Today, we are doing an Option Alpha review, a website and education platform dedicated to teaching investors how to trade options in a way that generates consistent income.

Contents

About Option Alpha and the Founder

OptionAlpha.com is a website and education platform dedicated to teaching individual investors how to trade options in a way that generates consistent income.

The founder of Option Alpha is named Kirk Du Plessis and has a background in investment banking at Deutsche Bank and as a REIT analyst with BB&T before co-founding a hedge fund.

They boast a subscriber list over 200,000 people which isn’t very surprising given the amount of content that they offer for free.

Option Alpha offers a large number of courses and instructional videos for free and only charge fees when you want access to their specific trading strategy, forums, coaches, etc.

They also have two custom-built tools for backtesting and strategy optimizing that can be purchased for a one time licensing fee.

Outside of their website, they also have a Twitter account (@OptionAlpha) that has a large following (for FinTwit).

They actively post links to blog articles, answer questions from followers, and post charts of tickers that they’re watching.

They also have a weekly podcast and a regularly updated YouTube channel complete with instructional trading videos.

What’s Offered?

Option Alpha offers a lot of content and fortunately for new traders, the best parts of it are free.

You’ll be able to sign up for the free service to gain access to the online courses and save your money for other subscription services or educational material!

If you upgrade your status to Pro or Elite, you’ll gain access to specific trade strategies and other information–more on that below.

Option Alpha offers 185 different instructional videos in 12 different categories.

The categories that they offer videos in are Options Basics, Entries and Exits, Options Expiration, Bullish Strategies, Neutral Strategies, Bearish Strategies, Portfolio Management, Pricing and Volatility, Trade Adjustments, and Professional Trading.

You can purchase access to these tools for a one-time licensing fee of $497.Additionally, they have custom software for backtesting strategies and analyzing potential trades.

We Prefer OptionNet Explorer For Backtesting

The backtesting is interesting but I would be interested to know what makes theirs different or better than any others. Personally, I prefer Option Net Explorer.

There is a demo version on the website and the interface is certainly nice however since it’s a one-time fee and not a subscription, there’s no opportunity to cancel if it’s not working well for you.

The Trade Optimizer is a similar offer and comes with the Backtester for the $497.

The interface is very clean and simplifies the often complicated process of identifying trade opportunities that match your market outlook.

If you’re considering purchasing the license to use this software, it might be worthwhile to message Option Alpha and ask if you can sample full access to these tools before you pay.

It doesn’t have to be a month-long trial but you definitely want to work with the tools a bit before you pay the $497.

They say explicitly on their pricing page that they do not offer trials on their monthly memberships because they offer so much quality content for free.

That’s true–they offer a ton for free!

But they don’t specify about the licensed software so this is worth looking in to.

Is It Worth It?

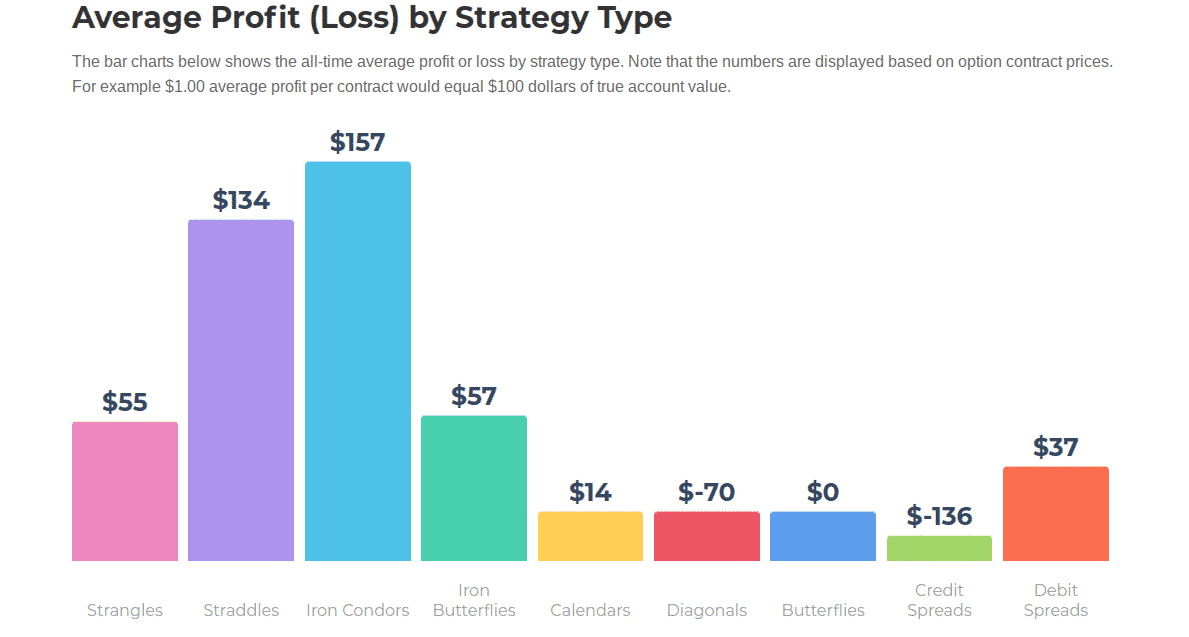

Option Alpha emphasizes transparency and has a page on its website dedicated to showing and explaining their performance record.

At the time of this writing, they are advertising that they win 74.3% of the time.

The average profit on a winning trade is $187 and the average loss on a losing trade is $437.

This roughly means that on four trades, you can expect to win three and lose one.

Your wins will bring you $561 ($187 x 3) and your one loss will cost you $437.

Therefore, your net on the action would be $124.

It’s not clear what risk/reward requirements they have in place but in almost any case we can conclude that the average loss is too high.

The win rate is impressive but because the losses are not small, the risk of a large drawdown or account blowup is too high.

If you’re going to trade along with Option Alpha, keep this in mind, be cautious, and make sure that you’re managing your bankroll properly.

If you’re losing one out of every four trades and that one loss is wiping out almost 80% of what

Option Alpha Review

you made on the other three trades, it won’t take a very long time to go on a bad run and drawdown your account.

4 Tips for Better Iron Condor Trading

Also, keep that they are likely trading with a much larger account than you will be.

This is really important because as was mentioned before, the losses are relatively high and a smaller account is particularly vulnerable to a strategy like that.

Similar in concept to a Martingale strategy at the roulette wheel.

With a theoretically infinite bankroll, it’s a winning strategy–but with a small bankroll, you’ll quickly go bust as the losses add up.

That said, the best value that you can get out of Option Alpha will likely be the educational videos, which are free!

The guided courses are really informative and great introductions to trading options.

As stated before, a 75% win rate is really impressive so even though their strategy might be too risky to follow along trade-for-trade, you will surely learn something from the free courses.

Beyond that, there are two pricing tiers–$99 per month and $299 per month.

The $99 tier gets you access to their daily trades and the forum while the more expensive tier gets you access to exclusive coaching sessions, small group conference calls, etc.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Hi Gav, thanks for this review. They recently did a demo of their new Autotrading Platform, and was wondering if you might have seen and have any thoughts on that. Cost to sign up for a lifetime membership and usage of the platform is currently at $1,997. Below is a YouTube link, would be insightful to hear what u think 🙂 have a great week!

https://m.youtube.com/watch?feature=youtu.be&t=35&v=mEnf2JZHbq8

I’m a paid lifetime member of Option Alpha and wish I could get my money back.

tldr: 1) the bots and YOUR strategy are being used by them for their profit, 2) the strategy they teach underperforms the market.

Their education they offer is honestly good, if you’re new to options and looking to learn more about neutral credit selling strategies. However…

1) The neutral credit selling strategies touted by Option Alpha are garbage. They refuse to talk about the CAGR of the strategies, but they do publish the win/loss stats of each strategy for the life of the account they teach with. You have to make a few assumptions, but you can calculate that the CAGR over 5 years is between 2% and 4% BEFORE commissions and fees. When you factor in that their system requires many small trades, those commissions/fees add up and dramatically decrease CAGR further. It’s an awful lot of work to underperform buy and hold.

But that’s not my main complaint!

They declare, completely publicly, but buried in Terms of Service Agreement document, that any trade logic you program into their bots that you’ve paid to use, becomes their property and that they can use or sell that trade logic. WTF! So, if you’ve done the work to find a market inefficiency that does well, and you code the logic to trade it into their bot (or backtester) they can use that strategy logic for their own gains. Guess what: nearly any market inefficiency, once exploited by a large enough player(s), ceases to be an inefficiency. The trade that reliably makes a few thousand a month for you will quickly get wiped out by them or whoever they are selling data to.

That’s BS for a service that I AM PAYING to use, to sell MY work (I do the discovery, work out the logic of the trade, and code it into the bot) for profit by others.

Option Alpha is one of the most dishonest rackets I’ve come across. I’d expect a free service to sell my data, just like your “free” broker does. But not if I’ve paid a hefty price to use their software.

Wow, that’s amazing. Thanks for sharing your experience.

The educational videos are worth watching, they complement

whatever you learn elsewhere.

Has for the actual worth of the service itself, its very risky at best.

Wins $ are small and losses high, one would be better off just selling covered call’s..

Thanks for sharing your experience.