There is one thing in common about successful traders, they manage their trading as a business.

This requires a level of seriousness and discipline that the average retail trader does not have.

This article will outline the importance of setting goals, understanding costs, and evaluating performance.

Contents

- How Much Money Do I Need to Start Trading for A Living?

- What Are Realistic Levels of Returns?

- What is My Realistic Level of Return?

- Costs

- Picking The Right Brokerage

- Having The Right Data

- Miscellaneous Costs And Poor Execution

- Know Your Competition

- Who Is the Competition?

- If I Don’t Have A Trading Business, What Would I Do Instead?

- Your Business May Fail

- Your Business May Succeed

Does It Make Sense to Trade?

When trading as a business there is one key metric we need to consider:

(Total Capital x Expected Returns) – Costs > Alternative Work Net Income

How Much Money Do I Need to Start Trading for A Living?

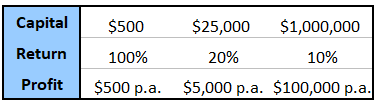

One of the most common questions people have is the minimum amount of capital one needs to start trading for a living. It is easy to open brokerages accounts with as little as a few hundred dollars.

Despite this it is impossible to generate enough returns to live on this account size for a day, let alone a year.

An account with $500 and a return of 100% annually, would still put an individual in extreme poverty in Somalia, let alone the United States.

Despite that with an account of $1,000,000 achieving a modest 10% annually provides 200 times the return of the smaller account making 100%.

This illustrates that while anyone can trade having access to capital makes trading as a business a lot more feasible.

What Are Realistic Levels of Returns?

A business that has a lot of capital but loses or fails to make money is not going anywhere.

If I buy hats for $50 and sell them for $40, I am a poor businessman. The same goes for trading.

Over 90% of investors fail to beat the index over long periods of time. While this may be discouraging, remember the same statistics are true for all entrepreneurs.

For every Shark Tank success story there are a hundred failed vegan fusion restaurants.

Trading, like entrepreneurship, has a lot of potential convexity, but it is not without its risk.

Taking average long run index returns of 7% can be a starting point.

If you are not confident in beating these returns the best decision for your business is passive investing and working another job.

This allows you to save while increasing your capital.

What Is My Realistic Level Of Return?

Establishing your own expected return is done by taking your investing performance and comparing that to a benchmark.

A long stock portfolio that went up by 20% may sound great until you realize that in the same year the index went up 30%.

To measure a realistic level of return one needs to have either a long track record or a clear understanding of the risks and rewards of your investments.

One of the biggest failures of individuals is underestimating how much luck goes into life let alone investing.

Simply because you got lucky and have had excess returns that does not mean you have any advantage in your investing method.

This is in the same way that a roulette player can win money but still have no edge over the casino.

Being able to state out clearly why you are generating the returns you are is an important part of managing expectations and defining risks.

The most dangerous trait of an investor is perceived skill.

Costs

Workstation Costs

A deceiving thing presented to new traders is that a workstation must be overly complicated.

A quick search for traders’ workstations will show pictures such as below.

Source: Investors Underground

Last time I checked the number of screens you have doesn’t have any correlation to how much money you make…

So why does everyone have all these screens?

You will notice the photos that come up are from the same guys flashing pictures of them sitting in a rented Lamborghini on their social media.

The goal from this “promoter” is to simply convince the investor that because of this complex set up they are smart. Have you been fooled?

As a caveat there are some professionals who need many screens though these are likely mainly market makers who are streaming multiple quotes and have an operator running them.

If you think you can compete in the high frequency game, think twice.

I will bet on the multimillion-dollar company with cables wired directly to the exchange before you in your parents’ basement anytime.

So, What Do You Need?

A laptop that works and is functional. Perhaps a second screen if you would like. A desk and a comfortable chair. That’s it!

The most important thing is you have a clean comfortable place away from distractions that can allow you to work efficiently.

Any additional expenses in your workstation are a cost that reduces the profitability of your business, so should be evaluated as such.

Simplicity is key.

The amazing thing about a simple set up is you can trade from almost anywhere.

Though I do not recommend bringing your workstation to a beach.

Source: The Lazy Investor

Picking the Right Brokerage

Choosing the right brokerage is another important decision in how you run your business. Commissions and transaction costs are part of the business, but the goal should be to have these as low as possible.

While a small commission of a few dollars may seem negligible, over the course of a year, it adds up.

>

This can flip a trading strategy from being profitable to one that loses money. While commissions should be kept as low as possible there is a caveat.

Picking a commission free broker may actually leave you worse off.

This is because the broker will simply sell your order flow.

Ironically, your resulting fill prices may be worse than simply paying the small commission in the first place.

If you don’t pay for the product, you are the product.

Another important thing for your broker to have is a professional reputation.

Asking yourself questions such as does this broker have frequent outages? What are the products and services offered that I could trade?

A few times an amazing trade comes up and one of my friends lacks permissions or the brokers ability to trade on that instrument.

That is an opportunity cost.

Overall choosing a brokerage with a complicated and unappealing user interface is often better than one with flashy bells and confetti.

To recommend a few choosing Interactive Brokers or TD Ameritrade are reasonable brokers while something like Robinhood should be avoided.

Though it is important for each investor to do their own due diligence to find the best broker for them based on their trading style and business.

Having the Right Data

Having access to data is another crucial part of your business.

Back before computers, investors would read the morning newspaper to get updates on their stocks.

Imagine the advantage if you could get access to the ticker tape at the exchange!

Nowadays a lot of the data has been democratized.

Hence getting things such as real time quotes and some analytics is generally available somewhere for free.

Nevertheless, it is often still subpar to paid data sources.

There is a reason why professionals pay over $30,000 for a Bloomberg terminal.

Hint…it’s not for the fancy keyboard!

Give a monkey a Bloomberg Terminal and it’s still a monkey.

Paying for data you gain no benefit from is like paying for a gym membership if you never go.

Added costs and reduced profitability of the business ensue.

Simple Conclusion. Pay for data if you cannot get it free if the added value exceeds its costs.

Miscellaneous Costs and Poor Execution

It would be nice to perform every investing decision perfectly as per a set out business plan. Unfortunately, in trading things get in the way.

Holding positions that didn’t work out to avoid a loss and changing variables to suit one’s emotional needs are a few examples of how a strategy can be poorly executed.

Even if one is diligent with their rules there is always the issue of fat fingered trades and mistakes.

These are purely unintentional, simply like a restaurant waitress spilling a drink. If most businesses have a section for accidental slippage, you should consider it to.

On a personal level it is always very annoying when these types of mistakes happen.

Yet by acknowledging they are part of the business and will happen in the future you may not be as hard on yourself, after all you are not a robot.

Know Your Competition

Trading is a competition not a test.

Gone are the days of a good job sticker for trying on top of your preschool art project.

The market does not care about fairness of profits, and it is unforgiving.

While this may seem unappealing it is no different than any other entrepreneurial business.

Imagine I want to sell custom made hats.

After selling a few to some friends, I placed an order for a thousand hats to be produced from a low-cost factory in China.

The hats arrived and it turns out I can’t sell them.

Everyone is already selling custom hats on Etsy and my friends were just pitying me by buying a few.

The money’s gone and all I have to show for it is a garage full of UV protection.

So, who is my competition?

Who Is the Competition?

Some of the world’s smartest people are involved in the financial markets.

They have access to better data and resources to you. Some might even have insider information.

They are sophisticated.

Often, they have degrees in mathematics or financial engineering.

They are faster than you.

They might work at market making firms such as Virtu or Susquehanna which make profit on almost 99% of all trading days.

If this sounds daunting, it should be.

Yet there are some distinct advantages you have in your retail business.

Firstly, while these firms have better tools, they also have more costs.

Data costs, insurance, Manhattan offices and six figure associate salaries to pay out.

These are substantial and can cause many funds to fail.

Another issue comes about because of their capital size.

Now you may be thinking, I thought you said the more capital the better right? Well, the irony is that capital can work as a double-edged sword.

Once funds grow large enough beating the market becomes increasingly difficult.

For example, a retail investor buying a hundred shares of Apple has virtually no market impact.

Contrast that to a fund buying a million shares, they are going to pay a price…

Now let’s imagine that the fund wants to buy the same amount of a small cap like Microvision.

Not going to happen.

The first slice of the pizza is always the best.

If I Don’t Have a Trading Business, what would I do Instead?

A key aspect of any successful trader is making the optimal decision with the highest positive expected value.

Naturally, even if one makes profits while trading it comes at an opportunity cost. That cost is time.

For a full-time trader, that time could be viewed as the potential earnings accrued in job one is qualified for.

That may be flipping Big Mac’s at McDonalds or as a top lawyer, it varies on your personal skills.

By taking one’s potential income, we can create a fair value for their time.

If trading will learn less than that value, then maybe it’s important to keep your day job.

Obviously making the decision comes down to more than purely economic reasons.

Perhaps you would enjoy trading more than flipping burgers, I know I would.

Hence using a calculation like net utility would make more sense.

Taking the best decision for you can be unique.

Maybe you work a full-time job while trading on the side.

Perhaps you realize you do not want to take it that seriously but enjoy the thrill as a hobby.

It is all about making the best decision for you while considering all the alternatives.

Your Business May Fail

In trading understanding variance is part of the game.

If you can’t deal with prolonged drawdowns, you are playing the wrong game.

There are freak events that happen that cause severe dislocation of prices. There are also long periods of time where strategies that should pay off simply do not work.

For example, if you invested in the Japanese stock market Nikkei in 1985 you would still be down today.

These events should be at best prepared for, although at the end of the day we must live so that they may happen, and our business could ultimately be unsuccessful.

No risk, no reward.

Your Business May Succeed

The amazing thing about the market is it does not care where you came from.

You could be a Harvard graduate, high school dropout, black, white, overweight, autistic, or a social reject.

None of these things have anything to do with being profitable in your trading business.

While the path is hard with the right resources, attitude, and the desire to continue to learn incredible things can happen.

One thing, no matter the journey, it will all be on your own terms.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

So True!

Great, well written article, Gavin!

Thanks Gert.

This, and many other articles, in your web site show you are a real trader, sharing your real and valuable experience (just as important as your know how or more).

If I was a beginner I will not hesitate to take you as my mentor and reference point. It will save me years of learning curve and thousands of market tuition.

I suppose in the following paragraph “learn” has to be replaced by “earn” (a minimal and insignificant typo):

“If trading will learn less than that value, then maybe it’s important to keep your day job.”

In a sea of delusional marketers, you are a rare pearl

Warm regards.

Thanks, much appreciated.

“One of the biggest failures of individuals is underestimating how much luck goes into life, let alone investing.”

“The most dangerous trait of an investor is perceived skill.”

These are great truths.