Let’s look at an iron condor example on RUT. We like doing iron condors on indices such as the RUT (Russell 2000 index) and the SPX (S&P 500 index) because we don’t have earnings risk and stock-specific risk.

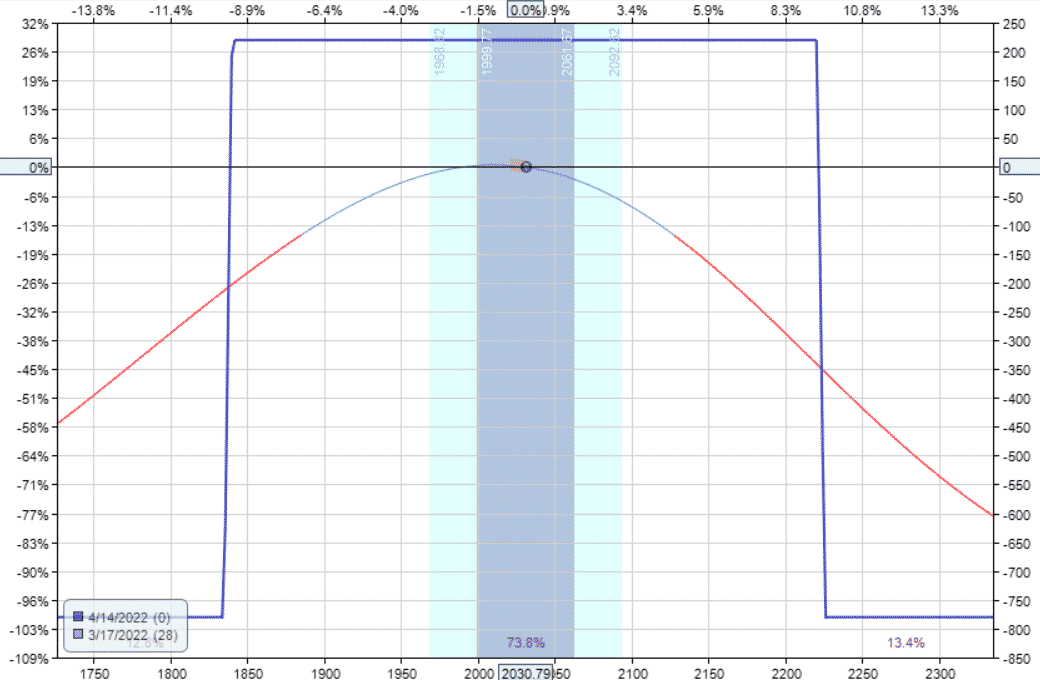

Consider a RUT iron condor with 5-point wide wings with 28 days to expiration:

Date: March 17, 2022

Price: RUT @ $2031

Buy two Apr 14 RUT $1835 put @ $16.25

Sell two Apr 14 RUT $1840 put @ $16.85

Sell two Apr 14 RUT $2220 call @ $6.10

Buy two Apr 14 RUT $2225 call @ $5.60

Total Credit: $220

Max Profit: $220

Max Risk: $780

Risk to reward ratio: 3.5

The short put is 190 points below the market at the 16-delta.

The short call is 190 points above the market at 10-delta.

They are at different delta due to the put-call skew in the RUT.

We wanted the short options to be equidistant apart.

Checking the initial Greeks at the start of the trade, we see that we are fairly delta-neutral:

Delta: -0.39

Theta: 7.38

Vega: -15.75

Gamma: -0.01

The payoff diagram at the start of the trade looks to be in a good position:

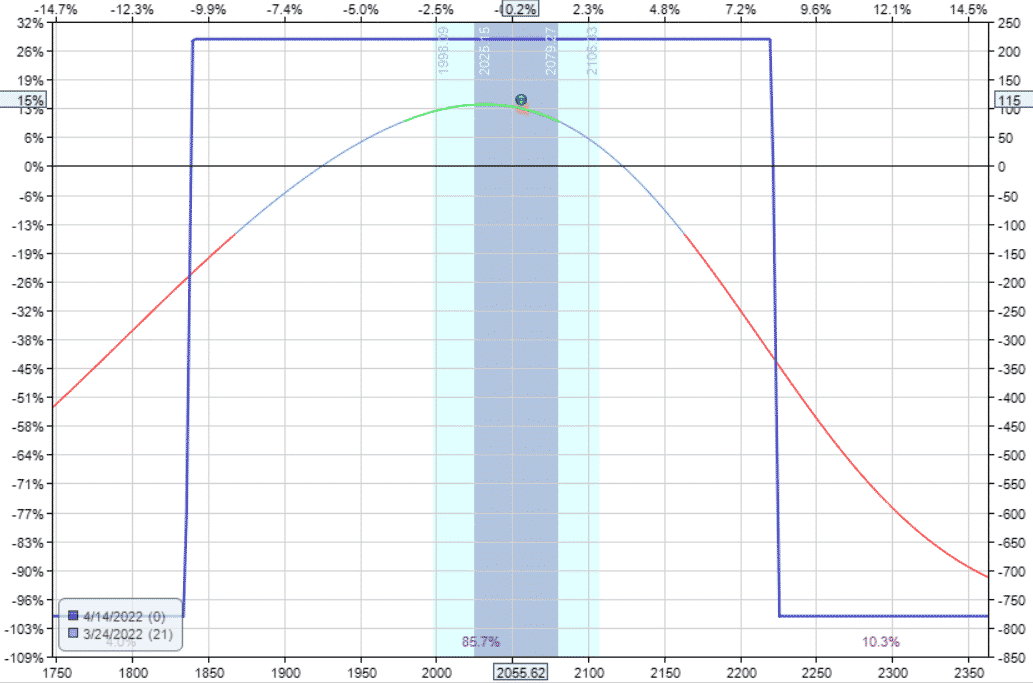

One week later, on March 24, the trade can be closed because it had achieved $115 in profits, which is 50% of the trade’s maximum profit potential.

A return of $115 on a max risk of $780 is a 15% return on capital at risk.

This is good for being in the trade for only one week.

Because the price is still fairly centered.

Some investors may want to hold the trade slightly longer.

But not too much longer.

The trade only has 21 more days to expiration, and we don’t want to stay in the trade too close to expiration.

We hope this iron condor example helps you with your trading.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Hi there

What does this profit look like after trading costs ?

Thanks

Depends on the broker, but most brokers only charge about $1 per contract these days, so trading costs do not have much of an impact.

Big fan of closing spreads at 21 DTE to limit gamma risk.

Thanks!

100% agree with you there Dr Mark.

Out of my price range, i only have

10K$ in my account.

I can use IWM as well which is 1/10 of RUT.

IWM is trading for 182$

182$ X 100 = 18,200$

Like i said before my account size is 10K$

Danny, maybe you are using the wrong broker. The puts/calls you buy lower the buying power requirements in credit spreads, whereas your calculations seem to reflect the cost of a naked puts/calls.. Your iron condor trade above costs only a couple of hundred dollars per contract, even with RUT. The spread between strikes is $500. With an iron condor, it doesn’t double charge your buying power, and the credit received is $220 for a net decrease in buying power of $280.

Your broker should not be double counting the iron condor against your buying power. Enter the trade in optionstrat.com and you can see for yourself.

Thanks Jeff, perhaps he is concerned about early assignment. But you’re comment above is 100% spot on.

At IBKR 1-1.6$ per contract are charged. In this example that is 8-12$ which then is around 10% commission. Seems fairly high. Can someone explain gamma risk in more details, please?

Johannes, try these articles:

https://optionstradingiq.com/gamma-explained/

https://optionstradingiq.com/gamma-risk-explained/

https://optionstradingiq.com/long-gamma-strategy/

https://optionstradingiq.com/gamma-hedging-guide/

Hope that helps.