Earnings announcements are uncertain events.

They are “known unknown events,” some people call them.

The stock price will usually make a big move – up or down, no one will know with any degree of certainty.

There are three ways of trading options on earnings reports:

- Pre-earnings trades, where you enter and exit before the earnings.

- Earnings trades, where you enter before the earnings and exit after the earnings.

- Post-earnings trades, where you enter and exit after the earnings report.

Let’s look at each of these three categories of trades.

Contents

Pre-Earnings Setup

Because the stock price might drop on the earnings report, investors who already own the stock may start to buy put options for protection.

The likely expiration cycle of these options they buy is the expiration right after the earnings event.

This increases the value of these put options, as evidenced by their increasing implied volatility (IV) as earnings approach.

The call options for that expiration cycle will also increase in IV because of put-call parity and speculators betting on a price spike due to a good earnings report.

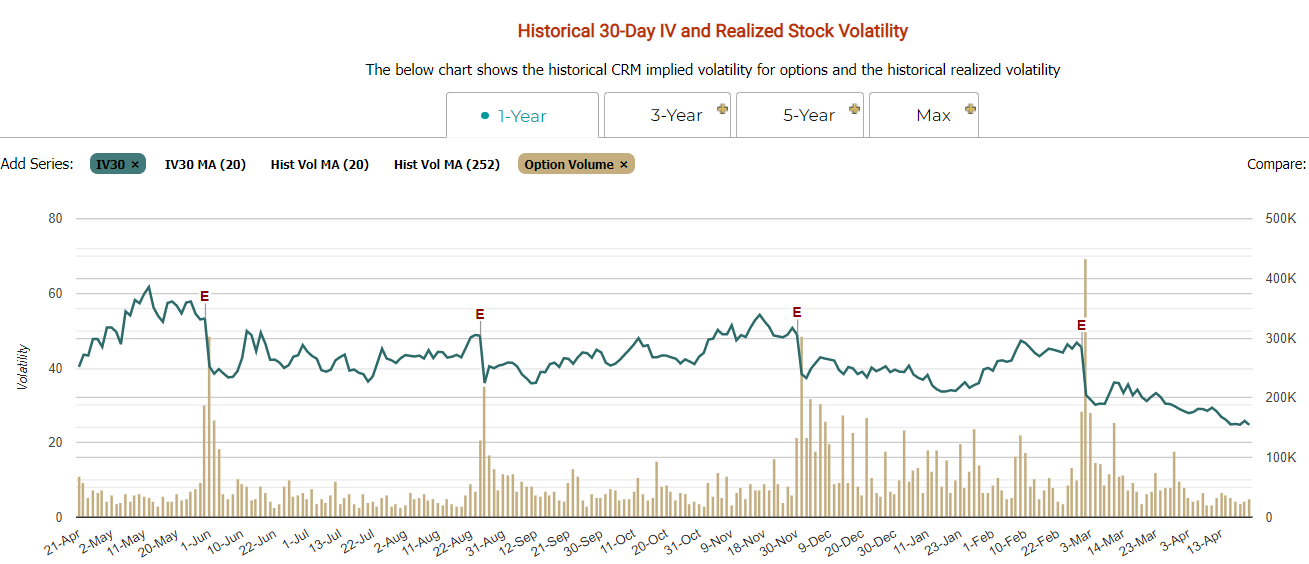

This is the chart of IV for Salesforce (CRM).

Source: marketchameleon.com

Note how the earnings report (marked by “E”) for March 1, 2023, preceded a rise in implied volatility starting on January 18, about six weeks prior.

Note that just prior to the earnings report on November 30, 2022, the IV was at around 50. One month earlier, on October 28, the IV was around 40.

On April 17, 2023, the IV of CRM was at 25.

CRM has an earnings report on May 31 after the market close.

A trader wanting to capitalize on the IV rise to the next earnings report will want to buy options with the expiration of June 2 (the closest expiration that is after the earnings announcement).

These are the put options that will rise in value as investors are trying to buy put protection for their stocks.

These call options will rise in value as speculators bet on a big price increase in the stock price.

Here is a potential pre-earnings trade that a trader would do.

Date: April 17, 2023

Price: CRM @ $197

Buy one June 2nd CRM $190 put @ $5.95

Sell one April 28 CRM $190 put @ $1.10

Buy one June 2nd CRM $200 call @ $8.45

Sell one April 28 CRM $200 call @ $2.21

Net Debit: -$1109.50

This is a double calendar buying the long option at the June 2nd cycle and selling the short option at a near-term expiration that is unaffected by the earnings.

Selling the short options brings in credit to help pay for the long options.

This is to bring in income.

Because when we sell options, we get a credit from the premium of the options.

The same strikes are used but for the April 28 expiration.

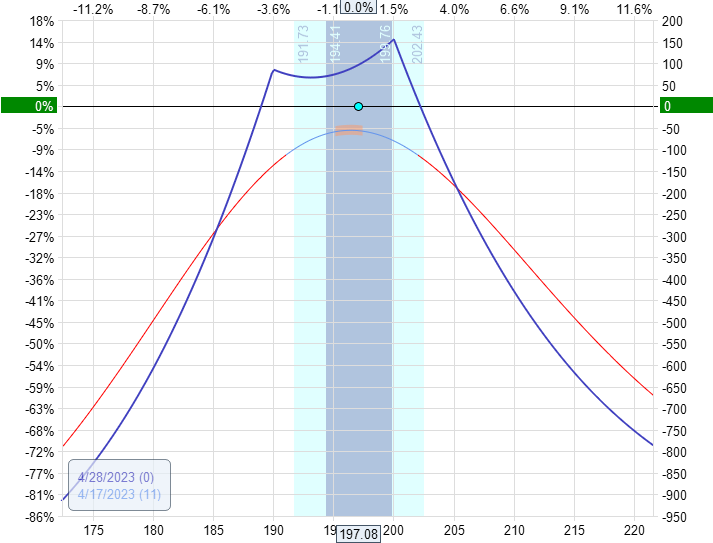

The resulting graph looks like this:

sour

Make sure the price dot is in between the two peaks. Make sure that the smile curve formed by the two peaks does not dip below the zero-profit horizontal.

If the smile curve dips too low, you need to bring the strikes closer to the current price.

The Greeks for this graph are:

Delta: -2.67

Theta: 10.15

Vega: 30.28

We need theta to be positive.

If theta is negative, we need to bring the strikes closer to the current price.

Bringing the price closer to the current price will increase the theta.

The raising can see the increase in theta of the smile curve.

Managing the Pre-Earnings Trade

The key to the pre-earnings trade is that you need to exit before the earnings announcement and before any short options expire.

We don’t want to hold the long options after the earnings announcement because the uncertainty is no longer there, and the value of those options will drop immediately as the earnings are announced.

This is a non-directional trade and cannot withstand a big directional move caused by the earnings catalyst.

The trader will adjust or exit if the price goes outside the two peaks during the trade.

If theta goes negative, the trader needs to adjust or exit.

If the short options have only a couple of days to expire, the trader would either exit or roll the short options to a later expiration date if possible.

Checking twice a day is ideal because stock prices can move a lot in a day sometimes.

Pros and Cons of the Pre-Earnings Trade

In this setup, the strikes of the two calendars are at $190 and $200.

The trader can have these strikes close together or further apart.

When the strikes are closer to the money, there is better theta.

However, it is easy for the price to make a big move and go outside the tent.

This means more frequent adjustments.

The trader needs to find the right balance of how far to put the strikes.

This comes with seeing a lot of these trades.

If the strikes are too close, they have to adjust too often.

If strikes are too far apart, the trade can not generate income from the theta.

And having to hold the trade longer to hit the profit target means giving the market a greater opportunity to make a large move against the trade.

A reasonable take-profit target on these pre-earnings double-calendar trades is around the 10% mark.

Time to Expiration for the Pre-Earnings Trade

Generally, initiate these trades about one month before the earnings date so IV can increase during that time.

It does not need to be exact.

Sometimes three weeks is okay.

Sometimes six weeks from earnings is also okay.

In the CRM trade, there were six weeks until the expiration date of the long option.

When you have more weeks till earnings, you can sell multiple expirations.

The first expiration date that that trader is selling is April 28.

When it gets to April 25, those options have very little life left.

So the trader closes the short options by buying them back (they will be less expensive then).

Then the trader sells more options in the May 5th expiration.

The back long options are kept as-is.

Don’t touch those.

Those are for protecting the trade.

The premise of these pre-earnings trades is that those long options will hold their value very well because they are linked to the earnings event.

The uncertainty of the event keeps their implied volatility (IV) elevated.

When time gets closer to May 5, the trader will exit the short options expiring on May 5, sell the next week’s expiration, and so on.

Repeat until it gets too close to the earnings date and needs to exit (hopefully with a profit).

We will know when it gets too close because the trader cannot find good strikes that can provide decent positive theta.

Earning Trade

There are a variety of earnings strategies that traders can implement.

Some traders will trade iron condors; others will do calendars, double calendars, or double-diagonals.

The premise of the trade is all the same.

We want to sell premium when IV is high just prior to the announcement.

And then buy back those options after the announcement when the price and IV have dropped.

This is known as the “volatility crush” that occurs during the earnings event.

While it is possible to do undefined-risk strategies such as selling a strangle, this is not recommended, and most traders will buy protection to make it a defined-risk strategy.

If the long options are purchased as protection on the same expiration cycle as the short options, then we have an iron condor or a butterfly earnings trade.

If the trader buys the long options further out in time, then we have a form of a time spread.

In the following example, we will look at the calendar time spread for the earnings trade where Google (GOOGL) announces earnings after the market closes on February 2, 2023.

The trader would initiate the trade on February 2 in the trading session just before the announcement.

Or they can start the trade even one day before if they are busy on that day.

The short option expiration is set to be the expiration cycle immediately after the announcement – In this case, the February 3 expiration.

That way, it will experience the greatest effect of the volatility drop.

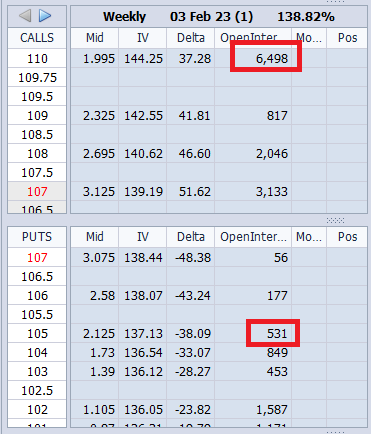

While there is a $107 strike for the February 3rd expiration, we see that the strikes at $110 and $105 have much better open interest:

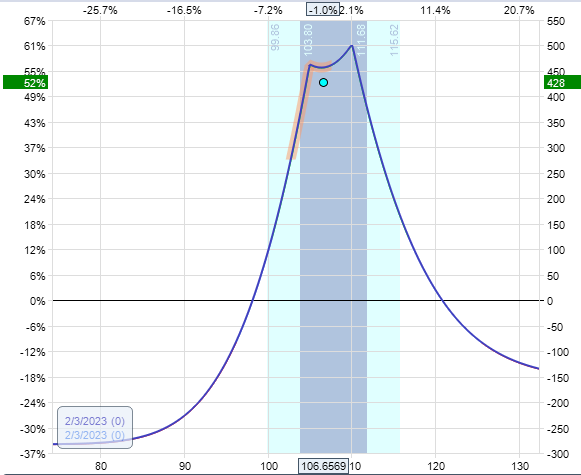

So let’s have two put calendars at the $105 strike and two call calendars at the $110 strike like this:

Date: February 2, 2023

Price: GOOGL at $107.02

Sell two Feb 3rd GOOGL $105 call @ $2.00

Buy two March 24 GOOGL $105 call @ $4.15

Sell two Feb 3rd GOOGL $105 put @ $2.13

Buy two March 24 GOOGL $105 put @ $4.08

Net Debit: $821

The max risk of the trade is $821.

The long options have expiration 50 days away.

This extra time gives the trader choices if the trade does not work out (as you shall see in this cherry-picked example).

While technically, this is known as a double calendar, its graph and behavior are very close to that of the calendar since the strikes of the two calendars are so close together.

If you do the math, the call calendars cost $215 each.

The trader sets a good-to-cancel (GTC) order to sell one of the call calendars at a limit price of $300 each.

That would return almost a 50% gain if the market swings during the open, causing this order to trigger.

The put calendars cost $195 each.

The trader also sets a GTC order to sell one of the put calendars for $300 each.

The trader could have set the orders to sell all the calendars.

We are only selling half to decide what to do with the other half later.

The next day after the earnings announcement, both orders were triggered.

The trader could have overslept or not been at the computer.

The orders had locked in some profits.

Now the trader has only one call calendar and one put calendar remaining.

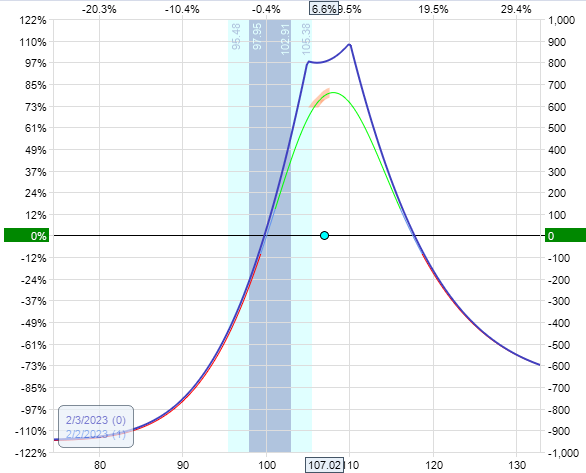

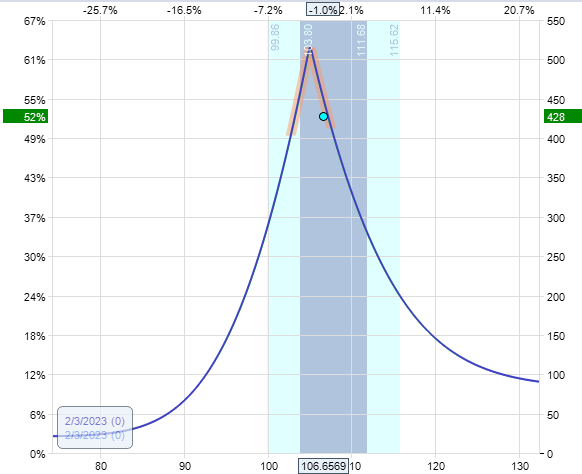

The position looks like this, with a P&L of $428.

This is a 50% return on capital, and the trader could certainly close out the remaining calendars and call it a successful earnings trade.

However, let’s see what else we can do.

We can close the call calendar for a profit and collect a $304 credit.

By doing so, we have collected enough credits such that the remaining one put calendar is in a no-risk position.

The short put in this calendar is about to expire on the same day, February 3.

Assignment Risk

Traders should understand assignment risk when working with short options close to expiration.

A short put option means that you have sold a put contract to someone else – probably to some investor who wanted the put option to protect existing Google shares of stock.

This put option grants that investor the right to sell his or her Google shares at the strike price of $105 per share regardless of how low the stock might drop.

That investor could exercise that put option at any time prior to the expiration date.

If that person chooses to do so, you would be obligated to purchase those 100 shares at $105 per share (regardless of the market price).

Therefore, your account should be large enough to perform this purchase.

If not, the broker will exercise your long put option to sell back the 100 shares to the market at the strike price of the long option (in this case, also $105).

This is why the long option exists as protection.

Never sell out the long option without first buying back the short option.

If the short option is running out of time (as in our case here), the trader can roll the short option further out in time.

Buy to close one Feb 3rd GOOGL $105 put @ $0.18

Sell to open one February 10 GOOGL $105 put @ $1.23

And get a net credit of $105.

This is why we bought the long option so far out in time – so that we can sell additional cycles if we want to.

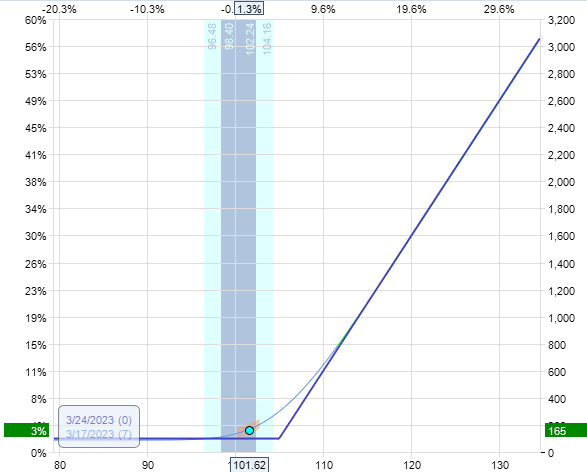

After rolling the short put further out in time, our new position looks like this:

On February 10, the new short put is about to expire.

The trader rolls again to the next expiration cycle of February 17. On February 17, the trader rolls the short put to the February 24 cycle, always keeping the strikes at $105 to maintain the calendar.

Some traders might convert it into a diagonal by selling at different strikes.

But understand that this will add additional risk to the trade and can take your no-loss trade back into a loss situation.

The trader continues rolling the short put to the March 3rd expiration and then to March 10 and to March 17.

Whether the trader makes or loses money doing all this rolling depends on what the price of the underlying happens to do.

Sometimes the roll is for a credit, and sometimes it is for a debit, again depending if the price of Google happens to go up or down.

On March 17, the trader cannot roll anymore since the long option expiration is in the next cycle of March 24.

According to the OptionNet Explorer, which kept track of the P&L as we went through the simulated trade, the final P&L at this point is $178, which is a 22% return on the original $821 of capital used.

This P&L is less than what the trader would have gotten if they closed the entire trade right after earnings.

At this point, the trader needs to decide if they want the assignment of the Google stock. If not, then they would need to close the trade.

If the trader decides that they don’t mind the assignment of 100 shares of Google stock, they can let the short option expire or get assigned.

At the end of the day on March 17, Google closed at $101.62, which is below the strike price of $105. Therefore, the trader is assigned 100 shares of the stock and paid $105 per share.

This is not a problem because the trader has a long put option that entitles him or her to sell 100 shares back to the market at $105 per share.

However, remember that this long option expires in a week.

But it can be extended by rolling it out in time as needed.

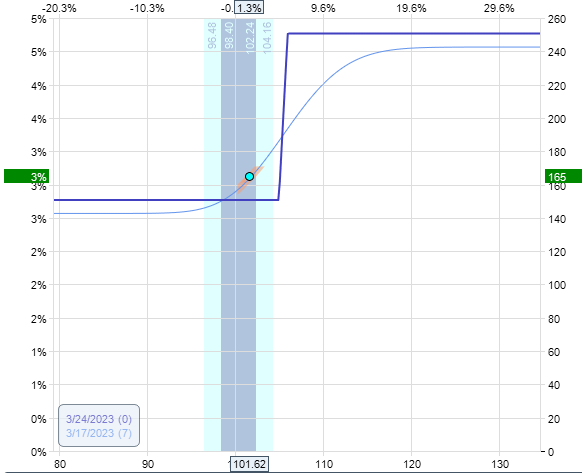

The position is now a married put position:

Now the trader could apply the Wheel strategy if desired.

For example, selling the $106 call option expiring March 24 would bring in a credit of $52 and “collar” the stock:

Due to the gains from the original earnings strategy, this trade continues to be in a no-risk position.

Apologies for such a long and complicated example.

The point was to show that the trader has many choices and flexibility after the earnings announcement, including potentially converting the earnings trade into a post-earnings trade which we show next.

Post-Earnings Trade

After an earnings announcement, the IV will be quite low.

Calendar trades are well suited for low IV environments. Calendars tend to lose values when IV drops.

But if you initiate calendars when IV is at the low end of the IV range, then we are betting that IV could not drop too much further.

In fact, we can wait another day after earnings before placing the calendar in case IV still falls more post-earnings.

Because we are going with non-directional calendars, we don’t want large price movements.

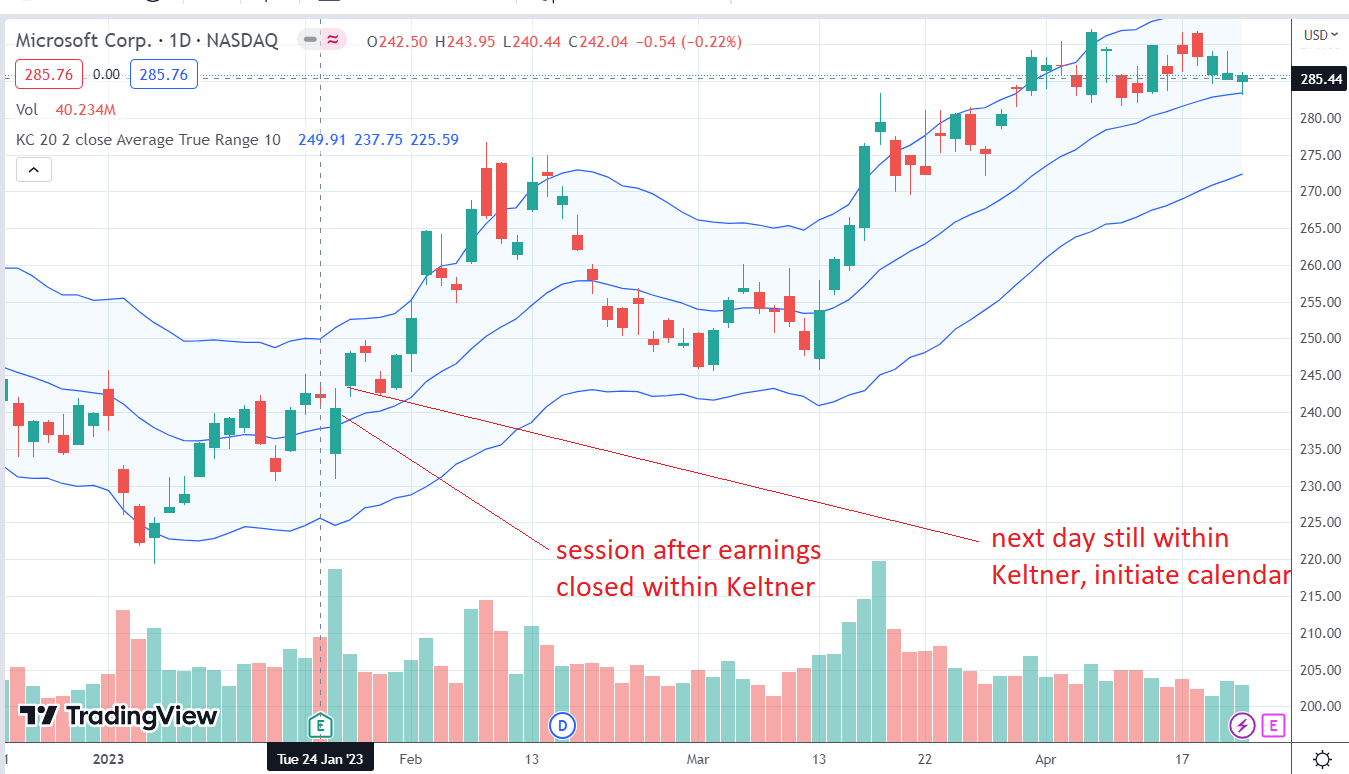

If the session after earnings closes outside the Keltner channel, then we will skip the trade.

But if the session after earnings close within the Keltner channel, and the next session also opens within the channel, then we can initiate a calendar that day.

Microsoft (MSFT) reported earnings after the market closed on January 24, 2023.

The day after earnings, MSFT closed within the Kelter channel.

On the morning of January 26, MSFT was trading at $243.

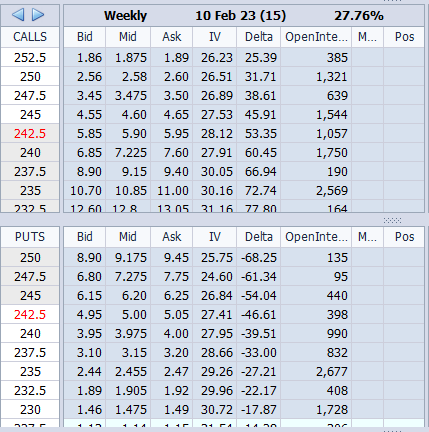

While it has a $242.5 strike, the investor decided not to do half strike and instead settled on splitting the calendar contracts between the $240 and the $245 strikes.

See how the $240 strike has a tighter bid/ask spread due to the higher open interest:

The trader initiated five put calendars at the $240 strike and five call calendars at the $245 strike, with the shorts about two weeks out.

The long options will be the next available expiration (usually one week further out).

Date: January 26, 2023

Price: MSFT @ $243

Sell five February 10 MSFT $240 put @ $3.98

Buy five February 17 MSFT $240 put @ $5.10

Sell five February 10 MSFT $245 call @ $4.60

Buy five February 17 MSFT $245 call @ $5.45

Net Debit: $987.50

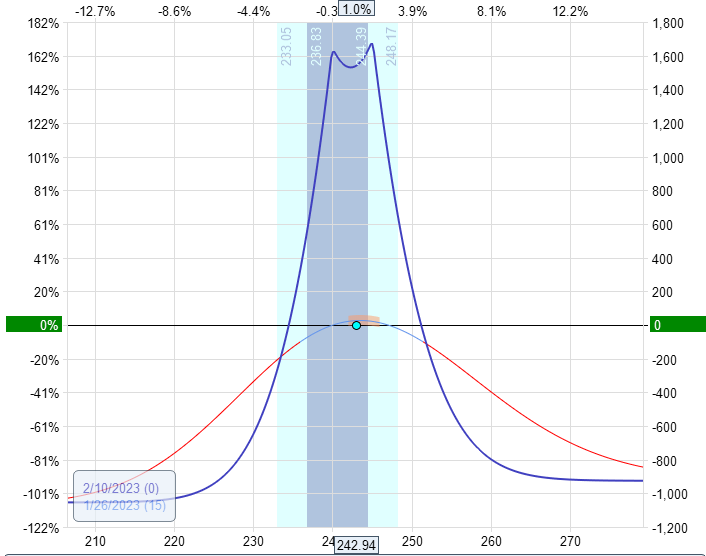

This is actually a close-together double calendar with a risk graph that looks like this.

Another advantage of having half of the calendars be put calendars and half of the calendars be call calendars is the added security provided in the event that the short options expired unintentionally, either because the trader forgot about the trade or because life events prevented the trader from closing out the short options.

If the shorts expired, you would be left with long options.

If they were all puts or all calls, that would leave you with a highly directional position.

A big loss can occur if the price decides to go in the wrong direction and you cannot get to the computer to stop it.

If half of the long options are calls and half of the long options are puts, at least you have a long strangle, which would be a non-directional position.

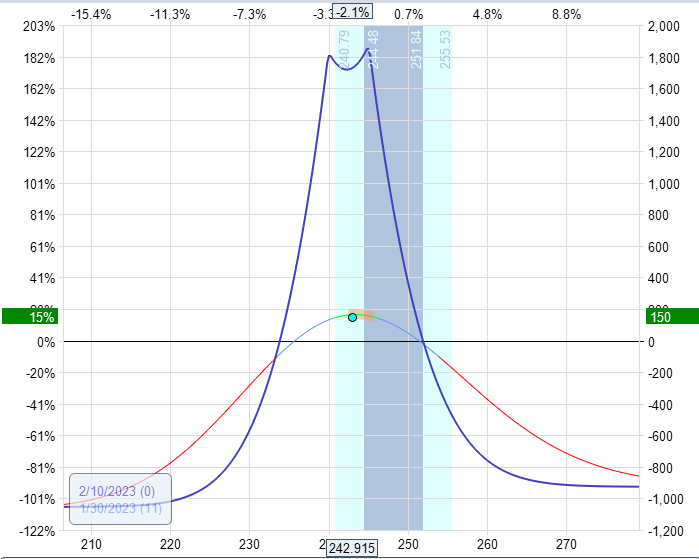

In any case, on January 30, the trade showed a profit of $150.

The investor decided to take it since it is 15% of the capital at risk.

This is how the trade ended:

Conclusion

We don’t mean to play favorites to the calendar regarding earnings.

However, they seem to make sense around the unknown known event where one of the expiration cycles is close to the event, and the other is further removed.

That is not to say that other strategies do not work.

These were just some ideas.

The iron condor is a long-time favorite for earnings trade, where you can fine-tune the risk-to-reward ratio of the trade.

And there is the double butterfly strategy, where you consider the event’s expected move.

We hope you enjoyed this article about trading options on earnings.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Typo

The Post Earning Call calendar should be 110 not 105 as you have written:

Sell two Feb 3rd GOOGL $105 call @ $2.00

Buy two March 24 GOOGL $105 call @ $4.15

Sell two Feb 3rd GOOGL $105 put @ $2.13

Buy two March 24 GOOGL $105 put @ $4.08