The Road Trip Trade is the name that Dan Harvey gave to his non-directional broken-wing butterfly options strategy.

Because this trade is placed with expirations 70 to 80 days out, there is usually little that needs to be done in the first 30 days of the trade except to check it once a day for large market moves.

Hence, this trade allows you to be able to take long road trips.

Contents

- Introduction

- The Road Trip Specifications

- Adjustments

- The Reverse Harvey

- Put Debit Spread

- Alternative Upside Adjustments

- Frequently Asked Questions

- Conclusion

Introduction

We cannot say that Dan was the inventor of the non-directional broken-wing butterfly, just like we cannot attribute any one person as the inventor of the iron condor.

The non-directional broken-wing butterfly is a category of options trading style of which there are many variations, including the Rhino (which incidentally has the same days-to-expiration as the Road Trip), John Lock’s “M3” butterflies, Amy Meissner’s A14, and even Dan Sheridan and Mark Fenton of Sheridan Mentoring has their own version of it.

Today, we will talk about Dan Harvey’s version of the “Road Trip Trade,” sometimes referred to as “RTT.”

The specification of this particular version can be found in Tom Nunamaker’s and Dan Harvey’s 2016 webinar.

A year later, in 2017, a good article providing the history and philosophy of the Road Trip was published in Stocks & Commodities V 35:02 (22-27) written by John Sarkett.

The Road Trip specifications

The Road Trip is an all-put butterfly done on the SPX or RUT indices.

The upper long strike is placed at the money with 40 points wide upper wings (for SPX) and 50 points wide lower wings.

These widths are not set in stone and can be tweaked. Dan tries to have at least two of the legs landing on quarter strikes (such as 2050, 2075, 2100, etc.) for liquidity.

However, those specs were for the market in 2016, where SPX is trading at 2150.

Today in 2022, the SPX is trading at 3590 — clearly a bit different.

Modelling Dan’s butterfly using historical data in OptionNet Explorer, I can see that his 40/50 wing spans at the time translate to having the short strikes around the 40-delta and the lower long put around the 30-delta.

If we put on a similar configuration in today’s market, it would look like the below with 75/85 wing widths. The lower wing is always the wider wing.

Trade Details

Date: January 21, 2022

Price: SPX @ 4465

Buy one Mar 31 SPX 4300 put @ $119.45

Sell two Mar 31 SPX 4385 put @ $144.35

Buy one Mar 31 SPX 4460 put @ $170.65

Net Debit: $140 Max Risk: $1140

Delta: -0.09

Vega: -22.22

Theta: 3.21

Gamma: -0.01

Like the iron condor, these butterflies are short vega and positive theta.

The main driver of the trade is the theta decay of the two short puts.

The upper long put is the protective option that prevents large losses if the market goes up.

The lower long put is to cap the margin and to balance the deltas.

The delta here is so small it is considered delta-neutral, which is how we want the butterfly to be.

The profit target is to get at least a 7% return on the capital at risk, and they are willing to take the trade within two weeks of expiration.

If the trade is in good shape, they can take up to 15% return and may sometimes even go to expiration.

When someone in the webinar asked about the returns, Tom mentioned that he was making about 25% to 30% annual returns.

Adjustments

In order to get into the topic of adjustments, let’s play out our example trade in OptionNet Explorer, keeping in mind that this example is in the midst of a volatile bear market of 2022.

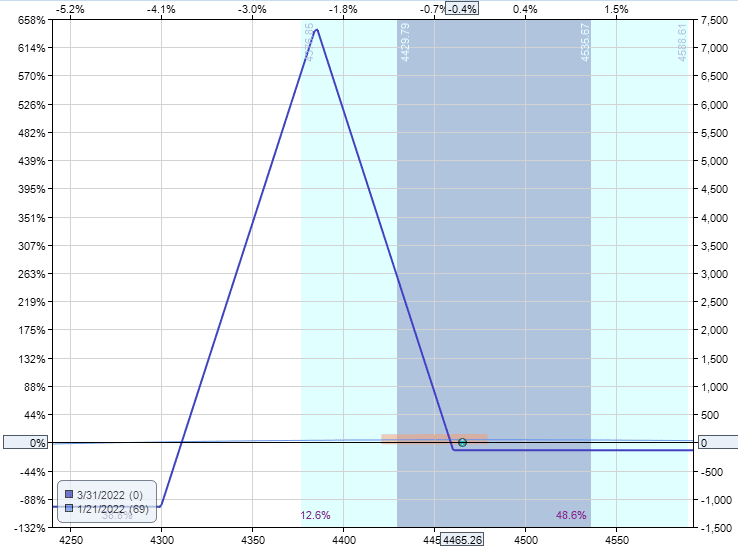

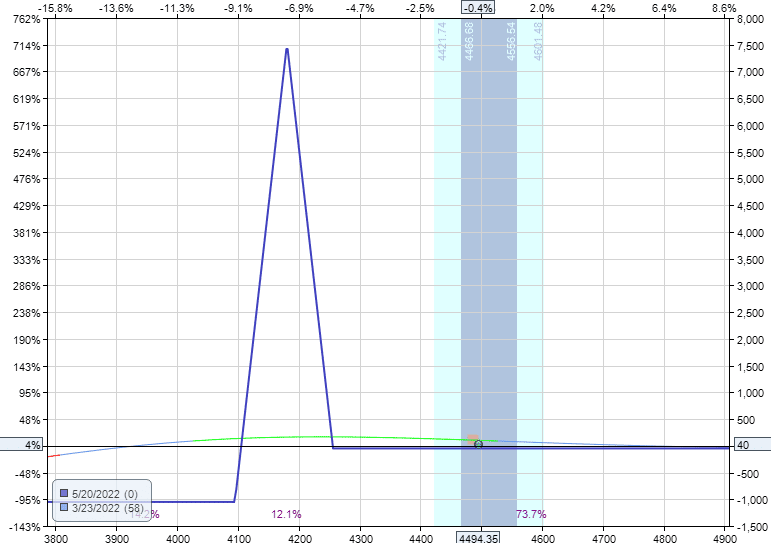

Our example trade above was initiated on January 21, 2022.

The next morning on January 24, SPX went down from 4465 to 4310, an unusually large 155-point drop that Dan and Tom said to watch out for.

This caused the price to drop to the lower edge of the butterfly graph with a position delta of 0.74.

source: OptionNet Explorer

The trade is down 17%, and P&L is at a loss of –$195.

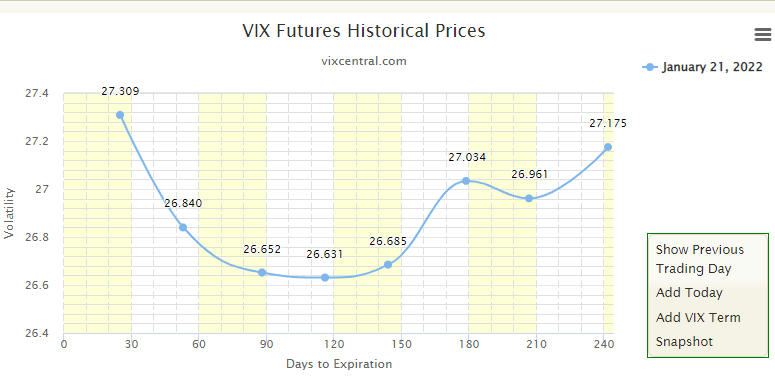

In hindsight, we see that the VIX term structure was steeply backward on January 21 when the hypothetical trade was placed.

Some traders may decide not to have initiated a non-directional trade under those conditions.

Other traders may want to tweak the butterfly to have a more negative delta under those conditions.

A negative delta makes the butterfly more resilient in the event of a black swan down move by the market.

This can be done by raising the lower put strike by 5 points.

So instead of a 75/85 butterfly, they would have a 75/80 butterfly with slightly more negative delta due to the decrease in width of the lower wing.

Stop Loss Or Not?

Dan Harvey and Tom Nunamaker did not mention a stop loss on the trade.

I suppose you can set your own personal mental stop loss on the trade if you like.

They just said they would often have a conditional order that would buy an at-the-money put debit spread to protect against such moves.

But since in our hypothetical trade, we don’t have such an order.

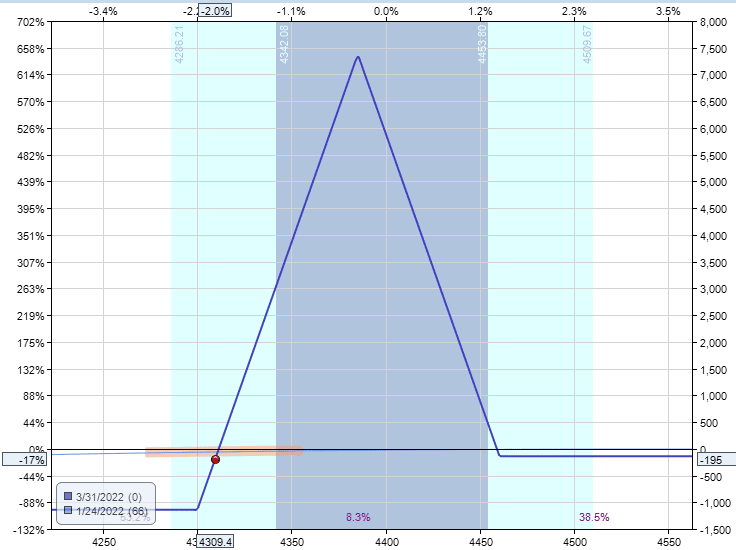

We would have to make the following adjustment by buying the put debit spread:

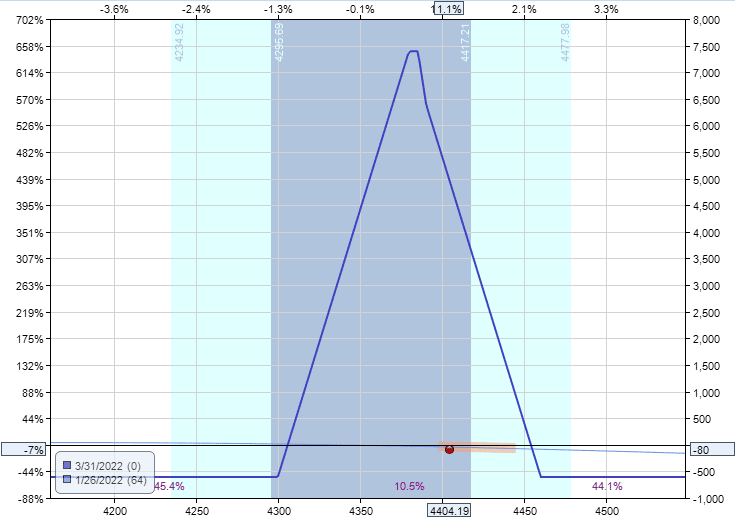

Date: January 24, 2022

Price: SPX @ $4309

Sell one Mar 31 SPX 4380 put @ $232.25

Buy one Mar 31 SPX 4390 put @ $236.90

Debit: –$465

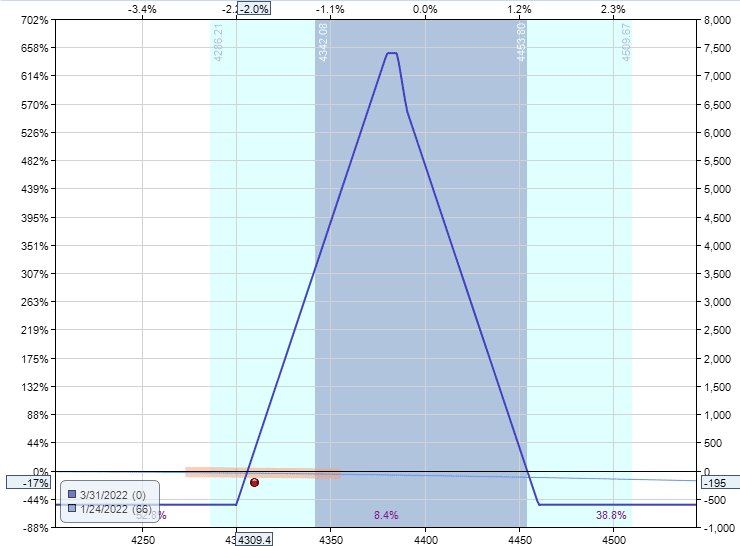

The result is a position delta of -0.43, and the graph now looks like this:

We paid $465 for the put debit spread.

They recommend closing the debit spread if its value drops to 50% to 75% of its original value.

This prevents us from losing the full cost of the hedge if the market whipsaws back up.

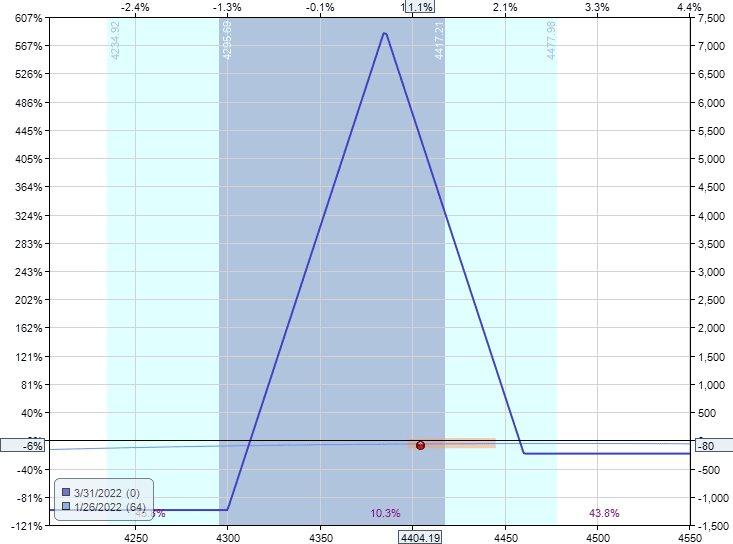

Two days later, on March 26, the market came back up to 4404.

Price is back into the center of the tent. P&L is at a loss of –$80.

We remove the put debit spread.

Date: January 26, 2022

Price: SPX @ $4404

Buy one Mar 31 SPX 4380 put @ $170.00

Sell one Mar 31 SPX 4390 put @ $173.70

Credit: $370

Trade is back in shape with a delta of 0.18 and a theta of 3.55.

The Reverse Harvey

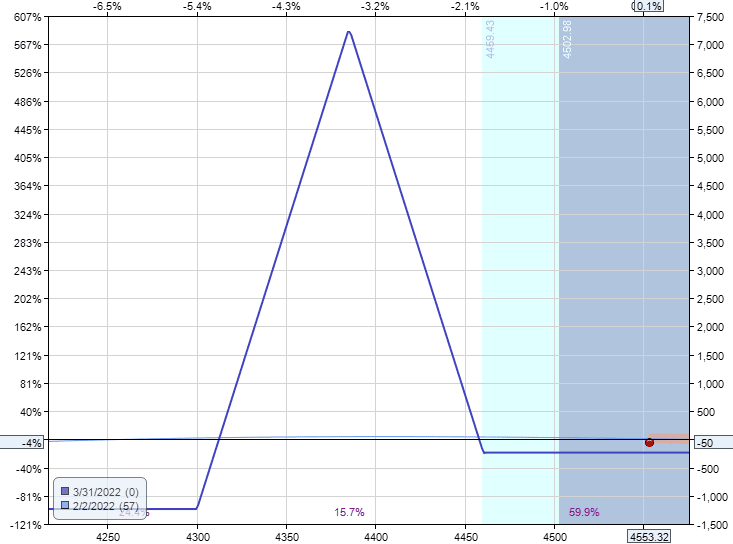

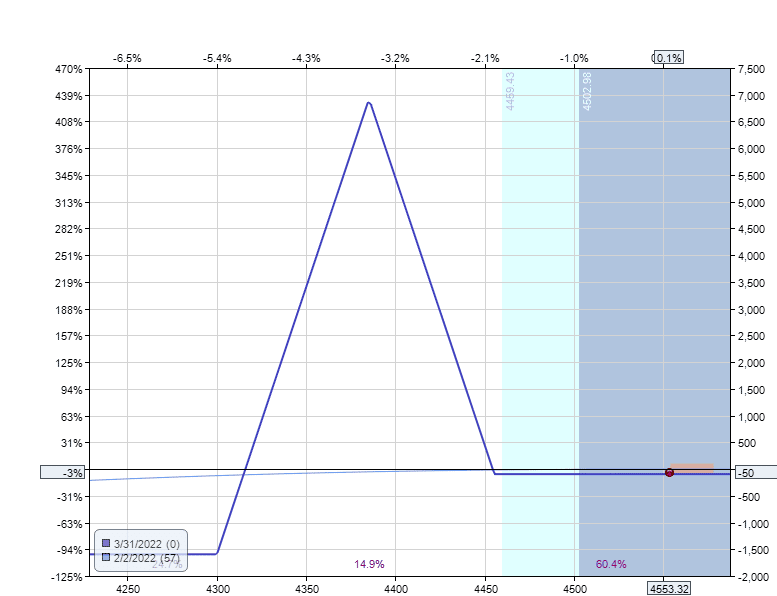

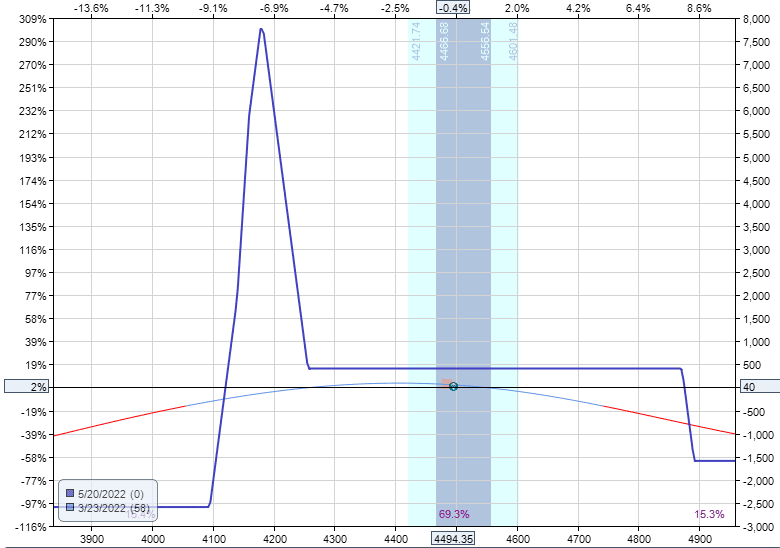

On February 2, the price is running up away from the tent.

The position delta is -0.52.

Let’s perform a small Reverse Harvey adjustment on the upside by selling the upper long put and buying a new upper long put with a strike 5 points lower.

Date: February 2, 2022

Price: SPX @ 4553

Buy one Mar 31 SPX 4455 put @ $107.15

Sell one Mar 31 SPX 4460 put @ $108.55

Credit: $140

In effect, we are selling a bull put spread to decrease the width of the upper wing.

The adjustment flattens the delta to zero and raises the expiration graph on the upside so that it now looks like this:

The Reverse Harvey is not a term that Dan named after himself, as he had mentioned in another webinar that he is not so vain to have done so.

It was a term given by Mark Sebastian (another butterfly trader at the time).

And somehow, the name stuck.

Put Debit Spread

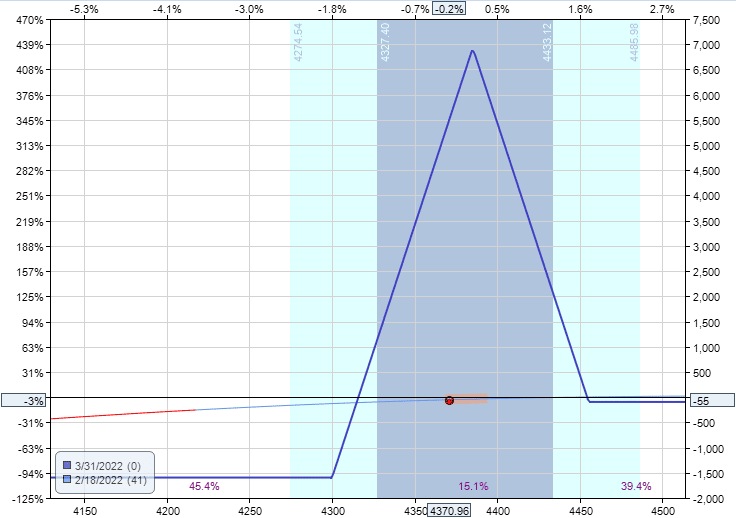

On February 18, the price dropped below the short strikes of the butterfly.

This is the area of the tent where we need to start thinking about adjustments.

The position delta is 0.87, and P&L is down 3.5% at –$55.

We again add a small put debit spread to flatten the delta a bit so that we let theta have time to do its work.

Date: Feb 18, 2022

Price: SPX @ 4371

Sell one March 31 SPX 4380 put @ $146.15

Buy one March 31 SPX 4390 put @ $150.15

Debit: –$400

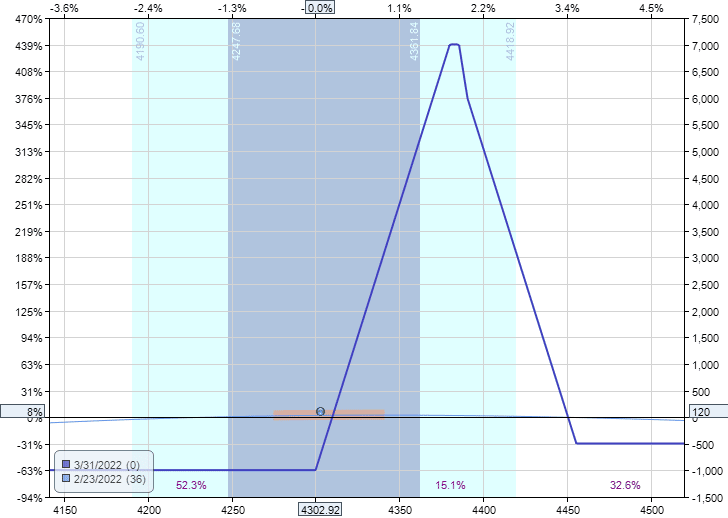

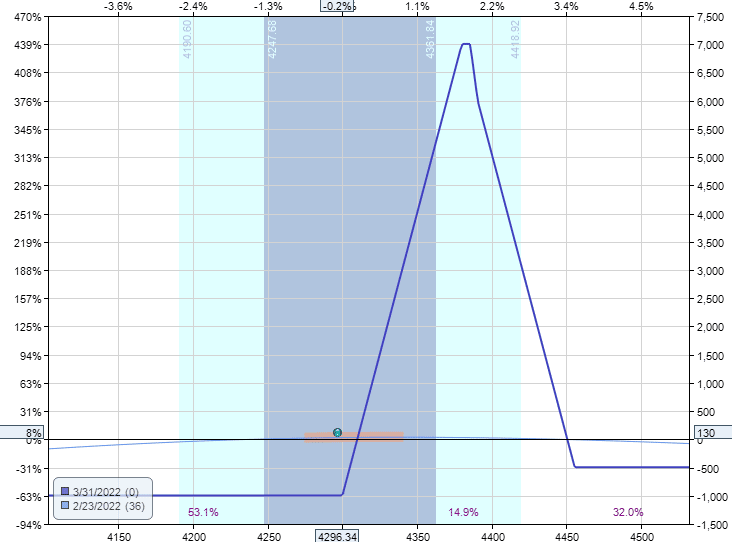

And the put spread did its work. Because on February 23, the P&L reached $120 intraday.

Hopefully, the trader will be back from the road trip by now to be able to watch the trade intraday because it’s been over a month since the trade was initiated.

And trade is getting more active with 36 days-till-expiration.

Alternatively, many traders would put in a good-to-cancel conditional order to take profits.

The current capital at risk changes due to adjustments, and the purchase of the put debit spread added capital at risk.

While with 36 days still left till expiration, the trade can be taken closer to expiration if the price is better positioned in the tent.

However, the current price has fallen outside the tent, and the trade is due for another adjustment.

Instead of making an adjustment, we simply take this profit and start a new trade with a correctly positioned starting configuration.

Alternative Upside Adjustments

The Reverse Harvey is the first go-to adjustment on the upside.

This let’s the “butterfly be the butterfly,” as Dan puts it.

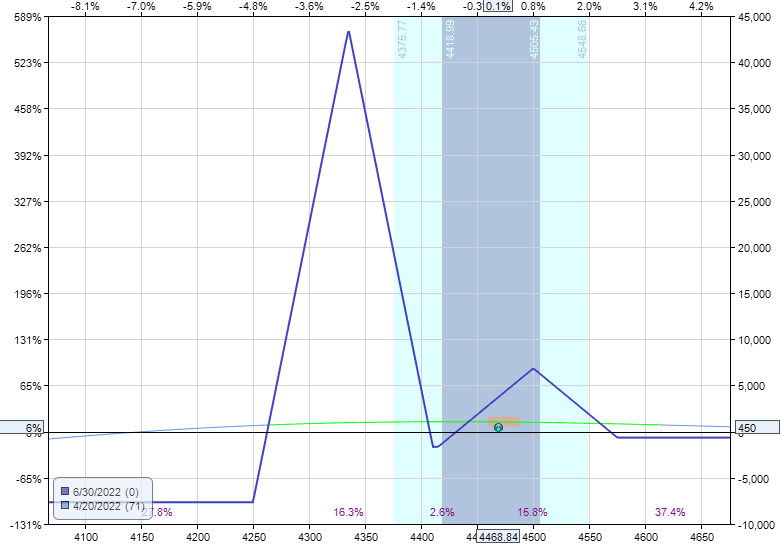

An alternate upside adjustment is to add a “baby butter.”

Suppose there are six contracts of butterflies here.

As the price gets ahead of the main fly, we add a one-contract fly slightly ahead of the price.

Here we added a fly with the same 75/85 wing widths, reducing the delta and increasing theta nicely.

If you had to adjust your various Greeks, there is no reason why you can’t move the baby fly further out or closer in and configure its wing width slightly in order to get you the resulting combined Greeks that you want.

Suppose for some reason, that the price gets so far ahead that the baby butter is no longer able to touch the mother, as in this case here:

The theta effect in a position like this would be greatly reduced.

We need to add some positive theta in order to increase profits to the point where we can get out of the trade.

Some traders might even reduce the profit target on the upside if the price stays above the fly.

One way to boost theta is to layer an iron condor on top of the current price.

The strikes of the condor can be adjusted to balance the delta. Since the condor adds more negative vega to the trade, it may be beneficial to keep the delta slightly negative.

The only issue is that the trade becomes more like a condor than a butterfly.

But since Dan was a former iron condor trader, he is comfortable managing these.

Frequently Asked Questions

What is Dan Harvey working on now?

Well, I’m guessing he is retired and on a road trip somewhere — I mean, on a real road trip.

But seriously, if I Google search, I see that Dan Harvey has introduced the “Boxcar Trade” in the year 2020.

What is the Boxcar Trade?

What Dan Harvey and Tom Nunamaker call the Boxcar is, in fact, a combination of a debit spread and a credit spread.

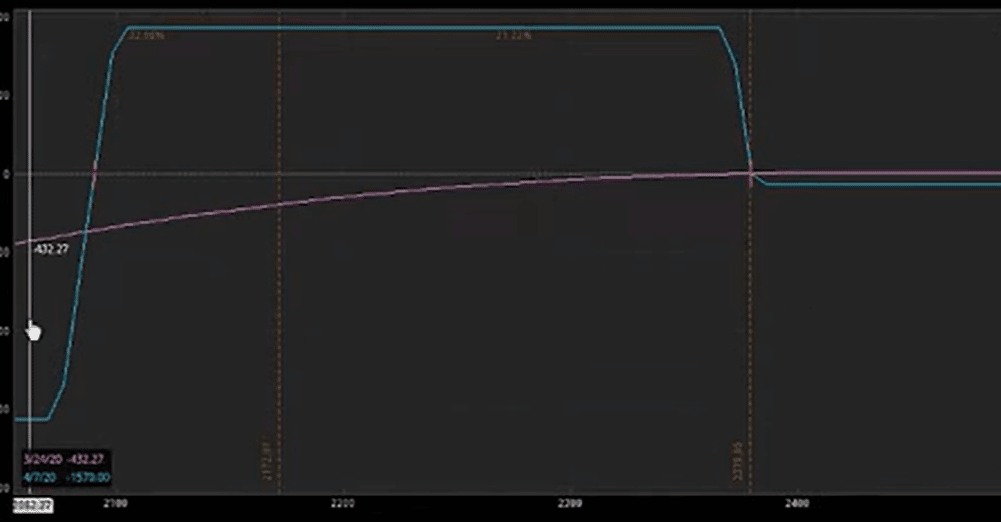

A screenshot glance from Aeromir’s video shows the Boxcar payoff graph to be the following:

It looks almost like a Road Trip butterfly with the top triangle of the butterfly loped off.

While the expiration graph is close to the asymmetric iron condor, the T+0 line remains quite similar to the Road Trip.

Is the Boxcar better than the Road Trip, then?

It’s hard to say; Google didn’t give me any info on why they switched to the Boxcar.

But we do know that the Boxcar is a much shorter-term trade with about 8 to 9 days to expiration.

Then in 2021, Amy Meissner, having worked with the Boxcar for a while, decided to go back to the butterfly configuration and introduced the A14 butterfly (also on the Aeromir YouTube channel), which has 14 days to expiration.

It is interesting how strategies evolve with time.

Different traders will personalize existing strategies to put their own spin on things.

The Boxcar, Road Trip, and A14 may all be just a preferential choice, just like chocolate, vanilla, and strawberry ice cream.

You may like one better than the other. But can you really say that one is better?

Conclusion

The Road Trip and similar butterflies will cost less the further out in time the expirations are. And it will cost less the higher the implied volatility is.

That means that the butterfly will be worth more and more as it has less, and less time left to expiration — if all other factors are kept the same.

The butterfly will also increase in value if implied volatility drops.

The goal of the trade is to let your fly increase in worth so that you can sell it for more than what you had paid for it.

The first obstacle stopping you from your goal is the price moving too much away from the fly.

You will find that the Road Trip does not have much risk on the upside.

Just patiently wait for time to pass as the price sits above the fly.

Theta will eventually bring the profit T+0 line up, and you can often get out with a small profit.

The trade is also quite resilient on the downside if you start adding the put debit spread as soon as the price goes below the short strikes of the fly.

The sweet spot is to have the price sit right near the upper long put — the same place as the RTT’s starting position.

Therefore, if you find that the price drifts out of this sweet spot and you have a profit on your hands, consider resetting the fly’s position back to its starting configuration by taking the profit and buying a new fly.

Give The Road Trip Trade A Test Drive

Give the Road Trip a try and test drive the various adjustments.

Either paper trade it, backtest it, or live trade it starting with a small size.

You might find that you enjoy the ride.

We hope you enjoyed this article on the Road Trip trade.

If you have any questions, please send an email or leave a comment.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Awesome article! Thank you very much!

I myself have been taking a similar approach and trading BWBs more and more lately

It would be very interesting and great if you could continue this topic by taking apart A14 and The Boxcar.

Good suggestion. Will do.

Awesome information, Gavin. Thanks for “curating” it for us. I second Anton’s request above.

Thanks for the info. Quick q, “Net Debit: $140 Max Risk: $1140” on initial trade, how is Max Risk calculated ?

The calculation for the lower side is a little tricky to follow, but you take the lower spread width (85) minus the upper spread width (75) times 100. Then add the debit paid.

Which gives (85 – 75) x 100 + 140

= 10 x 100 + 140

= $1,000 + 140

= $1,140

If doing multiple contracts, you would need to add in the number of contracts as a multiplier.

Boxcar is good strategy it may also called Jeep option strategy or weird strategy