There are many different ways to hedge a portfolio. One of the popular hedging strategies has been popularized by Option Alpha. This article will give an overview of their VIX strategy.

We will then provide some critiques on its limitations.

Contents

- Option Alpha’s VIX Hedging Strategy Overview

- The Structure

- Limitation #1 – Volatility Across the Term Structure is Not Priced the Same

- Limitation #2 – Decay and Untimely Vol Spikes

- Limitation #3 – Not Hedging Your Risks

- Concluding Remarks

Option Alpha’s VIX Hedging Strategy Overview

Option Alpha’s VIX Hedging Strategy consists of a few parts.

The first part consists of selling an at-the-money VIX option.

Then two out-of-the-money options are bought, with consecutive strikes. Alternatively, this is known as a short call ladder.

Source: Option Alpha

We can see above that we receive a credit from selling the at-the-money call and pay debits for the two out-of-the-money calls. Despite buying two calls and selling one, the goal is to place this trade for a net credit.

Thus, to choose our long strikes, we go far enough out-of-the-money so that our trade does not pay a debit. In the video below, they stuck to the 90-120 day options to place these trades.

The Structure

So, what does this structure look like, and under what conditions will it benefit?

From following the directions of the video, I went out slightly more than three months in time. As it only recommended to use a maximum 1% risk on the trade, I chose to demonstrate the trade with VXX (a VIX Futures ETN) rather than the VIX futures themselves.

After all, no point showing a position that only seven-figure accounts can take.

**A disclaimer: while being very similar, there are some slight nuances in the VXX three-month contract. VXX is actually three VIX one-month contracts as opposed to one three-month contract. This will result in it being slightly more volatile but will have very similar exposures either way.

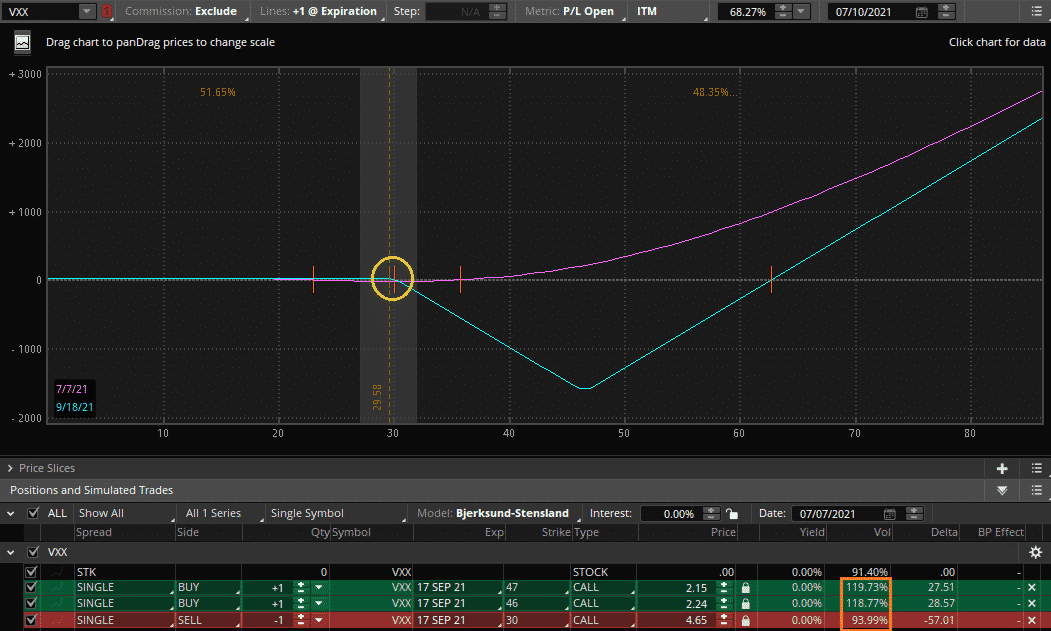

Below I sold one ATM 30 VXX call, then bought one 46 VXX call and one 47 VXX call. I was able to make the trade for a net credit of .26 cents.

We can see the position below.

Initially, our trade is at the yellow circle.

We can see from the purple line we will benefit from a sharp rise in volatility, and we have unlimited profit potential on the upside.

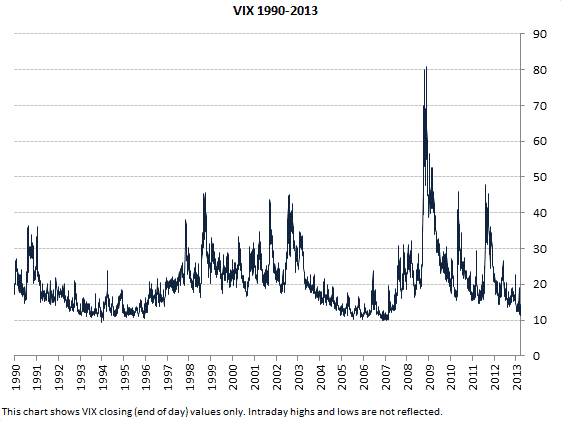

As volatility tends to experience long periods of calm with sudden spikes (as shown below), this trade structure makes intuitive sense.

Source: Macroption

We can do all this for a credit. Hence if volatility goes down, as the author says, “we have a free hedge.”

There are few reasons why this is wrong that we will discuss in the next section, but it is essential first to see the appeal of this type of trade.

In the event of a doomsday type volatility situation (for example, what we saw in Volpocalypse in 2018 and Covid in 2020), this type of structure would have historically provided a good hedge.

The video below provides an excellent and straightforward overview of Options Alpha’s VIX Hedge Strategy.

Now let’s get into some of the Assumptions and Limitations

Limitation #1 – Volatility Across the Term Structure is Not Priced the Same

What was shocking was that the author did not discuss the volatility skew in the VIX in the video.

For example, in my trade above, the ATM option I sold had a volatility of 93% annualized. In contrast, the options I bought had volatilities at 110+% (visually seen in the orange box on the first diagram).

This means that in implied volatility, I am buying the OTM options at is significantly higher than I am selling the ATM option at.

Now, should this be the case? Absolutely. Our graph of the VIX over time confirms this. Usually, volatility is low and clusters.

But when it spikes, it moves up quickly.

This fat tail confirms the call skew.

Despite that, no mention is made whatsoever of this VIX skew.

If the call skew is cheap, then this trade makes a lot of sense.

If not, then it is counterintuitive, and I would argue better structures could be chosen.

Limitation #2 – Decay and Untimely Vol Spikes

The initial risk profile of our position looks very appealing.

We can put on a trade that can benefit from a spike in volatility and do so for a credit.

Unfortunately, we cannot simply assume that volatility will spike initially when we place the trade.

In fact, as the trade evolves, it can often end up taking a very different form.

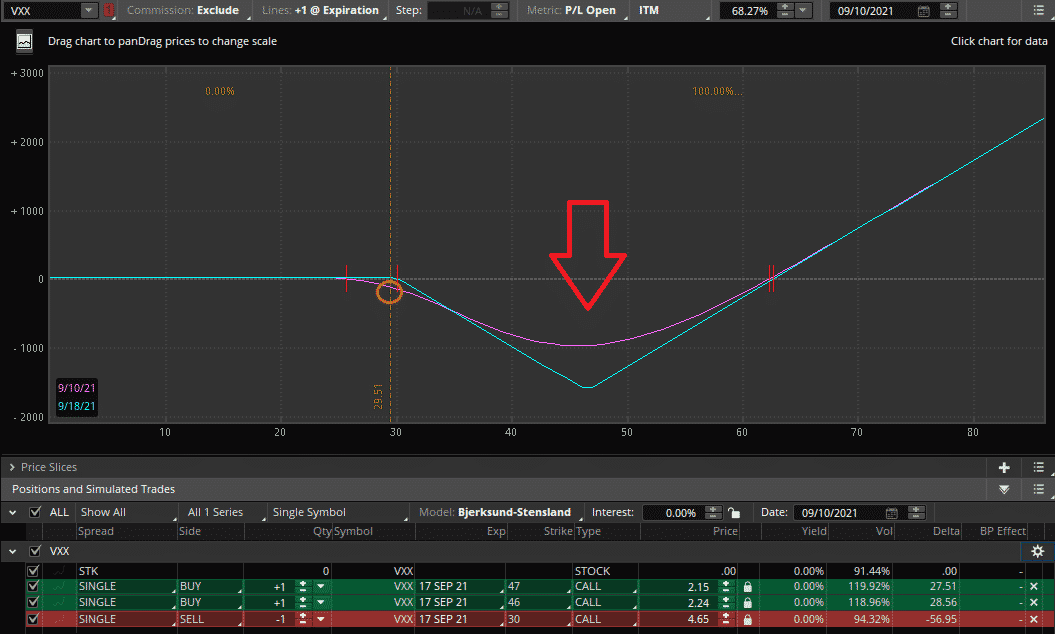

Here I moved the position forward in time nearing expiration with no changes.

We can see that we have a slight loss at the orange circle, but look at the purple line.

While we would have first benefitted from a significant spike in volatility, we are not so eager to see one now.

Our doomsday hedge has turned into a hedge about to cause us a doomsday.

Now, the prudent thing to do at this point is to remove the position and take a slight loss.

As most times volatility will drift or move down, these minor losses will be VERY frequent.

Overall, not a huge issue, but it will have its costs (so now our “hedge” isn’t really free).

Despite this, it is far better to take a small loss than relying on hope as the position nears expiration.

Limitation #3 – Not Hedging Your Risks

The reality is depending on your portfolio, a hedge using VIX options may not be the best bet.

That is because the VIX itself is already the forward volatility of the S&P 500 options.

Trading options on the VIX is therefore trading Vol of Vol or VVIX.

For investors simply long a basket of stocks, S&P 500 puts would offer a far better hedge in terms of correlation.

Even as a volatility trader, one could simply buy and sell the VIX futures themselves as that is already trading volatility.

The reality is that most of the time, the VIX and VVIX will move together, so your hedge would work relatively well.

However, it is always best to hedge your risks directly if you can do so at a similar cost.

For a full overview of the differences between VIX and VVIX, please check out this article.

Concluding Remarks

There is a saying in the stock market that there is no such thing as a free lunch. Free hedges are hard to come by.

If they do appear to exist, there is almost always a catch.

The best hedge is naturally going to be a direct long position. In the example of the VIX, it would simply be buying VIX futures.

This will best hedge a portfolio against any spikes of volatility.

The issue is the cost, and that over the long run, hedging like this will dampen portfolio returns.

This is where the VIX Call ladder attempts to fill a void.

Despite this, randomly repeating the same structure will most likely fail to perform in the long run.

This is unless the far tail risk on the VIX is underpriced.

As tail events are very infrequent, this is hard to evaluate, but most research suggests that the tails are even more overpriced than the bodies (which makes intuitive sense).

An alternative would be to tactically use these call ladders or other structures as hedges depending on volatility and skew characteristics and an investors view of what could happen.

For example, if an investor believes the market will be calm but is concerned about the small tail risk of a liquidity crash, such a strategy could make sense.

Being tactical with options structures and choosing the best hedge for a given situation and one’s portfolio should result in better returns and less risk in the long run.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

It would be nice if we could see how much 1% hedge will recoup portfolio losses in case of black swan event or black Monday/Friday type event since we only allocate 1% of the portfolio. A sudden drop of 10% in equity portfolio of $10,000 will wipe out $1000 then how much protection will this hedge provide?

Hard to say given that every drop is different in terms of speed and volatility spikes. I would suggest running some scenarios through Option Net Explorer:

https://optionstradingiq.com/optionnet-explorer-review/