The A14 Weekly Option Strategy is the name of an income-generating non-directional options strategy created by Amy Meissner.

It was named after the Autobahn 14 motorway in Germany, where drivers can drive at unlimited speeds (in certain sections).

It is short-term in nature with only 14 days to expiration — hence the name A14.

The strategy aims to make money quickly. So it is a bit more aggressive than the longer terms trades.

With this, it also comes with the risk of a large price move that can hurt the trade.

The plan is to have many more wins to offset losses caused by outlier moves.

Although the trade is not meant to be held to expiration, it is in the high gamma zone of being within two weeks of expiration.

The average number of days in the trade is eight calendar days.

Contents

About the Strategy

The detailed rules of the strategy are only available by purchasing the recorded A14 Weekly Options Strategy Workshop at Aeromir.

This workshop is taught by Amy using prepared slides, running through example trades in OptionNet Explorer, and answering live student questions.

It contains several hours of videos spread across perhaps three or so classes.

Traders can learn a lot about the basics of the strategy through a couple of public YouTube videos.

The first is Amy’s introductory video of her strategy.

And the other is her performance update on the strategy.

We can see that the trade is a delta-neutral broken-wing butterfly with short strikes placed below the money.

It is applied to the SPX index on Friday mornings with 14 days till expiration.

Amy mentions that she just puts one on every week without really needing to worry about the VIX level or what direction the market is moving.

In other words, this is a campaign-style trade meant to be initiated on a regular basis instead of an opportunistic trade.

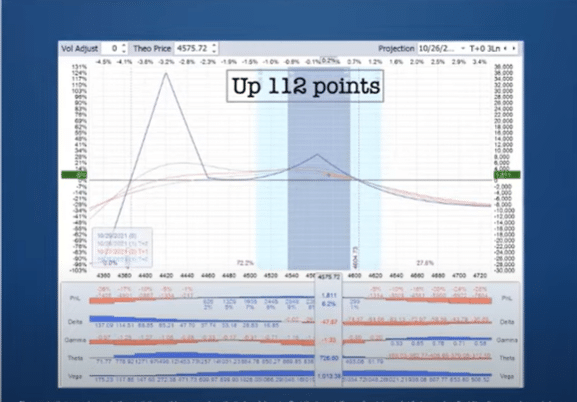

While the exact details of how to perform adjustments or what triggers the adjustment is reserved for members of the class, we can see on the YouTube video that the post-adjusted expiration risk graph contains curved lines.

source: YouTube video

This is a tell-tale sign that options of different expirations are being used.

Her adjustment on both the upside and downside probably consists of calendars or diagonals (otherwise known as time spreads).

If this is true, then this is a very interesting trade indeed.

Because not only are the butterflies and time spreads hedging each other in directional delta, but they are hedging each other in vega (or changes in volatility).

As you know, a butterfly is a short vega trade that benefits when volatility decreases.

Calendars are long vega that benefits when volatility goes up.

Insights

The public videos include her spontaneous responses to webinar attendees’ questions, which can reveal good information.

One interesting tidbit is that she said that she sometimes stress tests the strategy in her live account but does not recommend that other people do that.

I would agree, at least not in a live account.

However, it might be a worthwhile exercise to do in a backtesting paper account scenario.

That is an interesting concept. It means pushing the trade further than what the rules would allow.

For a trader to really understand what the optimal point to take profits or exit for a loss, the trader must see what is before the optimal point and what is past the optimal.

To know how close to expiration you can go before it becomes too dangerous, you need to go beyond the safe zone to know, “Oops, I’ve gone too far,” and to know what dangerous means.

What is dangerous to one trader might not be dangerous to another.

FAQs

What tool was used in her backtesting of the A14 strategy?

Amy uses OptionNet Explorer to manually backtest the strategy using historical intraday options prices.

Perhaps, the term back-trade might be a more appropriate term.

She also uses OptionNet Explorer to track her live trades using the “live data” feature to pull real-time data from other brokerage software.

What is the minimum account size needed for the A14 strategy?

The minimum size is a two-lot butterfly traded on the SPX.

That’s two butterflies in a single trade.

That would take up about $5000 to $8000 of margin. By using two-lot, you can make “half-adjustments.”

That is to use one of the two-lot to adjust.

In order to have some buffer, an account size of $10,000 is advised to comfortably trade the strategy.

So an A14 is suitable for small accounts (if you consider anything under $25,000 to be a small account).

How much of the portfolio can be used for the strategy?

Amy uses about half of her account in margin for the trades.

With added adjustments, that might go up to two-thirds of her account.

What is the performance of the A14 strategy?

It is always tough to answer performance results questions because the results of any strategy are highly dependent on the market conditions of the time being traded as well as the skills of the trader.

You can see Amy’s performance statistics from trading the A14 from January 2021 thru November 2021 on the Aeromir site. It shows a net profit of 115% return in 11 months.

Basically, she doubled her $50,000 account in less than a year.

The equity curve looks quite smooth and consistent, with only a small drawdown.

Given 15 months, she tripled her account by using compounding.

In the intro YouTube video mentioned above, she showed her Tastyworks brokers statement that she made 229% net profit over the last 15 months from September 2020 to November 2021.

If you look at the chart of SPX during that period, it was essentially a bull run which makes trading easier because most of the loss in the A14 strategy comes from a bad down move in the market.

What I want to see is the stats in a down market like the year 2022.

In a future post, I’ll share with you a backtest of a student of that year. Keeping in mind that backtest results may not be indicative of live trading results, it was a 73% return on $25,000 of planned capital for the year 2022.

Can I get the same returns if I learn the rules?

Perhaps.

However, in order to achieve the same returns, you need a good amount of practice with initiating the various adjustments over a wide variety of market conditions.

And that takes work and time.

There is more to trading than just learning the rules.

The rules may not cover all the possible nuanced situations that the market may throw at you.

It depends on how consistently you can follow the rules when the psychology of trading a large sum of money is involved.

The rules still leave some traders’ choices as to when exactly to take profit and how exactly to perform the adjustment.

Your performance can vary depending on how you decide on these choices.

Remember that Amy is an experienced trader with decades of worth of knowledge.

She traded variations of this strategy on her own before she finalized the rules for the A14.

She also back-traded the strategy using historical data before running the live trading data seen in 2021.

Is there an alert service for the A14 options strategy?

As of current writing, there is no alert service.

Only the recorded workshop.

Can the A14 be traded on the RUT?

No, not using the same rules.

The rules for the A14 are designed for SPX with the wing sizes and positioning as specified.

The RUT value is not close enough to the SPX value that you can apply the same rules.

You can conceptually use the same basic principles of the strategy on RUT with modified rules.

However, she mentioned that she tried it and did not like trading the A14 on the RUT.

The RUT is composed of small-cap stocks, which may cause it to be more volatile.

In contrast, SPX consists of 500 large companies.

How is the A14 different from the Rhino?

The A14 and Rhino look quite similar in that they both utilize broken-wing butterflies in combination with calendars.

However, the main difference is that the A14 is a short-term 14-days-to-expiration (DTE) trade, whereas the Rhino starts with 78 DTE.

As such, the Rhino has more complex scaling in rules and can have long stretches of time where you don’t need to do anything.

With the A14, you have to keep your hands on the wheel and be prepared to make adjustments nearly every day.

In addition, the A14 is designed for the SPX, and the Rhino is designed for the RUT.

Conclusion

The A14 allows drivers to press the pedal to the metal and drive at unlimited speeds.

This allows the expert driver to get from point A to point B in the fastest possible time.

However, we all know what happens if we drive too fast for our skill level.

Drive safely.

We hope you enjoyed this article on the A14 weekly option strategy.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Could you please give me an example of the A14 option strategy using SPX Just for educational purposes but I would like to learn. Thanks

Ok, I will post one soon. Keep an eye out for it.

229% gain form real account ?

did you try this as well ? how was yours performance