Today, we continue our discussion on the Parabolic SAR Trading Strategy.

In the previous article, we showed how to use the Parabolic SAR indicator.

This article shows how we can apply a strategy to trade the S&P 500 Index (SPX) using this indicator.

Contents

Backtest Results

In the previous article, we showed how to use the Parabolic SAR indicator.

This article shows how we can apply a strategy to trade the S&P 500 Index (SPX) using this indicator.

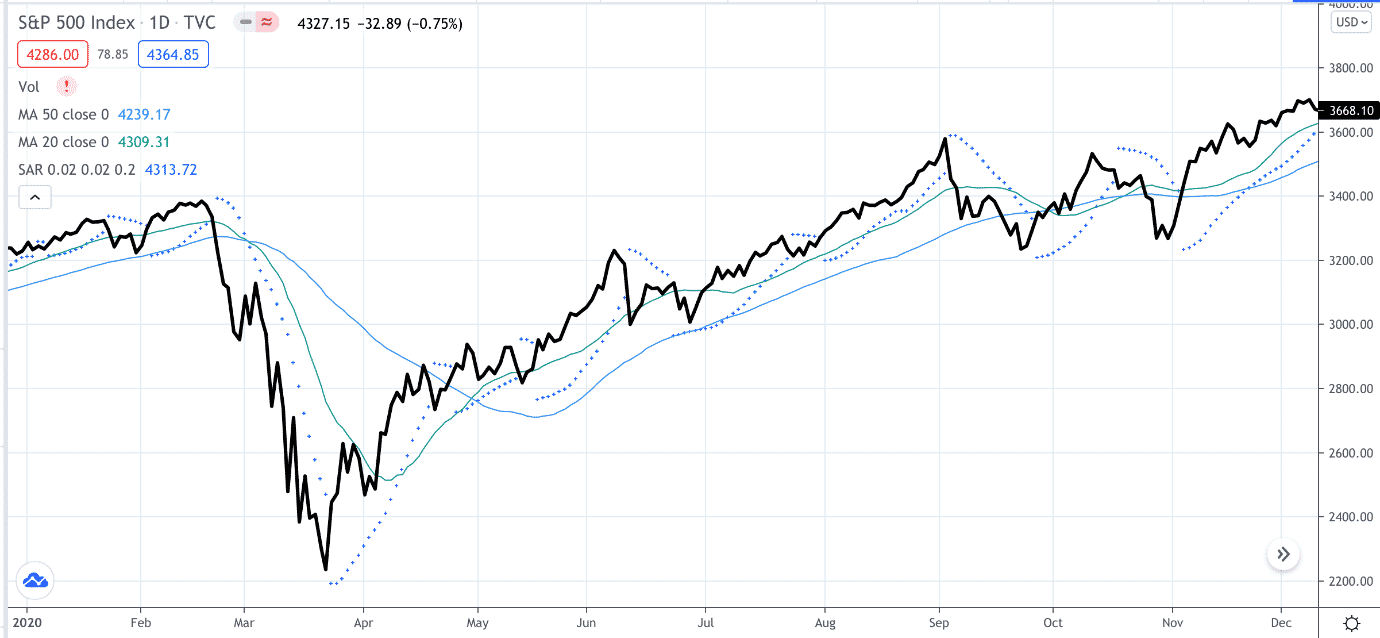

Recall that the PSAR gives a bullish signal if the dots switch from above the price to below the price.

Since we only want to take these signals when the price is trending, we will use the rule of taking bullish trades only if the price is above the upward sloping 50-day moving average and if the 20-day moving average is above the 50-day moving average.

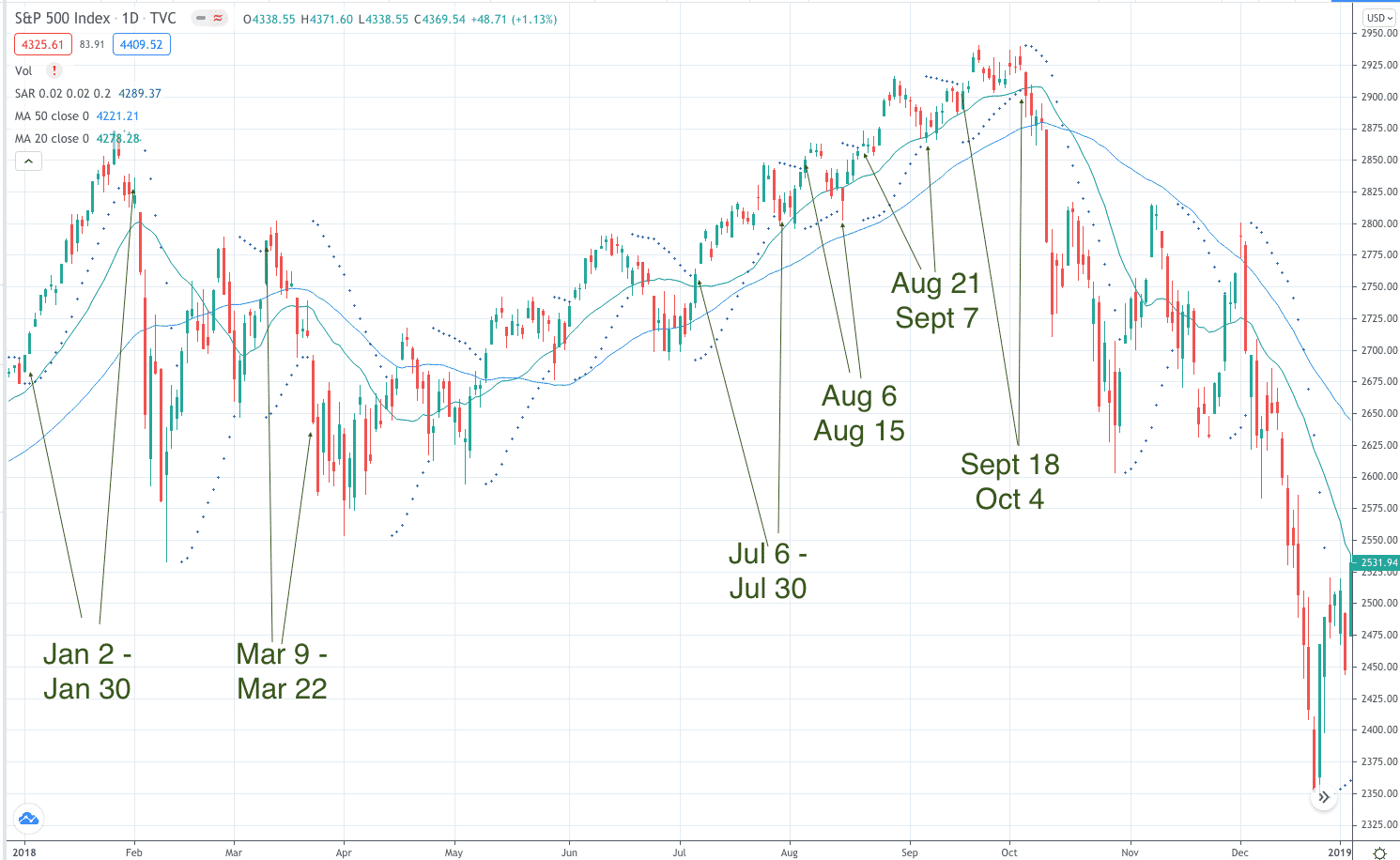

SPX Year 2018

Starting with the bearish year of 2018, the PSAR indicator gave us six bullish trades, as shown where the green line is the 20-day moving average and the blue line is the 50-day moving average.

Some bullish PSAR signals were not entered because the 50-day moving average was not sloping up or because the price was not above the 50-day moving average.

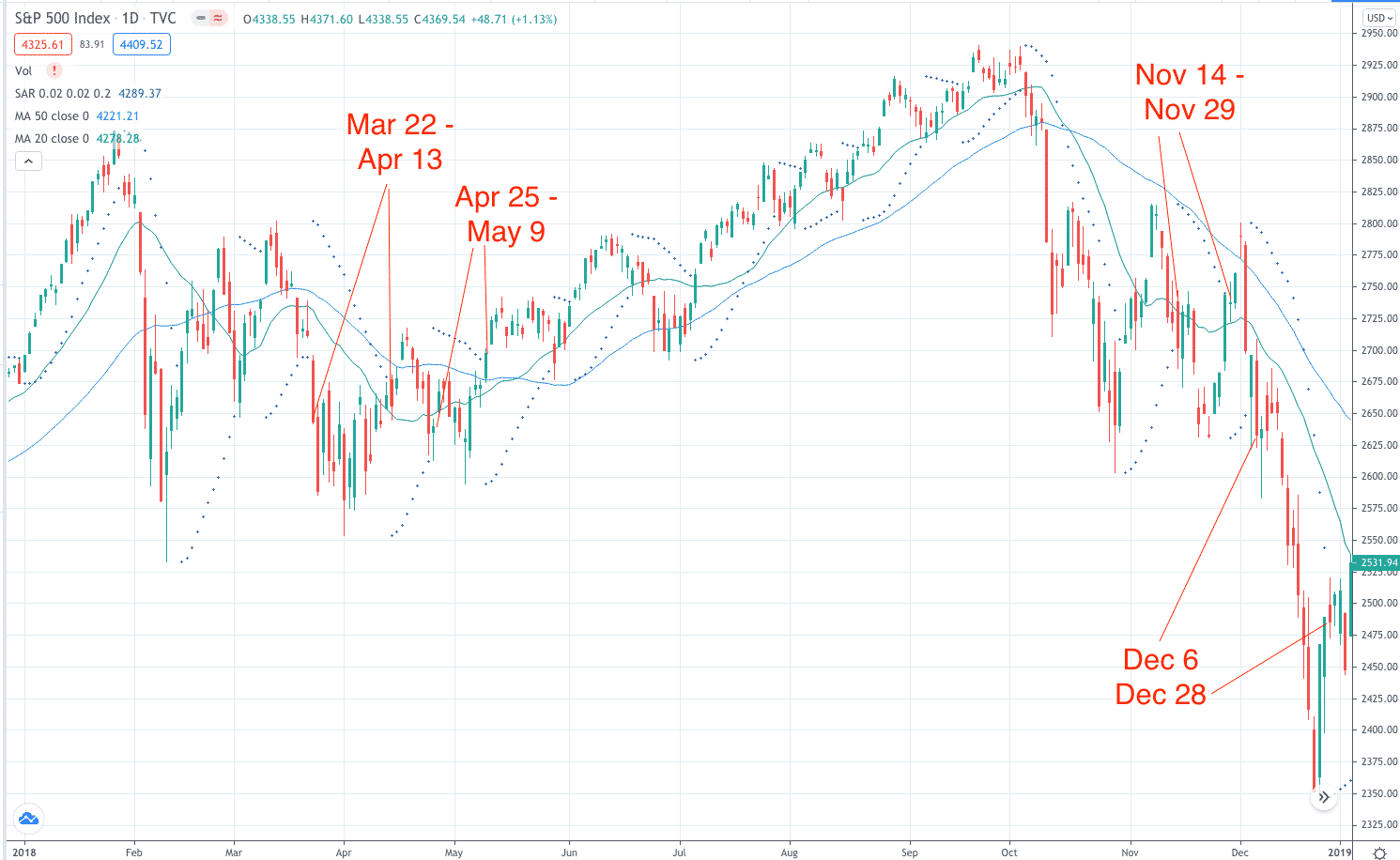

Similarly, we take PSAR bearish signals if the price is below a downward sloping 50-day moving average and if the 20-day moving average is below the 50-day moving average.

The year 2018 gave us four bearish trades.

We will use bull put spreads for bullish trades and will use bear call spreads for bearish trades.

We locate the short strikes at the PSAR dot.

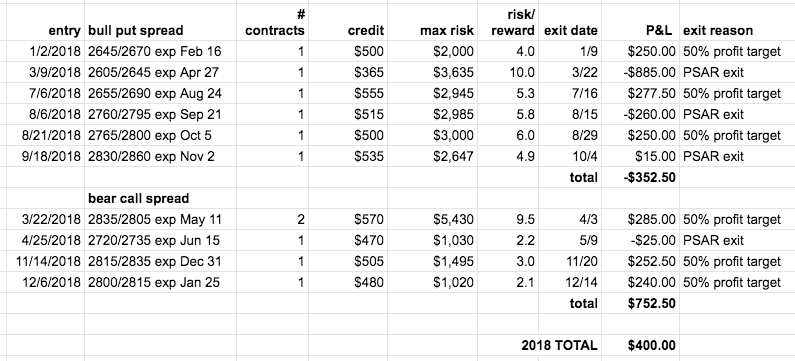

Trading the strategy on both the bullish and bearish sides, we get an overall profit/loss (P&L) of positive $400.

Results

The spread width was adjusted to collect an initial credit of around $500 but never let the risk-to-reward ratio of the trade exceed 10.

The days to expiration on the spreads are at least 45 days.

We followed our usual rule of taking profits at 50% of the initial credit received for the spread for this backtest.

Our exit rule is to exit whenever the PSAR signals us to (assuming that we had not taken profits already).

If we are still in the trade with less than 21 days until expiration, we exit the trade for whatever profits or losses we have.

We are using end-of-day data in OptionNet Explorer.

Because the year 2018 was a bearish year with the S&P 500 dropping in price by 6.6% for the year, it is not surprising that the bear calls spreads were making the bulk of the profits with a positive $752.50.

The bull put spreads lost a total of $352.50.

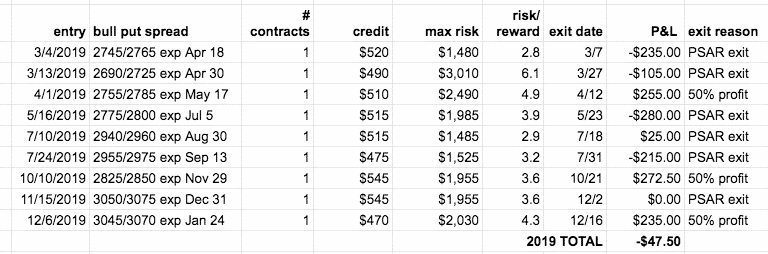

SPX Year 2019

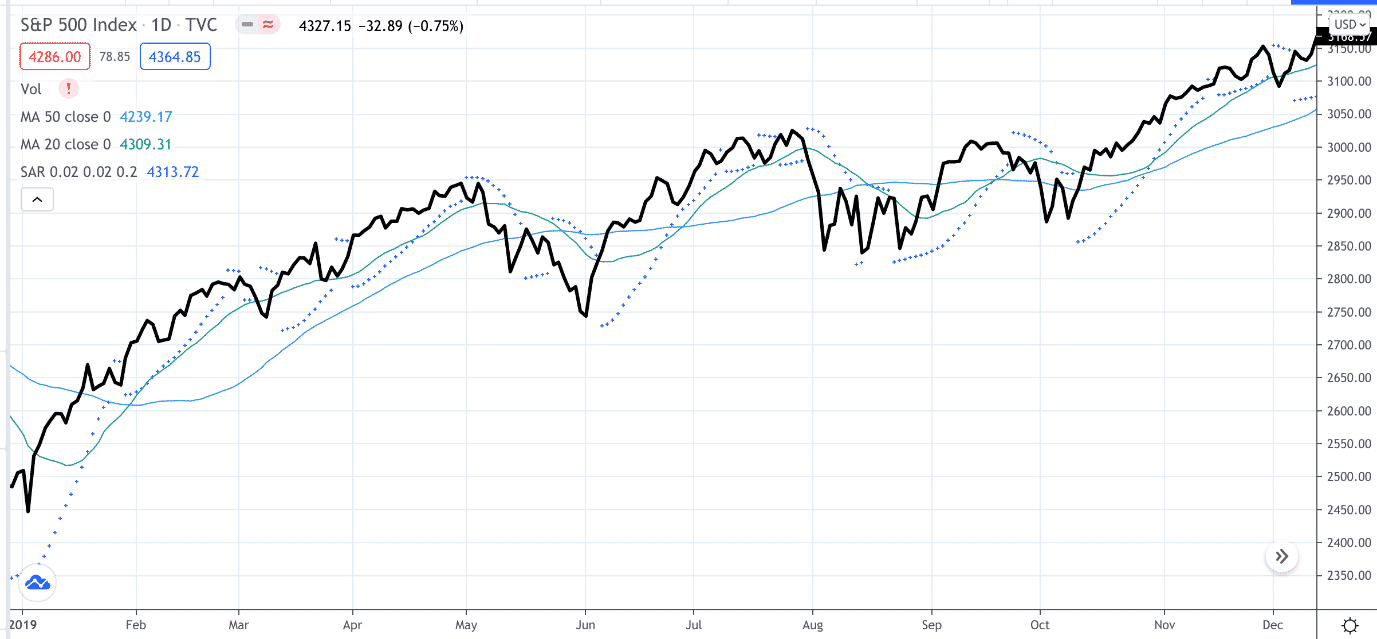

Let’s see the year 2019, which is a bullish year.

In this case, our moving averages rule prevented us from taking any of the bearish PSAR signals. We are left with the following nine bullish trades.

The backtest ended the year with a slight loss of $47.50.

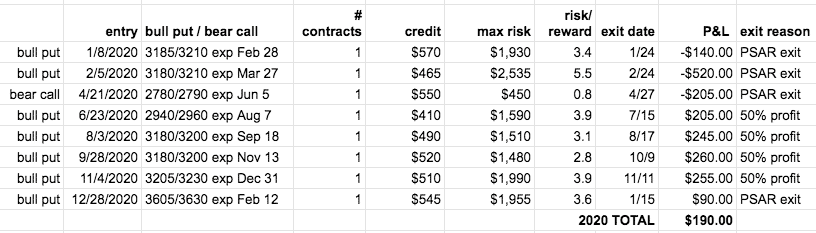

SPX Year 2020

The year 2020 was overall another bullish year.

The results of seven bullish trades and one bearish trade were a positive $190.

Conclusion

The net result of the 27 backtested trades on SPX for the three years is a positive $542.50.

There were 16 wins, 10 losses, and one breakeven.

This is primarily using one contract.

You can scale up at your discretion, of course.

You can use the PSAR on other indices and equities to increase the number of signal occurrences.

Keep in mind that we did not use any adjustment techniques for the credit spreads, such as how to recover from credit spreads that had gone bad.

If we had, we probably could have gotten some of the losses back to breakeven.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.