Risk of ruin is an important calculation for option traders.

As a trader to be rewarded you have to take on risk. The more risk you take on the more reward you can obtain, but the more you can lose.

Nobody wants to go broke.

This article will look at one measure of risk called the Risk of Ruin.

We will define it and discuss its usefulness as a measure of risk.

Contents

- What is Risk of Ruin?

- Can I Go Broke With a Positive Expected Value?

- Why The Numbers Matter

- Should I Target a Risk of Ruin of 0?

- How to Take Control of Your Own Risk

- Concluding Remarks

What is Risk of Ruin?

The Risk of Ruin is the probability of a trader losing substantial amounts of money, to the point where they are broke or unable to recover from losses.

The formula helps traders quantify a probability for this worst-case scenario.

The risk of ruin formula calculation is as follows:

((1 – (W – L)) / (1 + (W – L)))U

Where:

W = The probability of a winning trade.

L = The probability of a loss.

U = The maximum number of trades till Bankruptcy (or ruin is reached)

Can I Go Broke With a Positive Expected Value?

One of the main reasons why Risk of Ruin is important is that simply having the odds in your favor is not enough.

Without proper risk management it is possible that even though the trades are good ones you still go broke.

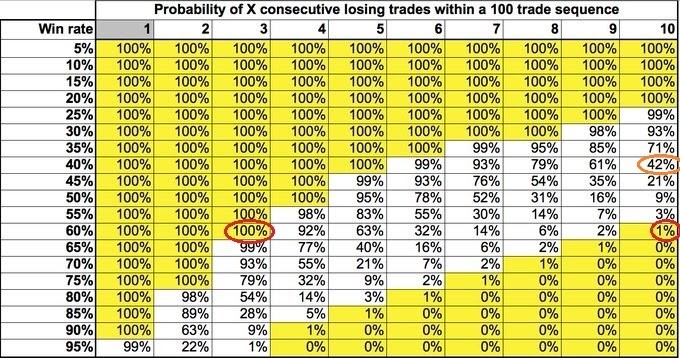

Let’s look at the table below. Imagine a 60% win rate.

Over 100 occurrences it is a guarantee that you will lose a minimum of 3 times in a row.

There is also a 1% chance of you losing 10 times in a row!

Source: NewTraderU

Why The Numbers Matter

Notice in our risk of ruin formula we have various variables.

The difficulty in all games that do not have fixed odds, like the stock market, is that we have to calculate a value as if it were fixed.

Let’s imagine we think we have a 60% probability but in reality our strategy is a dud. Turns out we only have a 40% probability.

Now instead of a 1% chance of losing 10 times in a row we have a 42% chance.

Not only that ,odds are that in 100 trades we will almost certainly lose 6 times in a row!

While calculating these odds can be difficult, by having a larger data set we can help determine what are normal drawdowns and when the strategy needs to be re-evaluated.

For good strategies it is common to have drawdowns, though mathematically they become more and more uncommon as the drawdown grows in size.

**Tip**

When calculating values without a lot of data, be conservative with your numbers.

Remember you are trading against the market.

The market is generally very smart.

Being conservative with your numbers can help keep you from being surprised.

After you have more data, you can always readjust values upwards.

Should I Target a Risk of Ruin of 0?

Naturally, the question of whether one should target a Risk of Ruin of 0 is generally answered yes.

That being said, the true answer is, it depends.

The Risk of Ruin formula calculates ruin as the inability to come back.

Though mathematicians sometimes go overboard.

In most cases bankruptcy, or financial ruin, is not equivalent to death. If a young investor with $1000 loses everything it is most likely not the end of the world.

After all, they still can get a job at McDonalds.

In fact, risking .01% randomly on a $1000 account may be far worse for that young investor.

They have used the opportunity cost of their time with nothing to show for it.

Conversely a long-term investor nearing retirement should most definitely have a Risk of Ruin of 0.

They are dependent on the money they have saved in their career and have no interest or will not be physically able to work any longer.

In fact, the Risk of Ruin for this investor might be as low as losing 25% of their account.

Naturally, individual preferences also come into play here.

Perhaps I am a younger investor but cannot stomach the slightest possibility of going broke.

In that case giving up returns for a piece of mind makes sense.

Yet it is important to remember without risk there are no returns.

Equally said the opposite gambling type mentality will leave a trader in ruin before they know it.

While in the long run under betting is bad, overbetting is deadly.

How to Take Control of Your Own Risk

At this point it might seem disparaging to realize the amount of luck that goes into investing.

Yet there are many ways to reduce your risk aside from simply betting smaller.

These strategies reduce your risk of ruin far more than the formula will predict.

The first is to vary your bet sizing based on your edge, instead of simply having a set bet size for every trade.

Define your edge and bet accordingly.

Taking bigger risks for some trades may seem like a risk seeking action, yet it is exactly the opposite as if payoffs and probabilities increase, risk of ruin decreases.

The second is if you are losing, bet smaller.

This is the opposite of what many investors do. Doubling down or betting more, vastly increases the risk of ruin.

By betting smaller it may take you longer to recover from a drawdown, but at least you will recover.

Lastly placing diversified trades.

If one trades success is correlated to another trades failure, then a lot of each trades risk has been hedged off. Conversely placing 100 short straddles on all the Nasdaq’s components may seem diversified though in reality it is simply one bet on the Nasdaq itself.

Concluding Remarks

Measuring the risk of a catastrophic drawdown is important. It may seem better to keep these things out of sight and out of mind.

Unfortunately, ignorance is only bliss for so long in the stock market.

Using Risk to Ruin can give a probability of a worst-case scenario and provide guidance as to when risk is too high or too low.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.