Contents

- What’s The Plan?

- Happy Path: When XLE Goes Down

- Sad Path: When XLE Goes Up

- Middle Path: When XLE Goes Sideways

While I do like selling credit spreads and iron condors, they don’t work very well when implied volatility (IV) is low or when they IV spikes high after you sell them.

In a low imply volatility environment, I lean towards calendar spreads, diagonals, and iron butterflies.

And there is one more… That is scalping gamma on long puts.

While I generally don’t like to have one single leg option on for any significant length of time, this one starts off with a single long put on a ticker with a downward trend.

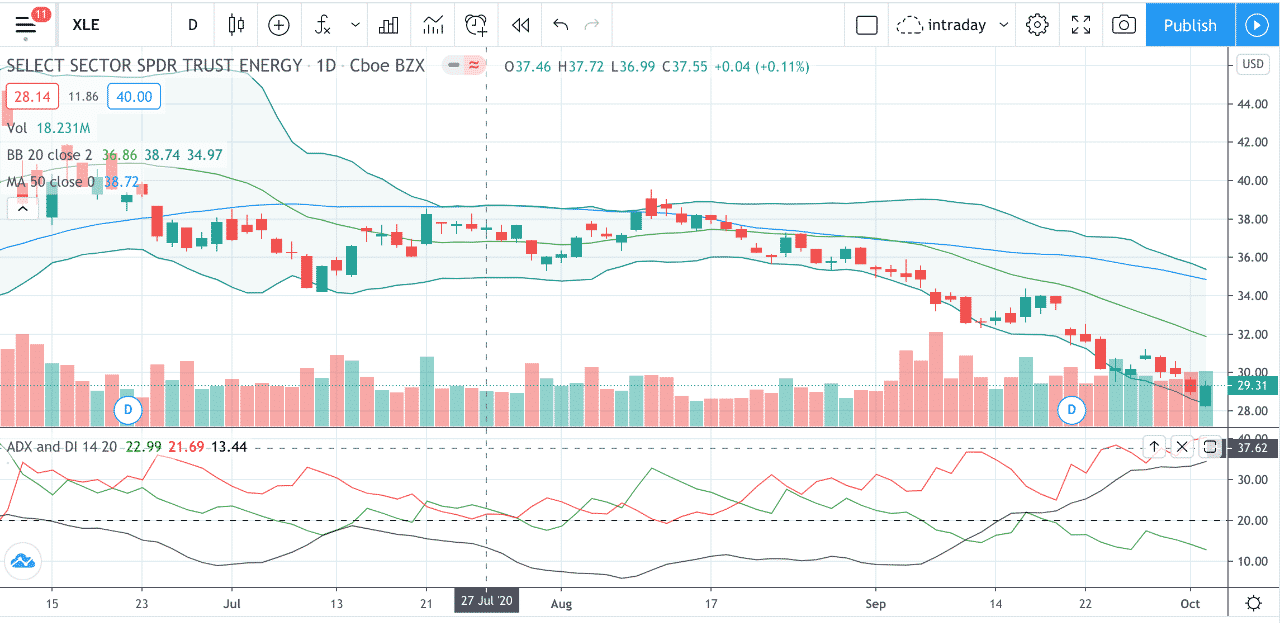

Such as XLE here…

Look at that nice downward trend of XLE on the daily chart.

The price is below the 20-day simple moving average (that is the green middle Bollinger band line).

The 20 SMA is below the 50-day simple moving average (blue line).

The ADX indicator above 30 showing nice trendiness with red DI line above and diverging away from green DI line.

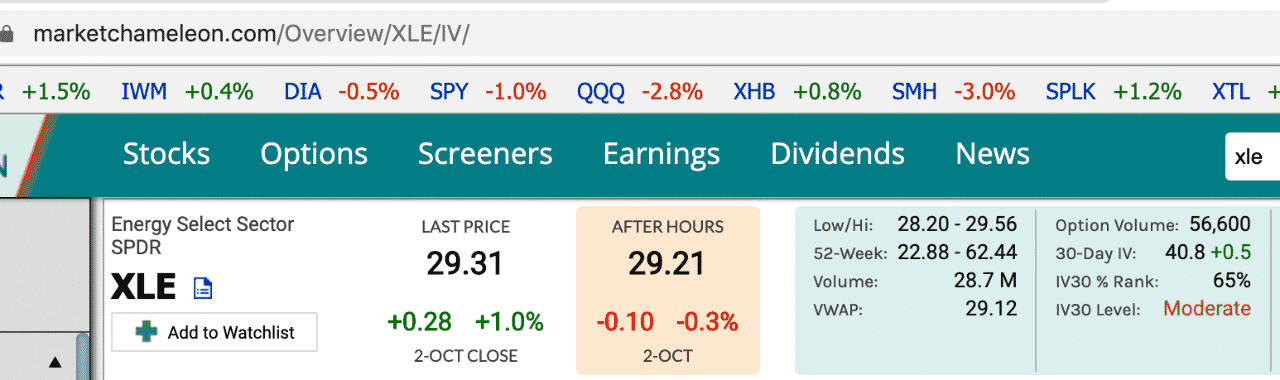

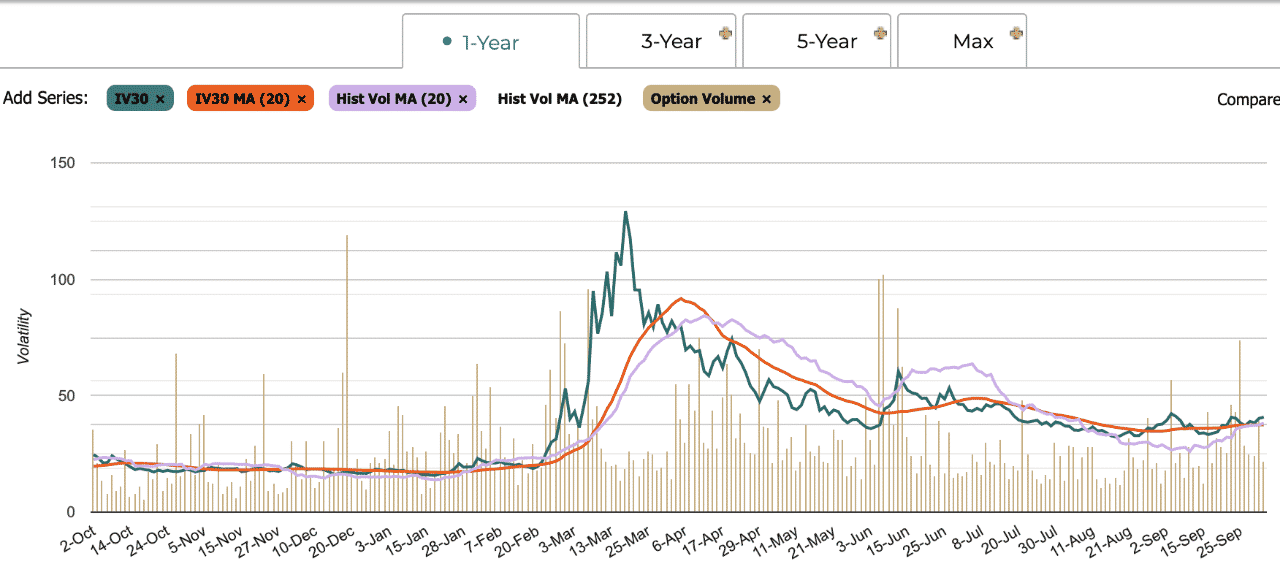

Next we check implied volatility (IV) using Market Chameleon or ivolatility.com.

Let’s take a quick look:

and its corresponding graph…

It’s moderate at 65% IV rank. IV can go either way.

Not ideal, but acceptable.

As long as IV is not too high.

If IV was high, I would not do this trade.

High IV means cost of the option is expensive.

With XLE trading at $29.31, let’s buy a one strike slightly out-of-the-money put at the $29 strike with November 20 monthly expiration. (That is at delta of -0.43 for those who are curious).

This is a monthly expiration with bid/ask spread about $0.10 wide.

Liquidity on the option is fine. We don’t want to buy short dated options, because that means the option will experience faster time decay.

At the time of writing this (Oct 4th, 2020) the option expiration is 47 days away.

This doesn’t mean that we are going to hold it for 47 days.

Let’s try not to keep it that long if we don’t absolutely have to.

What’s The Plan?

Always plan your trades before you get into them. What will we do in each of these cases?

- Happy path: when XLE goes down

- Sad path: when XLE goes up

- Middle path: when XLE goes sideways

The Happy Path, When XLE Goes Down

If XLE goes down, we scalp gamma.

Let’s say XLE goes down to $28 making our $29 puts be “in-the-money”. We buy some XLE stock.

Since we own 1 contract of the put. The maximum we would ever buy is 100 shares of stock.

Generally, we don’t want to buy the maximum.

We buy enough to hedge out or neutralize our delta.

Let’s say that our $29 put now has a new delta of -0.60.

We buy 60 shares to hedge the delta.

This gives us a combined position delta of roughly zero.

This means that we will not get hurt too badly at this point if the XLE moves up or down (for now – delta will continue to change as the stock moves and time passes).

Intuitively, it makes sense to buy 60 shares at $28. Because we own a $29 strike put, we have to right to sell up to 100 shares at $29 at any time up to expiration.

We are buying low with the option to sell high.

If after we buy our shares, XLE goes back up to $29, we sell our 60 shares, profiting $60.

Note that we haven’t touched our put.

We have just scalped $60 from the market due to the up/down and up/down gamma type movement that tickers usually do.

We call this gamma scalping.

If XLE goes down to $28 again, we buy stock again. If it goes back up to $29, we scalp profit again.

If XLE continues its downward trajectory.

Yes, we lose money on the 60 shares of stock, but our put makes money — hopefully in about the same amount (and theoretically it should if we buy the right amount of stock to balance our delta).

As an added bonus, as price drops, volatility usually increases, maintaining or possibly boosting the value of our put.

The Sad Path, XLE Goes Up

In the sad scenario that XLE goes up right after we purchased our $29-strike put, we either get out quick (hopefully for breakeven or a small loss) or turn our put into a spread.

Let’s say XLE goes up to $31 and our put is losing money.

You don’t want to have a single leg option that is going against you.

We can add another leg to turn it into a spread by either …

a) Selling a $30-strike put at November 20 expiration to turn it into a bull put credit spread.

Now you actually want the stock to go up (or at least not come back down to $30).

You’ve reversed your directional view and have moved with the market. (Much smarter than being stubborn on your original view and not going with the trend).

b) Selling a $30-strike put at October 16 expiration to turn it into a diagonal put spread.

c) Selling a $29-strike put at October 16 expiration to turn it into a calendar spread where the short put strike is at the long put strike.

You chose a, b, or c depending on how aggressively XLE is going up.

Choose “a” if XLE is looking very bullish. Choose “b” if only it’s only slightly bullish.

The Middle Path: When XLE Goes Sideways

And choose “c” if XLE goes sideways.

If you are not sure which “a”, “b”, “c” to choose, just pick the one that neutralizes your delta of the new overall position.

When your delta is near zero, you don’t have to worry too much about which direction the stock is going.

At this point, you no longer can scalp gamma.

Just manage the spread, the way you would manage that type of spread.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.