Today I want to walk you through a VXX options strategy that I’ve been using recently that has worked quite well.

If you need a refresher on trading vxx options, you should read this first.

VXX has the tendency to explode higher when market volatility spikes, but when the market is in a normal contango situation, then VXX tends to just slowly drift lower.

The strategy I’ve been using is a diagonal put spread that has zero risk on the upside and a nice profit zone on the downside.

Before we start, it’s important to remember that just because something has worked in the past, doesn’t mean it will continue to work in the future.

Let’s get in to the details.

Trade Setup

For this diagonal put spread trade I like to sell an out-of-the-money put with delta around 25-30.

Then I go out either 2 weeks or 4 weeks and buy a put for around the same value of slightly less than the put I sold.

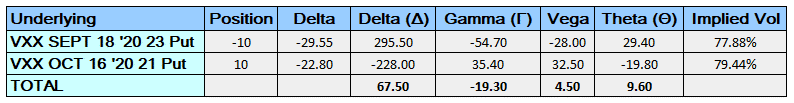

Here’s an example:

Trade Date: August 12, 2020

Current Price: 25.46

Trade Details:

Sell 10 VXX Sept 18th, 23 puts @ $1.31 (delta 29)

Buy 10 VXX Oct 16th, 21 puts @ $1.30 (delta 23)

Premium: $10 net credit

Max Loss: +$10 on the upside and -$1,990 on the downside

Max Gain: Estimated at $1,090

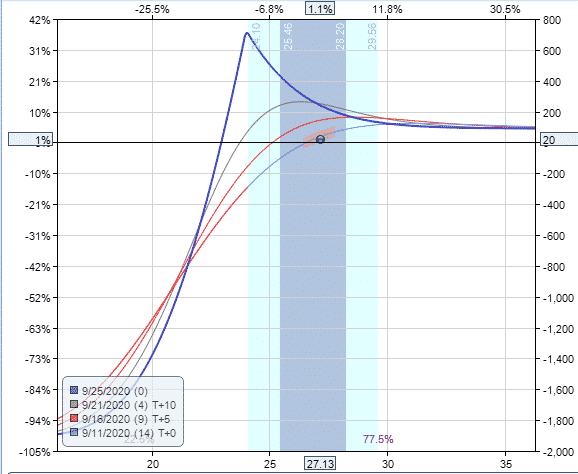

You can see above that the trade starts as a long delta trade, but that can switch to negative delta later in the trade if VXX is well above the short strike.

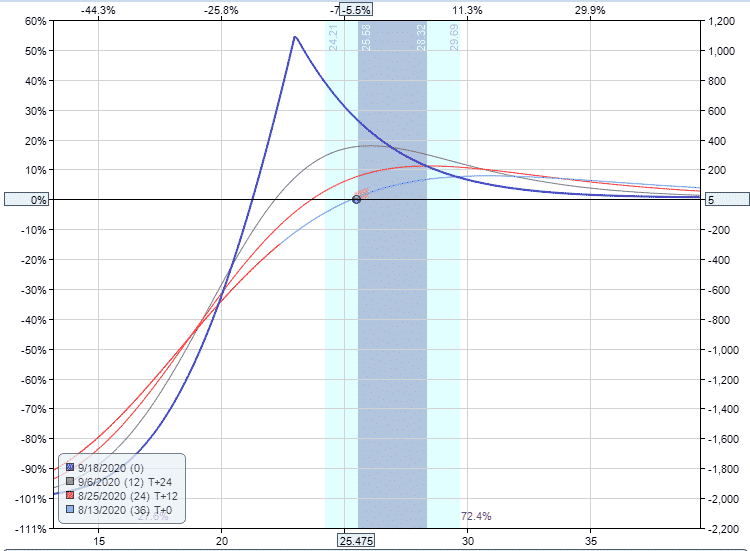

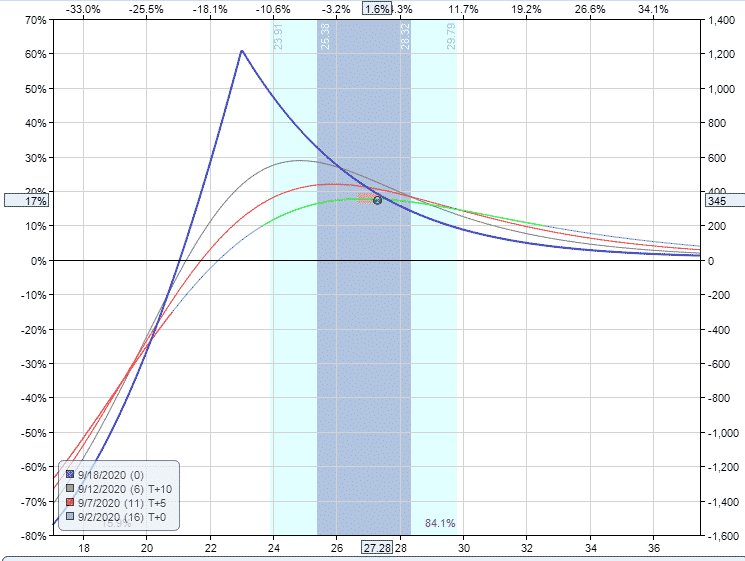

Looking at the payoff diagram, notice that there is absolutely no risk on the upside.

The worst that can happen is that both puts expire worthless and we keep the $10 premium received.

Also, take a look at the interim payoff lines. The T+24 line shows a healthy profit zone for anything above 22, which is a roughly 18% decline for the current price.

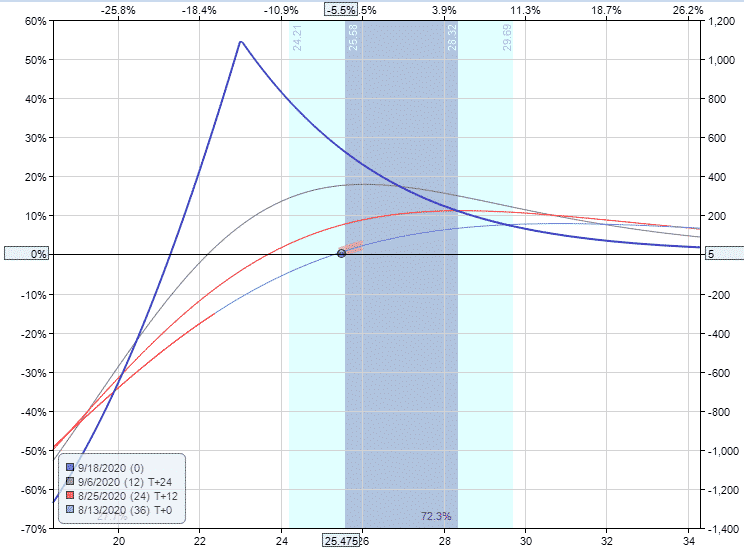

Here’s a zoomed in version.

The good thing with a diagonal put spread on VXX is that even if the market is quiet, VXX will tend to drop quite slowly (provided we haven’t entered after a large implied volatility spike).

This gives you plenty of time to exit the trade without too much damage if VXX gets down towards the short strike.

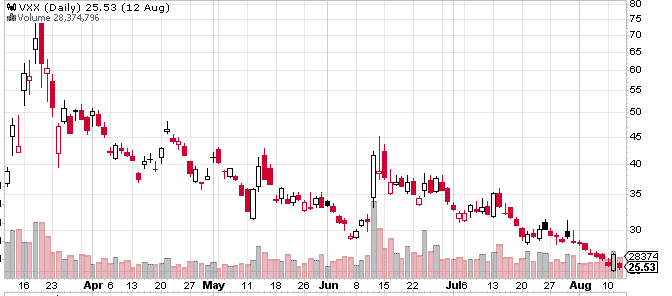

Below is the VXX chart from that date. I was pretty confident that it wasn’t going to drop too sharply as it had already been declining for a few months.

The key is not to enter a diagonal put spread after a big spike when VXX could potentially drop quickly as the market returns to normal.

After a spike in VXX, I prefer to buy long-term puts or trade a poor man’s covered put (the opposite of a poor man’s covered call).

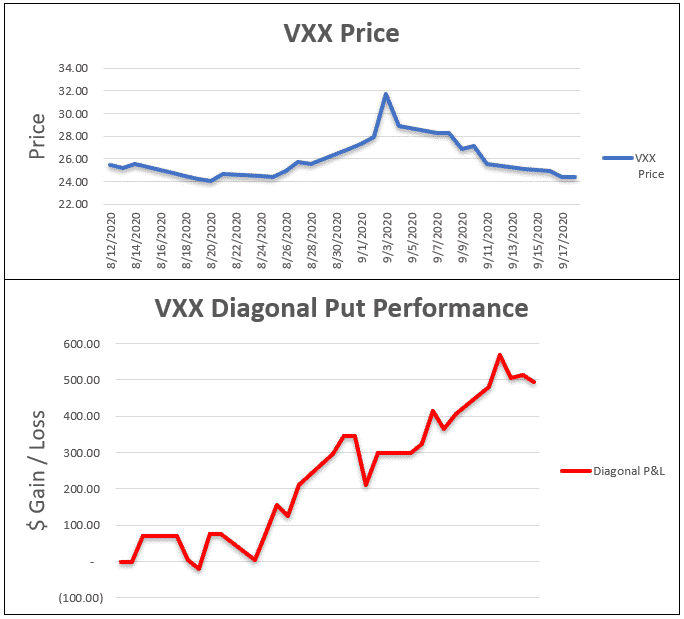

Let’s see how the trade progressed. As of September first the trade was up $345, here’s how it looked.

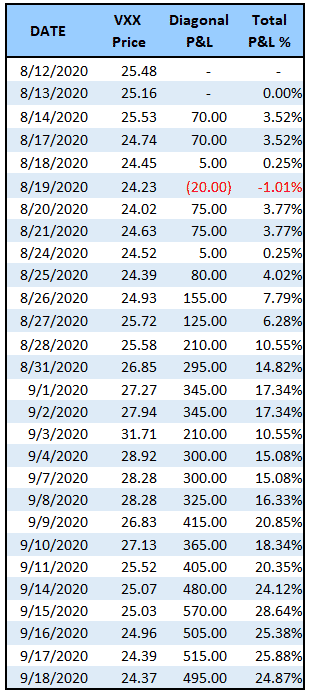

Below is a full list of the dates and P&L until expiry.

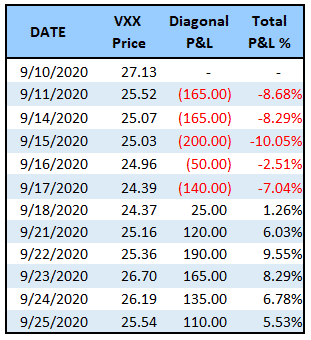

Let’s take a look at the next example. This one was a little different in that it was a shorter duration trade and also utilized weekly options.

The delta on this one was slightly further out at 21 and the credit received was a bit higher, so the profit in the event of a move up was larger.

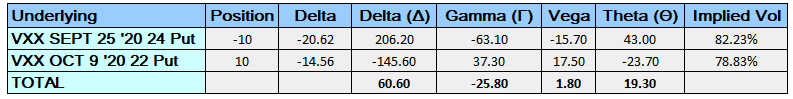

Trade Date: September 10, 2020

Current Price: 257.13

Trade Details:

Sell 10 VXX Sept 25th, 24 puts @ $0.66 (delta 21)

Buy 10 VXX Oct 9th, 22 puts @ $0.57 (delta 15)

Premium: $100 net credit

Max Loss: +$100 on the upside and -$1,900 on the downside

Max Gain: Estimated at $710

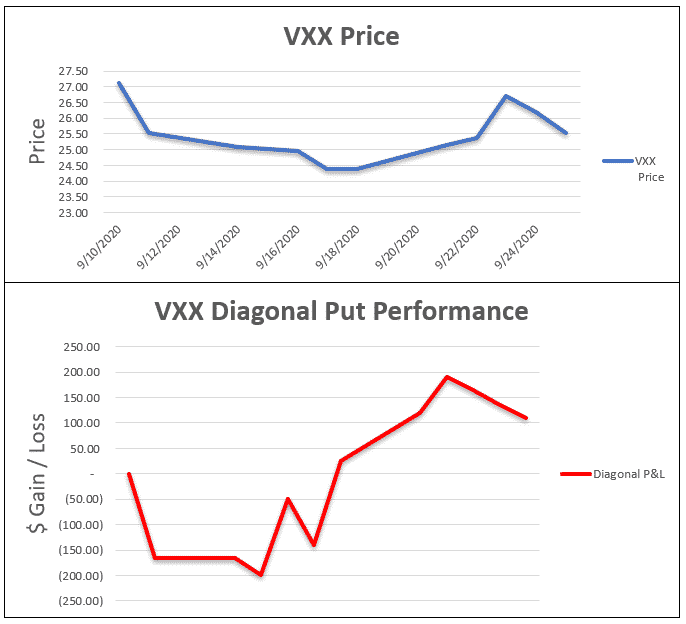

This trade started off under a bit of pressure with VXX dropping pretty quickly, but it never broke through the short strike.

Here’s the P&L details:

With this VXX option strategy, I would set a stop loss of around 20% OR if VXX breaks through the short strike.

Profit target is 10-15% otherwise hold to expiration of the front option.

This should help to minimize any big losses.

Also, remember that just because something has worked in the past, doesn’t mean it will continue to work in the future.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

What strategy can we do with vxx before the élections ? Thanks

I’m still looking at the same strategy, but will probably close everything out 2-3 days before the election and wait until 2-3 days after to open new ones.

Hi Gavin,

Just read this, and I actually recently put VXX Diagonal Put Spreads on, and scaling up to experiment as follows:

VXX Underlying Price: 22

a) Short Puts

-2 VXX Oct23’20 -23.5 PUT ~12 days

-1 VXX Nov20’20 -23 PUT ~ 40 days

b) LEAPS

+2 VXX Jun18’21 23 PUT ~250 days ~$6.56,

+1 VXX Jun18’21 24 PUT ~250 days ~$7.23

Just this past week, IV on SPX dropped., I had to roll the Short Legs Down and Out (Would you rather roll Down and out or, just roll out keep the intrinsic value in the

Short Legs, even though the short option has slightly less theta decay due to being ITM?). I am keeping track the trades and adjustments in Excel (pulling trade logs from IB) for these campaigns.

My Puts became ITM this past week and the Gamma is quite high with the 12 day at -12.3 Gamma. Correct me if I am wrong, once a Short Put or Call option is touched / and breached to 100-150% of the price you sold it for, is it a bit late to adjust the option itself or adjust with using stock to delta hedge it?

What else adjustments would be appropriate? Short Iron Butterflies on the challenged strike?

1) On the short put side, I am experimenting with selling 4-5 DTE, 10-14 DTE, 18-21 DTE, 28 DTE, and actually started with 45-60 DTE to lower the gamma risk.

I’m not sure if it makes sense to do such a short 4-5 DTE due to gamma risk, or be a bit more conservative and work with 21-28 DTE but, try adjust/rolling to either take profit, to recharge the short put (and possibly adjust the strike if needed if it gets touched/breached)?

Initially, they would be entered ideally if the VXX has settled and aiming for 25-30 Delta and aiming for 35-50 cent depreciation per week. I have yet to do build out a Excel calculator to roughly model to determine profit projection – Would you recommend OptionNetExplorer to help with modeling (I only have IB at to moment)?

2) On the LEAP Side, I am looking at farther out (270 days $5-$7 slightly OTM) the reason being lower theta decay rate and sort of an insurance leg. and trying to enter if the VXX spikes up but should be okay to setup in order to keep scaling in

3) I read your articles on delta hedging, would it make sense to bother to short VXX to adjust on a daily/weekly basis? I’m thinking other ways would be just to add more LEAP Puts or also include the Naked Put Sell but with the Delta to neutralize – but this may not be as efficient as just adding/subtracting VXX shares

4) Thoughts on covering the upside with a PMCC / Calendar / Diagonal Spread (i.e. Buy OTM Long Call at 30, and sell 30 or 30+) or would this be not as good as VXX moves fast and breach to the upside. Would a better option structure for the Upside be to just do Long Call Debit Spreads or Long Calls (and sell Put Credit Spreads to finance it?)

Appreciate any of your thoughts and comment on improvements?

It depends how quickly the underlying hits the short strike, if it happens early in the trade it’s harder to adjust compared to later in the trade. But yes, you want to close if it breaks through the short strike.

1) Yes, I highly recommend Option Net Explorer.

3) Interesting question, haven’t tried delta hedging with shares on VXX and sometimes there are restrictions on short selling so it’s something that I would need to research a bit more.

4) I wouldn’t want to have any trade with big risk on the upside, because when this thing moves, it really moves.

Hi Gavin,

Thanks for the reply

1) Even though VXX is slow trending down, it seems to make more sense to avoid gamma risk in general and aim at 30-45 DTE like in your first experiment for a smoother P&L and less potential adjustments (roll out / down) than a 14 DTE , and <7 DTE.

But it sounds like it's not a hard & fast rule and depends on market conditions, and it would deserve some comparisons.

2) After thinking further in regards to 2) in use of LEAP vs your strategy of structuring this for a credit / little capital cost up front (buy a month behind as the insurance leg), it seems like this is more capital efficient and if VXX goes up, it won't be as big of a draw down as the LEAP Put (unless you hedge upside with calls)

Hi Gavin,

I see there is a SL, but I miss a PT here. Is that on purpose? Normally you take 10% profit take of amount risk, right?

10-15% otherwise hold to expiration of the front option.

Brilliant strategy, very creative…I like that it’s tailored to the underlying product’s characteristics (slow grind down with sudden, sharp spikes). I’ve noticed that when I try to implement the strategy today (early May 2021), the “tent” is lower relative to the 2 case studies you presented i.e. lower risk-reward profile. Is this because vol has come in since the US election? Any ideas how to make the payoff profile more attractive e.g. different strikes/expiries/underlyings (eg VIX options)?

Hi Denis, sorry for the delay in responding. Yes, partly it’s because volatility was lower around that time. Vol is up a bit now so should look a bit better. You can also try the trade with slightly longer-dated options.

I am trading VXX options also. I do not like Calendars or Diagonals in this ETN due to sudden volatility spikes that could happen. I am trading mostly Verticals with more advanced technics as well as butterflies (unbalanced or not, depending on IV levels). Also, be aware that buying longer term Puts when there is a VXX spike is a bit tricky due to high options IV due to that effect.

This was very interesting. I am a novice options trader, with limited experience selling options either hoping they expire worthless, rolling them out, or wheeling them. Needless to say, your strategy here is much more complicated than that. Let me see if I have this straight (using rough numbers and dates in your example for clarity):

– Sell VXX 10 contracts, strike=23 ~30 days out – receiving $1310 credit

– Buying VXX 10 contracts, strike 21.5 ~45 days out – paying $1300 debit

– You end up with $10 in your hand right now.

The *goal* here is that that first short put expires worthless. And then at that time, the long put your purchased will hopefully have a ~similar value, and you can sell that for that same $1300 amount netting you a profit of $1300. That is what you want to happen, right? And the value of that long put is going to depend on the price of the underlying. If it spikes up a ton, that put is going to be almost worthless, which is undesirable, but you still can’t lose any money on the upside. The best case is if the underlying gets riiiiight to the price of the short put’s strike price; that equals maximum value of the long put ….. Am I understanding this correctly?

It seems if you wanted to make a profit $1300, you *could* just sell the short put and hope it expires worthless. However, that, of course exposes you to downside risk in the unlikely event that VXX craters. So, you purchase the long put as an insurance policy. And, presuming VXX decays at the expected rate, the long put really shouldn’t change in value all that much, allowing you to sell this insurance policy for ~roughly what you purchased it for in the beginning. The profit that you’re making is really coming from the theta decay/expiration of that short put.

Yep, you got it.

Why not do this strategy but with call credit spreads? Seems like a more definite win since the vxx is in a perpetual downward drift.

Yeah, worth a try. Main issue is the all the risk is on the upside and when it moves higher, it moves higher very quickly.

Would this work with a calendar spread instead of a diagonal put spread?

Yes and no. You will have risk on the upside if vol spikes, but not too much. Limited to the debit paid.