Commodity futures offer investors access to unique exposures that can diversify against certain risks in a portfolio.

Most retail investors are either unaware of the diversification provided by commodities, or aware, but investing in commodities incorrectly.

This can actually lead to a portfolio with more risk.

This article will provide some thoughts on using commodities prudently to diversify a portfolio.

Contents

- Correlation in Downturns

- Not all Risks are the Same

- When do Commodities Hedge My Portfolio?

- Should I Care About Inflation?

- The Golden Exception

- What is the Problem with my Commodity Exposure?

- What About Oil, Gold and Metal Stocks?

- Concluding Remarks

Correlation in Downturns

A casual investor who goes down the path of looking for portfolio diversification in commodities may have ended up a little confused over the last few years.

The portfolio that they thought was diversified, does not seem diversified at all.

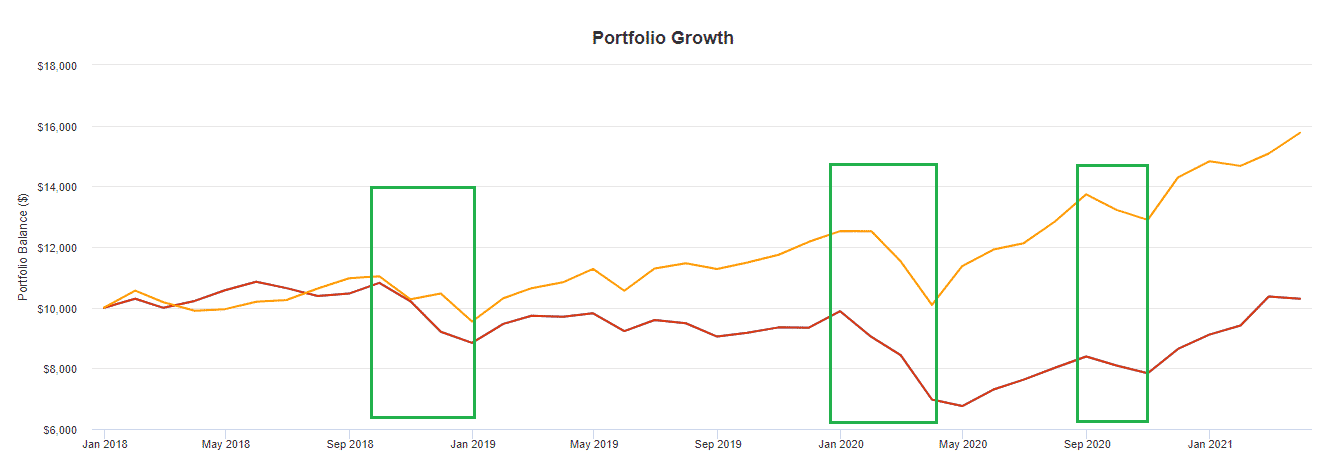

Below is a graph showing the S&P 500 (in orange) and DBC, which is an ETN tracking commodities (in red). We can see right off the bat that they are very correlated.

Simply adding commodities to a stock portfolio did not help at all during the downturns in 2018 or 2020.

In fact, during the bear markets above the commodity portfolio underperformed the S&P 500! This diversification turned to diworsification!

In fact, one would have a lower risk by shorting the commodities while going long the index. So, what happened here?

Not all Risks are the Same

One first thing of importance is not all bear markets are the same.

They happen for a unique reason.

The recession of 2008 (which also saw commodities decline) was sparked due to the subprime mortgage crisis. 2020 was caused by the coronavirus pandemic.

These crises have been coupled with a slowing in economic activity that is needed for the demand of most commodities.

Hence investing in both commodities and equities over these periods have not done well. So, when do commodities outperform?

When do Commodities Hedge My Portfolio?

The single best hedge commodities provide is against inflation.

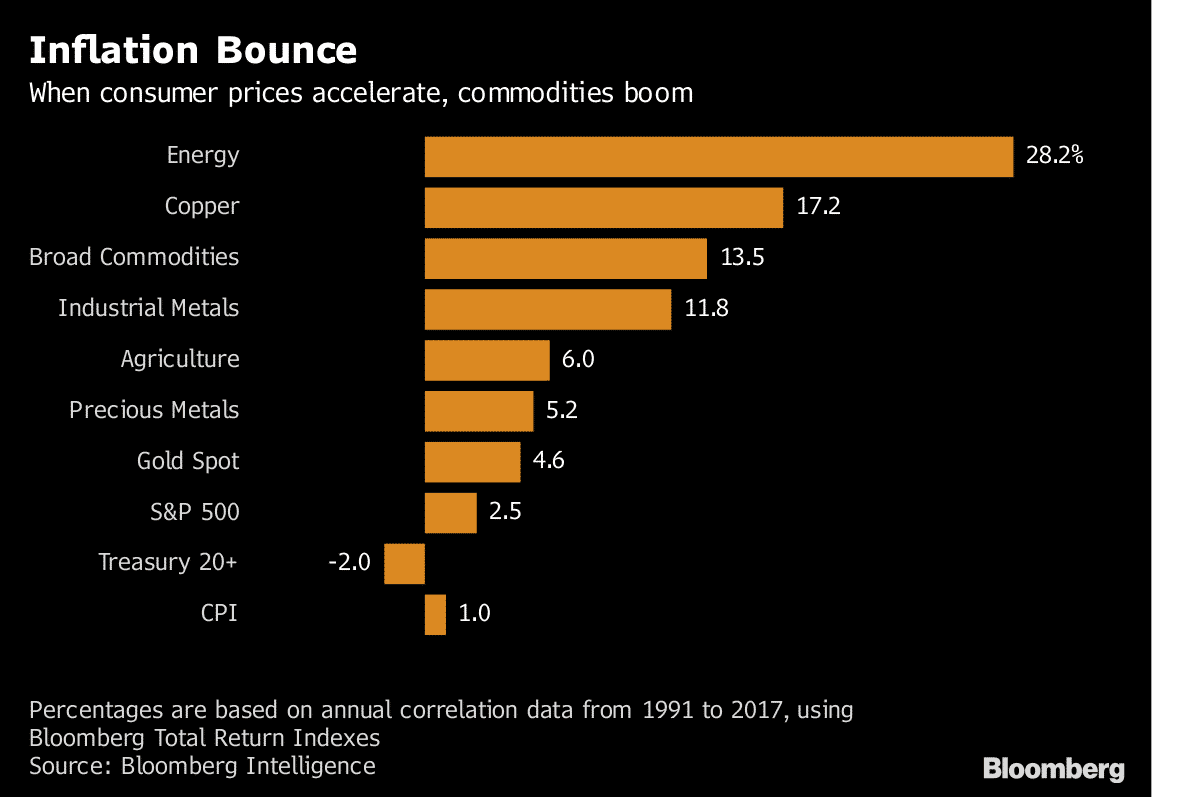

Below we can see the performance of different commodities when consumer prices rise.

Source: Bloomberg Intelligence

Inflation is defined as the rising of consumer prices over time.

Since commodities directly impact consumer prices, a rise in commodity prices will naturally lead to a rise in consumer prices.

This is no more prevalent than with oil.

Rising oil prices impact the whole macroeconomic chain from the prices of the food we eat to the trips we take.

So naturally, oil is one of the best hedges against inflation.

Should I Care About Inflation?

For many developing countries, such as in Venezuela, citizens know all too well about inflation.

For the rest of us it seems like a headline that never really mattered.

In the last few decades, we have moved into a zero-interest rate world and many countries have experienced the opposite concern, deflation.

So, an ignorance about inflation is not unjustified.

That being said as economic regimes change, so do their risks.

Due to the massive coronavirus stimulus many suggest significant inflation is now inevitable.

Certain portfolios will be more susceptible to inflation risk.

Treasuries, corporate debt and other bond-like equity investments (such as utilities and consumer staples) will likely fare poorly in periods of inflation.

Ironically these are the best investments in most downturns.

If you are over leveraged in these areas adding a small portion of commodity exposure is not a bad idea.

Yet even if not, there is one commodity that is unique for its use as a safe haven and diversifier against risk.

The Golden Exception

All commodities in one way or another benefit from an expansion in global economic activity, with one exception.

Gold is a very unique metal in that it is rarely used in any industrial uses.

Instead, it is hoarded by central banks and speculators as a store of value.

As it has little industrial use the price of gold depends minimally on how the economy is doing.

In the long run gold will not make you wealthy, as its value has not increased much in real value terms since Roman times.

What it will do is protect an investor against long term inflation while also doing well in times of market stress.

There is a reason why Ray Dalio always has a percentage of Bridgewaters investment portfolio in gold.

Most portfolio theorists recommend a 1-5% position in gold as a value of a total portfolio.

This can be done by buying and rolling gold futures or simply buying a gold based ETN such as GLD.

Some investors will argue for other alternatives.

Silver is another commodity that has this store of wealth value.

Despite this it is also used in industrial uses hence gold is usually a better hedge in a strict economic downturn.

Another disadvantage of Silver is it is also far more volatile.

This makes it more appealing for a speculator but worse for a hedger.

Emerging assets like cryptocurrency have, at this point, no diversification benefit.

Instead, the coins seem to be more a tool for speculation as they are both severely volatile and have tended to move with equity markets.

Although it’s noted that with a small track record cryptocurrency could potentially become a good diversifier in the future once volatility has stabilized.

What is the Problem with my Commodity Exposure?

Any long commodity exposure has a problem that most retail investors are unaware exists.

Whenever you buy commodities futures or invest in the ETN’s that hold them, you are expressing the view that this commodity will go up against the US Dollar.

Hence your long commodity position is as much a bullish view on the commodity as it is a bearish view on the dollar.

As the US dollar is treated as a haven currency it tends to do well precisely when the markets are in turmoil.

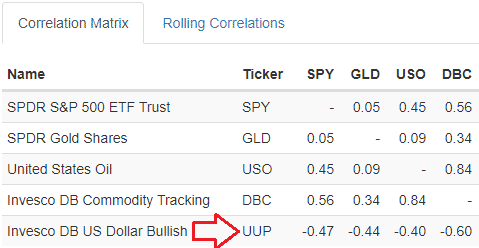

In the asset correlation below we can clearly see this as the US dollar is both strongly negatively correlated to the S&P 500 as well as all commodities.

Thus, shorting it makes little sense in terms of diversification.

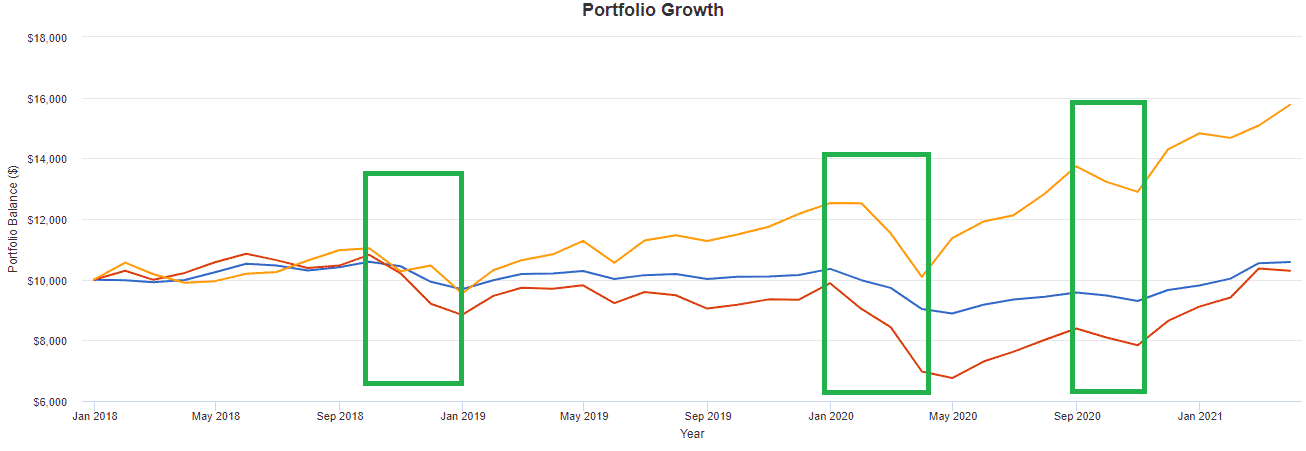

In order to balance this risk going long a US dollar in the equivalent exposure to commodities will result in a much less volatile portfolio, without sacrificing returns as shown below (in blue).

Here I took the same graph as initially shown with our commodities ETN in red but subsequently went long the equivalent amount of US dollars to neutralize our currency exposure.

When every asset is down, the US dollar is likely up!

Getting US dollar exposure can be done by buying US dollar futures against a basket of currencies, holding USD cash, or buying a US dollar ETN such as UUP or USDU.

Additionally, the small exchange has recently come out with US dollar futures vs. a global basket of currencies.

What About Oil, Gold and Metal Stocks?

Commodity stocks such as gold miners and oil drillers offer investors synthetic exposure to the underlying commodities and can provide outsized returns in the long run.

In inflationary periods these sectors will likely outperform.

Despite this, they will naturally be more correlated to equities than the underlying commodities themselves.

So, enjoy an equity risk premia but don’t expect your gold mining stocks to go up in a recession.

***Note***

Many indexed portfolios especially in stock markets such as Australia and Canada already have a heavy correlation to commodities from their sector exposures.

An investor with local equity index exposure in these economies is probably already over concentrated in commodities.

Arguably these investors should seek lowing their exposures to oil, mining and industrials to maximize long term risk adjusted returns.

Concluding Remarks

Commodities offer a great source of risk management against inflationary periods when some other assets may underperform.

Gold is unique in that it can add a store of value and diversification benefit regardless of economic regimes.

Other commodities, while doing well in inflationary periods, may tend to add risk during more traditional economic downturns.

Thankfully a lot of this excess risk can be removed once an investor neutralizes their exposure to the US Dollar.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.