Today we are talking about the Boxcar option strategy developed by Dan Harvey, who is also the creator of the Road Trip trade.

The Boxcar option strategy is not to be confused with the box spread, which is something else that we will not go into now.

Contents

Introduction

The best publicly available YouTube video that describes the guidelines of the Boxcar strategy can be found posted on Aeromir’s trade alert service page.

The video is presented by Tom Nunamaker, who runs Aeromir’s alert service for the Boxcar strategy, with commentary from Dan.

The strategy can be done on the SPX or RUT indices.

Or it can even be done with ES futures options and stock options.

As Dan mentions, the Boxcar performance on stocks will not be as good and will have lower win rates.

The Boxcar is a short-term trade starting with eight or nine days to expiration but is usually closed within a few days.

Trade usually starts on a Thursday or Friday for the following Friday’s expiration.

For SPX, they say to always use the PM-settled weekly options instead of the regular monthly options.

Because the expiration is not far out in time, the trade has low sensitivity to volatility. In other words, the position vega of the options structure is small compared to its theta.

Selling premium and theta decay is the primary driver of these kinds of trades.

You probably have seen the value decay curve where the value of an option drops off quickly as it approaches expiration and decays the fastest during the last day of expiration.

This is a bit of an oversimplification because the rate of decay also depends on whether you are talking about in-the-money, out-of-the-money, or at-the-money strikes.

Nevertheless, this is the prevailing belief

Trade Setup

The strategy consists of some put credit spreads, and one put debit spread.

But it is not a butterfly.

The two spreads do not share the same strikes.

The credit spreads and the debit spread are unequal in the number of contracts and have different widths.

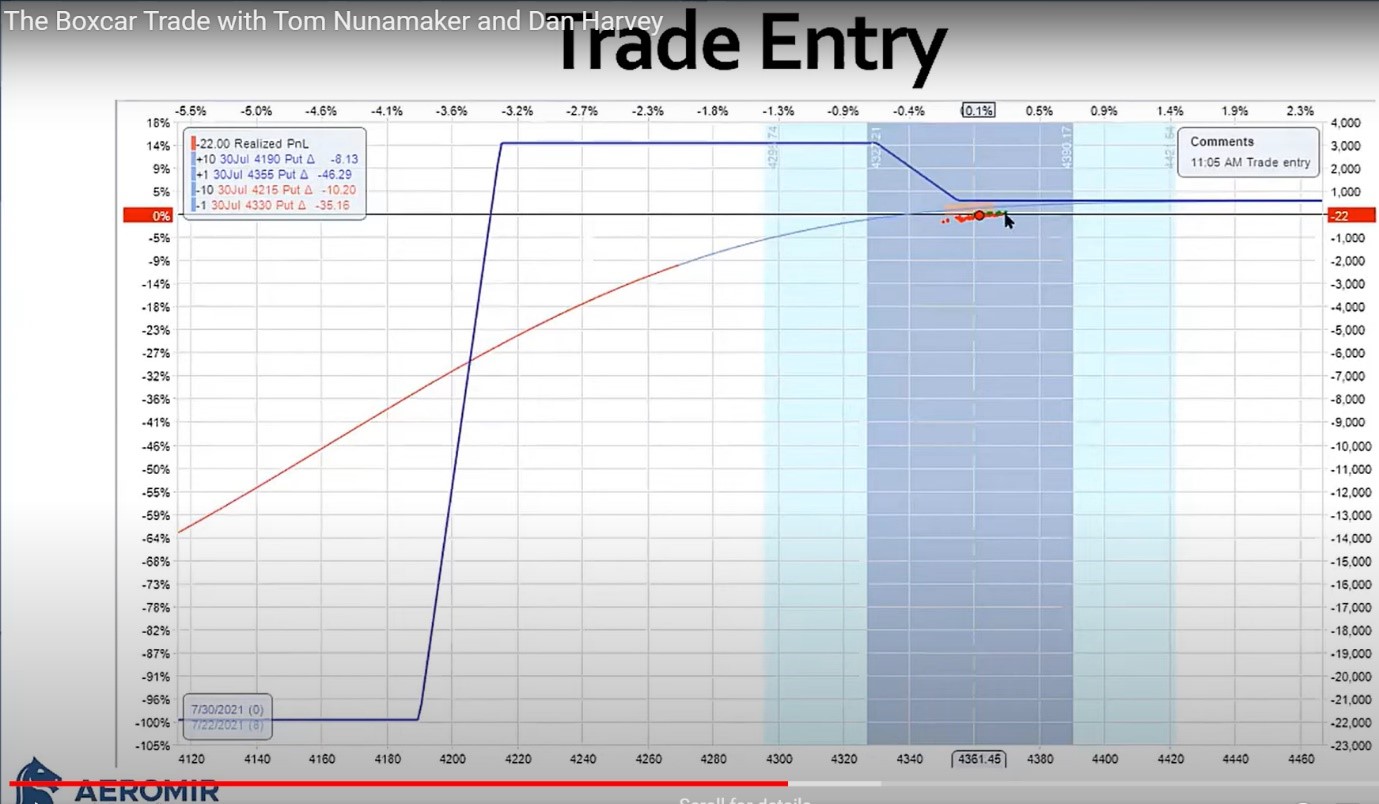

As Tom shows in his presentation, this is a typical entry in the SPX.

Source: YouTube

The credit spread is placed out-of-the-money at around 1.3 to 1.5 standard deviations below the current price.

In terms of delta, it usually ends up being around the 10 to 12 delta for the short put option.

The long put option of the credit spread is just 25 SPX points below that.

For the RUT, the long option would be 20 points below the short option.

It is better to place the trade when volatility is a bit higher because you can get a larger credit and be further away from the money.

Once the credit spread is filled, buy the put debit spread.

Don’t pay more than 1.2 times the credit received from the credit spread — that is, if the trade is opened normally on a Thursday or Friday.

The multiplier is less if you decide to open it on other days.

This usually ends with the long leg of the debit spread being 1 to 3 strikes out-of-the-money.

The short leg of the debit spread is adjusted to get a +1 position delta for every short put spread.

So for a 10-lot put spread trade, the position delta of the entire position (put credit spread plus put debit spread) should be around ten delta, which means that this trade initially starts off with a slight bullish bias.

Trade Adjustment Point

You need to make adjustments or exit:

- If the mark-to-sale ratio > 1.7 (see FAQs below)

- If the delta of the credit spread is greater than 19

- If the probability of touch of the credit spread is >= 40%

- If the P&L shows a loss of greater than 3.0% of the margin. Hard stop to exit the position if P&L is 5% loss.

- If the debit spread loses more than 20% of its value (market moving up)

- If the debit spread gains more than 10% of its value (harvest debit spread gains by rolling down)

- If the credit spread gains more than 10% (probably time to close position)

Closing Trade

If you get a 3% return on the max-margin used, consider taking profits or, at least, close part of the trade.

Deciding when to close is based on how much reward is left in the trade in relation to how much risk there is.

FAQs

What is the mark-to-sale ratio of the Boxcar mean?

The Boxcar can be placed either for a debit or for a credit.

Suppose you put on the Boxcar for an initial debit (known as the mark price).

You lose money if the price of the Boxcar drops.

The current price of the Boxcar is the sale price.

You are in trouble if the sale price is too much lower than the mark price.

The mark-to-sale ratio is the mark price divided by the sale price.

You don’t want the sale price to drop so low that this ratio exceeds 1.7.

If you initially get a credit for putting on the Boxcar, then if the sale price of the Boxcar goes up, we lose money.

If it goes up higher than 1.7 times the mark price, we need to do something (exit the trade or make an adjustment).

How often do we need to monitor the Boxcar trade?

Because this is a short-term trade, Dan and Tom recommend monitoring the trade at least twice a day.

Perhaps one hour after the market opens and one hour before the close would be ideal.

How much capital is needed to trade the Boxcar?

On the SPX, the planned capital is $2500 per credit spread.

A typical 10-lot trade would require about $25,000 of planned capital.

At a minimum, you should use a 5-lot trade, which would mean a minimum account size of $12,500 is needed.

If the guidelines for the Boxcar strategy are public, why do we need the alert service?

The YouTube video provides only the general guidelines.

The strategy requires quite a bit of calculation to get the trade to perform optimally.

In fact, Tom uses a complex spreadsheet that he shares with members of the alert service.

You can see some of the spreadsheet’s math features in the video linked here.

The alert service does the work for you in terms of computing the exact dimensions of the credit spread and debit spread and their ratio. Members of the alert service have access to weekly review webinars (most of which are live so that attendees can ask questions).

What is the performance of the Boxcar options strategy?

The win rate of the strategy is said to be around 75%.

On the Aeromir website, you can find the performance of closed trades as run by Tom in the alert service.

From Feb 2022 to Jan 2023, the strategy averages around 2% to 3% per month return on the maximum margin of the trade.

Dan says he can average around 2% to 3% return a week.

Dan sometimes takes the trade much closer to expiration to capture the fast option decay during those last two days of expiration — probably something you might want to try, only if you have a certain level of experience.

I surmise that Dan’s stated return was during the bullish year 2021, which is quite different from the tough bearish year of 2022 when Tom was trading the Boxcar.

In short, the performance of the Boxcar depends on the market and on the skill of the trader that is trading it.

This is another reason some beginners might want to start with the alert service to follow someone’s trade while gaining experience.

What is the Leapfrog adjustment?

In regards to the Boxcar strategy, it is an adjustment that is made when the price makes a large move down.

We would roll the short leg of the credit spread down below the long leg of the credit spread.

In other words, we have flipped the credit spread into a debit spread.

The short leg is now 3 or 4 strikes below the long leg.

But we do not leapfrog all the credit spreads; just about maybe a third of the credit spread contracts.

This adjustment can be placed as a conditional order as well.

Why did Dan name this strategy the Boxcar?

Because, as a kid, Dan used to play with trains.

The expiration graph, with its vertical walls, looks like the Boxcar of a train.

Concluding Insights

I’ll leave you with one more YouTube video where Tom and Dan are chit-chatting about the Boxcar strategy, flying and jumping out of planes, and so on.

Plus, it contains an animation of a cat reading a book that you might want to see.

While this video does not go over the rules of the Boxcar, it does contain some trading insights from Dan Harvey.

At some point in the video, Tom asked Dan, “what do you think about continuing with the trade after reaching stop loss?”

We all know the answer to that question, including Tom.

I don’t even know how this question even came up.

It might have been an audience question in the chat, maybe.

As expected, Dan said that it is a big “negative.”

Then here comes the insightful comment, which I try to paraphrase from memory.

Dan said to remember that a new trade in starting configuration is the perfect trade.

If you keep in mind that if you start a new trade, it will be in perfect condition, then why not replace struggling trades with new trades?

Just exit the position, and never hold on to the past stop loss.

We hope you enjoyed this article on the boxcar option strategy.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.