Today, we will look at the broken-wing butterfly and see how, under certain conditions, an adjustment can be made mid-trade to lock in profits and turn it into a risk-less trade.

In this example, we start with a broken-wing butterfly with no risk on the up side.

One week later, we locked in profit and turned it into a risk-free butterfly.

Contents

A broken wing butterfly, also known as a skip-strike butterfly, is a three-legged options spread similar to the traditional butterfly.

Whereas in a tradition butterfly, the width of the wings are equal; the broken-wing butterfly has wings of different widths.

The Setup

Unlike the traditional butterfly which is non-directional, a broken wing butterfly is slightly directional.

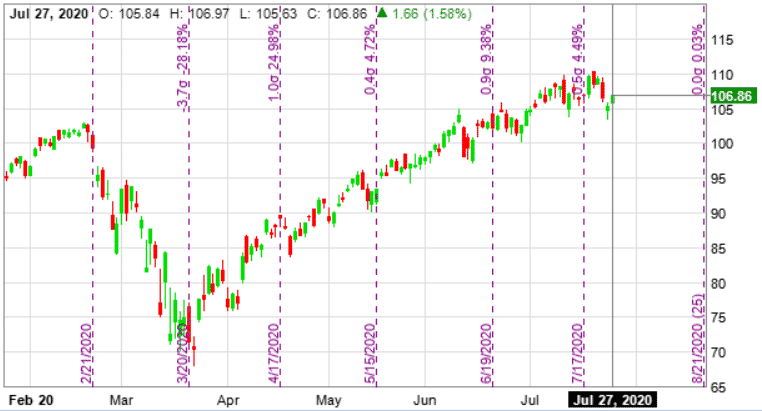

Let’s start with chart that has clear support and a bullish outlook.

For example, on July 27, XLK (technology sector ETF) is seeing an up day and bouncing up from support level of $204.

Here is the setup.

Date: July 27, 2020

Current Price: $106.86

Trade Set Up:

Buy 1 XLK Aug 21st, $80 puts @ $0.06

Sell 2 XLK Aug 21st, $100 puts @ $1.13

Buy 1 XLK Aug 21st, $102 puts @ $1.51

Premium: $0.69 net credit

This is an all-puts broken-wing-butterfly centred at $100 below the current price.

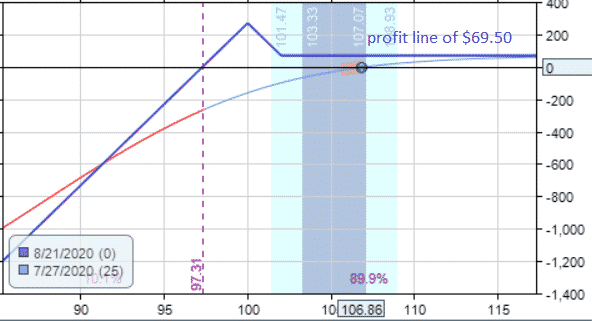

The initial payoff diagram has curve line sloping upward in profits as price moves to the right.

This means the spread profits as price increases.

We are using the lowest unit of contracts for illustrative purposes. Contracts can be scaled up by maintaining the ratio of 1-2-1.

Unlike the traditional butterfly where we pay a net debit, always construct a broken-wing-butterflies with a net credit.

We are able to do this by making the $80/$100 wings wider then the $100/$102 wings.

By having a net credit of $69 it also means that the broken-wing-butterfly has no price risk on one side.

In this case, there is no risk if XLK goes up.

A traditional butterfly has price risk on both sides, where one loses if price moves up too much or down too much.

Locking In The Profit

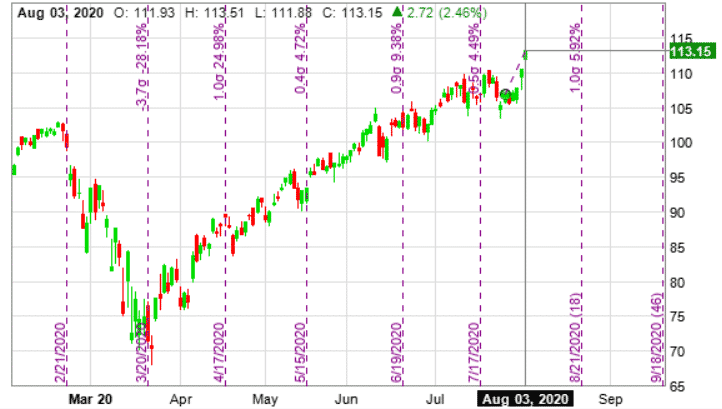

A week later on Aug 3, the price has gone up as expected and we are seeing paper profit of $57.

At this point, we don’t want price to drop, taking away the profit.

We lock in this profit by converting our broken-wing-butterfly into a traditional butterfly by moving the wide wing back to be evenly spaced with the upper wing.

Adjustment made on Aug 3

Sell 1 XLK Aug 21, $80 puts @ $0.04 (sell the existing long put of the wide wing)

Buy 1 XLK Aug 21, $98 puts @ $0.16 (buy the new put closer to the butterfly body)

Net cost: $0.12

We got an initial credit of $69 and we paid $12 to make this adjustment.

We have $57 now in the account (more or less based on bid/ask spreads and fills).

This is the profit we have locked it.

It is not possible for the new butterfly spread to incur any loss, because the adjustment gave us a new payoff diagram that is always above zero.

At this point, no matter what happens to the price of XLK or its volatility, we cannot lose money if we are able to hold till expiration (and if we don’t break the spread by legging out for example).

Although, we can close the entire spread off at any time to avoid assignment on the stock.

Post-adjustment, these are the legs of the spread we own.

Long 1 XLK Aug 21st, $98 puts

Short 2 XLK Aug 21st, $100 puts

Long 1 XLK Aug 21st, $102 puts

Let’s examine all possible scenario at expiration:

1) Price is above $102: All puts expire worthless. We pay nothing and are left with the profit of $57.

2) Price is between $100 and $102: All short puts expire worthless. Our long $102 put is in-the-money, which gets exercised and we get some more money into the account (maximum of which is $200, which would mean $257 total profit).

3) Price is between $98 and $100: Our two short strikes are in the money, and we automatically get assigned 200 shares of stock at $100. Since the 102 puts are in-the-money, 100 shares of stocks immediate gets sold at $102. We gained $200.

The remaining 100 shares of XLK is trading below $100, but not below $98.

Hence, we lose some money here, but never more than $200. In net, we end up with more money in the account.

At this point, we can decide to sell 100 shares of XLK at current value, or we can hold and manage XLK as any stock position.

4) Price is below $98: All puts are in the money. We gain $200 from the $100/$102 spread and we lose $200 from the $98/$102 spread. We pay nothing and keep the profit of $57.

Worst case is that we don’t get any more money into our account than what we have locked in. So we have minimum P&L of $57..

The best case scenario is when price of XLK ends up at $100.01 at expiration in which we would get an addition $199.99 into our account. Final P&L of $257 ($200 + $57).

On Aug 21 expiration day, we ended up with scenario 1 where XLK closed at $117.94.

All puts expired worthless, resulting in a final P&L figure of $57.

Paper Trade And Backtest First

While all broken-wing-butterflies can be converted into traditional butterflies, not all broken-wing-butterflies end up happy with a no-risk payoff graph as shown in our example.

The happy scenario will usually happen only when price and volatility goes in our favor right from the start.

And certainly, this trade can lose money just like any other trade.

Butterflies are complex spreads and this is an advance strategy. Beginning traders should definitely paper-trade this first to get the mechanics correct.

And they should also backtest different examples to see what happens under what scenarios.

One way to manual backtest is to use various software that have historic options data available.

We use Option Net Explorer to perform this backtest and to provide the screen shots in this article.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

how would this differ if locking profit into a balanced butterfly?