This article will delve into the world of “options income trading,” a specific category of options trading.

This type of trading aims to generate consistent income, regardless of whether the market is rising, falling, or moving sideways.

Options income trading involves option strategies that aim to generate profits or income from the passage of time while minimizing any price or volatility risks.

Unlike directional trading, options income trading does not rely on the underlying asset’s price movement to make money.

In fact, income strategies are designed to perform best when the underlying asset’s price remains stagnant.

Being non-directional allows income strategies to make money in both bearish and bullish markets.

Contents

Benefits Options Income Trading

Let’s face it; unless a trader becomes really good at reading price action and market direction, it is difficult to correctly pick the direction of the price movement of an underlying.

This is because there is a lot of randomness in the short-term movement of a stock.

One of the benefits of options income trading is that we do not need to pick the direction correctly.

This is why options income strategies are also known as non-directional or delta-neutral strategies.

Delta is a Greek in options theory that tells us the directionality of a position.

A delta with a positive number means that the position will make money as the price of the underlying goes up. And it will lose money if the price of the underlying goes down.

The larger this number is, the more the position will make or lose for each point move in the underlying.

A positive delta is a bullish position.

If the delta is a negative number, it means that the position will make money as the price of the underlying goes down.

It will lose money if the price of the underlying goes up.

A negative delta is a bearish position.

Regardless of the sign of delta, the larger the magnitude of delta, the more directional the trade is.

Most option income traders prefer not to have to pick a direction.

So they want to make the options structure have a delta close to zero.

While one can be direction-agnostic in options income trading, one can also apply a little subjectivity and bias the trade slightly in one direction or another if they so choose.

Drawbacks of Option Income Trading

The drawback of option income trading is that you do not get the big wins that directional traders will sometimes get.

Since option income trading relies on the passage of time in order to make money, this income comes in slowly. I should not say slowly.

It comes in at the normal rate. But this rate may be slower than what some traders would like.

Hence, it will test the patience of these traders.

I get it. There are many days when the trader is sitting on his or her hands. Watching the P&L of the trade is like watching paint dry – especially for some of the longer DTE (days to expiration) trades.

When you take away price risk, getting delta to zero, and by having longer DTEs, you also take away the quick wins.

Because income-style trading does not give you that big win, it often will not give you that big loss either.

Hence, the equity curve over time is less volatile (less up and down) and typically does not experience as big of a drawdown as directional trades.

Which Is Better?

There is no better. It depends on your trading style.

There are successful directional traders.

And there are successful option income traders.

Some traders are directional in individual trades.

But by having equal numbers of bearish and bullish trades, they maintain a non-directional portfolio.

What Underlying?

Option income traders like to trade on large indices such as the SPX (S&P 500 index) and the RUT (Russell 2000 index).

The corresponding ETFs, which are the SPY and IWM, can be used for learning or small account sizes. However, a larger amount of commission will start to eat into some of the profits.

The indices are used because they are diversified with many stocks so that price movement is moderated and does not make out-sized large moves that individual stocks can.

They are not subjected to earnings announcements and other event risks that can move the price around.

What Are Some Option Income Trading Strategies?

We are going to show you some option income trading strategies with their corresponding Greeks.

The main characteristic of option income strategy is that they all have positive theta. All of them use the passage of time to make money.

The trade’s P&L increases with time because the value of individual options decreases with time. The options income trader is a net seller of options and benefits from this.

They like to sell options, collect the premium, and buy back the option when they have decayed in value.

This is why these strategies are sometimes also referred to as positive theta or positive theta trading.

Most option income strategies are non-directional. And hence you will see that their delta’s are close to zero.

Iron Condor

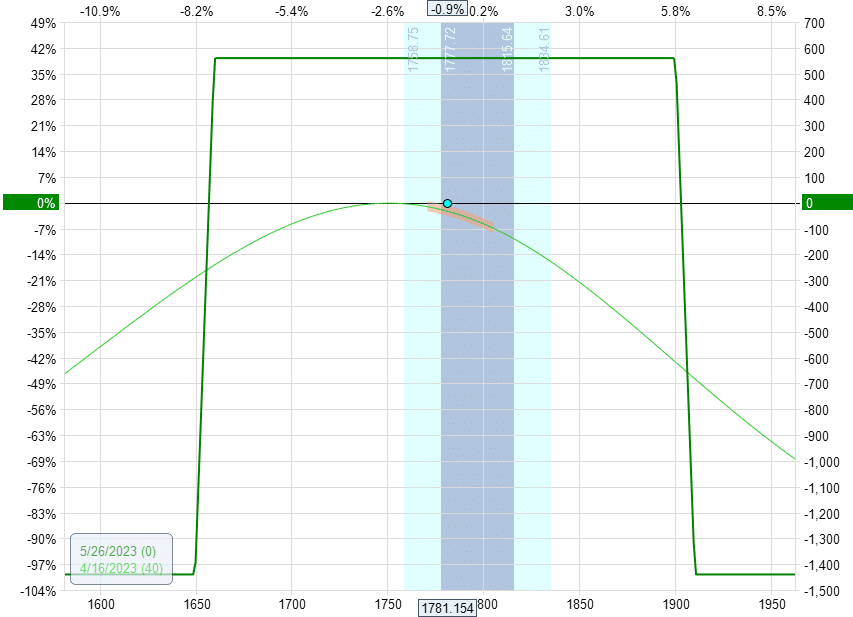

The classic option income trading strategy is the iron condor consisting of selling a bullish put credit spread and selling a bearish call credit spread in opposing directions.

Here is an example of an iron condor on the RUT.

Date: April 14, 2023

Price: RUT @ 1781

Buy two May 26 RUT 1650 put

Sell two May 26 RUT 1660 put

Sell two May 26 RUT 1900 call

Buy two May 26 RUT 1910 call

Source: OptionNet Explorer

Delta: -2.01

Theta: 11.41

Vega: -45.71

These graphs and Greeks are modeled with OptionNet Explorer.

The blue dot is where the price is currently.

So you can see that the two credit spreads are about equidistant from the current price.

Butterfly

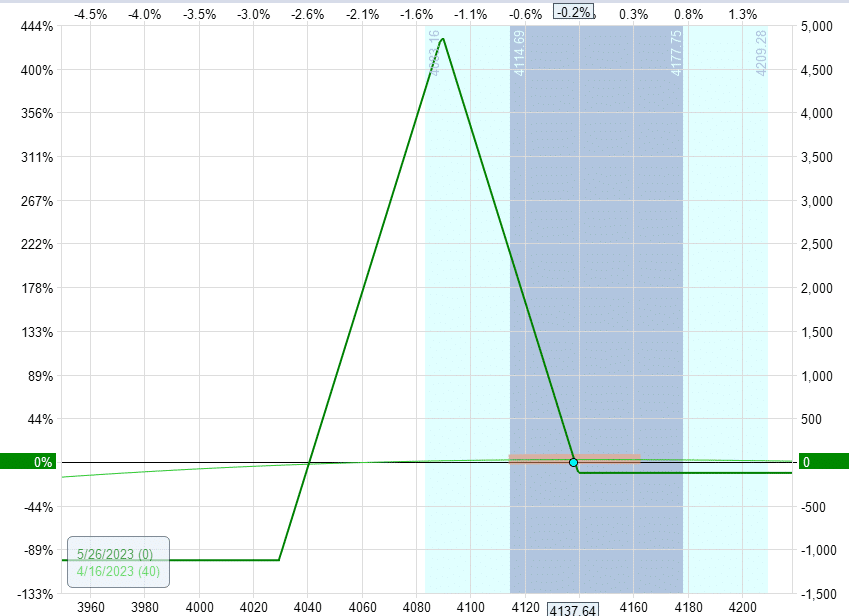

An option income butterfly is typically centered at the money or below the money.

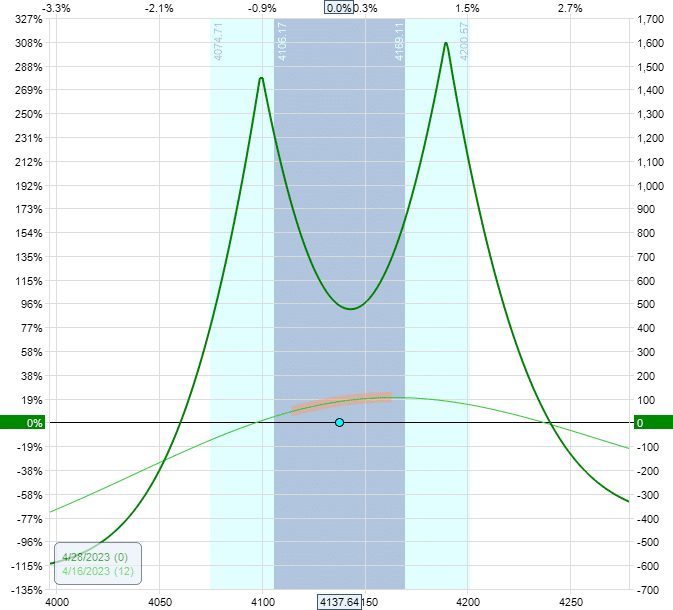

Here is an at-the-money butterfly with asymmetrical wings in order to bring the delta closer to zero.

Date: April 14, 2023

Price: SPX @ 4137

Buy one May 26 SPX 4070 put

Sell two May 26 SPX 4140 put

Buy one May 26 SPX 4200 put

Delta: 0.12

Theta: 7.64

Vega: -46.83

Or the butterfly can be centered below the money like this:

Date: April 14, 2023

Price: SPX @ 4137

Buy one May 26 SPX 4030 put

Sell two May 26 SPX 4090 put

Buy one May 26 SPX 4140 put

Delta: 0.06

Theta: 5.19

Vega: -27.18

The trader just needs to adjust the wing widths accordingly to neutralize the delta.

A perfect butterfly centered at the money would naturally have too much negative delta due to the put-call skew and hence would not be suitable for a non-directional income style trade unless an additional option is added.

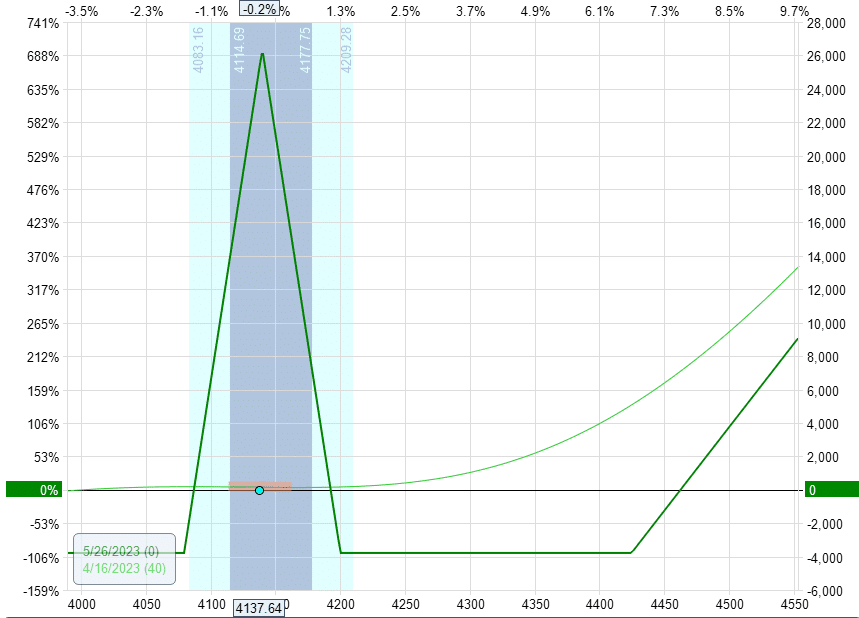

If a symmetrical butterfly is used, an out-of-the-money call option is added to balance the negative delta.

Such as in this case here:

Date: April 14, 2023

Price: SPX @ 4137

Buy five May 26 SPX 4080 put

Sell ten May 26 SPX 4140 put

Buy five May 26 SPX 4200 put

Buy one May 26 SPX 4425 call

Delta: -1.20

Theta: 10.65

Vega: -25.66

John Locke’s M3 strategy is also a symmetrical butterfly but uses a deep in-the-money long call instead of an out-of-money call.

Other income-style butterflies include the M3.4u, the A14, the Rhino, the Road Trip Trade, and many others.

Calendars

Non-directional income trading strategies can be either positive vega or negative vega.

The iron condors and butterflies have negative vega, which means that they benefit from a drop in implied volatility.

Now we will look at income trading strategies that have positive vega.

These are the calendars and double calendars.

They are known as time spreads because they have options expiring on different cycles.

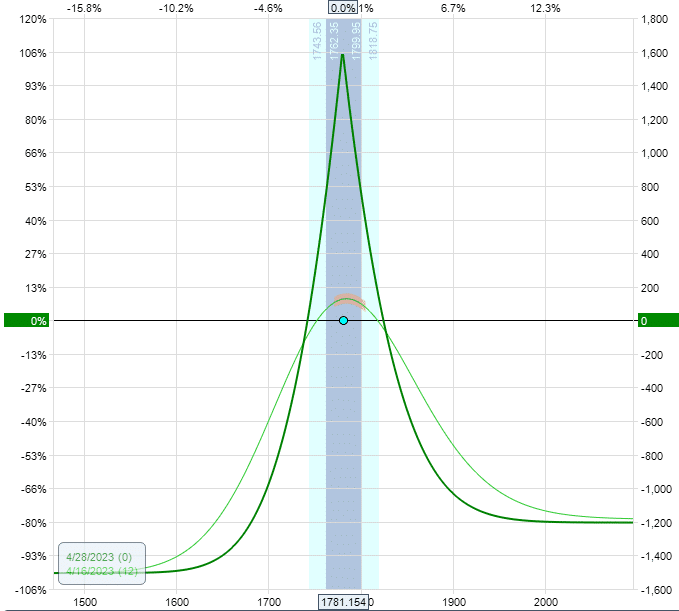

Here is an example of a two-week calendar on RUT where the front short option is two weeks till expiration and the back long option is one month away.

Date: April 14, 2023

Price: RUT @ 1781

Sell one April 28 RUT 1780 call

Buy one May 12 RUT 1780 call

Delta: 0.74

Theta: 25.37

Vega: 60.25

Next is an example of a double calendar on the SPX.

Date: April 14, 2023

Price: SPX @ 413

Sell one April 28 SPX 4100 put

Buy one May 1st SPX 4100 put

Sell one April 28 SPX 4190 call

Buy one May 1st SPX 4190 call

Delta: 1.25

Theta: 32.89

Vega: 73.61

Variations of these are the double diagonals.

Can Option Income Trading Be Directional?

Yes. Some people will consider credit spread an income style trading because they have positive theta.

They are selling options.

And they are benefiting from option decay and the passage of time.

When they initiate the credit spread, far out-of-the-money, the directional delta is fairly small anyways.

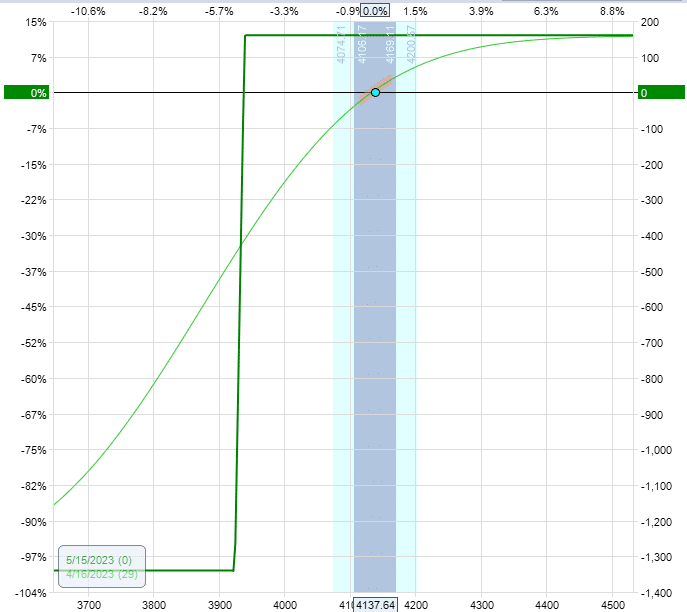

Here is an example of a bull put credit spread with the shorts at around 15 delta out-of-the-money.

Date: April 14, 2023

Price: SPX @ 4137

Buy one May 15 SPX 3925 put

Sell one May 15 SPX 3940 put

Delta: 1.25

Theta: 3.12

Vega: -16.14

Its delta is only 1.25, which is not that much, even though the steepness of the T+0 line makes it look more directional.

Admittedly, the theta/delta ratio is lower than the other strategies that we have seen.

So the directional delta does play a larger role in this trade.

How To Manage Option Income Strategies?

The key to this option income trading style is managing the directional delta.

Secondly, it is to manage vega – the volatility effects.

And while at the same time keeping theta as high as reasonable.

When the delta becomes too large, either in the negative or positive direction, the trader will adjust the trade to reduce the delta.

Many traders like to reduce the delta by 50%.

They fear that if they reduce it too much, the market will whipsaw change direction again, and then they will have to adjust again.

There is a danger in option income strategies where the trader over-adjusts or adjusts too soon or too frequently.

Every adjustment has a cost in terms of slippage and commissions.

Slippage is the less favorable price when the adjustment order is filled due to market forces preventing the order from filling at the expected price.

If there are too many adjustments, the slow income that is generated by theta may not be enough to overcome this cost – especially in shorter-term trades where there is not much time left.

Hence, many traders will lower profit expectations when they see that the trade has already experienced a number of adjustments.

There are two kinds of non-directional option income traders.

It is said jokingly: those that adjust too much and those that adjust too little.

Adjusting too late is also a problem. Because the trade has gone too far, the loss is already too large, and the adjustment is less effective.

When to adjust is quite important in options income trading.

It becomes an art that gets better with practice. And we shall end with that.

We hope you enjoyed this article about options income trading.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.