Contents

In this example, we will trade a double-calendar earnings trade on Tesla (TSLA), which reported earnings on April 19, 2023, after the market closes.

The trade could have been placed on April 19 or April 18.

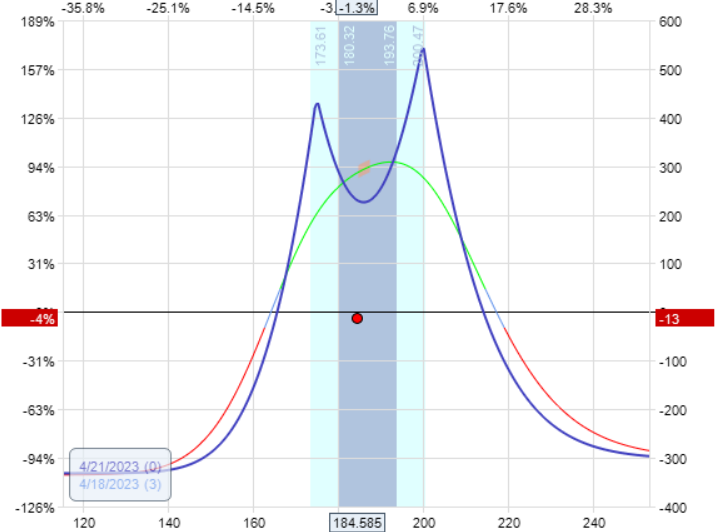

We placed the following on April 18 while TSLA was trading around $185.

Sell one April 21 TSLA $200 call @ $2.00

Buy one April 28 TSLA $200 call @ $3.50

Sell one April 21 TSLA $175 put @ $2.57

Buy one April 28 TSLA $175 put @ $4.18

We sell on the expiration right after the earnings report. We buy the option that expires one week later.

The further out in time we buy the long option, the more the calendars will cost.

The trade filled for a total debit of $318.

This is also the max risk of the trade.

In these short-term earnings trades, not many adjustments can be made to help the trade if it gets into trouble.

So we need to size the trade appropriately, understanding that we can potentially lose the entire capital in the trade.

Hit or Miss Trades

Also, the Greeks are not very relevant.

Theta might even be negative for these very short-term trades.

This strategy is “hit or miss,” no adjustments, no rolling, etc.

Either the price falls inside the tent after earnings or outside — win or lose.

Immediately after getting filled, we set a good-to-cancel (GTC) order to exit for a credit of $360.

That way, my broker will automatically exit for me if the price is hit (even when I’m not watching on my computer).

Why $360?

That’s up to you. $360 represents a 113% profit on the trade.

$360 / $318 = 1.13

If the profit target is set too high, it is not likely to hit.

And if set too low, you might cap your profits.

That’s why some traders set an automatic GTC order on half the position to evaluate what to do with the remaining half.

On the day after the announcement, April 20, TSLA gapped down on the open.

It gapped a little too far for our double calendar to handle.

TSLA went from $180 to $160 due to the earnings report.

That is why the price dot on the payoff graph went from being in between the two peaks of the double calendar all the way down to sliding down the slope of the left mountain.

Or to say it in another way.

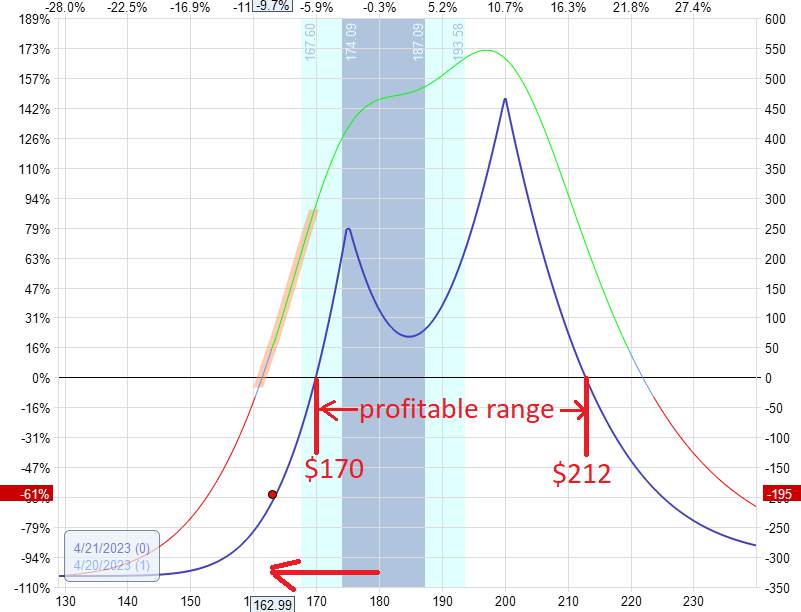

The price movement was much greater than the profitable range of the double calendar. See, the price is $162.

That is outside the profitable range of $170 and $212.

The P&L is showing a loss of around -$150.

There is no way we will collect a credit of $360 for this trade.

So we canceled the pending GTC order.

Since the upper calendar is too far from the current price to be of much use, we decided to close the upper calendar and get back $16.

And the resulting graph is as follows:

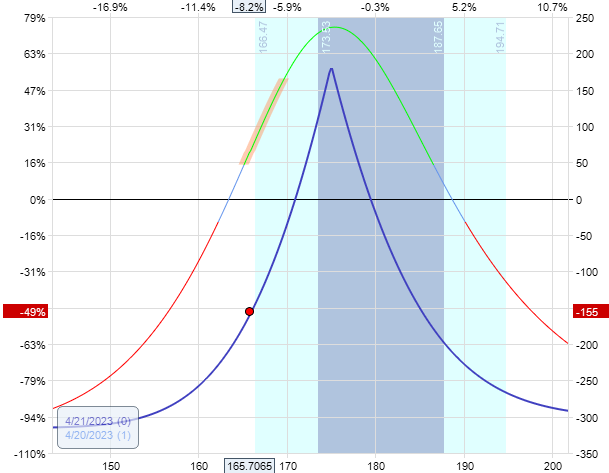

The graph looks a little out of whack because we are so close to expiration.

The remaining put calendar has the short option expiring in one more day.

We then placed a GTC order to see if we could get out at breakeven for the trade.

If we can exit the put calendar for a credit of $300, then we will be about to break even.

Assignment Risk

Later in the day on Thursday, April 20, we see a bearish price action on TSLA.

It tried to go up to $170, but sellers pushed the price of TSLA down, creating the upper wick in the “price rejection” candle shown above.

The price is currently hitting the bottom of the day’s trading range.

The short put option is already in-the-money because its strike is $175, and the underlying price is below that at $164.

This option expires at the end of the day tomorrow.

An in-the-money short option close to expiration is at risk of being assigned early.

This means that we could get the short option assigned at any time (even any time today).

If that happens, we are obliged to purchase 100 shares of Tesla at the strike price of $175.

We do not want this to happen because buying TSLA at $175 is at a loss since it is trading at $164.

But more importantly, the account size may not be big enough to buy that many shares.

We would need to pay $17,500 to fulfill our obligation of the short option if it is assigned to us.

If the account size is not large enough to make this purchase, the broker will exercise your long $175 put option in order to sell these 100 shares back to the market at the price of $175 per share.

Even if we do not get assigned early on the short option, we will need to close the short option tomorrow.

What if the internet is down or if life gets in the way and we cannot get to the computer to close the short option tomorrow?

Well, then the short option would automatically get assigned at the end-of-day tomorrow, and we run into the same situation as before when we get “assigned early.”

For all these reasons, we decided to close the trade out now on Thursday.

The order to close the remaining put calendar was filled and gave us a credit of $110.

This TSLA earnings trade had a net loss of -$192.

This is calculated as follows:

Initial double calendar cost: -$318

Credit for closing the call calendar: +$16

Credit for closing the put calendar: +$110

Net loss: -$192

This is a 60% loss on the capital at risk. Calculated as $192 / $318 = 60%

Retrospective

In any failed trade, it is a good idea to see if there was anything we could have done differently.

This is where OptionNet Explorer is helpful in simulating some back trades.

What if we had used a calendar instead of a double calendar?

P&L is -$268.50, or -71% loss.

What if we used a calendar with the long option expiration further out in time (say 45 DTE)?

P&L is -$327, or -46% loss.

What if we had initiated the trade on April 19 instead of April 18?

And towards the end of the day instead of in the morning.

P&L is -$263, or -75% loss.

Looking at the chart to see what happened:

Source: tradingview.com

TSLA had gapped outside the Keltner channel.

The channel represents a two-ATR move.

With such a large price move, we probably couldn’t have done anything.

Conclusion

We can not win all trades.

With earnings trades, you will win some, and you will lose some.

We hope you enjoyed this TSLA earnings trade example.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.