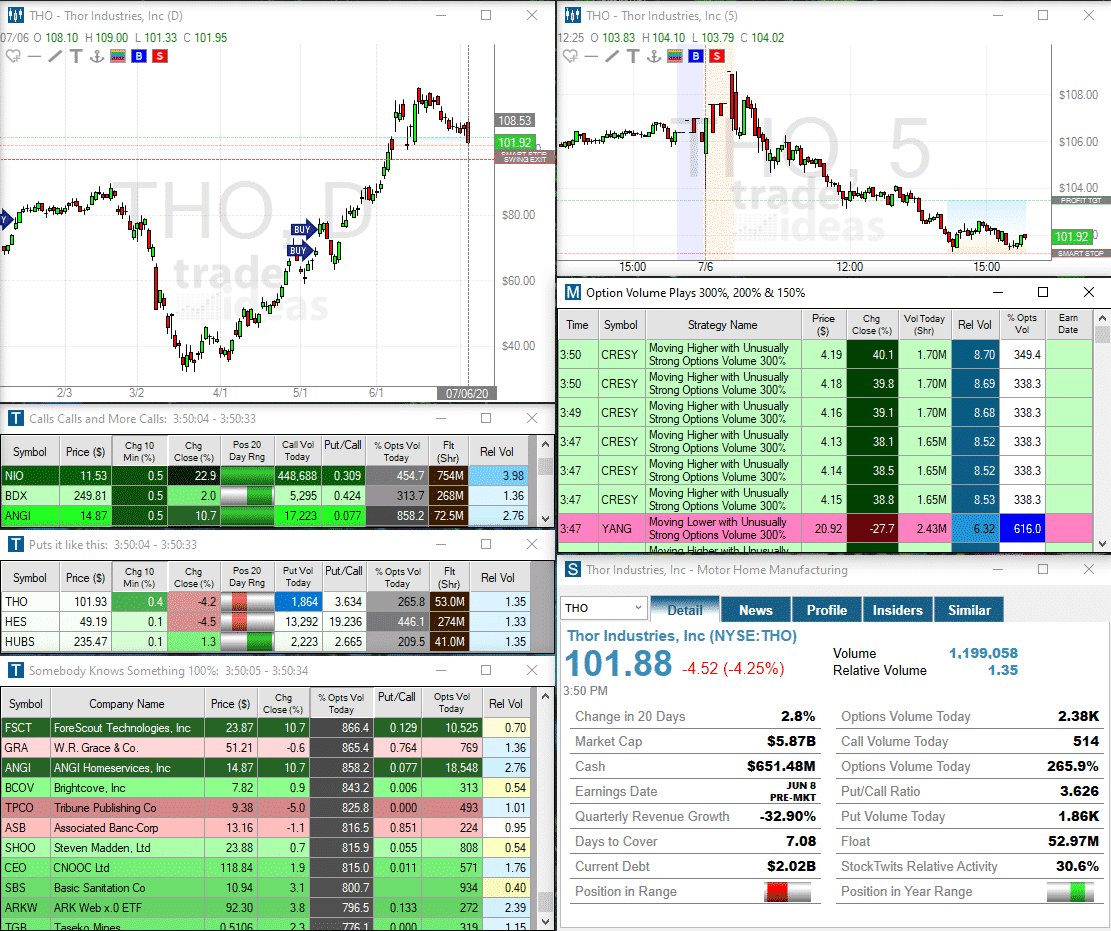

Options

This is one of the most interesting strategies and windows to monitor.

It’s buried pretty far down on the list, so I suspect it’s not the most popular view, but it has a lot of really valuable information.

It identifies stocks that have a lot of unusual option volume.

The view breaks down these interesting stocks by heavy call volume, heavy option volume, or what it calls “Somebody Knows Something” which is a stock with very heavy option volume but it might have a put/call ratio closer to 0.

It also alerts you to stocks where the underlying is in a strong trend and there is also unusual option volume.

This window gives you a constant stream of unusual option volume which is incredibly valuable.

If you’re going to use this to trade the underlying, this may work.

If you’re going to use this to trade the options that are being identified, you should be aware that a lot of the stocks have low option volume and might be difficult to trade.

For instance, a stock may be identified as moving higher with 300% more than usual option volume.

Unusual Option Volume

This is a great alert and might be a clue for you to join the party.

However, just because there is a 300% increase it doesn’t mean that there is a lot of volume in real terms.

Because some of the options have lower volume than what is ideal for an individual day-trader, you will need to be extremely careful when entering and closing positions.

If there is a very wide spread on the bid-ask, take note of this when you enter the trade and be sure to consider this when strategizing about how to exit.

If there is a wide spread and low volume, you will have to compromise on the price of your closing order.

This could easily make or break the trade.

I’ve found that you will get better results by scrolling through all of the alerts and selecting only stocks that are large-cap and are trading with high volume in real terms (not just as a percent of normal).

Of course, you can always change the parameters of the filter so that you’ll only see stocks that have traded, for example, 5000 contracts today.

This is a personal choice, but sometimes I think it’s better to look at the big picture and narrow the list down manually rather than risk missing the forest for the trees.

Premium Highlights

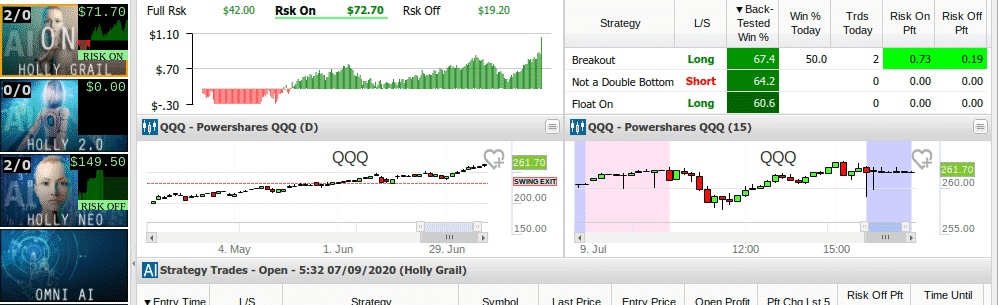

Omnia AI

Trade-Ideas has given a personality to their AI suite–she’s named Holly.

She’s definitely a face that you’ll get used to seeing if you stick around the platform.

There are 4 different ways to view the AI trades and 3 of them are named for Holly.

The 4 windows are called “Holly Grail”, “Holly 2.0”, “Holly Neo”, and “Omnia AI”.

There are 4 different ways to view the AI trades.

They can be viewed compartmentalized by strategy or viewed all together in the “Omnia AI” window.

From this “Omnia” window it’s easy to determine which strategies are in play at the moment so this is the recommended view.

Unless one strategy is having a particularly strong or weak day, it makes sense to view everything at the same time.

Trade-Ideas AI has many different strategies constantly being examined and improved upon.

They offer explanations of each one here.

The universe of stocks that Trade-Ideas examines is very large and so depending on the broker that you use, you may or may not be able to short sell some stocks.

Watch For PDT Rules

Related to this note and what you should expect from your broker, if you are following along with the AI strategies, you will surely be designated as a Pattern Day Trader if you are located in the United States.

If you execute more than 3 day-trades in a trailing 5 day period, you are a Pattern Day Trader.

As such, your brokerage will require that you keep at least $25,000 in your account at all times.

If this is a problem, you might be able to carefully choose which AI trades are most likely to win and filter them out such that you’ll be under the limit.

However, the strategy’s win rate is not above 50% on some days.

So if you want to be successful trading along with the AI, you really need to be taking as many of the trades as possible.

That said, some filtering of the AI trades isn’t a bad thing and may even be advisable.

This is similar to playing Advanced Chess–a human/computer partnership.

In chess, these teams are often able to beat the very best of solo humans and solo computers.

The same may be true for trading–especially as an individual with a modest bankroll.

Personally, I’ve noticed that it’s best to stay away from trades that are opposite the overall market trend.

If the overall market is trading very strongly in a particular direction, the AI win rate seems to be lower on contrarian trades.

If the market is moving higher, I will only take long trades that day.

The opposite is the case if the market is moving lower.

Trade-Ideas has about 50 different AI strategies and so I’ll highlight a few of the ones that stand out.

Neo

Neo is a bit different from the other AI.

It’s not looking at many algos and filtering them down each day.

It is looking for stocks in play that are doing many many times normal volume and then optimized with that sole focus.

Breakout long/short- Neo’s focus is on high volume stocks that are currently in the news. For these algorithms they are looking to take an early move on these stocks in the direction of the gap.

Pullback long/short- These algos look for the same NEO signature stocks in the news but are looking for them to base sideways before pushing higher.”

Alpha Predator

This strategy looks for momentum stocks under 20 dollars to buy on a pullback trigger as the event to go long.

These stocks will be green on many time frames from 5-day to 5 minutes.

There are numerous filters looking at moving averages and change in price over the last hour. We need at least 1 consecutive green candle coming in on the current day.”

The Continuation

Stocks between 50 cents and 50 dollars make up this strategy.

The trigger is a new 30 minute high if the stock had 2 consecutive up days coming into the present day. Thus the name “continuation”.

The daily range for this candle will be a wide range above normal.”

Quarterback

Looks for strong stocks that had a significant move upward then pulls back 25% for the entry trigger.

Stock prices will be 5 to 100 dollars and relative volume needs to be above normal.

The A.I. has added many RSI filters and the stock must be up from yesterday’s close.”

Backtesting

The Trade-Ideas OddsMaker allows you to backtest strategies and provides visualizations to go along with it.

“The OddsMaker is fast and powerful.

There’s no programming or scripting knowledge needed – any of your Trade-Ideas strategies can be tested and improved in a few minutes.”

There’s no limit to the amount of backtesting that you can do and all of the operations are performed on their servers–so the results are very fast.

Backtesting is also available quickly and conveniently through a right-click from inside any of the standard strategy windows.

Brokerage+ and Auto-Trade

This feature is extremely powerful and lets you sync your Trade-Ideas platform with an Interactive Brokers account.

If you are a premium subscriber, you will have access to making Brokerage+ which will allow you to manually place real trades from inside Trade-Ideas.

If you want to automate the AI trades with real money in your Interactive Brokers account, you need to be a premium subscriber and purchase a lifetime license for Brokerage+, which currently costs $1100.

“B+ add multiple execution functions to Trade-Ideas Pro including the ability to automate any alert strategy so that signal’s appearing in an alert window will automatically send an initial order, a stop order, profit target and its respective time stop.

In addition, when B+ is connected to IB, additional execution functionality is available to the user from any Trade-Ideas window.”

Conclusion

Well, as noted before, a lot of professional traders and educators seem to think so.

And I’m broadly in agreement.

The platform is useful for novices and experts alike and is priced at a point that makes it accessible to everyone.

If you sign up for the premium package, it will cost roughly $200/month.

Even if you are trading with a small account, Holly and the AI program should be able to provide you with enough successful trades to at least cover your costs.

If you are a new trader, breaking even is a huge success!

It is a free education (except your time) and you will learn how to use the Trade-Ideas more effectively as a tool and how to integrate it with your brokerage account, whether you use Broker+ and Interactive Brokers or any of the other options that are out there.

If you are trading with a larger account, you should have no problem at all covering your costs.

Worth The Cost?

If you sign up for the standard package, you’ll get the most out of Trade-Ideas if you already have a solid strategy in place.

The standard package does not give specific trade recommendations or alerts.

It only alerts you to conditions in the market or a particular stock that might be interesting.

Therefore, you’ll be responsible for position sizing, entry price, stop price, target price, etc.

If you’re a new trader, this might be daunting, risky, or even dangerous.

However, the Standard Option does provide access to Barrie and the trading room.

So if you don’t want to splurge on the Premium Option and are feeling a bit lost with the Standard Option, you should head over to the trading room to watch, learn, and trade.

If you’re an experienced trader or a professional, this is no problem and you’ll be able to get the most out of Trade-Ideas.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.