Contents

- Introduction

- What Is A 0 DTE SPX Option Trade?

- Overview Of The Trade

- How To Prepare Yourself To Enter The Trade

- Making Your Entry

- Managing The Trade

- Setting Your Stops

- Should You Trade Naked?

- Trading With A Small Account

- Backtesting – Comparing Various Deltas

- Use OptionNetExplorer For Backtesting

- FAQ

- Conclusion

Introduction

Recently there has been a lot of talk in my trading circles about selling 0 DTE SPX options.

The idea primarily revolves around selling SPX credit spreads or iron condors on the day they expire.

Traders sell the spreads in the morning and hope to by them back in the afternoon for a lower price, or let them expire worthless.

This is not something I’ve tried yet because it is difficult for me with the time difference, but I wanted to share some information about this strategy with you so that you can make your own decisions.

So, let’s dive in to this style of option trading.

What Is A 0 DTE SPX Option Trade?

A 0 DTE SPX trade is one which uses SPX options that expire the day of the trade.

The advantage of using SPX is that it is an index, meaning you reduce the risk of large price-moving catalysts that individual stocks would normally be exposed to (e.g. earnings announcements).

SPX is also cash settled, so there is no risk of early assignment.

There are several benefits to trading a 0 DTE SPX strategy.

The main benefit of the 0 DTE SPX strategy is that there is no overnight risk as the position is closed on the day of the trade.

The second benefit is that by trading the SPX, you have the tax advantages of IRS Section 1256 contracts which means that 60% of profit is taxed at the long-term rate, with the remainder taxed at the short-term rate.

The third benefit is that it is a high win percentage and is coupled with a stop loss to protect capital and limit downside risk.

The final benefit is that you don’t need to trade high volume and can enter only one or two trades per day and scale your position as your account grows.

Overview Of The Trade

This trading style was something I learned from a trading presentation by Tammy Chambless.

To execute the trade, only enter trades on Mondays, Wednesdays and Fridays using options that expire that same day.

By entering trades on only these three days of the week, you can avoid being classed as a pattern day trader (this is important for small accounts – see the last section in this article).

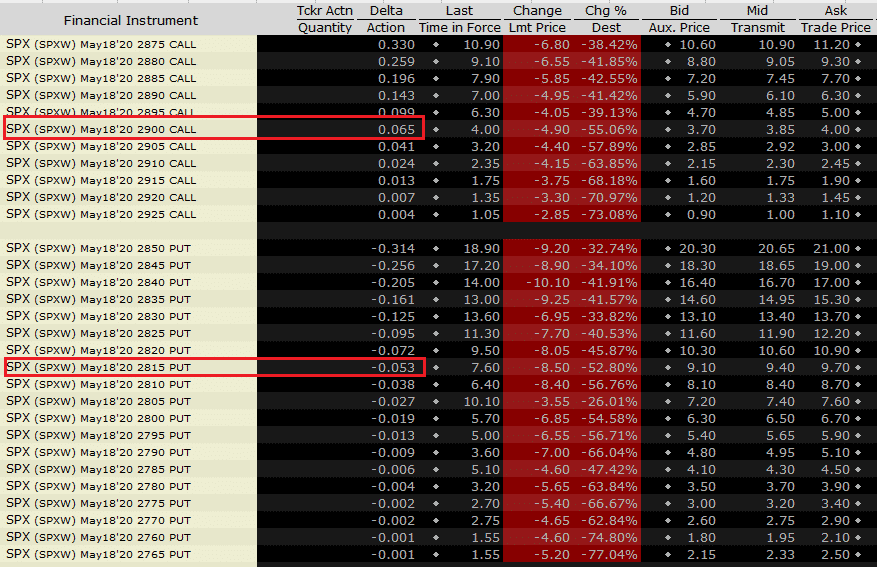

Most traders aim to sell Delta 5 Put and/or Call Credit Spreads, with as wide a spread as you can afford for your account size (a 50-point spread is the optimal spread).

It’s important to note that the purpose of the long options is not to limit risk but to minimize the cost of the position so you can collect more premium.

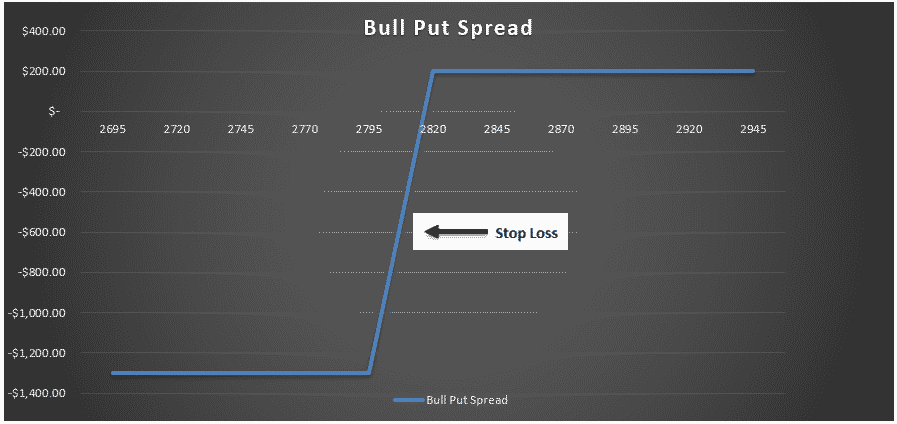

The final step is to ensure you set up a stop loss that automatically exists when the trade shows a net loss of two times the initial credit.

Provided the stop loss isn’t triggered, leave the trade active until expiration occurs.

As with any trading strategy, it’s important to implement risk management strategies.

For the 0 DTE SPX trade, cap your risk at no more than 2% of your total account size on any one trade.

To be specific, the 2% risk cap is not referring to the buying power for your spread, but the maximum amount you will lose if the trade goes against you

How To Prepare Yourself To Enter The Trade

Before entering the trade, there are a number of steps you should take to prepare yourself.

Step 1 is to check for any announcements that are expected throughout the day so that you can position yourself accordingly.

The Bloomberg economic calendar is a great place to check this.

Step 2 is to review CNBC and FINVIZ to see how the futures market has been performing.

This is useful to help you get a feel for the possible direction that the market may be headed for the day.

Step 3 is to prepare your entry points by comparing the high and low range from the day before using a 1 minute or 3 minute chart.

When to make your entry will be covered in more detail in the next section.

Step 4 is to review volume, however since the SPX has no volume you can use the E-Mini S&P 500 futures or SPY as a proxy.

Step 5 is optional and involves you doing any further research or analysis you need (e.g. technical analysis, market profile, etc.).

Making Your Entry

There are two key approaches you can consider when determining your entry points.

The first approach is to make an entry within 15 minutes of the market opening.

The benefit of this approach is that you can collect a higher premium due to the volatility at the open.

However, this approach worked best prior to the COVID crash in March 2020 so until markets return to their prior state you are probably best to go with the second approach which follows below.

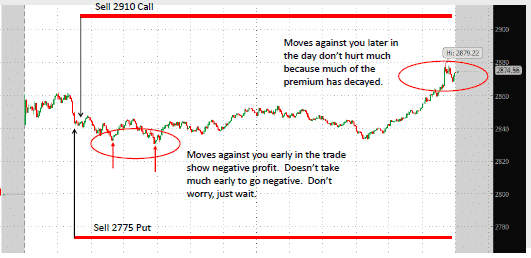

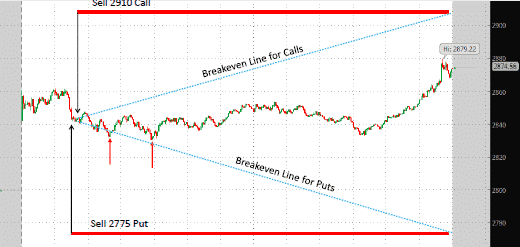

The second approach is to avoid the market open and wait until the direction of the market is clearer.

Once this occurs, time your entry so that you execute the puts when the market has dipped and you execute the calls when the market has risen.

This approach has performed much better than the first approach since the COVID crash but this is likely to change once market behavior adjusts over time.

In terms of the order of trade entry, you can either:

- Enter the spread as one vertical spread order.

- Leg into the trade by executing the long options first and then selling the short options.

This gives you flexibility in timing your entries so that either both sides of the spread are entered near the same time or you can leg into the trade, in response to market movements.

This can be risky though because the market could move against you after only opening one side of the spread.

Personally, I would prefer to open the whole spread at once.

When choosing which direction to trade, the important point to remember is that you should aim to sell where you think the market will not go.

Managing The Trade

A key pillar of this strategy is an effective, almost procedural approach to management of the trade.

Your first step is to ensure that you set a stop and do so using only the short leg.

In the event that that you get stopped out on the short leg, you have two options for dealing with the long option.

You can either hold it and hope the market keeps trending in that direction or close it manually.

This is up to you and something you will learn to judge better over time.

If you do get stopped out, you have the option to re-enter.

You can re-enter using OTM options which can potentially allow you to recoup some of the loss.

I’m not a fan of this approach because it is akin to throwing good money after bad.

If the market is experiencing a strong trending day, you could easily suffer multiple losing trades in one day.

My approach if I was stopped out would be to leave the trade for that day and try again on the next day.

image credit: Tammy Chambless

Setting Your Stops

As you can see from the trade management section, a critical component of the trade is ensuring you have effective stops.

There are four different options you can choose from for your stop orders, which will have slightly different execution:

- A market stop order which is where you set a price for the stop to be triggered but the broker will close the position at whatever price they can get.

- A stop limit order allows you to specify the maximum price you are willing to pay to close the position.

- A stop on condition will exit your position when a certain condition you specify is met.

- A manual stop is your final option, which requires you to keep a mental record of when you’ll get out and to manually execute the trade yourself.

If using a market stop order (1), multiply the initial credit by 3 to determine the price to set the stop at, as the initial credit will be subtracted from the loss.

For example, if you sell the initial spread for $1, set the stop if the spread reaches $3.

If you go with a stop limit order (2), multiply the initial credit by 3 as well, but set the limit price at 4 times the initial credit.

This will help ensure you do actually get taken out of the trade.

Sometimes, if you’re limit is to low, the stop trade will go live, but never get executed leaving you exposed to continued adverse market movement.

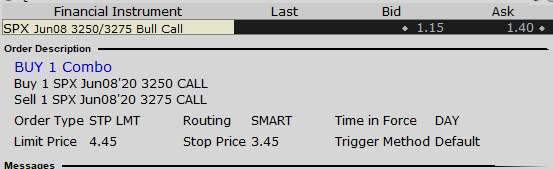

See below for an example of how to set up a stop limit order.

![]()

Should You Trade Naked?

Some traders swear that the ideal way to trade this strategy is by selling naked puts and calls.

This is very risky though.

By doing so, these traders are accelerating the theta decay in the trade but leaving themselves exposed without the protection from the long options.

Trading naked will minimize commissions by not having to trade as many contracts.

It does however, require more buying power than spreads as naked options require 20% of the notional value of the naked calls or puts as buying power.

When setting your spreads, go as wide as you can based on your account buying power.

The reason being that the tighter the spread, the slower it decays which means you’re in the trade longer and therefore taking on added risk.

Tighter spreads also require you to pay more for the long options compared to the credit on the short options which will reduce your profit potential.

Finally, since the premium is lower, you’ll likely suffer from getting stopped out more often as the stop is formulated based on the criteria of 2 x initial credit.

Trading With A Small Account

If you trade an account that’s less than $25,000, note that when you open and close a trade on the same day, it’s considered a day trade (although this isn’t counted if your trade expires worthless).

It is a requirement that when a trader executes four or more trades within five business days using the same account that they are flagged as a pattern day trader.

As a pattern day trader, brokers will require you to hold $25,000 in your margin account.

If you limit your trades to only one trade every Monday, Wednesday, and Friday, you will not meet the definition of a pattern day trader and you can avoid having to put $25,000 in your margin account.

Backtesting – Comparing Various Deltas

I haven’t done any backtesting on this strategy yet, but I did find this from another trader’s presentation that I attended.

Keep in mind I can’t verify the accuracy of this data and it is always best to conduct you own backtests.

Also, as you know, just because something has worked in the past, doesn’t mean it will continue to work in the future.

Also, the data below is from January 2012 to December 2019 so doesn’t include results from the volatile period in March-April 2020. Perhaps the author deliberately left these out??

image credit: Tammy Chambless

When trading higher deltas, there is a greater risk of being stopped out because the trades are being placed closer to the money.

The advantage of course is the higher credit that is received, but looking at the results it seems like higher delta trades resulted in a greater return but with higher drawdowns.

Use OptionNetExplorer For Backtesting

I’ve just recently signed up for OptionNetExplorer to do some backtesting and it’s very good.

Previously I’ve used OptionVue, but ONE is just as good and A LOT cheaper.

I’ve managed to secure a 10% discount for my readers if you want to check it out.

I’ll be doing a full review of the software shortly, but if you want to try it you can actually get a one month trial for only 10 GBP.

You can get your 10 GBP trial here.

Just remember to cancel before 30 days if you don’t want to continue!

FAQ

What Are 0 DTE SPX Options?

0 DTE SPX options are SPX options with a zero-day expiration.

This means they expire at the end of the trading day they are purchased.

How Do 0 DTE SPX Options Work?

0 DTE SPX options are a type of option contract that allows traders to speculate on the price movements of the SPX index for a single day.

These options are priced based on the expected movement of the index, and traders can buy or sell them to profit from their price changes.”

What Are The Benefits Of Trading 0 DTE SPX Options?

0 DTE SPX options offer several benefits to traders, including high potential returns, low capital requirements, and the ability to profit from both bullish and bearish market movements.

Additionally, because these options expire at the end of the trading day, traders can avoid the risks associated with holding positions overnight.”

What Are The Risks Of Trading 0 DTE SPX Options?

While 0 DTE SPX options offer high potential returns, they also come with significant risks.

Because they expire at the end of the trading day, traders must be prepared to act quickly to close out their positions or risk losing their entire investment.

Additionally, the high leverage of these options means that traders can lose more than their initial investment if the price of the index moves against their position.

How Can I Get Started Trading 0 DTE SPX Options?

To start trading 0 DTE SPX options, you’ll need to open an account with a broker that offers options trading.

You’ll also need to learn the basics of options trading and develop a trading strategy that works for you.

Once you’re ready to start trading, you can place orders for 0 DTE SPX options through your broker’s trading platform.

Conclusion

So, that gives you a little information on what trading 0 DTE SPX options is all about.

What do you think?

Is it a totally crazy idea, or is it something you would consider?

I think the idea has merit, but it should only be done by experienced traders who understand how to set and use stop losses.

As with any new strategy, it’s always best to paper trade first before risking any live capital.

Trade safe!

This information includes many excerpts from a document by Tammy Chambless titled “0 DTE Credit Spreads in SPX- Presentation on May 2, 2020. pdf” dated May 2, 2020

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Hi Gavin, nice article which has stuff I can use for a weekly income-trade I have.

Question with regard to ‘setting stops’: Is the text aligned with the IB image shown? I think the image is wrong on Stop- and Limit-price!?

What are considerations not using a Stop-order which results in a Market-order when being triggered?

When having a big move in price the Stop Limit order will be triggered but not sure to be executed even if the limit-price is $1 above the stop-price.

Hi Bart, a market order is ok if the bid-ask spread is tight, but if the spread is wide, you could get a pretty bad fill.

I back tested 3 weeks of spx after I learned the iron butterfly and went live last week. Every single trade including the backtest I let expire were green. Tofay was the first day where if I didn’t close out my trade at 60% it would have went -2500 at expiration. Before today, last week one a 70% profit ended up green for $5 and expiration. Also of the 3 weeks only 1 day actually captured 99% profit which I would never allow that to do. Since you stated u don’t know how to trade O dte, the data for this year, you are better off letting your trade exp or hold then use a stop loss. The guys at tastyworks ran a backtest and 56% of the time you come out a winner without a stop. Yesterday night I opened an iron butterfly before market open. At one point up 1k then reverse to -3k. It was fluctuating from -1500-3000 until market open. Once market opened 10 mins after I was in the green. It took til 10 am for me to hit 60% and I let it run a bit because I was monitoring the chart. I closed at 63% with profit of 4600. Now with that said, Monday I had a trade during open when o was up 2700 just for it to go -2500. I was close to closing my trade but I let spx hit their ATH and sure enough it reversed. I ended up 70% green for 3800. Until spx is climbing slowly upward throughout the day I would have worried. The fact that it climbed quick at open told me to remind patient for that reversal. But yes, if trading 0dte, stay in the trade as long as possible. The only way u can lose that max risk is if spx moved 170 points. In this market where bulls run and bears are nowhere to be found, vol is low. Spx only moves about 25 points and 30-40 on a good day. Not70 each way like last year and the start of 2024. If your trade is near the break even by eod then it’s your choice. I’m just letting u know the data favors lettting the trade play out. Ytd if u trade a butterfly or condor u have over a 56% chance win rate. That’s actually really good. Condors have a higher win rate but the payout is way less and more risk

Great article, I find the credit spreads confusing plus I have cash account ( no margin) so don’t think I can do spreads. Can this strategy be adapted to simple calls or puts ? If so, what’s the best way to pick the strike ? ATM or ITM , any specific delta to look for ?

I would suggest using spreads rather than naked options due to the fact they are defined risk. Even with a cash account you should be able to do credit spreads, you might just need to apply for a higher trading level.

This article might help you understand credit spreads better:

https://optionstradingiq.com/top-3-ways-to-trade-credit-spreads-for-income/

Question on the PDT rule: If you place an iron condor trade, are they counted as 2 trades (2 credit spreads)? How many iron condor trades can you place in a week without being flagged for the rule?

Thanks.

Hi Ron, I believe if you are placing 1 iron condor on Mon, Wed and Fri then you should be ok, but best to check with your broker.

Hi Gavin, great article. How about using ITM debit call or put spread? No margin requirement.

It’s effectively the same trade. Max loss is still the same.

Hi Gavin,

I’ve seen people use 5 points, 10 point wide spread with multiple contracts. My understanding is that the wider the spread can be afforded, the further away from in the money you could setup to achieve a 6-10% return on max loss, in addition to the faster delta/premium decay as the move moves away from you, is a 20-50 point the way to go? And, I think less contracts less commission traded.

Regarding the Performance return for selling 20 Deltas, 50 point wide spread, the performance indicated is 7 transactions, and 300% is that per annum?

In all those cases, are you generally looking for a 8-10% return on max loss?

For the stop-loss, is it just as easy to fill on the spread, as oppose on the short leg?

Stop-limit still recommended with a max 1 dollar slippage from the looks of it – as oppose to fully stop/market

Does IB execute the stop loss on the ask side on the short leg (buying), and bid side on the long leg (selling)

Thank you for summarizing the Tammy Chambless style. I have her reports but found things I disagreed with at the beginning and was waiting to find time to wade through the rest.

Meanwhile I was backtesting my own ideas. All my conclusions soon thrown out when I started live trading.

So here is my return tip and also why I have not put much faith in Chambless. I could be mistaken but…. prepare for the possibility that the so-called major component of Stop orders is completely unfeasible with SPX. Some days might work. But only one bad catch can cause you to lose in one trade as much as you can expect to earn in the entire day. And some days then activity is high–every single SPX trade can go like that.

Also as a general rule–if you should happen to find solutions to trading problems–do not go posting them online before you have made at least a million dollars. And I am not attempting to mock the possibility of finding such solutions. Quite the contrary. There are solutions but as you yourself imply–what works this month might not work next month. It will especially shorten the lifespan of a solution if everybody and his sister starts doing it. Or if one hedge fund catches wind of it. Capiche?

Hi Gavin,

I have a few questions. First, how to use direction of futures and volume to determine when and how (i.e. put credit spread, call credit spread, or iron condor) to get into position?

Second, you write “avoid the market open and wait until the direction of the market is clearer.” What criteria do you use to determine when and how (i.e. put credit spread, call credit spread, or iron condor) to get into position?

Third, you write “time your entry so that you execute the puts when the market has dipped and you execute the calls when the market has risen.” Exactly what criteria do you use to determine how to get into the call and/or put credit spread?

Thanks!

Hi Mark,

There’s no guaranteed way to predict the direction of the market. If we knew that we would all be billionaires. Find a system that works for you, whether that is candlestick analysis, trend analysis or using another type of indicator.

Hey Gavin great stuff! Is there a way to figure out at what price the 3xcredit received stop will be triggered before entering the trade. I know this will be a moving target and change based on many factors as the day goes on. I just thought it might be nice to know the delta of the stop and the stop trigger price so that this information could be used in conjunction with the technical analysis when considering trade opportunities. Thanks

The price should be pretty easy to work out right? Just 3 times the price of the original trade. Almost impossible to work out what the delta would be though, too many moving parts.

Thanks Gavin, just to clarify I was referring to at what ballpark price the underlying will be when the stop gets triggered. That way before placing a trade you could know where things fit in the technical picture. For instance a trade may be more compelling if the the stop trigger price is outside of an area of support or resistance.

Right, I see what you’re saying. Again, a lot of moving parts, such as how much does vol spike? How quick was the drop? But, you could look at a T+0 line which would give you an estimate of the price where you stop would get hit.

Ok thanks.

Backtesting and paper-trading don’t work well with stop-losses in illiquid options. Are there any real-trade logs showing actual drawdowns?

Hello GAVIN

Your article is simply awesome!

In the article mentioned the use of iron condor, the actual operation of the order transaction and stop loss, the mouse ear method is I have used in the real world, so it seems very friendly. Thank you again.

I have been profitable through doomsday options. Underlyings used include SPY, SPX, NDX.

I would like to ask you a couple of questions

1. Is there any forecasting software that can predict the closing range of the day?

2. Do you have any method to predict the closing range of the day?

Translated with http://www.DeepL.com/Translator (free version)

Thanks for the kind words. I’m not aware of any software that does that, but you can use the option prices to find the expected range – https://optionstradingiq.com/how-to-calculate-the-expected-move-of-a-stock/

OK, thank you very much for your reply

In addition, I would like to ask you two questions

1. In short iron condor, you usually use NDX instead of SPX. I think the reason why NDX tends to be liquid is that sometimes MM depresses the price, resulting in the inability to close the transaction at the market price. I’d like to hear your opinion

2. For SPX, for example, short call 3920 long call 3945 short put 3765 long put 3740 (this is leg spread is 25)

Would you like to ask, do you usually use leg spacing of 50,25, 20, or 10?

The broker is TD ameritrade

Thank you again for your reply and look forward to your reply