Some traders believe it is not a good idea to trade options at the open.

While there are always exceptions, and a hard and fast rule should not be made, there is some truth to this belief.

In this article, we’ll explore why.

Contents

Introduction

The two main reasons are market reversals and wide bid/ask spreads that often occur at the start of the market day.

Seth Freudberg of SMB Capital even has a video titled “Don’t trade before 10 am“.

The time 10 am is a half hour after the market opens at 9:30 am Eastern Standard Time.

He says it this way:

“If you are more in a protective adjusting mode on a trade where you are at the beginnings and you’re not really looking to cash in on the trade. You’re looking to control the risk of the trade. Trading first thing in the morning is a really, really bad idea most of the time.”

What is considered “at the open” is up for debate.

Most will agree that the timeframe from opening to a half hour to an hour after the opening is the time most prone to the effects we will discuss.

In another video, Seth tells a story that happened to him as a beginning trader where he freaked out by a large opening-down move and closed his position at a big loss.

This happened within the first hour of the market opening, and had he waited one hour longer before reacting; the position would have been fine.

This is what he said,

“The market was down 500 points at one point, which back in 2007 was a monstrous move. I didn’t know anything about not trading between 9:30 and 10:30. I didn’t know nothing. And so. I freaked out. My put side was being hammered beyond belief. I freaked out. I closed the trade. If I hadn’t done anything, the market would recover like one hour later. I would have been fine.”

While Seth is talking about options trades, the concept also applies to equities day traders.

Tim Bohen has a “9:45 rule,” which is simply waiting until 9:45 am Eastern to jump in a trade.

This waiting time lets the stock prove itself and give confirmation of a valid rise instead of a fake rise due to FOMO (fear of missing out) price action.

The rule prevents traders from taking emotional trades based on headlines and press releases that just came out at 8:30 am.

Emotional Trades

A lot of emotional trades happen during the first hour, especially by newer traders.

It is also when many pending queued overnight trades get triggered.

This queue causes a lot of market fluctuations resulting in market reversal and wide bid ask spreads.

Opening Reversals

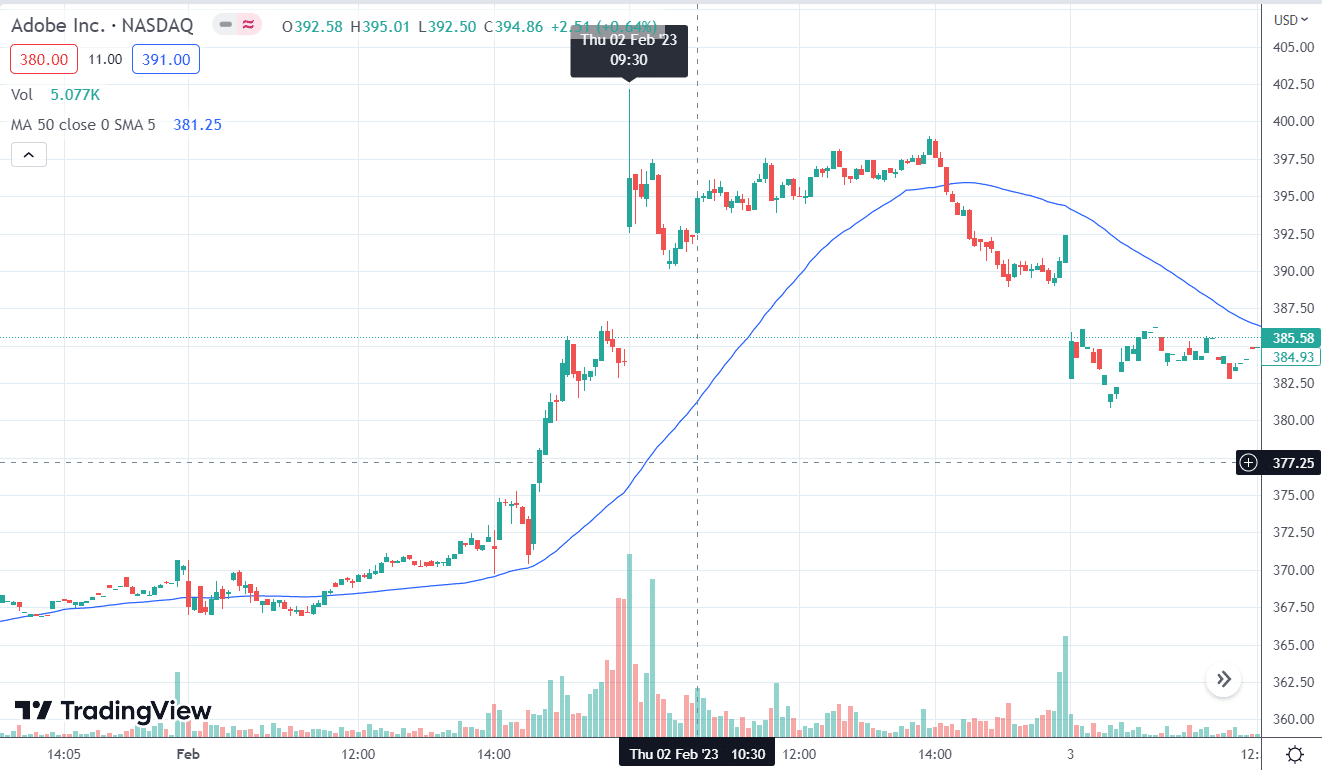

Take a look at what happened to Adobe (ADBE) at the market open on February 2, 2023…

This is a 5-minute chart, where each candle represents five minutes.

During the first 5 minutes at the opening, the price went from $393.28 to $402.49.

A move like that might trigger an adjustment in an options trade.

Ultimately that adjustment would not have been needed since the price moved back down to its opening price of $393.28 within the first hour of opening.

We are not sure what triggered this spike and ultimate reversal.

It was not even an earnings announcement day or anything.

We are not saying that these reversals don’t happen at other times of the day.

They do. However, they are quite common during the opening.

Wide Bid Ask Spreads

Even if the market does not reverse, it might be trending hard during the opening.

This can cause panicky trades where some traders need to get out and are willing to pay up to get out.

This causes wider bid ask spreads.

If you are trading in wide bid ask spreads, you might end up getting filled at unfavorable prices.

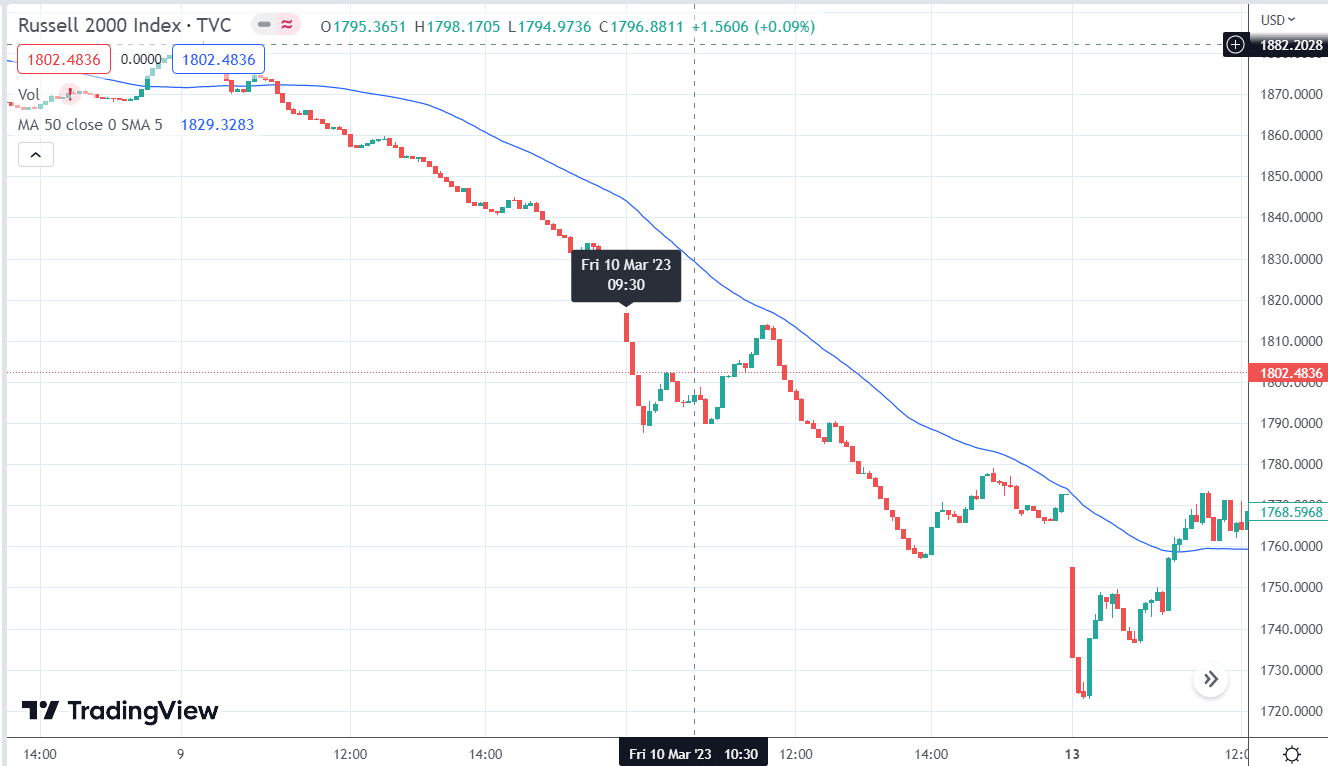

On March 10, 2023, the RUT index gapped down from the previous day and is trending hard downward at the open…

Because of the fast-dropping market, the price of put options is in great demand.

There were probably some panicky traders wanting to get some put options.

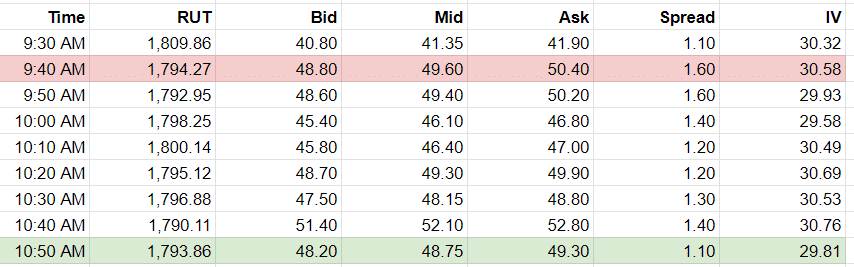

If you also need to buy a put option to adjust your option trade, here would be the mid-price and bid-ask spread of an at-the-money put option expiring in two weeks:

The data is from Option Net Explorer for the 1810 RUT put expiring March 24, 2023.

Compare the mid-price of the put option at 9:40 am and 10:50 am Eastern standard time. The RUT is at about the same price.

In fact, it is slightly lower at 10:50, which implies that put options should be worth more.

However, the put option price ($48.75) at 10:50 am is less than the put option price at 9:40 am ($49.60).

The price of the put option is more favorable at 10:50 simply because the emotional demand for the puts has lessened by then.

As you can see, if your option adjustment to protect your position is not urgent, you might get better pricing if you wait one hour after the opening when the demand pressures of certain options are reduced.

Whether you can get filled at mid-price depends to some extent on the width of the bid-ask spread.

The more narrow the spread, the better.

I have calculated the bid-ask spread in the “spread” column above.

You can see that the spread is wider at 9:40 am than at 10:50 am – at $1.60 and $1.10, respectively.

Using the Open to Your Advantage

In the above table, note that the implied volatility at 10:50 is lower at 29.81 versus 30.58 when it was 10 minutes after the opening.

Options with high demand drive up the implied volatility of that option.

Some strategies (perhaps 0-DTE option selling strategies) may specifically intend to capitalize on the higher implied volatility at the open.

In that case, they do want to trade at the open.

Another reason to put limit orders at the open is if you are taking an options trade at a profit target and believe you can get a good price during the open.

Then, of course, you can trade at the open and put in a limit order to see if the price swings can exit your trade at a profit target.

Or if you know what is a good price when making an adjustment, you can similarly put in a limit order.

The use of limit orders is the way to go with options trades.

If you need to trade out of a position, negotiate the price by putting in limit orders at favorable prices and waiting a bit to see if it hits before moving your limit price.

Don’t just click the mid-price at the first commit.

Slippage can affect your P&L.

The slippage during market opens may be larger than you might realize.

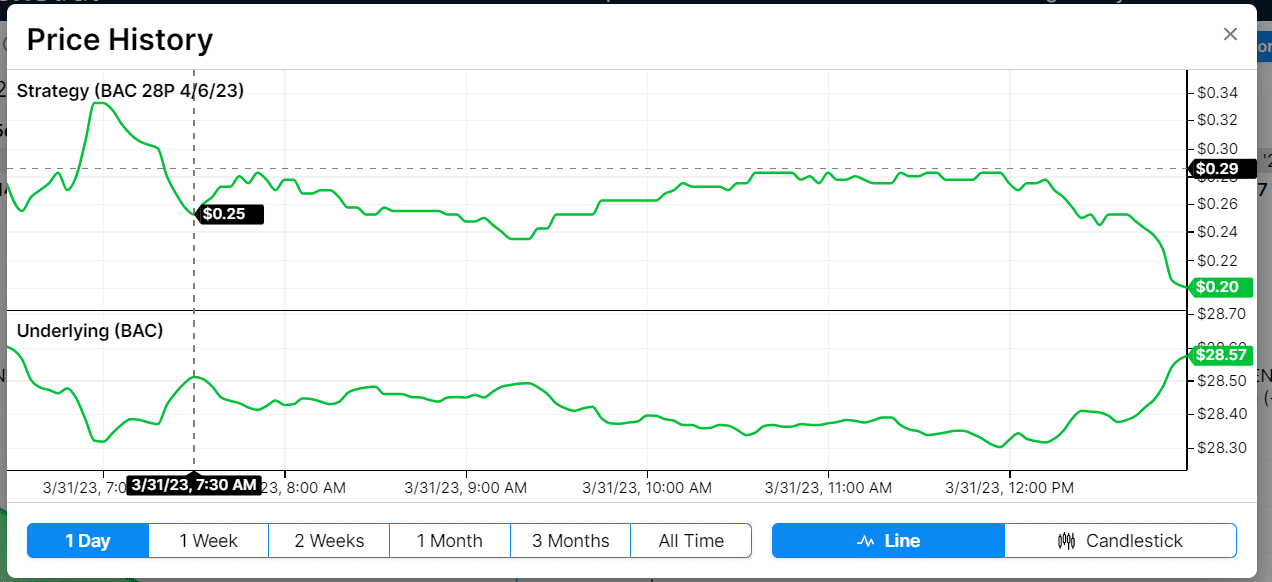

Take a look at how the price of a put option on Bank of America (BAC) can fluctuate throughout the day of March 31, 2013.

Source: OptionStrat.com

This is the value of the put option with a strike price of $28, expiring in one week.

See the large price fluctuation during the first hour after the option.

It went as high as $0.34 and back down to $0.25.

Conclusion

As mentioned at the start of the article, this should not be made a rigid rule but a general guiding principle.

Each situation needs to be evaluated on a case-by-case basis.

And there are certainly times when you have to trade at the open, such as correcting a trading error or hitting a “must-exit” loss trigger per your trading rules, etc.

At least now you have seen some data and some quotes from other traders who believe it is not a good idea to trade options at the open and the reasons why.

With this understanding, it is up to you to decide as a trader whether your particular situation warrants trading at the first hour or not.

We hope you enjoyed this article about trading options at the open.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.