Contents

- Bull Put Spread

- The Bear Call Spread

- The Iron Condor

- Non-directional Broken Wing Butterflies

- What Happens If The Price Goes Up

- Conclusion

This article will look at why it might be beneficial to balance short vega strategy with some short delta.

Iron condors, butterflies, bull put, and bear call spreads are all short vega trades, meaning that their vega value is negative most of the time.

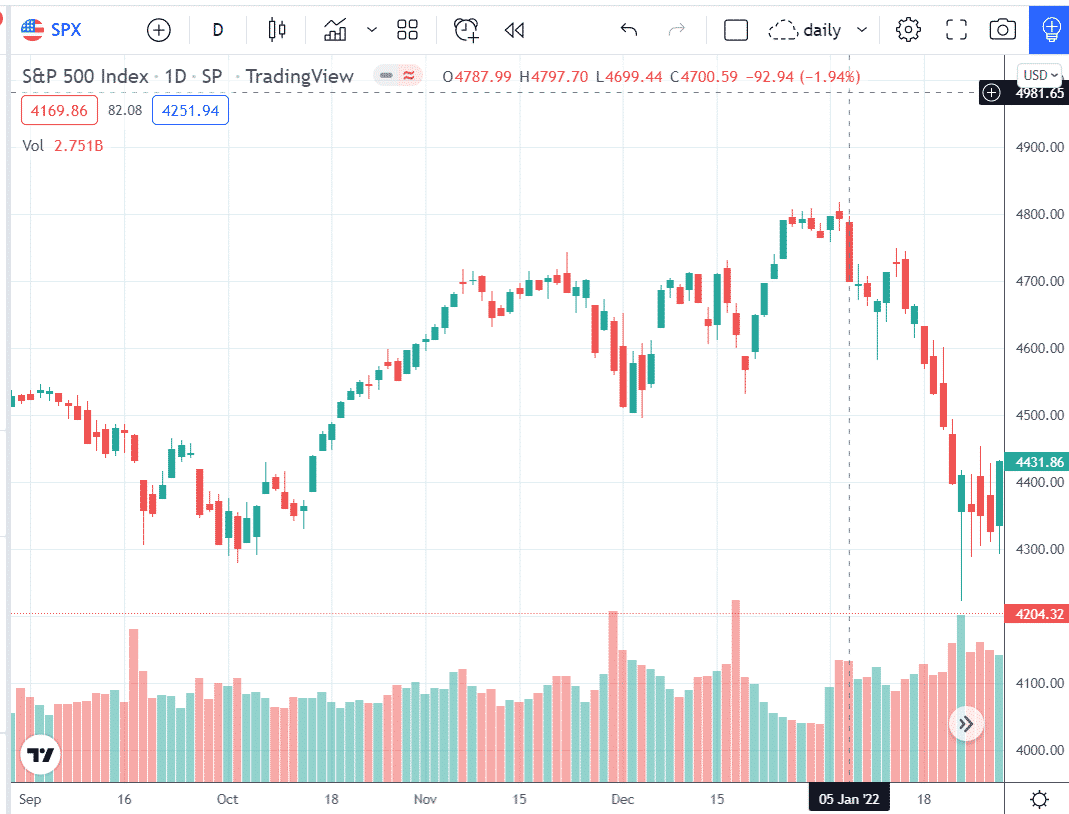

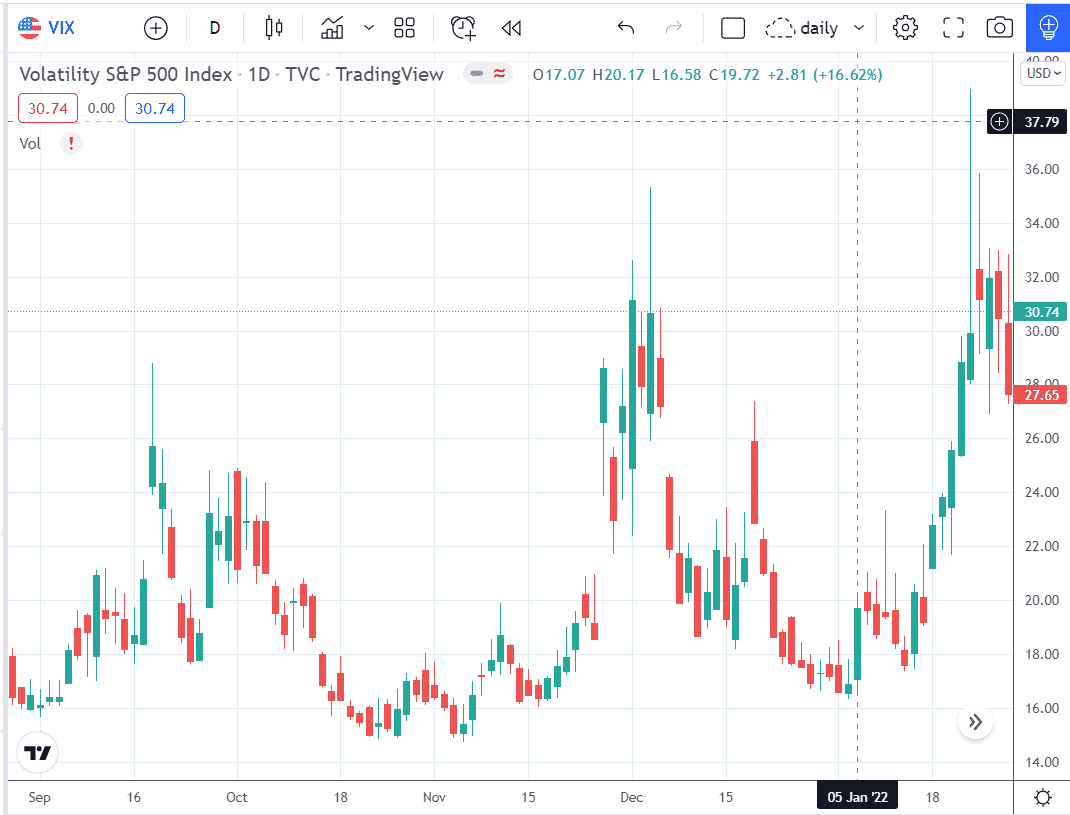

Let’s look at some hypothetical trade examples and their Greeks on January 4, 2022, to see what happened to them by the end of the day on January 5, the next day when implied volatility spiked up.

On January 5, the S&P 500 index (SPX) dropped 1.9%.

This caused the VIX (a measure of market volatility) to go up from 17.07 to 19.72.

Bull Put Spread

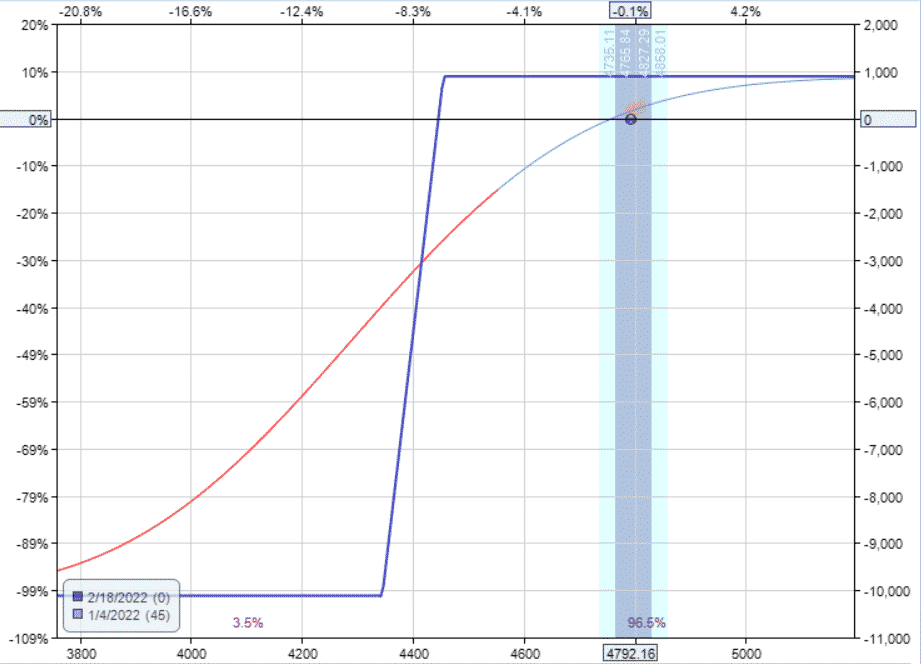

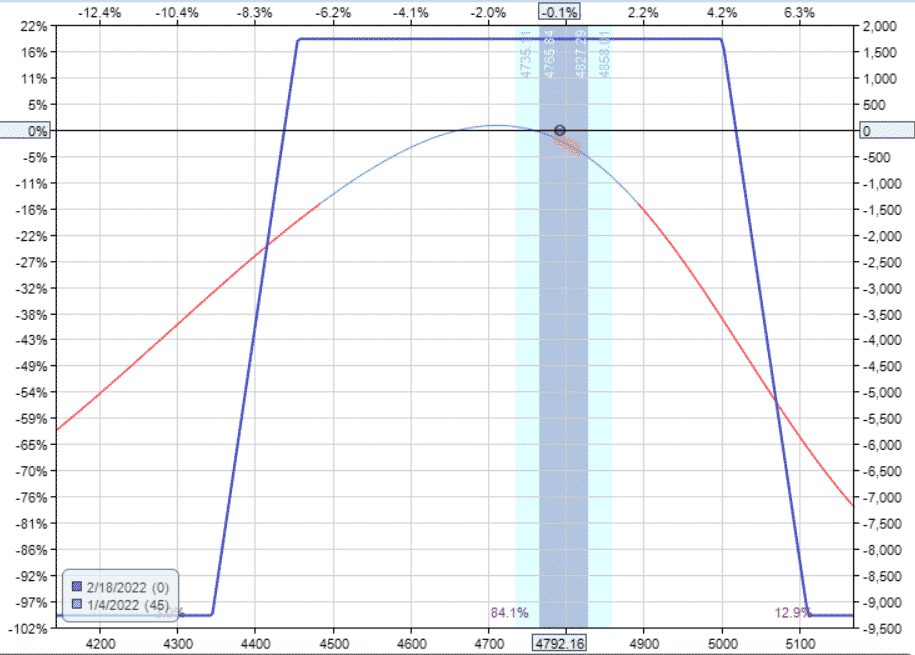

Suppose on the morning of January 4 (say two hours after the open), we have a bull put spread on the SPX with 45 days to expiration with the short strike at the 15-delta.

Date: January 4, 2022,

Buy one February 18 SPX 4345 put

Sell one February 18 SPX 4455 put

The payoff diagram with profit and loss (P&L) at zero to start looks like this:

The Greeks are:

Delta: 4.17

Theta: 10.55

Vega: -82.27

Note the negative vega.

A negative vega means that the P&L will decrease if implied volatility increases.

By the end of the next day, on January 5, the P&L had dropped to -5%, as noted on the left axis of the resulting payoff graph:

The implied volatility (IV) of the short option had gone from 21.55 to 21.98.

While this does not seem like a significant change, it is an increase of 2%, and after all, it has only been one day.

In this trade, both the price and volatility had gone against us.

It is expected that as the price goes down, volatility will increase.

You will often see that when SPX goes down, the VIX will go up.

The Bear Call Spread

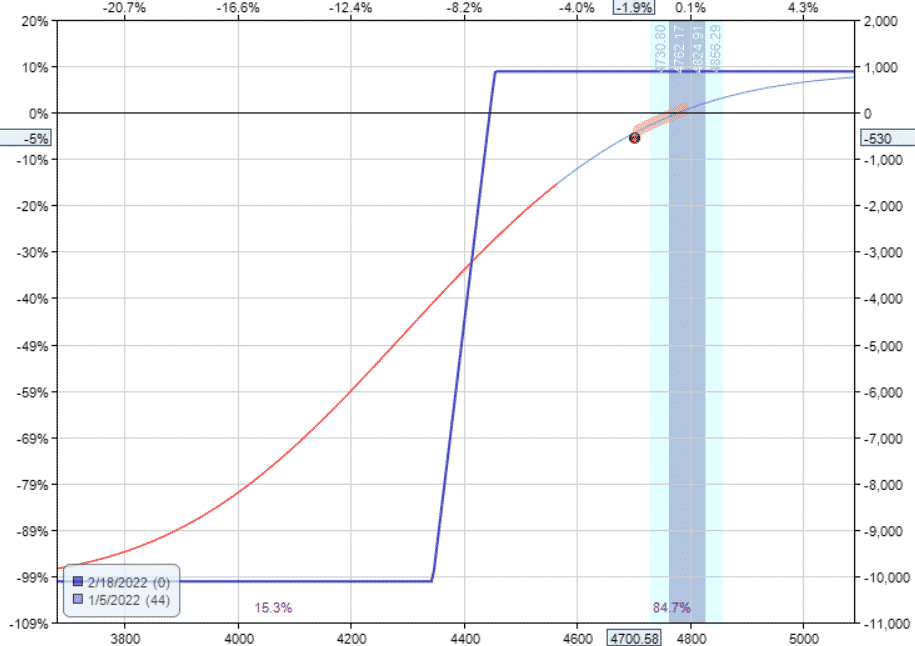

The bear call spread of a similar starting setup faired a little better.

At least price was going in its favor, even though volatility was not.

At the end of the day, on January 5, its P&L is up 8%.

This shows that delta is the dominant Greek.

If you get your direction correct, you can win even if vega is against you.

This is the modus operandi of the directional options trader.

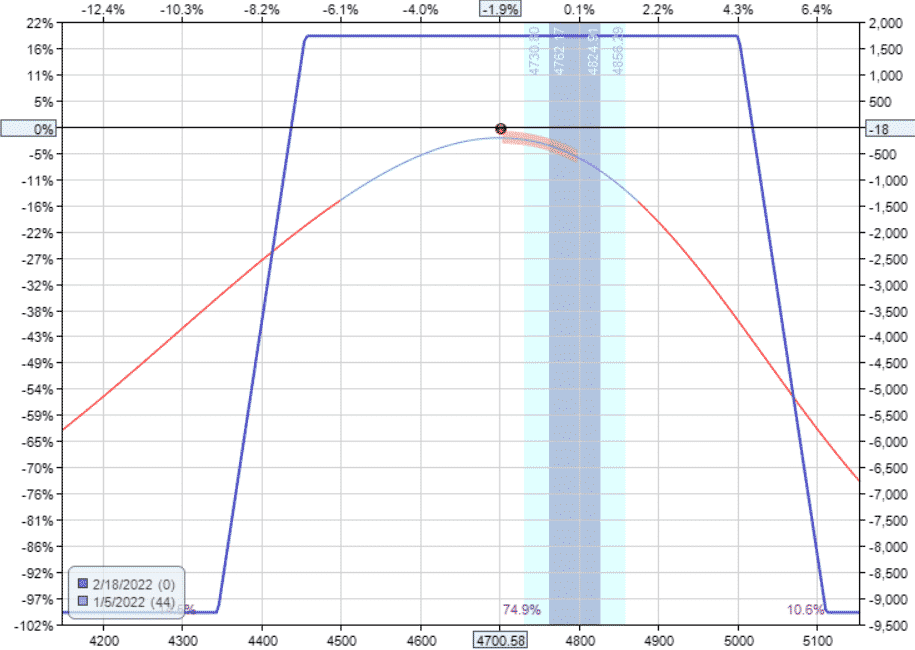

The Iron Condor

On the other hand, for the non-directional trader, the goal is to neutralize delta, maximize theta, and hope that volatility does not go against them.

The iron condor is a common strategy used by non-directional traders.

In the case of the iron condor, where vega is negative, we hope that volatility does not go up.

Let’s see what happens to this SPX iron condor when volatility increases.

Date: January 4, 2022,

Buy one February 18 SPX 4345 put

Sell one February 18 SPX 4455 put

Sell one February 18 SPX 5000 call

Buy one February 18 SPX 5110 call

Max Reward: $1730

Max Risk: $9270

Delta: -7.03

Theta: 46.04

Vega: -346.91

This condor starts with a slight negative delta of -7.

For indices (and ETFs that track them), note that a typical symmetrically balanced iron condor with equal wing widths on the call and put side will naturally start out with a small negative delta due to the put-call skew in implied volatilities.

At the end of the next day, on January 5, the iron condor’s P&L is near break-even despite a market drop and a spike in implied volatility.

The negative delta had hedged the spike in volatility.

Another way of saying it is that the short delta hedged the short vega.

For the non-directional trader, this is a good thing.

Having a slight negative delta will provide peace of mind by knowing that when volatility spikes, it means prices are dropping.

Because of the price drop, the trade benefits from the negative delta, which helps offset losses from vega.

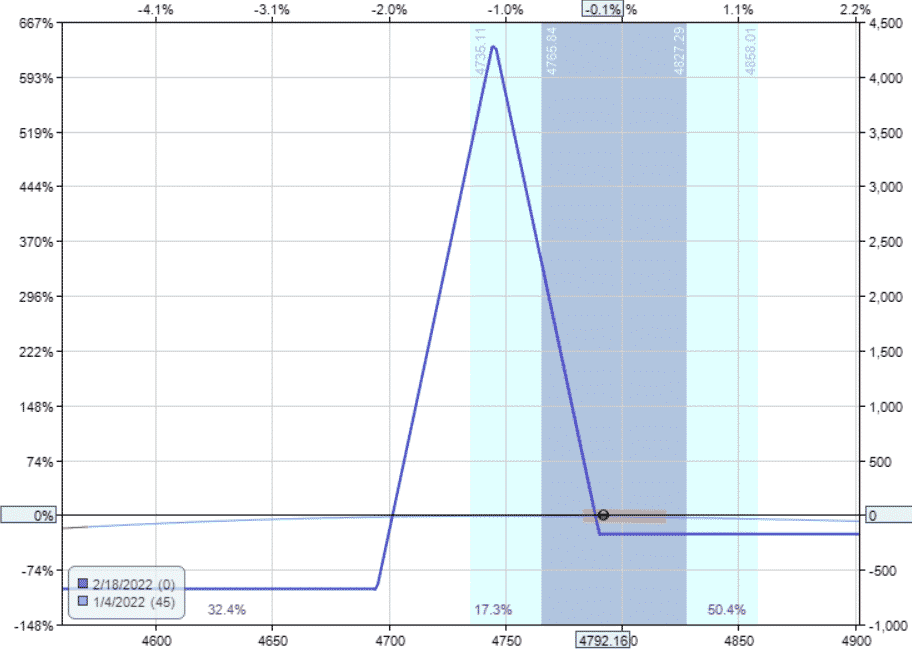

Non-directional Broken Wing Butterflies

Another form of non-directional income trading strategy is to use the broken-wing butterfly, as in the following example:

Date: January 4, 2022,

Buy one February 18 SPX 4690 put

Sell two February 18 SPX 4745 puts

Buy one February 18 SPX 4790 put

Debit: –$65

Max Risk: $1,065

This butterfly was purchased for a debit of –$65.

Nevertheless, it also has negative vega (and positive theta) as in the iron condor.

Delta: 0.41

Theta: 3.14

Vega: -24.21

This particular butterfly starts out with a slightly positive delta.

At the end of the next day, on January 5, its P&L is down –$155, or -14.55%.

Now let’s see what happens if we initially configured the trade to have a slightly negative delta.

With these types of butterflies, the delta can be fine-tuned quite easily by adjusting the strikes by a small amount, such as moving the strike of the bottom put option up by 5 points:

Date: January 4, 2022

Buy one February 18 SPX 4695 put

Sell two February 18 SPX 4745 puts

Buy one February 18 SPX 4790 put

Delta: -0.26

Theta: 3.01

Vega: -19.96

Slightly Higher Cost

This butterfly costs a little more at a debit of $175.

But it suffers less on a market down move.

At the end of the day on January 5, it is down –$85, or -12.6% of the capital at risk.

While still down, it had a lower loss than the previous case.

Perhaps it just needed a little bit more negative delta to overcome the vega risk.

Looking at the risk graph of these butterflies, we see that the risk is almost always on the downside.

So to protect the downside, one might want to configure it to have a slightly negative delta.

Depending on your preference, how much negative delta you want to give it up to you depends on your market views.

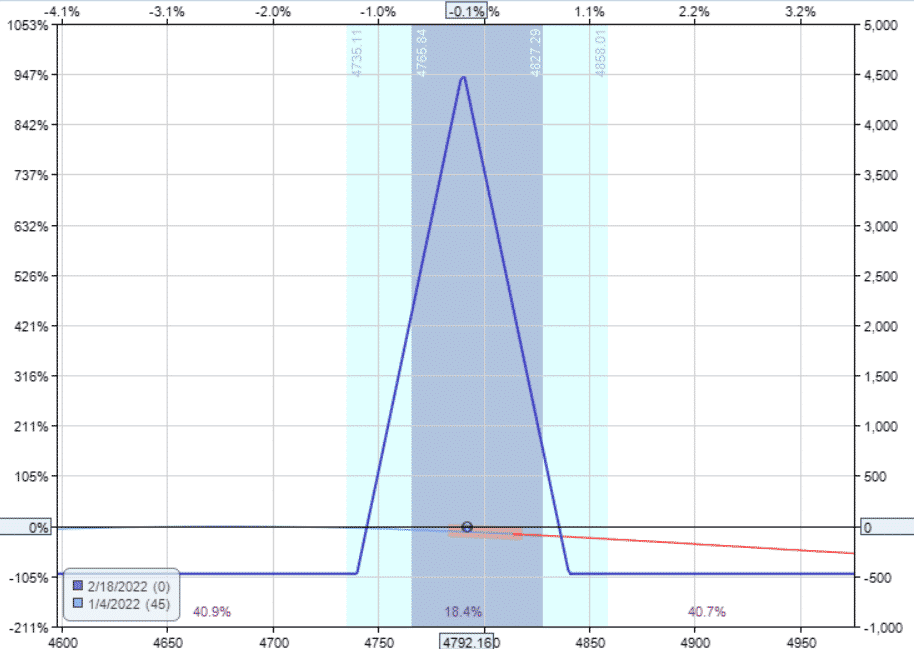

One can even make it a symmetrical at-the-money butterfly to get an even more negative delta.

Date: January 4, 2022

Buy one February 18 SPX 4740 put

Sell two February 18 SPX 4790 puts

Buy one February 18 SPX 4840 put

Delta: -0.99

Theta: 4.36

Vega: -27.94

In this case, the P&L after the market down move would be positive $19%.

While it did will on a down move, this butterfly would have a greater risk on the upside.

It would be considered a bearish direction butterfly rather than a non-directional butterfly.

So don’t over-do it on the negative delta. Otherwise, it will become a directional trade instead.

What Happens If The Price Goes Up

If we give the butterfly a negative delta, it should hurt us if prices go up.

However, due to the relationship between price movement and volatility, it is typical that volatility decreases slightly as the market goes up.

Hence we would get hurt on a directional move. But benefit from volatility.

Which Greek will have a greater impact on the P&L?

Let’s pick a bullish day to take a look.

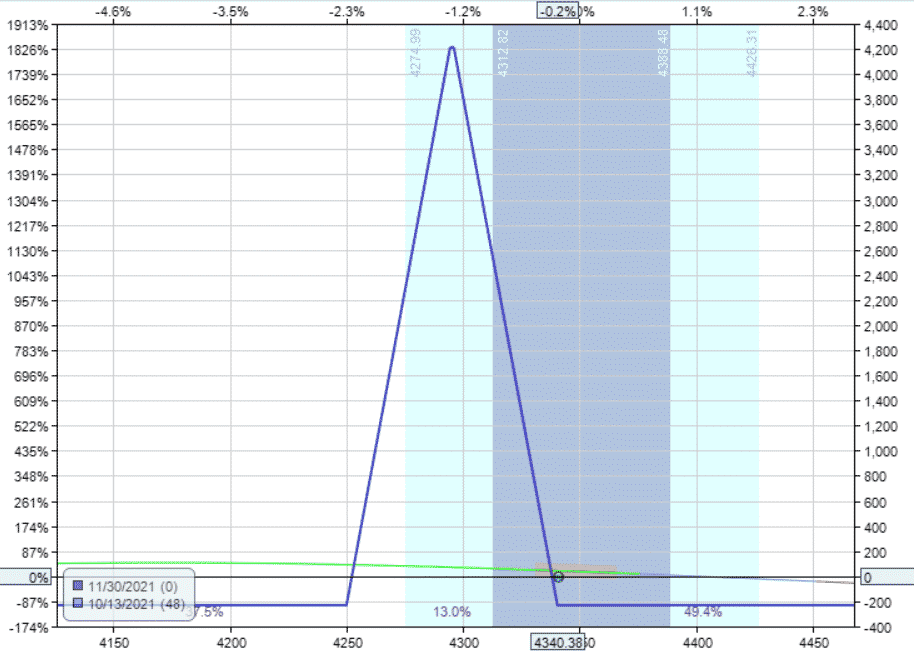

Suppose we put on this symmetrical butterfly on the morning of October 13, 2021:

Buy one November 30 SPX 4250 put

Sell two November 30 SPX 4295 puts

Buy one November 30 SPX 4340 put

The debit and max risk is $230.

We gave it a slightly negative delta.

Delta: -0.67

Theta: 2.62

Vega: -13.45

At the end of the next day after the market makes a up move, we are down –$80, or -35% on the max risk of $230.

Looking at the VIX, we see that it dropped during that time in our favor.

Yet the Greek vega is not strong enough to overcome the negative effects of delta.

One of the challenges of positive-theta trading lies in keeping the dominant delta in check.

Conclusion

If you are a non-directional trader worried about the market making a large down move or worried that volatility will increase that will hurt your short vega trades, consider having a little bit of negative delta.

This will help protect you from the spike in implied volatility as the market moves lower.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.