Today, we are looking at how to use option scanners to find Iron Condor trades.

An Iron Condor is an options trading strategy that lets the seller profit from a lack of price movement from the underlying stock.

The strategy is a combination of a Bull Put Spread and a Bear Call Spread.

Contents

- Introduction

- Bear Call Spread

- Key Elements Of Profitable Iron Condors

- Combining All The Search Criteria In A Single Place

Introduction

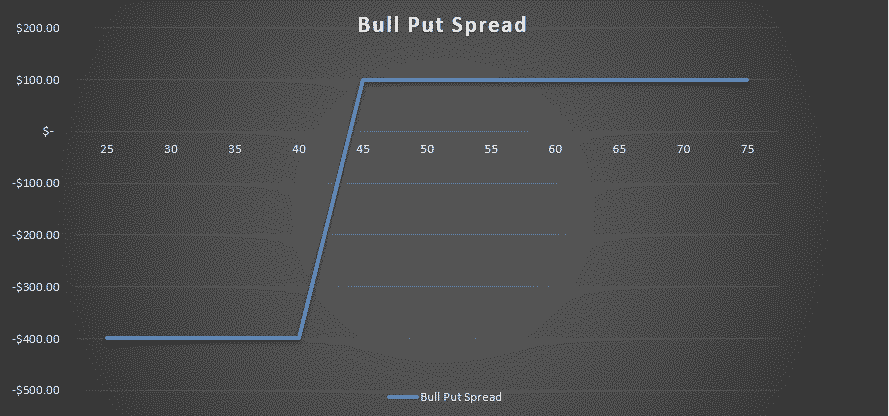

A Bull Put Spread works by selling a put option and buying another put option at a lower strike price that expires at the same time.

A Bull Put Spread defines a lower limit of the profitable range.

The Bull Put Spread is profitable when the underlying stock does anything but go down.

As long as the underlying stock price stays stable or moves up, the Bull Put Spread is profitable.

Bear Call Spread

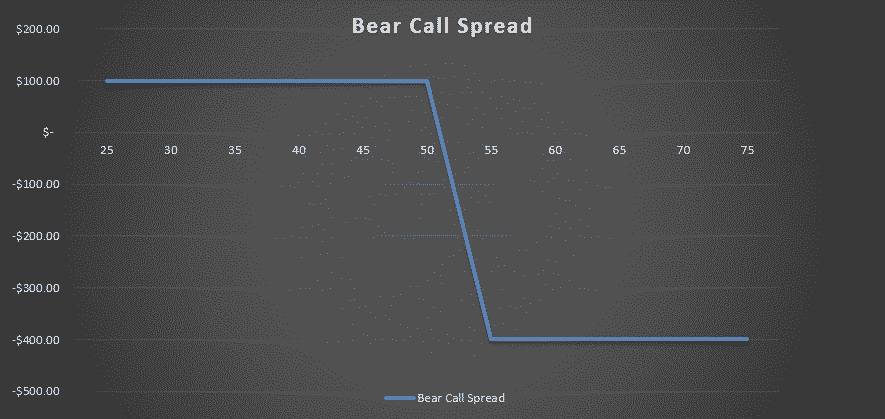

A Bear Call Spread works by selling a Call option and buying another Call option at a higher strike price that expires at the same time.

A Bear Call Spread defines an upper limit for a profitable range.

The Bear Call Spread is profitable when the underlying stock does anything but go up.

As long as the underlying stock price stays stable or moves down, the Bear Call Spread is profitable.

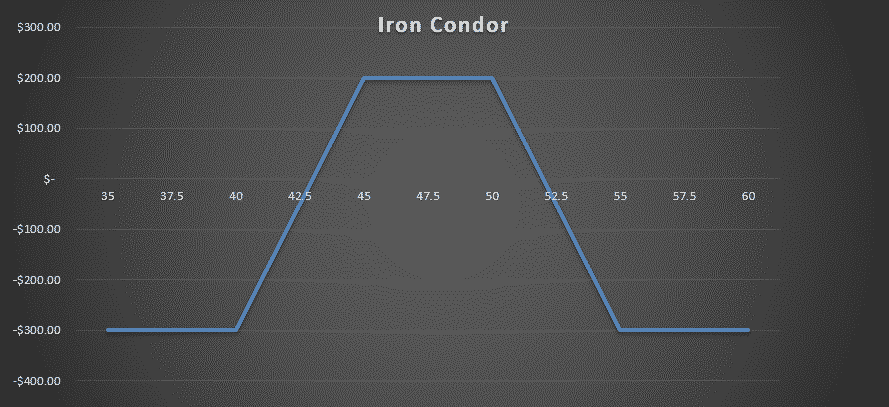

An options seller combines a Bull Put Spread (to define a low range) and a Bear Call Spread (to define a high range) to define a range of profitability.

If the underlying stock price stays within the low and high range, all four legs of the Iron Condor will expire worthless, and the seller pockets the premium in full.

The Iron Condors are great for generating consistent income over the long term, as the seller can use data to control the entry points with the highest probability of profit while also limit the maximum loss if the unexpected happens.

An Iron Condor is profitable when the underlying stock price does not move up or down beyond the limits.

In this article, we will share with you key elements to trading profitable Iron Condors and also the steps to use data to find the most profitable and safest opportunities in 7 steps.

Key Elements Of Profitable Iron Condors

Iron Condors work by both theta decay and vega contraction, as both mechanisms work in an option seller’s favor to reduce options value for profit.

Theta is the change of options value over time. By selling longer monthly expiration options (>30 DTE), we get more predictable theta decay, and hence profit, as time passes.

Vega is the change of options value over IV. By selling Iron Condors when IV is high, we can benefit from the inevitable IV contraction as the market revert to the mean, reducing the options prices along the way.

Lastly, to make an Iron Condor successful, we need the underlying stock price to remain stable during the trade.

With the help of Options Scanners by SlashTraders, we can use the following seven criteria to help you consistently find profitable and safe Iron Condor entry points.

For simplicity, the Options Scanner provides the Strangle and Iron Condors of all the optionable underlying, including both stocks and ETFs, at 0.20 delta Put and Call strikes.

This gives us a good starting point to look for high return neutral trade opportunities very quickly. Then you can dig into the chart analyses and fine-tune your entry points for the best Iron Condors.

Find A Monthly Expiration Date With Predictable Theta Decay

As we mentioned earlier, Iron Condors profit by theta decay, the passage of time.

Even though the theta decay is most predictable when the expiration is further than 90 days, the speed of decay is very slow.

We prefer a Day to Expiration (DTE) range of between 30-60 days to give us a good balance of predictability and speed of theta decay.

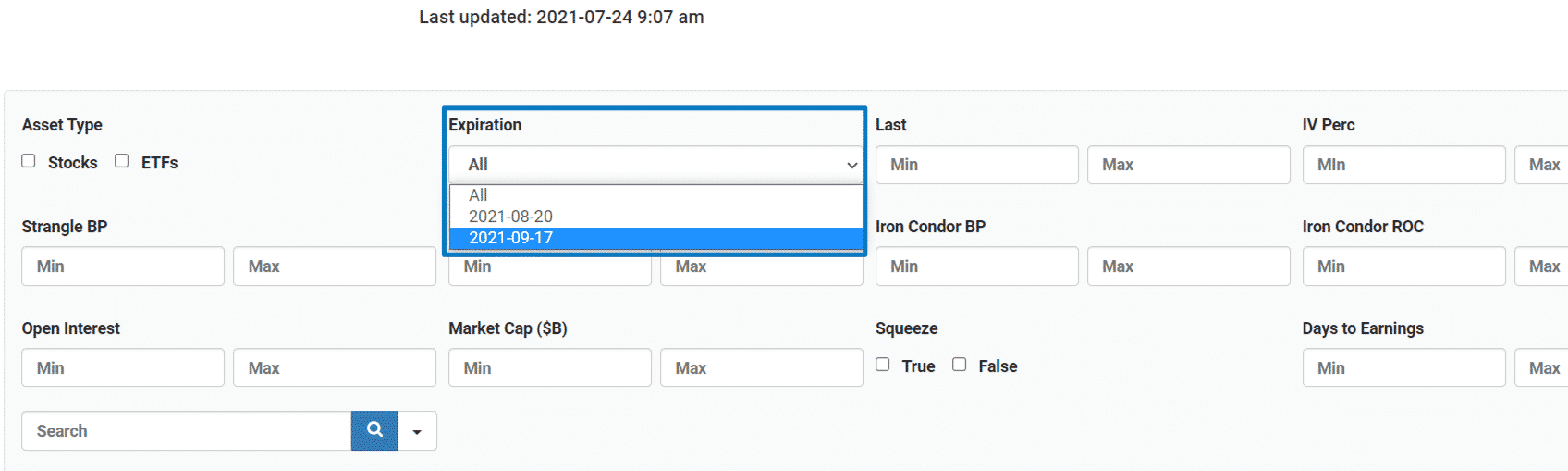

In SlashTraders’ Options Scanners, the choice of DTE is made much simpler by providing only the expirations of the next two months, with the nearest expiration at least 20 days away.

So you can easily stick to the rule of choosing Iron Condors that expire between 30-60 days.

The Options Scanner simplifies the choice of DTE by providing the expirations for the next two months.

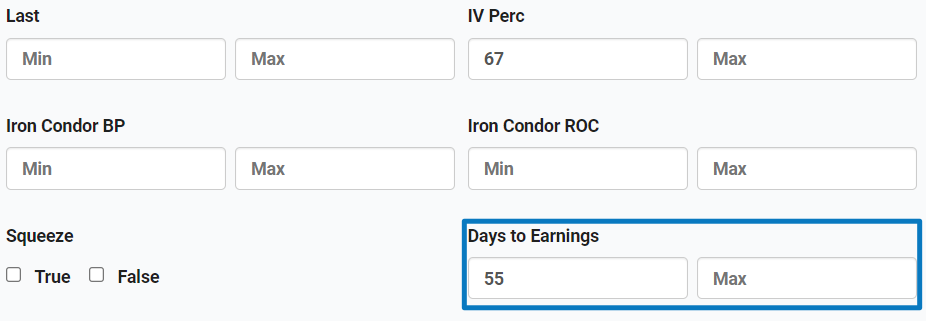

In this exercise, we will choose the 9/17 expiration that is 55 days away and display only the opportunities that expire on 9/17.

Find Opportunities With High Chance of IV Contraction

Then we want to find the underlying stocks with an overextended IV, so we have a higher probability of seeing the vega change in our favor.

IV Percentile is an excellent way to find abnormally high IV states.

IV Percentile is a number between 0-100% that measures current IV for the upper and lower IV range within the last year.

For example, an IV Percentile of 100% means the current IV is at a 52-week high, while an IV Percentile of 30% means the current IV is only higher than 30% of the trading days in the past year.

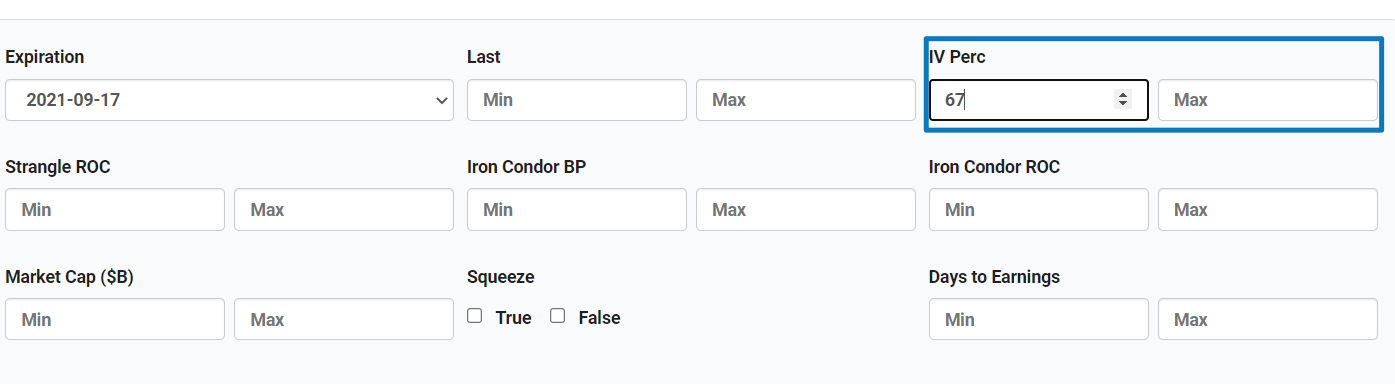

So if we filter IV Perc to a minimum of 67%, we get a list of underlying that have at least 2 to 1 chance of IV contracting in our favor.

By filtering opportunities with IV Perc higher than 67%, we get an underlying high chance of contracting IV in the near future.

Eliminate Stocks Vulnerable to Manipulation

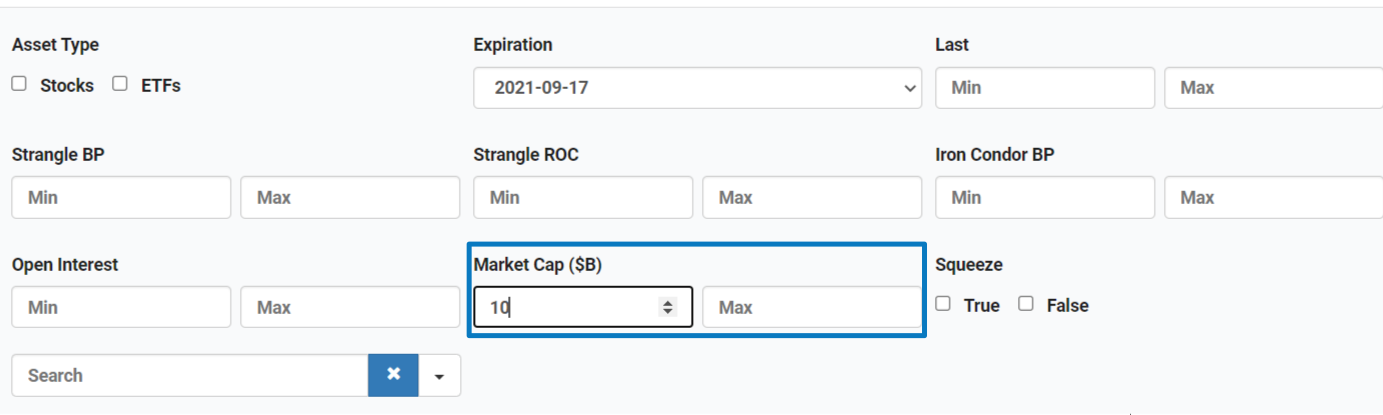

When selling Iron Condors, we want to trade the underlying that don’t fluctuate much, so we want to avoid stocks with low market capitalization.

In our experience, a stock with >$10 billion in market cap is usually high enough to discourage WSB guys from manipulating stock prices in a big way.

So, we filter the Market Cap ($B) to a minimum of 10 to avoid selling Iron Condors, or worse, Strangles, on the next GME and AMC.

Underlying stocks with Market Cap larger than $10 billion are less prone to manipulation.

Eliminate Stocks With Low Options Liquidity

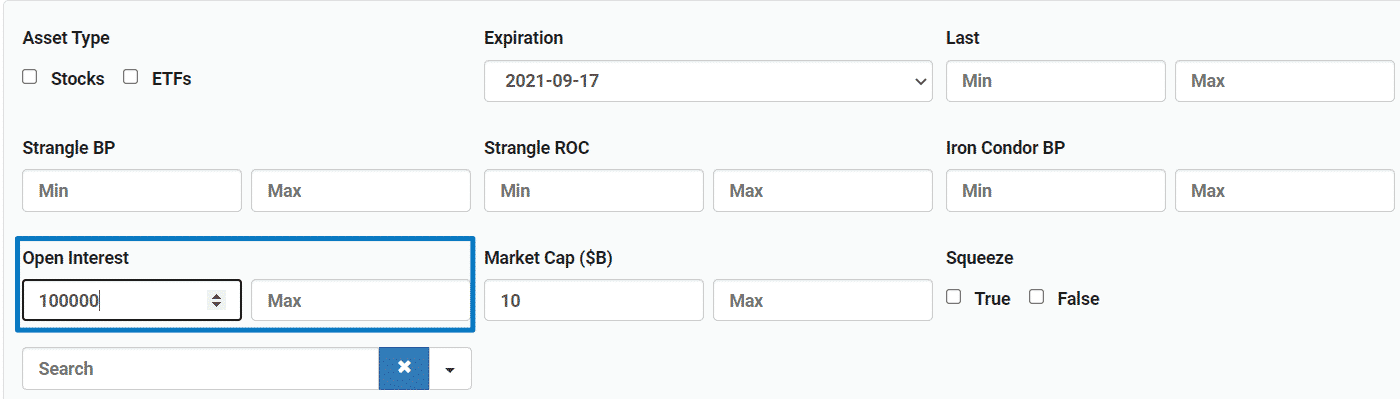

Next, we want to only trade options on liquid underlying that have high options volume.

Open Interest is the number of outstanding options contracts on the underlying.

The higher the Open Interest, the more popular and more liquid the underlying is.

We want to choose stocks with > 100,000 Open Interest to easily get our orders filled whether we want to open or close trades.

So we set the filter of Open Interest to a minimum of 100000.

Find underlying with Open Interest higher than 100,000 for high volume options opportunities, so our trades get filled easily.

Avoid Stocks With Upcoming Earnings

Stocks are prone to high IV and big price movements as it approaches earnings date because earning announcements stir up all sorts of newsworthy debates about the underlying outlook.

Therefore, we expect the IV expansion to go against our desired vega movements right up to the earnings date.

We can use the Days to Earnings filter to find Iron Condor opportunities that do not expire after an earnings call.

Make sure the earnings dates of stocks do no occur before Iron Condor expiration.

Find Iron Condors With High Return on Capital

Then we will sort the Iron Condor opportunities by way of highest Return on Capital.

By clicking the Iron Condor ROC header, the filtered list of Iron Condors can be sorted from the highest return to the lowest.

Sort the Iron Condor ROC from highest to lowest to find the highest return opportunities.

Enter the Iron Condors When the Price Is Right

An Iron Condor is a neutral options strategy. We want to find stocks that are neither overvalued nor undervalued, so the underlying has less chance of a sudden jolt that escapes our profitability range.

As mentioned earlier, the Options Scanner provides the Strangle and Iron Condors of all the optionable underlying at 0.20 delta Put and Call strikes.

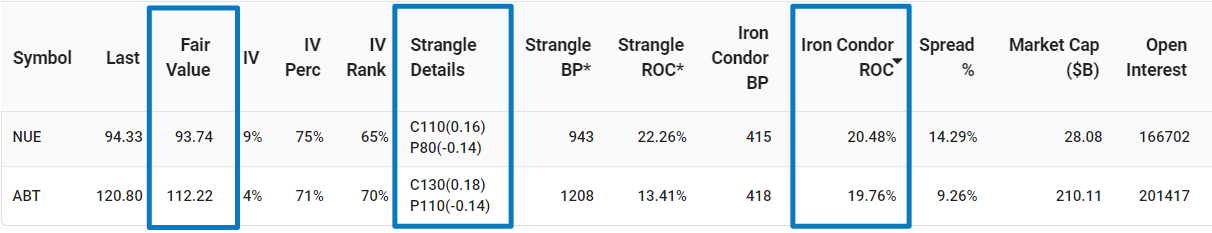

We can use the Fair Value field to identify the stock that falls within the Call and Put outlined by the Strangle Details.

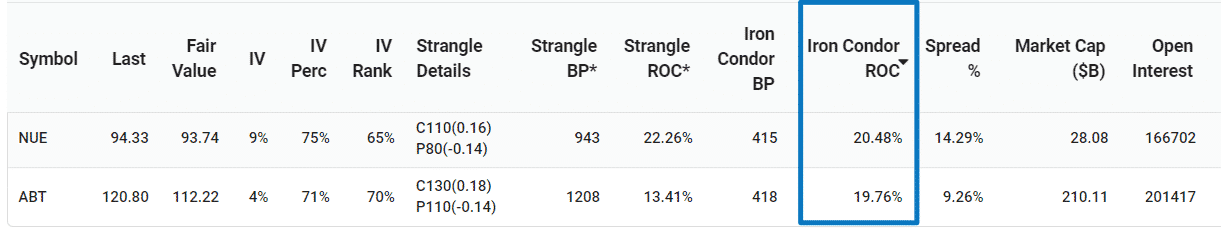

The stocks that fit all our filtering criteria at this moment in time are NUE and ABT.

So we see only NUE and ABT fit all the filter criteria that we set out for high probability and high return Iron Condors, while NUE has a slight edge on the Return on Capital of 20.48% (calculated before commissions and fees).

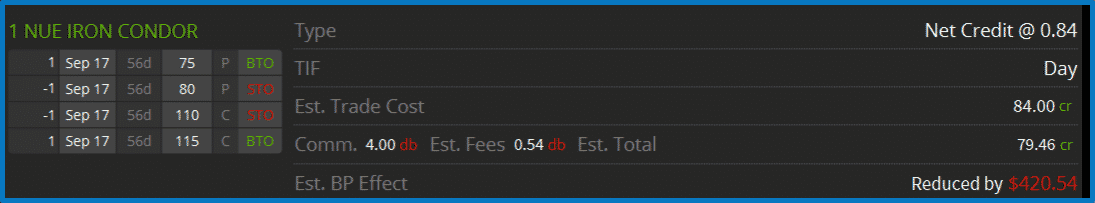

Finally, we can enter the trade in the platform of our choice and execute a high probability Iron Condor trade for NUE.

We see the NUE Iron Condor fits all our criteria as the safest and most profitable opportunity at this time.

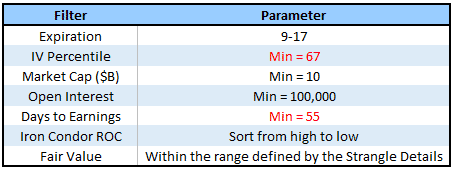

Combining All The Search Criteria In A Single Place

We covered a whole set of filtering parameters in the SlashTraders’ Options Scanner, so here is a cheat code of all the 7 criteria you need to find high probability Iron Condor entry points in seconds.

Feel free to customize the parameters based on your own trading experience and risk tolerance to find the best Iron Condor entry points for your trading style.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Decent explaination.